CA to Repurchase $590 Million of Shares From Largest Holder

November 18 2015 - 9:17AM

Dow Jones News

By Tess Stynes

CA Technologies (CA) agreed to repurchase 22 million of its

shares from its largest stockholder, Careal Holding AG, in a deal

valued at roughly $590 million, effectively completing the

company's previous $1 billion stock buyback authorization.

As a result, CA's board authorized the repurchase of an

additional $750 million in company stock. CA also said it plans to

raise its annual dividend by 2% in its fiscal year that ends in

March 2017.

"The transaction with Careal provided us with the opportunity to

accelerate our share repurchase program at favorable prices, and

highlights our long-term strategy of returning capital to

shareholders," CA Finance Chief Rich Beckert said Wednesday in

prepared remarks.

Careal recently owned roughly 125.8 million shares, or 28.68% of

CA's shares outstanding, according to FactSet.

CA also said it plans to raise its annual dividend to $1.02 a

share, an increase of two cents a share.

The Careal transaction, expected to close in the current

quarter, is seen benefiting CA's per-share earnings by four cents,

excluding certain items, for the current fiscal year ending in

March.

Meanwhile, Careal co-principal Martin Haefner plans to acquire

roughly 37 million CA shares for his personal investment

holdings.

Write to Tess Stynes at tess.stynes@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 18, 2015 09:02 ET (14:02 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

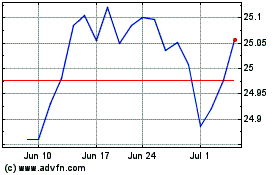

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Apr 2023 to Apr 2024