UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

_________________________

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13

OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

July 14, 2015

UNIVERSAL SECURITY INSTRUMENTS, INC.

(Exact name of registrant as specified in

its charter)

| Maryland |

0-7885 |

52-0898545 |

| (State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

| of Incorporation) |

|

Identification No.) |

11407 Cronhill Drive, Suite A, Owings

Mills, Maryland 21117

(Address of Principal Executive Offices)

Registrant’s telephone number, including

area code: (410) 363-3000

Inapplicable

(Former Name or Former Address if Changed

Since Last Report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

INFORMATION TO BE INCLUDED IN THE REPORT

| Item 4.02. | Non-Reliance on Previously Issued Financial Statements

or a Related Audit Report or Completed Interim Review. |

On

July 10, 2015, the Registrant concluded and informed its independent registered public accounting firm that, based on new information

received from the Registrant’s 50%-owned Hong Kong Joint Venture (the “HKJV”), the financial results

of the Company and its HKJV as reported in the Registrant’s Quarterly Reports on Form 10-Q for the fiscal quarters ended

September 30, 2014 and December 31, 2014 were misstated as a result of errors in the HKJV’s accounting for inventory. Based

on a preliminary review, (i) for the quarter and six month period ended September 30,

2014, equity in the loss of the HKJV and net loss were understated by approximately $182,000,

and (ii) for the quarter and nine month period ended December 31, 2014, equity in the

loss of the HKJV and net loss were understated by approximately $163,000 and $345,000, respectively. Accordingly, investors should

no longer rely upon the Registrant’s financial statements set forth in those Reports and other financial data for these

periods or any press releases or other shareholder communications that relate to that information. The Registrant will be filing

Forms 10-Q/A restating its financials for these periods as soon as practicable. Management and an authorized officer has discussed

the matters disclosed in this Item 4.02 of this Current Report on Form 8-K with the Company’s independent registered public

accounting firm.

On July 14, 2015,

the Registrant issued a press release stating that it is delaying the filing of its Annual Report on Form 10-K for the year

ended March 31, 2015. The press release contains certain anticipated unaudited financial information for the

Registrant’s fourth fiscal quarter and full fiscal year. A copy of the press release is being furnished as Exhibit 99.1

to this Current Report on Form 8-K.

This Form 8-K Item

8.01 and the attached exhibit are furnished to, but not filed with, the Securities and Exchange Commission (“SEC”)

and shall not be deemed to be incorporated by reference into any of the Company’s filings with the SEC under the Securities

Act of 1933.

| Item 9.01. | Financial Statements and Exhibits. |

(c) Exhibits

The following

exhibits are filed herewith:

| Exhibit No. |

|

| 99.1 |

Press Release dated July 14, 2015 |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

| |

UNIVERSAL SECURITY INSTRUMENTS, INC. |

|

| |

(Registrant) |

|

| |

|

|

|

| |

|

|

|

| Date: July 14, 2015 |

By: |

/s/ Harvey B. Grossblatt |

|

| |

|

Harvey B. Grossblatt |

|

| |

|

President |

|

|

EXHIBIT 99.1

For Immediate Release

Contact: Harvey Grossblatt, President

Universal Security Instruments, Inc.

410-363-3000, Ext. 224

or

Don Hunt, Jeff Lambert

Lambert, Edwards & Associates, Inc.

616-233-0500

|

Universal Security Instruments, Inc.

Updates Status on Delayed Filing of Form 10-K

OWINGS MILLS, MD. July 14, 2015 - Universal

Security Instruments, Inc. (NYSE Amex: UUU) announced today that it is further delaying the filing of its Annual Report on Form

10-K for the fiscal year ended March 31, 2015 with the Securities and Exchange Commission (“SEC”).

As the Company previously disclosed in

its Notification of Late Filing on Form 12 b-25 filed with the SEC on June 29, 2015, the Company delayed filing its Annual Report

on Form 10-K because of unforeseen delays in the completion of the financial statements of the Company’s 50%-owned Hong Kong

Joint Venture. Pursuant to Rule 12b-25 under the Securities Exchange Act of 1934, the Company received an extension until July

14, 2015 to file its fiscal year ended March 31, 2015 Annual Report on Form 10-K, which extension will expire without the filing

of the Company’s Form 10-K. The Company is working diligently to complete and file its Annual Report on Form 10-K with the

SEC, and expects to do so on or prior to July 31, 2015.

Based on current unaudited information, the preliminary

results which the Company anticipates that it will report in its Annual Report on Form 10-K are as follows:

| · | A net loss for the fourth quarter of approximately $748,500,

or $0.32 per basic and diluted share, on sales of $2,782,210. This compares to a net loss of $1,504,306 or $0.65 per basic

and diluted share, on sales of $2,636,933 for the comparable period of the previous year. |

| · | For the 12 months ended March 31, 2015,

sales decreased approximately 21% to $9,891,554 versus $12,577,127 for the same period last year. The Company expects to report

a net loss of approximately $3,704,985 or $1.60 per basic and diluted share, versus a net loss of $4,450,224 or $1.94 per basic

and diluted share, for the same period last year. |

| · | Total assets of approximately $19,906,028

for the fiscal year ended March 31, 2015, compared to total assets of $23,202,976 for the fiscal year ended March 31, 2014. |

| · | Total liabilities of approximately $1,149,031

for the fiscal year ended March 31, 2015, compared to total liabilities of $785,561 for the fiscal year ended March 31, 2014. |

| · | Total shareholders’ equity of approximately

$18,756,997 for the fiscal year ended March 31, 2015, compared to total shareholders’ equity of $22,392,415 for the fiscal

year ended March 31, 2014. |

UNIVERSAL SECURITY INSTRUMENTS, INC. is

a U.S.-based manufacturer (through its Hong Kong Joint Venture) and distributor of safety and security devices. Founded in 1969,

the Company has a 43 year heritage of developing innovative and easy-to-install products, including smoke, fire and carbon monoxide

alarms. For more information on Universal Security Instruments, visit our website at www.universalsecurity.com.

------------------------------------------------------------

"Safe Harbor” Statement under

the Private Securities Litigation Reform Act of 1995: Certain matters discussed in this news release may constitute forward-looking

statements within the meaning of the federal securities laws that inherently include certain risks and uncertainties. Actual

results could differ materially from those projected in or contemplated by the forward-looking statements due to a number of factors,

including, among other items, our Hong Kong Joint Venture's respective ability to maintain operating profitability, currency fluctuations,

the impact of current and future laws and governmental regulations affecting us and our Hong Kong Joint Venture and other factors

which may be identified from time to time in our Securities and Exchange Commission filings and other public announcements.

We do not undertake and specifically disclaim any obligation to update any forward-looking statements to reflect occurrence of

anticipated or unanticipated events or circumstances after the date of such statements. We will revise our outlook from time

to time and frequently will not disclose such revisions publicly.

11407 CRONHILL DRIVE, SUITE A •

OWINGS MILLS, MARYLAND 21117, USA

(410) 363-3000 •

www.universalsecurity.com

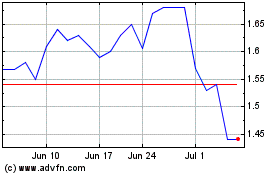

Universal Security Instr... (AMEX:UUU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Universal Security Instr... (AMEX:UUU)

Historical Stock Chart

From Apr 2023 to Apr 2024