CREDIT MARKETS: Corporate Bond Supply Scales New Heights

March 31 2011 - 5:19PM

Dow Jones News

Global high-yield corporate debt sales hit a record quarter

Thursday, with $113.8 billion sold over the past three months,

according to data provider Dealogic.

Investment-grade issuance for the quarter was $279 billion, the

third highest on record and up 19% on the $234 billion raised this

quarter last year. Dollar-denominated debt sold by banks or

corporations based outside the U.S., or Yankee issuers, accounted

for 49% of that volume, Dealogic said.

The high-yield volume snuck past the previous record from the

fourth quarter of 2010, despite shaky market conditions stemming

from the nuclear crisis in Japan, Middle East and North African

turmoil and continued sovereign debt woes in Europe.

"A significant amount of the first quarter volume was from

companies looking to refinance," said Jason Rosiak, senior managing

director at Pacific Asset Management, an affiliate of Pacific Life

with $2.5 billion under management.

Investment-Grade Bonds

Campbell Soup Co. (CPB) sold $500 million of senior unsecured

notes Thursday, and Macquarie Bank Ltd. sold $1 billion of

unsecured U.S. medium-term notes.

Macquarie's 10-year issue was a Rule 144a private sale and

priced to yield 6.652%, or 3.20 percentage points over comparable

government debt. That was five basis points narrower than the level

suggested by preliminary price guidance, indicating solid demand

for the offering.

Asciano Finance Ltd. was also in the market to sell $1 billion

of seven-year notes. Price guidance suggests a risk premium in the

area of 2.25 percentage points over Treasurys.

Junk Bonds

The U.S. high-yield issuance pipeline was strong. Several deals

were expected to price late Thursday, including Ameristar Casinos

Inc. (ASCA), with a $800 million bond sale in the 8% area via Wells

Fargo; Visteon Corp. (VC) with a $500 million debt offering

expected to price around 6.75% via Bank of America Merrill Lynch;

CNL Lifestyle Properties with a $400 million deal in the 7.25% area

via Jefferies & Co.; and Kennedy-Wilson with a $200 million

deal.

Millar Western Forest Products completed a $210 million issue,

pricing the debt at 8.5%, and Park-Ohio Industries Inc. sold $250

million of senior notes at 8.125%.

Asset-Backed Securities

The U.S. Small Business Administration has begun tapping the

securitization market with a $252.38 million bond. The deal has the

full faith and credit of the U.S. government and will be priced

next week.

Mortgage-Backed Securities

There was steady buying of agency mortgage-backed securities

Thursday despite the quarter end, said Paul Jacob, director of

strategy at Banc of Manhattan Capital. "Whatever flight to quality

we had a few weeks ago has abated," he said. "Origination flows and

refinancing risk remains modest." Risk premiums were quoted at 143

basis points versus 144 basis points Wednesday.

Commercial Paper

The U.S. commercial paper market grew on a seasonally adjusted

basis but shrank on an unadjusted basis in the week ended March 30,

according to Federal Reserve data.

In the week, the commercial paper market grew by $1.7 billion on

a seasonally adjusted basis. On an unadjusted basis, it shrank by

$700 million.

At its peak in July 2007, this market was a little over $2

trillion in size.

Treasurys

Benchmark Treasurys were flat Thursday as the bond market

prepared for a key U.S. employment report. The non-farm payrolls

report due Friday morning will shed light on the health of the

labor market and shape market expectations on the Federal Reserve's

monetary policy outlook.

Economists in a Dow Jones Newswires survey expect the payrolls

report to show U.S. employers added 195,000 new jobs in March,

following 192,000 new hires in February. The unemployment rate is

forecast to stay unchanged at 8.9%.

"Given the slowdown in the rate of economic growth over the last

few data points, the payrolls report will be an important

confirmation or contradiction of any slowdown in employment," said

Christian Cooper, head of U.S. dollar derivatives trading at

Jefferies & Co. in New York.

Cooper said a strong number will reinforce the recent comments

from some Fed officials about the need to withdraw liquidity sooner

rather than later and the bond market could begin to price in a

change in the easy monetary policy.

In late afternoon trading, the 10-year note was flat to yield

3.460%. Bond prices and yields move in opposite directions.

-By Katy Burne, Dow Jones Newswires; 212-416-3084;

katy.burne@dowjones.com

--Kellie Geressy-Nilsen, Anusha Shrivastava and Min Zeng

contributed to this article.

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Mar 2024 to Apr 2024

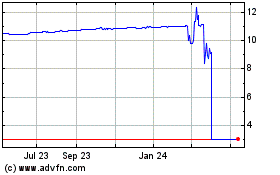

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Apr 2023 to Apr 2024