U.S. Hot Stocks: Hot Stocks to Watch

September 16 2015 - 9:45AM

Dow Jones News

By Chris Wack

Among the companies with shares expected to trade actively in

Wednesday's session are Anheuser-Busch InBev (BUD), Adept

Technology Inc.(ADEP) and TICC Capital Corp. (TICC).

Anheuser-Busch InBev NV on Wednesday said it had approached

SABMiller PLC about a takeover, paving the way for a deal that

would likely value SABMiller well in excess of its $75 billion

market capitalization and create a brewing giant that would

dominate much of the global beer market. Anheuser-Busch InBev

shares were trading up 5.97% at $114.49 in premarket trading.

Robotics systems company Adept Technology Inc. said Wednesday

that it would be acquired by Japanese automation firm Omron Corp.

for about $195 million, a 63% premium over Tuesday's closing price.

Adept shares rose 62% to $12.92 premarket.

The speciality lending arm of private-equity firm TPG (TSLX)

took its $450 million offer for investment firm TICC Capital Corp.

public on Wednesday, after being rebuffed a day earlier. TICC

Capital shares rose 11.8% to $7.01 premarket.

B/E Aerospace Inc. (BEAV) said Wednesday that it would cut

around 450 jobs as part of a cost reduction program that would also

close some of the company's facilities and consolidate certain

product lines.

Amgen Inc. (AMGN) struck a research and license agreement with

Xencor Inc. (XNCR), a move aimed at expanding its immuno-oncology

portfolio as the biotech faces increased competition from copycat

drugs.

Ascena Retail Group Inc. (ASNA), which recently closed on its

deal to buy Ann Inc., swung to a loss in its July quarter amid a

big writedown on its Lane Bryant brand and tumbling sales at its

Justice brand.

Chip maker Integrated Silicon Solution Inc. (ISSI) said

Wednesday that the review period for its pending acquisition by a

consortium of Chinese investors has been extended to a 45-day

investigation period.

Cracker Barrel Old Country Store Inc. (CBRL) reported Wednesday

a better-than-expected 21% jump in quarterly earnings, helped by

higher menu prices.

Hewlett-Packard Co. (HPQ) outlined plans to cut another 25,000

to 30,000 workers as it prepares to split into two separate

businesses, but the company signaled it was finally nearing the end

of a brutal period of layoffs.

Write to Chris Wack at chris.wack@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 16, 2015 09:30 ET (13:30 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

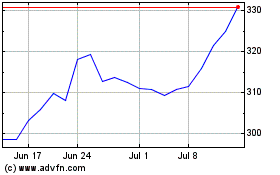

Amgen (NASDAQ:AMGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

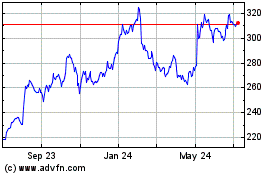

Amgen (NASDAQ:AMGN)

Historical Stock Chart

From Apr 2023 to Apr 2024