Carrefour Launches the Disposal of 12.7 Million Treasury Shares

March 23 2015 - 12:50PM

Business Wire

Regulatory News :

Carrefour (Paris:CA) announces today the launch of the disposal

of 12.7 million treasury shares, representing about 1.73% of its

share capital, through a private placement by way of an accelerated

bookbuilding.

Of the 12.7 million treasury shares to be sold, 9.3 million

shares are directly owned by Carrefour and 3.4 million shares were

indirectly owned through an equity swap. These shares correspond to

the excess coverage of Carrefour’s obligations under stock option

plans and free share allotments.

Carrefour has committed not to issue or transfer shares, subject

to certain usual exceptions, including the payment of the dividend

in shares, for a period of 90 calendar days (from the day of the

settlement and delivery).

This transaction is part of Carrefour’s continued strict

financial discipline with the objective of maintaining its BBB+

rating.

The private placement will be conducted by Société Générale

Corporate & Investment Banking, acting as Global Coordinator

and Joint Bookrunner, and BNP Paribas, acting as Joint Bookrunner.

The results of the private placement will be released after closing

of the books.

About CarrefourThe Carrefour Group is the leading

retailer in Europe and the second-largest retailer in the world,

employing 365,000 people. With more than 10,800 stores in more than

30 countries, Carrefour generated sales under banners of €100.5

billion in 2014. As a multi-local, multi-format, and multi-channel

retailer, Carrefour is a partner for daily life. Every day,

Carrefour welcomes more than 10 million customers around the

world.

For more information: www.carrefour.com and @CarrefourGroup on

Twitter

This press release is for information purposes only and does not

constitute an offer to sell and the offering of the Carrefour

shares does not constitute a public offering of securities in any

country, including France.

In France, the offer is made through a private placement

pursuant to article L. 411-2-II of the Code Monétaire et Financier

and no prospectus has been or will be approved by the Autorité des

marchés financiers. The offer will not be made to the public and

only qualified investors, as defined in accordance with Articles

L.411-2, D.411-1, D.744-1, D.754-1 and D.764-1 of the French Code

Monétaire et Financier, may participate in this offer.

With respect to the member States of the European Economic Area

other than France (the "Member States") which have implemented

Directive 2003/71 of the European Parliament and the Council of

November 4th, 2003 (as amended in each member State, the

"Prospectus Directive"), no action has been undertaken or will be

undertaken to make an offer to the public of Carrefour securities

which would require the publication of a prospectus in any of the

Member States. As a consequence, the Carrefour shares may be

offered in the Member States only to qualified investors, as

defined in the Prospectus Directive and provided that this offer

does not require the publication of a prospectus by the Company or

Société Générale or BNP Paribas pusuant to the provisions of

Article 3 of the Prospectus Directive or a supplement to the

prospectus pursuant to the provisions of Article 16 of the

Prospectus Directive.

This press release shall be distributed, directly or indirectly,

in the United Kingdom only to (i) persons who are investment

professionals within the meaning of Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005 (the

"FSMA") or (ii) high net worth entities, and other persons to whom

it may lawfully be communicated, falling within Article 49(2)(a) to

(d) of the FSMA (all such persons together being referred to as

“relevant persons”). The Carrefour shares are only available to,

and any invitation, offer or agreement to subscribe, purchase or

otherwise acquire such Carrefour shares will only be engaged in

with, relevant persons. Any person who is not a relevant person

should not act or rely on this document or any of its contents.

This press release and any information contained herein shall

not be published or distributed, directly or indirectly, in the

United States, Canada, Australia or Japan.

This announcement is not an offer to sell, or the solicitation

of an offer to buy, any securities. The offer and sale of the

securities referred to in this announcement has not been, nor will

it be, registered under the U.S. Securities Act of 1933, as amended

(the “Securities Act”), and the securities may not be offered or

sold in the United States absent such registration or pursuant to

an available exemption, or a transaction not subject to, the

registration requirements of the Securities Act. There will be no

public offering of the securities in the United States in

connection with this transaction.

Any investment decision to buy Carrefour shares shall be made

solely on the basis of publicly available information regarding

Carrefour.

Société Générale and BNP Paribas are registered with the

Autorité de contrôle prudentiel et de résolution for the provision

of investment and banking services. Société Générale and BNP

Paribas are acting in the name of Carrefour (and excluding any

other person) in the context of this placement and shall not be

held liable in any respect to any other person than Carrefour, with

respect to the warranties given to Société Générale and BNP

Paribas’s clients or in the context of the provision of advice

relating to the placement.

Release, publication or distribution of this press release is

forbidden in any country where it would violate applicable laws or

regulations.

Not to be released, published or distributed

directly or indirectly in the USA, Canada, Australia or

Japan

CarrefourGroup Communications, Tel : +33 (0) 1 41 04 26

17orInvestor relations Tel : +33 (0) 1 41 04 28 83

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Mar 2024 to Apr 2024

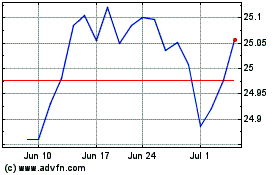

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Apr 2023 to Apr 2024