UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 21, 2015

BioMarin Pharmaceutical Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

000-26727 |

|

68-0397820 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 770 Lindaro Street, San Rafael, California |

|

94901 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (415) 506-6700

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement.

On August 21, 2015, we entered into an Asset Purchase Agreement with Medivation, Inc. (“Medivation”) to sell our proprietary poly (ADP-ribose)

polymerase inhibitor known as BMN-673 or talazoparib.

Pursuant to the Asset Purchase Agreement, we agreed to sell to Medivation our assets related to

BMN-673 upon closing of the transaction, including all relevant patents, data, know-how, third party agreements, regulatory materials, and inventories.

As partial consideration for the acquired assets, upon closing of the transaction, Medivation will pay us an upfront payment of US$410 million. In addition,

contingent upon the successful development and commercialization of BMN-673, Medivation will pay us milestone payments up to a total of US$160 million and royalties on net sales of BMN-673 at a mid-single digit royalty rate.

Medivation will assume all liabilities related to the acquired assets that arise after closing, including liabilities for the on-going clinical trials of

BMN-673 and liabilities under license agreements with AstraZeneca UK Limited and companion diagnostic agreements with Myriad Genetic Laboratories, Inc. In addition, Medivation will also assume certain obligations, including diligence obligations and

milestone payments, under our Stock Purchase Agreement with LEAD Therapeutics, Inc. (“LEAD”), dated February 4, 2010, as amended, the agreement under which we initially acquired rights to BMN-673.

We agreed that during a certain period of time after closing of the transaction, we will not clinically develop or commercialize any poly (ADP-ribose)

polymerase inhibitor.

The consummation of the transaction is subject to the satisfaction of customary closing conditions, including the expiration or

termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

In connection with the

transaction, we will also enter into a Transition Services Agreement with Medivation to facilitate the transition of BMN-673 development to Medivation.

The foregoing is only a summary of the material terms of the Asset Purchase Agreement, does not purport to be complete, and is qualified in its entirety by

reference to the Asset Purchase Agreement that will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2015.

| Item 7.01 |

Regulation FD Disclosure. |

On August 24, 2015, BioMarin and Medivation issued a

joint press release announcing the entry into the Asset Purchase Agreement. A copy of the joint press release is filed as Exhibit 99.1 hereto and is incorporated herein by reference.

The information in this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed filed for purposes of

Section 18 of the Exchange Act, or otherwise subject to the liability of that section, nor shall such information be deemed to be incorporated by reference in any registration statement or other document filed under the Securities Act of 1933,

as amended, or the Exchange Act, except as otherwise stated in such filing.

| Item 9.01 |

Financial Statements and Exhibits |

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press release dated August 24, 2015 |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

BioMarin Pharmaceutical Inc., a

Delaware corporation |

|

|

|

|

| Date: August 24, 2015 |

|

|

|

By: |

|

/s/ G. Eric Davis |

|

|

|

|

|

|

G. Eric Davis Senior Vice President, General

Counsel |

3

Exhibit 99.1

|

|

|

|

|

|

|

|

| Medivation Contact |

|

BioMarin Pharmaceutical Contacts |

|

|

| Anne Bowdidge |

|

Investors: |

| (650) 218-6900 |

|

Traci McCarty |

|

|

(415) 455-7558 |

|

|

|

|

Media: |

|

|

Debra Charlesworth |

|

|

(415) 455-7451 |

Medivation to Expand Global Oncology Franchise with the Acquisition of All Worldwide

Rights to Talazoparib (BMN 673), a potent PARP inhibitor, from BioMarin

| |

• |

|

Talazoparib is a Highly-Potent PARP Inhibitor in Phase 3 Development for the Treatment of BRCA-Mutated Breast Cancer |

| |

• |

|

Clinical Activity Observed in Multiple Oncology Opportunities with Potential for monotherapy or Combination therapy with Standard of Care Oncology Treatments |

| |

• |

|

Transaction Price of $410 Million Upfront, Up to $160 Million in Milestones and Mid-Single Digit Royalties |

San Francisco and San Rafael, Calif., Aug 24, 2015 — Medivation, Inc. (Nasdaq: MDVN) and BioMarin Pharmaceutical Inc. (Nasdaq: BMRN) announced today that

they have entered into an asset purchase agreement under which Medivation will acquire all worldwide rights to talazoparib (formerly referred to as BMN 673), a highly-potent, orally-available poly ADP ribose polymerase (PARP) inhibitor currently in

a Phase 3 study for the treatment of patients with deleterious germline BRCA 1 or BRCA 2 mutations and locally advanced and/or metastatic breast cancer. Under the agreement, Medivation will be responsible for all research, development, regulatory

and commercialization activities for all indications on a global basis.

“Acquiring all worldwide rights to talazoparib provides Medivation with a

transformational opportunity to diversify and expand our proprietary portfolio and global oncology franchise. PARP inhibitors are an exciting class of oncology therapeutics that have been associated with promising activity across multiple tumor

types, including breast and prostate cancer. These latter two disease indications are areas in which Medivation has proven expertise and development capabilities and in the case of prostate cancer, an established and successful commercial

presence,” said David Hung, M.D., President and Chief Executive Officer of Medivation. “Talazoparib’s potential to act alone or augment the effects of a wide array of tumor DNA-damaging oncology therapies and its high potency and

level of activity in various cancers make talazoparib a great strategic fit for Medivation’s oncology portfolio, building on existing strengths as well as potentially allowing Medivation to expand into new oncology indications.”

1

“We believe that Medivation is an outstanding company to drive the future development of talazoparib and

ensure it reaches its full therapeutic potential,” said Hank Fuchs, M.D., Chief Medical Officer at BioMarin. “Medivation’s expertise and track record in oncology clinical development and commercialization has been well demonstrated by

the Company’s success to date. Placing talazoparib in their capable hands allows us to optimize our portfolio and focus our resources on established areas of expertise – developing novel products to treat rare and ultra-rare genetic

diseases.”

Under the terms of the agreement, Medivation will pay BioMarin $410 million upfront, up to an additional $160 million upon the

achievement of regulatory and sales-based milestones and mid-single digit royalties for talazoparib. At the closing of the transaction, Medivation will assume all financial obligations associated with the development and commercialization of

talazoparib.

The closing of the transaction is conditioned on the expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust

Improvements Act. The transaction is anticipated to close in 2015.

About Talazoparib

Talazoparib is a highly-potent, orally available PARP inhibitor, a class of molecules that has shown clinical activity against cancers involving defects in DNA

repair, under investigation for the treatment of certain cancers.

Talazoparib is currently in the Phase 3 EMBRACA trial in patients with germline BRCA

mutated breast cancer. The pivotal study is a two-arm study randomizing patients with germline BRCA mutated locally advanced and/or metastatic breast cancer 2:1 to talazoparib or the protocol-specified physicians’ choice of chemotherapy.

Patients may have received no more than two prior chemotherapy regimens for metastatic disease. The primary objective of the study is to compare progression-free survival of patients treated with monotherapy talazoparib relative to those

treated with protocol-specified physicians’ choice single-agent chemotherapy. Radiographic progression will be determined by blinded independent central radiology review. Talazoparib is also being studied in a single arm Phase 2 ABRAZO trial

evaluating overall response rates in patients with germline BRCA mutated breast cancer, and in multiple investigator-sponsored trials across multiple tumor types.

About Medivation

Medivation, Inc. is a biopharmaceutical

company focused on the development and commercialization of medically innovative therapies to treat serious diseases for which there are limited treatment options. Medivation aims to transform the treatment of these diseases and offer hope to

critically ill patients and their families. For more information, please visit us at http://www.medivation.com

About BioMarin

BioMarin develops and commercializes innovative biopharmaceuticals for serious diseases and medical conditions. The company’s product portfolio comprises

five approved products and

2

multiple clinical and pre-clinical product candidates. Approved products include Vimizim® (elosulfase alfa) for MPS IVA, a product wholly developed and commercialized by BioMarin;

Naglazyme® (galsulfase) for MPS VI, a product wholly developed and commercialized by BioMarin; Aldurazyme® (laronidase) for MPS I, a product which BioMarin developed through a 50/50 joint venture with Genzyme Corporation; Kuvan®

(sapropterin dihydrochloride) Powder for Oral Solution and Tablets, for phenylketonuria (PKU), developed in partnership with Merck Serono, a division of Merck KGaA of Darmstadt, Germany and Firdapse® (amifampridine), which has been approved by

the European Commission for the treatment of Lambert Eaton Myasthenic Syndrome (LEMS). Product candidates include drisapersen, an exon skipping oligonucleotide, for which a marketing application has been submitted to FDA and EMA for the treatment of

patients with Duchenne muscular dystrophy (DMD) with mutations in the dystrophin gene that are amenable to treatment with exon 51 skipping, pegvaliase (formerly referred to as BMN 165 or PEG PAL), PEGylated recombinant phenylalanine ammonia lyase,

which is currently in Phase 3 clinical development for the treatment of PKU, reveglucosidase alfa (formerly referred to as BMN 701), a novel fusion protein of insulin-like growth factor 2 and acid alpha glucosidase (IGF2-GAA), which is currently in

Phase 3 clinical development for the treatment of Pompe disease, vosoritide (formerly referred to as BMN 111), a modified C-natriuretic peptide, which is currently in Phase 2 clinical development for the treatment of achondroplasia, BMN 044, BMN 045

and BMN 053, exon skipping oligonucleotides, which are currently in Phase 2 clinical development for the treatment of Duchenne muscular dystrophy (exons 44, 45 and 53), cerliponase alfa (formerly referred to as BMN 190), a recombinant human

tripeptidyl peptidase-1 (rhTPP1) for the treatment of CLN2 disease, a form of Batten disease, which is currently in Phase 1, BMN 270, an AAV-factor VIII vector, for the treatment of hemophilia A and BMN 250, a novel fusion of

alpha-N-acetyglucosaminidase (NAGLU) with a peptide derived from insulin-like growth factor 2 (IGF2), for the treatment of MPS IIIB. For more information, please visit us at http://www.BMRN.com

Forward-Looking Statement Disclaimer

The forward looking

statements in this press release are based on information currently known to Medivation and BioMarin, and are subject to risks and uncertainties. Actual results may differ substantially for a number of reasons, including, but not limited to: failure

to satisfy the conditions to complete the acquisition; risk that Medivation will not be able to advance the talazoparib research program; risk that Medivation will not be able to reproduce the results of earlier studies in the on-going studies or in

later studies; other challenges inherent in product development, including ability to obtain regulatory approvals, competition and challenges to intellectual property; and other risks detailed in Medivation’s and BioMarin’s filings with

the Securities and Exchange Commission, or SEC, including their respective quarterly reports on Form 10-Q for the quarter ended June 30, 2015. Neither BioMarin nor Medivation undertake any obligation to update these forward-looking statements

other than as required by law.

Legal advisors were Sidley Austin LLP (Medivation) and Cooley LLP (BioMarin).

3

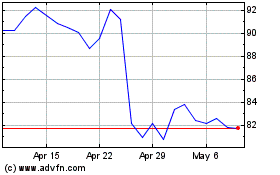

BioMarin Pharmaceutical (NASDAQ:BMRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

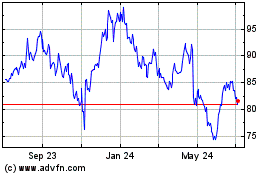

BioMarin Pharmaceutical (NASDAQ:BMRN)

Historical Stock Chart

From Apr 2023 to Apr 2024