SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report: August 28, 2015

(Date of earliest event reported)

Timberline Resources Corporation

(Exact name of registrant as specified in its charter)

Commission File Number: 001-34055

________________

| Delaware |

82-0291227 |

| (State or other jurisdiction of incorporation) |

(IRS Employer Identification No.) |

| |

|

101 East Lakeside Avenue

Coeur d’Alene, Idaho 83814

(Address of principal executive offices, including zip code)

(208) 664-4859

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Kiran Patankar Employment Agreement

On August 28, 2015, Timberline Resources Corp. (the “Registrant”) and Kiran Patankar, the Registrant’s Chief Executive Officer, entered into an employment agreement (“Patankar Agreement”) setting forth the material terms of his employment with the Registrant, consistent with the terms and conditions set forth in the previously disclosed Employment Term Sheet, dated December 17, 2014, between the Registrant and Mr. Patankar.

Pursuant to the terms of the terms of the Patankar Agreement, the Registrant employs Mr. Patankar as a full-time executive employee for an indefinite period of time. The Patankar Agreement details Mr. Patankar’s duties pursuant to his employment are to fulfill the obligations and duties of the President and Chief Executive Officer of the Registrant and report to the Board of Directors of the Registrant. In consideration for rendering such services, Mr. Patankar shall be compensated with an annual salary of not less than $225,000, less required and authorized deductions and withholdings, payable in semi-monthly payments consistent with the Registrant’s normal payroll practices. The Registrant will also pay for (or reimburse Mr. Patankar the cost of) health, dental and vision insurance for Mr. Patankar and his eligible family members. The Patankar Agreement provides for the reimbursement of all reasonable business expenses of Mr. Patankar.

The Patankar Agreement also provides that Mr. Patankar is eligible to participate in such profit-sharing, bonus, stock purchase, incentive and performance award programs which are made available to employees of the Registrant with comparable authority or duties. Mr. Patankar is eligible to receive performance bonuses and other incentive compensation based upon the recommendations and approval, and subject to the sole discretion, of the Board of Directors of the Registrant. The Patankar Agreement provides that Mr. Patankar is entitled to take six (6) weeks of paid vacation in each 12 month period of employment and will be permitted to carry-over up to six (6) weeks of unused vacation into the next calendar year.

The Patankar Agreement provides that Mr. Patankar may be terminated (i) without “Cause” upon 90 days written notice, (ii) with “Cause” immediately upon written notice, (iii) for “Good Reason” immediately upon written notice and (iv) without “Good Reason” upon 30 days written notice. “Cause” is as defined in the Patankar Agreement and includes: material breach of the Patankar Agreement by Mr. Patankar, conviction of a crime involving moral turpitude, fraud or misrepresentation, or the commission of such acts by Mr. Patankar, and Mr. Patankar’s inability to fulfill his duties under the Patankar Agreement. “Good Reason” is as defined in the Patankar Agreement and includes assignment of duties inconsistent with Mr. Patankar’s duties, a reduction without consent to Mr. Patankar’s base salary, a requirement to relocate without Mr. Patankar’s consent, the failure of the Registrant’s to obtain the assumption of obligations under the Patankar Agreement by any successor or breach of the Patankar Agreement by the Regsitrant. The Patankar Agreement also terminates upon retirement, permanent disability or death.

Upon termination without Cause or for Good Reason following a Change in Control of the Registrant (as defined in the Patankar Agreement) or upon termination due to death or permanent disability, the Registrant shall: (a) pay Mr. Patankar a severance benefit equal to the product of his base annual salary immediately preceding his termination, inclusive of any non-equity performance bonus earned in the twelve (12) months preceding termination, multiplied by a “change in control multiplier” equal to two (2) plus one twelfth (1/12) of the number of full years (up to a maximum of twelve (12) years) that Mr. Patankar was employed by the Registrant, (b) pay for health insurance benefits for Mr. Patankar and his eligible family members up to $20,000 per year for a period of one (1) year plus one (1) additional month for each full year that Mr. Patankar was employed by the Registrant or until such benefits are paid for by another employer, and (c) pay Mr. Patankar the value of his earned but unused vacation days.

Upon termination without Cause or for Good Reason not following a Change in Control of the Registrant, the Registrant shall: (a) pay Mr. Patankar a severance benefit equal his base annual salary immediately preceding his termination, inclusive of any non-equity performance bonus earned in the twelve (12) months preceding termination, (b) pay for health insurance benefits for Mr. Patankar and his eligible family members up to $20,000 per year for a period of one (1) year plus one (1) additional month for each full year that Mr. Patankar was employed by the

Registrant or until such benefits are paid for by another employer, and (c) pay Mr. Patankar the value of his earned but unused vacation days.

Receipt of any severance payments is conditioned upon the execution of a separation agreement and release of claims against the Registrant.

Upon termination with Cause or without Good Reason, the Registrant shall on the date of termination pay Mr. Patankar: (a) his earned salary, bonus or other compensation, (b) the value of Mr. Patankar’s earned but unused vacation days and (c) unreimbursed business expenses.

Upon retirement, the Patankar Agreement provides that the Registrant is not obligated to pay Mr. Patankar a monthly retirement benefit but shall endeavor in good faith to devise and implement a retirement plan for Mr. Patankar and the other employees of the Registrant.

The Patankar Agreement provides for Mr. Patankar to maintain the confidentiality of the Registrant’s confidential information and contains a non-competition provision pursuant to which Mr. Patankar agrees for a one year period following termination to not directly or indirectly for himself or on behalf of others (a) solicit for employment or as a consultant or independent contractor or enter into an independent contract or relationship with any person employed by the Registrant at any time during such period or otherwise interfere with such employment relationship, (b) induce or attempt to induce any customer, supplier, licensee or business relation of the Registrant to cease doing business with the Registrant, or (c) disparage the Registrant.

The Patankar Agreement also contains standard provisions regarding notices, amendments, governing law and jurisdiction.

Steven Osterberg Employment Agreement

On August 28, 2015, Timberline Resources Corp. (the “Registrant”) and Steven Osterberg, the Registrant’s Vice President of Exploration, entered into an employment agreement (“Osterberg Agreement”) setting forth the material terms of his employment with the Registrant.

Pursuant to the terms of the terms of the Osterberg Agreement, the Registrant employs Mr. Osterberg as a full-time executive employee for an indefinite period of time. The Osterberg Agreement details Mr. Osterberg’s duties pursuant to his employment are to fulfill the obligations and duties of the Vice President of Exploration of the Registrant and report to the Chief Executive Officer of the Registrant. In consideration for rendering such services, Mr. Osterberg shall be compensated with an annual salary of not less than $150,000, less required and authorized deductions and withholdings, payable in semi-monthly payments consistent with the Registrant’s normal payroll practices. The Registrant will also pay for (or reimburse Mr. Osterberg the cost of) health, dental and vision insurance for Mr. Osterberg and his eligible family members. The Osterberg Agreement provides for the reimbursement of all reasonable business expenses of Mr. Osterberg.

The Osterberg Agreement also provides that Mr. Osterberg is eligible to participate in such profit-sharing, bonus, stock purchase, incentive and performance award programs which are made available to employees of the Registrant with comparable authority or duties. Mr. Osterberg is eligible to receive performance bonuses and other incentive compensation based upon the recommendations and approval, and subject to the sole discretion, of the Board of Directors of the Registrant. The Osterberg Agreement provides that Mr. Osterberg is entitled to take six (6) weeks of paid vacation in each 12 month period of employment and will be permitted to carry-over up to six (6) weeks of unused vacation into the next calendar year.

The Osterberg Agreement provides that Mr. Osterberg may be terminated (i) without “Cause” upon 90 days written notice, (ii) with “Cause” immediately upon written notice, (iii) for “Good Reason” immediately upon written notice and (iv) without “Good Reason” upon 30 days written notice. “Cause” is as defined in the Osterberg Agreement and includes: material breach of the Osterberg Agreement by Mr. Osterberg, conviction of a crime involving moral turpitude, fraud or misrepresentation, or the commission of such acts by Mr. Osterberg, and Mr. Osterberg’s inability to fulfill his duties under the Osterberg Agreement. “Good Reason” is as defined in the Osterberg Agreement and includes assignment of duties inconsistent with Mr. Osterberg’s duties, a reduction without consent

to Mr. Osterberg’s base salary, a requirement to relocate without Mr. Osterberg’s consent, the failure of the Registrant’s to obtain the assumption of obligations under the Osterberg Agreement by any successor or breach of the Osterberg Agreement by the Regsitrant. The Osterberg Agreement also terminates upon retirement, permanent disability or death.

Upon termination without Cause or for Good Reason following a Change in Control of the Registrant (as defined in the Osterberg Agreement) or upon termination due to death or permanent disability, the Registrant shall: (a) pay Mr. Osterberg a severance benefit equal to the product of his base annual salary immediately preceding his termination, inclusive of any non-equity performance bonus earned in the twelve (12) months preceding termination, multiplied by a “change in control multiplier” equal to one (1) plus one twelfth (1/12) of the number of full years (up to a maximum of twelve (12) years) that Mr. Osterberg was employed by the Registrant, (b) pay for health insurance benefits for Mr. Osterberg and his eligible family members up to $20,000 per year for a period of one (1) year plus one (1) additional month for each full year that Mr. Osterberg was employed by the Registrant or until such benefits are paid for by another employer, and (c) pay Mr. Osterberg the value of his earned but unused vacation days.

Upon termination without Cause or for Good Reason not following a Change in Control of the Registrant, the Registrant shall: (a) pay Mr. Osterberg a severance benefit equal his base annual salary immediately preceding his termination, inclusive of any non-equity performance bonus earned in the twelve (12) months preceding termination, (b) pay for health insurance benefits for Mr. Osterberg and his eligible family members up to $20,000 per year for a period of one (1) year plus one (1) additional month for each full year that Mr. Osterberg was employed by the Registrant or until such benefits are paid for by another employer, and (c) pay Mr. Osterberg the value of his earned but unused vacation days.

Receipt of any severance payments is conditioned upon the execution of a separation agreement and release of claims against the Registrant.

Upon termination with Cause or without Good Reason, the Registrant shall on the date of termination pay Mr. Osterberg: (a) his earned salary, bonus or other compensation, (b) the value of Mr. Osterberg’s earned but unused vacation days and (c) unreimbursed business expenses.

Upon retirement, the Osterberg Agreement provides that the Registrant is not obligated to pay Mr. Osterberg a monthly retirement benefit but shall endeavor in good faith to devise and implement a retirement plan for Mr. Osterberg and the other employees of the Registrant.

The Osterberg Agreement provides for Mr. Osterberg to maintain the confidentiality of the Registrant’s confidential information and contains a non-competition provision pursuant to which Mr. Osterberg agrees for a one year period following termination to not directly or indirectly for himself or on behalf of others (a) solicit for employment or as a consultant or independent contractor or enter into an independent contract or relationship with any person employed by the Registrant at any time during such period or otherwise interfere with such employment relationship, (b) induce or attempt to induce any customer, supplier, licensee or business relation of the Registrant to cease doing business with the Registrant, or (c) disparage the Registrant.

The Osterberg Agreement also contains standard provisions regarding notices, amendments, governing law and jurisdiction.

Randal Hardy Employment Agreement

On September 2, 2015, the Registrant and Randal Hardy, the Registrant’s Chief Financial Officer, entered into a letter agreement regarding Mr. Hardy’s continued employment with the Registrant (the “Hardy Agreement”). Pursuant to the Hardy Agreement and the accompanying letter agreement between the Registrant and Mr. Hardy (“Hardy Letter Agreement”), Mr. Hardy’s prior employment agreement dated August 27, 2007, was mutually terminated in its entirety.

The Hardy Letter Agreement further provides that the Registrant will inform the Registrant’s compensation committee at the time it is considering issuing awards under Registrant’s proposed 2015 Stock and Incentive Plan, which remains subject to shareholder approval and which awards won’t be considered, if at all, until after such

approval, that Mr. Hardy and the Registrant have agreed that the value of the surrender of Mr. Hardy’s change of control rights contained in Mr. Hardy’s prior employment agreement is approximately $145,000. The Hardy Letter Agreement, however, does not bind the Registrant or the compensation committee to undertake any issuance of awards under the 2015 Stock and Incentive Plan and the issuance of any such awards to Mr. Hardy in the future remains in the sole discretion of the compensation committee.

Pursuant to the terms of the terms of the Hardy Agreement, the Registrant employs Mr. Hardy as a full-time executive employee for an indefinite period of time. The Hardy Agreement details Mr. Hardy’s duties pursuant to his employment are to fulfill the obligations and duties of the Chief Financial Officer of the Registrant and report to the Chief Executive Officer of the Registrant. In consideration for rendering such services, Mr. Hardy shall be compensated with an annual salary of not less than $175,000, less required and authorized deductions and withholdings, payable in semi-monthly payments consistent with the Registrant’s normal payroll practices. The Registrant will also pay for (or reimburse Mr. Hardy the cost of) health, dental and vision insurance for Mr. Hardy and his eligible family members. The Hardy Agreement provides for the reimbursement of all reasonable business expenses of Mr. Hardy.

The Hardy Agreement also provides that Mr. Hardy is eligible to participate in such profit-sharing, bonus, stock purchase, incentive and performance award programs which are made available to employees of the Registrant with comparable authority or duties. Mr. Hardy is eligible to receive performance bonuses and other incentive compensation based upon the recommendations and approval, and subject to the sole discretion, of the Board of Directors of the Registrant. The Hardy Agreement provides that Mr. Hardy is entitled to take six (6) weeks of paid vacation in each 12 month period of employment and will be permitted to carry-over up to six (6) weeks of unused vacation into the next calendar year.

The Hardy Agreement provides that Mr. Hardy may be terminated (i) without “Cause” upon 90 days written notice, (ii) with “Cause” immediately upon written notice, (iii) for “Good Reason” immediately upon written notice and (iv) without “Good Reason” upon 30 days written notice. “Cause” is as defined in the Hardy Agreement and includes: material breach of the Hardy Agreement by Mr. Hardy, conviction of a crime involving moral turpitude, fraud or misrepresentation, or the commission of such acts by Mr. Hardy, and Mr. Hardy’s inability to fulfill his duties under the Hardy Agreement. “Good Reason” is as defined in the Hardy Agreement and includes assignment of duties inconsistent with Mr. Hardy’s duties, a reduction without consent to Mr. Hardy’s base salary, a requirement to relocate without Mr. Hardy’s consent, the failure of the Registrant’s to obtain the assumption of obligations under the Hardy Agreement by any successor or breach of the Hardy Agreement by the Regsitrant. The Hardy Agreement also terminates upon retirement, permanent disability or death.

Upon termination without Cause or for Good Reason following a Change in Control of the Registrant (as defined in the Hardy Agreement) or upon termination due to death or permanent disability, the Registrant shall: (a) pay Mr. Hardy a severance benefit equal to the product of his base annual salary immediately preceding his termination, inclusive of any non-equity performance bonus earned in the twelve (12) months preceding termination, multiplied by a “change in control multiplier” equal to one (1) plus one twelfth (1/12) of the number of full years (up to a maximum of twelve (12) years) that Mr. Hardy was employed by the Registrant, (b) pay for health insurance benefits for Mr. Hardy and his eligible family members up to $20,000 per year for a period of one (1) year plus one (1) additional month for each full year that Mr. Hardy was employed by the Registrant or until such benefits are paid for by another employer, and (c) pay Mr. Hardy the value of his earned but unused vacation days.

Upon termination without Cause or for Good Reason not following a Change in Control of the Registrant, the Registrant shall: (a) pay Mr. Hardy a severance benefit equal his base annual salary immediately preceding his termination, inclusive of any non-equity performance bonus earned in the twelve (12) months preceding termination, (b) pay for health insurance benefits for Mr. Hardy and his eligible family members up to $20,000 per year for a period of one (1) year plus one (1) additional month for each full year that Mr. Hardy was employed by the Registrant or until such benefits are paid for by another employer, and (c) pay Mr. Hardy the value of his earned but unused vacation days.

Receipt of any severance payments is conditioned upon the execution of a separation agreement and release of claims against the Registrant.

Upon termination with Cause or without Good Reason, the Registrant shall on the date of termination pay Mr. Hardy: (a) his earned salary, bonus or other compensation, (b) the value of Mr. Hardy’s earned but unused vacation days and (c) unreimbursed business expenses.

Upon retirement, the Hardy Agreement provides that the Registrant is not obligated to pay Mr. Hardy a monthly retirement benefit but shall endeavor in good faith to devise and implement a retirement plan for Mr. Hardy and the other employees of the Registrant.

The Hardy Agreement provides for Mr. Hardy to maintain the confidentiality of the Registrant’s confidential information and contains a non-competition provision pursuant to which Mr. Hardy agrees for a one year period following termination to not directly or indirectly for himself or on behalf of others (a) solicit for employment or as a consultant or independent contractor or enter into an independent contract or relationship with any person employed by the Registrant at any time during such period or otherwise interfere with such employment relationship, (b) induce or attempt to induce any customer, supplier, licensee or business relation of the Registrant to cease doing business with the Registrant, or (c) disparage the Registrant.

The Hardy Agreement also contains standard provisions regarding notices, amendments, governing law and jurisdiction.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

TIMBERLINE RESOURCES CORPORATION

|

| |

Date: September 3, 2015

|

By:

|

|

| |

|

|

Kiran Patankar

Chief Executive Officer

|

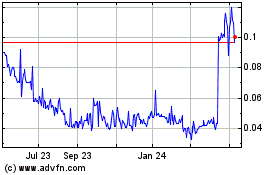

Timberline Resources (QB) (USOTC:TLRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

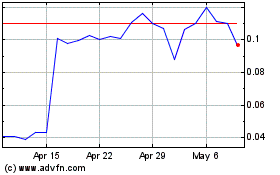

Timberline Resources (QB) (USOTC:TLRS)

Historical Stock Chart

From Apr 2023 to Apr 2024