As filed with the Securities and Exchange Commission on June 17, 2015

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

TIMBERLINE RESOURCES CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

1040

|

|

82-0291227

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial Classification Code Number)

|

|

(I.R.S. Employer Identification No.)

|

101 East Lakeside Avenue

Coeur d’Alene, Idaho 83814

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Randal Hardy

Chief Financial Officer

101 East Lakeside Avenue

Coeur d’Alene, Idaho 83814

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Kenneth G. Sam, Esq.

Jason K. Brenkert, Esq.

Dorsey & Whitney LLP

1400 Wewatta Street

Suite 400

Denver, CO 80202-5549

|

From time to time after the effective date of this registration statement

(Approximate date of commencement of proposed sale to public)

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, please check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filed ¨ Smaller reporting company x

CALCULATION OF REGISTRATION FEE

|

Title of each class of

securities to be registered(1)

|

Proposed Maximum

Aggregate Offering Price(2)

|

Amount of

registration fee(3)(4)

|

|

Common Shares, par value $0.001

Warrants

|

$30,000,000

|

$3,486

|

|

Total

|

$30,000,000

|

$3,486

|

|

(1)

|

Includes an indeterminate number of common shares and common share purchase warrants or any combination thereof. This registration statement also covers common shares that may be issued upon exercise of warrants. In addition, any securities registered hereunder may be sold separately or as units with other securities registered hereunder. The securities which may be offered pursuant to this registration statement include, pursuant to Rule 416 of the Securities Act of 1933, as amended (the “Securities Act”), such additional number of common shares of the Registrant that may become issuable as a result of any stock split, stock dividends or similar event.

|

|

(2)

|

Represents the initial offering price of all securities sold up to an aggregate public offering price not to exceed $30,000,000 or the equivalent thereof in foreign currencies, foreign currency units or composite currencies to the Registrant.

|

|

(3)

|

Pursuant to Rule 457(o) under the Securities Act, the registration fee has been calculated on the basis of the maximum aggregate offering price and the number of securities being registered has been omitted.

|

|

(4)

|

The Registrant previously paid a registration fee of $3,438, consisting of $1,395 carried over from a prior filing and $2,043 paid at the time of filing, pursuant to its previously filed Registration Statement on Form S-3, File No. Registration No. 333-181378 (the “Prior Registration Statement”), originally filed with the Securities and Exchange Commission on May 11, 2012 and subsequently declared effective on May 22, 2012. Of the $30,000,000 aggregate value of the Registrant’s securities registered pursuant to the Prior Registration Statement, only $2,000,000 of aggregate value of its securities was sold. Pursuant to Rule 457(p) under the Securities Act, the Registrant is applying the available filing fee of $2,403 associated with the $28,000,000 aggregate value of unsold securities under the Prior Registration Statement against the total filing fee of $3,486 that would otherwise be due in connection with this registration statement. A filing fee for the remaining amount of $1,443 has been paid in connection with the filing of this registration statement. The Prior Registration Statement will be deemed terminated and withdrawn as of the filing date of this registration statement.

|

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the Securities and Exchange Commission declares our registration statement effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion: Dated June 17, 2015

$30,000,000

Common Shares

Warrants

|

Timberline Resources Corporation may offer and sell, from time to time, up to $30,000,000 aggregate initial offering price of the Company’s shares of common stock, par value $0.001, warrants to purchase shares of common stock or any combination thereof in one or more transactions under this prospectus.

This prospectus provides you with a general description of the securities that the Company may offer. Each time we offer securities, we will provide you with a prospectus supplement that describes specific information about the particular securities being offered and may add, update or change information contained in this prospectus. You should read both this prospectus and the prospectus supplement, together with any additional information which is incorporated by reference into this prospectus. This prospectus may not be used to offer or sell securities without the prospectus supplement which includes a description of the method and terms of that offering.

We may sell the securities on a continuous or delayed basis to or through underwriters, dealers or agents or directly to purchasers. The prospectus supplement, which we will provide to you each time it offers securities, will set forth the names of any underwriters, dealers or agents involved in the sale of the securities, and any applicable fee, commission or discount arrangements with them. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution” in this prospectus.

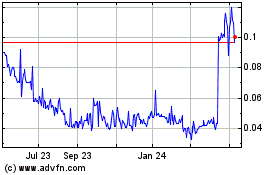

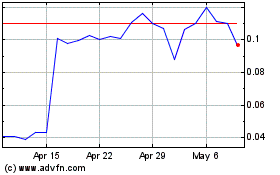

Our shares of common stock are traded on the NYSE MKT LLC (“NYSE MKT”) under the symbol “TLR” and on the TSX Venture Exchange (“TSX.V”) under the symbol “TBR”. On June 15, 2015, the closing price of our common stock on the NYSE MKT was $0.63 per share of common stock and on the TSX.V was Cdn$0.75 per share of common stock. There is currently no market through which the securities, other than the shares of common stock, may be sold and purchasers may not be able to resell the securities purchased under this prospectus. This may affect the pricing of the securities, other than the shares of common stock, in the secondary market, the transparency and availability of trading prices, the liquidity of these securities and the extent of issuer regulation. See “Risk Factors”.

The aggregate market value of our outstanding voting and non-voting common equity held by non-affiliates on June 15, 2015 was approximately $6 million. During the 12 calendar month period that ends on and includes the date hereof we have not issued any securities pursuant to Instruction I.B.6 of Form S-3.

Investing in our securities involves risks. See “Risk Factors” on page 5.

These securities have not been approved or disapproved by the U.S. Securities and Exchange Commission (“SEC”) or any state securities commission nor has the SEC or any state securities commission passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

THE DATE OF THIS PROSPECTUS IS __________, 2015

ABOUT THIS PROSPECTUS

This prospectus is a part of a registration statement that we filed with the SEC utilizing a “shelf” registration process. Under this shelf registration process, we may sell any combination of the securities described in this prospectus in one or more offerings up to a total dollar amount of initial aggregate offering price of $30,000,000. This prospectus provides you with a general description of the securities that we may offer. The specific terms of the securities in respect of which this prospectus is being delivered will be set forth in a prospectus supplement and may include, where applicable: (i) in the case of shares of common stock, the number of shares of common stock offered, the offering price and any other specific terms of the offering; and (ii) in the case of warrants, the designation, number and terms of the shares of common stock purchasable upon exercise of the warrants, any procedures that will result in the adjustment of those numbers, the exercise price, dates and periods of exercise, and the currency or the currency unit in which the exercise price must be paid and any other specific terms. A prospectus supplement may include specific variable terms pertaining to the securities that are not within the alternatives and parameters set forth in this prospectus.

In connection with any offering of the securities (unless otherwise specified in a prospectus supplement), the underwriters or agents may over-allot or effect transactions which stabilize or maintain the market price of the securities offered at a higher level than that which might exist in the open market. Such transactions, if commenced, may be interrupted or discontinued at any time. See “Plan of Distribution”.

Please carefully read both this prospectus and any prospectus supplement together with the documents incorporated herein by reference under “Documents Incorporated by Reference” and the additional information described below under “Where You Can Find More Information.”

Owning securities may subject you to tax consequences both in Canada and the United States. This prospectus or any applicable prospectus supplement may not describe these tax consequences fully. You should read the tax discussion in any prospectus supplement with respect to a particular offering and consult your own tax advisor with respect to your own particular circumstances.

References in this prospectus to “$” are to United States dollars. Canadian dollars are indicated by the symbol “Cdn$”.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. The distribution or possession of this prospectus in or from certain jurisdictions may be restricted by law. This prospectus is not an offer to sell the securities and is not soliciting an offer to buy the securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted to make such an offer or sale. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the securities. Our business, financial condition, results of operations and prospects may have changed since that date.

In this prospectus and in any prospectus supplement, unless the context otherwise requires, references to “Timberline,” the “Company,” “we,” “us,” or “our” refers to Timberline Resources Corporation and/or its wholly owned subsidiaries.

TABLE OF CONTENTS

| SUMMARY |

1 |

| |

|

| RISK FACTORS |

5 |

| |

|

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS |

15 |

| |

|

| DOCUMENTS INCORPORATED BY REFERENCE |

16 |

| |

|

| USE OF PROCEEDS |

17 |

| |

|

| DESCRIPTION OF COMMON STOCK |

17 |

| |

|

| DESCRIPTION OF WARRANTS |

18 |

| |

|

| PLAN OF DISTRIBUTION |

20 |

| |

|

| TRANSFER AGENT AND REGISTRAR |

21 |

| |

|

| LEGAL MATTERS |

21 |

| |

|

| EXPERTS |

21 |

| |

|

| WHERE YOU CAN FIND MORE INFORMATION |

21 |

SUMMARY

Our Business

We are a mineral exploration company. We acquire properties which we believe have potential to host economic concentrations of minerals, particularly gold, silver and copper. We have acquired mineral prospects for exploration in Nevada, Montana, and Idaho mainly for target commodities of gold, silver, zinc and copper. The prospects are held by both patented and unpatented mining claims owned directly by us or through legal agreements conveying exploration and development rights to us. Most of our prospects have had a prior exploration history as is typical in the mineral exploration industry. Most mineral prospects go through several rounds of exploration before an economic ore body is discovered and prior work often eliminates targets or points to new ones. Also, prior operators may have explored such mineral prospects under a completely different commodity price structure or technological regime. Mineralization which was uneconomic in the past may be ore grade at current market prices when extracted and processed with modern technology.

Talapoosa Property

Talapoosa is a 14,870 acre district-scale property comprising US Bureau of Land Management (“BLM”) claims, fee lands, and water rights. Mineralized material at Talapoosa consists of 42.5 million tons of in place bulk tonnage with an average grade of 0.03 ounces of gold per ton and 0.37 ounces of silver per ton. The project was fully permitted by Miramar Mining Corporation with the BLM and the State of Nevada in 1996, but remained undeveloped due to low prevailing metals prices. The deposit is open on strike, and we believe potential exists to expand the quantity of mineralized material with additional exploration. The acquisition includes the 4 mile-long Appaloosa zone located one mile to the north of and parallel to the Talapoosa mineralized area. The Appaloosa zone outcrops as epithermal-type sinter and breccia with vein fragments and is untested but for six historic, shallow drill holes.

In March, 2015, we completed a National Instrument 43-101 (“NI 43-101”) compliant Technical Report entitled “Technical Report and Resource Estimate on the Talapoosa Project, Nevada,” dated March 24, 2015 (the “Talapoosa Technical Report”) substantiating the mineralization for the Talapoosa project. Upon completion of the Talapoosa Technical Report, we initiated an NI 43-101 Preliminary Economic Assessment (“PEA”) on the property. Results of the PEA were released on April 27, 2015 and reported positive results on a potential open pit mine with heap leach processing and Merrill Crowe recovery of gold and silver. To support the PEA, we completed due diligence reviews on the gold and silver mineralization; historic studies including metallurgy, geotechnical pit wall stability, hydrology, geochemistry, mining methods, and facility siting for the previously proposed operation.

Follow-up work is planned to include additional metallurgical studies, drilling for additional samples and to increase our level of confidence for certain parts of the mineralized zone, and initiation of studies to update historic permits to current standards. These activities are expected to be incorporated into a NI 43-101 compliant Preliminary Feasibility Study during the first half of 2016.

There are no proven and probable reserves as defined under United States Securities and Exchange Commission’s Industry Guide 7 (“Guide 7”) at Talapoosa and our activities there remain exploratory in nature.

Eureka Property

The Eureka Project, which includes Lookout Mountain, comprises an area of approximately 15,000 acres, or more than 23 square miles. The Eureka Project is located within the southern portion of Nevada’s Battle Mountain-Eureka gold trend and includes three structurally controlled zones of gold mineralization, each approximately 3- 4 miles in strike length, all zones of which are open and will require additional in-fill and step-out drilling. The project has an extensive exploration, drilling, and gold production history by a number of companies since 1975, including Idaho Mining Corp., Norse-Windfall Mining, Amselco, Echo Bay Mines, Newmont and Barrick Gold. A total of 533 holes, totaling 267,000 feet, were drilled on the property prior to its acquisition by Timberline in 2010. Gold mineralization tested to date is typical sediment-hosted “Carlin-type” gold mineralization, most of which may be amenable to low cost, heap leach processing.

In 2010-2011 we completed an exploration program that culminated in the release of an NI 43-101 compliant technical report, entitled, “Technical Report on the Lookout Mountain Project, Eureka County, Nevada, USA,” dated May 2, 2011 (the “Lookout Mountain Technical Report”). The Lookout Mountain Technical Report details mineralization at Lookout Mountain.

The Lookout Mountain Technical Report was modeled and estimated by MDA by evaluating available drill data statistically, utilizing geologic interpretations provided by Timberline to interpret gold mineral domains on cross sections spaced at 50- to 100-foot intervals across the extent of the Lookout Mountain mineralization, rectifying the mineral-domain interpretations on level plans spaced at 10-foot intervals, analyzing the modeled mineralization geostatistically to aid in the establishment of estimation parameters, and interpolating grades into a three-dimensional block model.

During most of 2014, the Company limited exploration related activities to low cost field surveys including soil and rock sampling, drill site reclamation, site archeological surveys, and geologic mapping. The mapping led to identification of new targets on each of the three structural zones of gold mineralization. In December, 2014 drilling resumed at Eureka with an initial test of one new target completed before year-end. Reverse circulation (RC) drill hole BHSE-171 identified a new zone of gold mineralization and intersected 25 feet of 0.144 ounces of gold per ton (opt) (7.62 meters (m) of 4.93 grams of gold per tonne (g/t)) within a longer 65 foot interval assaying 0.094 opt (19.82 m of 3.22 g/t) in the Lookout Mountain area. This hole was offset 140 feet from BHSE-152 (drilled in 2012) which first encountered the new zone in 2012 but was not completed due to drilling difficulties.

In follow-up to the successful results in RC drill hole BHSE-171, two diamond drill core holes were completed in January, 2015. BHSE-172 intersected 25.2 feet of 0.15 opt (7.7 m of 5.02 g/t) within an interval of 46.6 feet of 0.10 opt (14.2 m of 5.02 g/t). BHSE-173 intercepted 57.4 feet of 0.06 opt (17.5 m @ 1.92 g/t). The two core hole intercepts of the mineralized zone were offset approximately 140 feet from BHSE-171. The intercepts are well-correlated, as the gold occurs in mineralized collapse breccia within the pyritic Dunderberg Shale-Hamburg Dolomite contact zone. The intercepts are thought by Timberline geologists to be related to a higher grade feeder system as recognized in many Carlin-type systems.

Two additional RC holes were completed as infill drilling within the existing resource area at Lookout Mountain. Results were highlighted by hole BHSE-174 which intercepted 75.0 feet of 0.02 opt (22.9 m of 0.57 g/t) which is very consistent with surrounding intercepts.

We also completed a six-hole RC drill program on the Windfall target within the Eureka project. This drilling successfully tested on-strike, offset, and down-dip extensions of gold mineralization that was previously mined at Windfall. Six drill holes completed over a strike length of approximately 3,000 feet intersected gold mineralization consistent with results from over 600 historic drill holes, highlighted by BHWF-40 which intersected 80 feet at 0.09 opt of gold (6.1 m @ 8.79 g/t).

Further work at Eureka is planned for 2015 to include updating of geologic models at Lookout Mountain and Windfall based on the recent drilling results. The data for Windfall will be evaluated to support potential development of a resource estimate of the gold mineralization at the project.

Of our previously announced budget of approximately $2 million for 2015 exploration on the Eureka Project, including Lookout Mountain and Windfall, we have spent approximately $0.5 million to date, and we have reduced our anticipated expenditures at Eureka in order to prioritize resources toward the development of Talapoosa.

There are no proven and probable reserves as defined under Guide 7 at the Eureka Project and our activities there remain exploratory in nature.

Butte Highlands Gold Project

In conjunction with our joint venture partner, Highland, we continue to advance the Butte Highlands project toward an expected commencement of mineral extraction. With the receipt of final assays from the 50,000-foot underground exploration drill program that was completed in the year ended September 30, 2011, Highland completed an initial mine plan and obtained necessary data for the submission of the Hard Rock Operating Permit (“HRO Permit”) application. The mine plan anticipates mineral extraction of approximately 400 tons per day during the first four years of operation, with mineralized material to be direct shipped to a nearby mill.

We submitted the application for our HRO Permit to the Montana Department of Environmental Quality (“MDEQ”) in May 2010. As a result of hydrological studies, it had become evident that there would be a need to pump and discharge more water from the mineralized area than was initially expected. As a result, the project requires an additional water discharge permit (“MPDES Permit”) issued by the State of Montana and the construction of additional water treatment facilities. An application for the MPDES Permit was submitted to the MDEQ on March 30, 2012, and during the quarter ended June 30, 2013 we received the MPDES Permit, to take effect on August 1, 2013.

In May 2013, we released an NI 43-101 compliant technical report, entitled, “Technical Report on the Butte Highlands Gold Project, Silver Bow County, Montana, USA,” dated May 10, 2013 (the “Butte Technical Report”).

A significant project milestone was achieved with the receipt of a notice of completeness and draft HRO Permit from the MDEQ on December 7, 2012. In January, 2013, with environmental baseline studies substantially complete, the MDEQ initiated completion of an Environmental Impact Statement (“EIS”) for the project upon which the final HRO Permit was scheduled to be issued late in the third quarter of 2013. A draft EIS was issued on October 11, 2013 and, after receipt of public comments thereupon, the MDEQ spent most of 2014 preparing the final EIS document which was published on December 18, 2014. The MDEQ has subsequently published, on January 26, 2015, a Record of Decision (“ROD”) authorizing Butte Highlands Joint Venture (“BHJV”) to construct and operate the proposed underground gold mine.

During 2014, the United States Forest Service (“USFS”) completed specialist studies in support of a proposed Plan of Operations to allow the usage of USFS roads for haulage of mineralized material from the mine site. The USFS initiated preparation of an Environmental Assessment (“EA”) in the second quarter of 2013. The draft EA was released and followed with a public comment period in the first quarter of 2014. During the fourth quarter of 2014, the USFS continued preparing a Final EA which considers the public comments and is coordinating plans with Butte-Silver Bow County and BHJV for long-term road maintenance plans.

In March, 2015, the USFS released a Draft Decision Notice on an EA which, when finalized, will authorize material haulage by BHJV and provides a route for mine support vehicles. The USFS concluded that the effects of using either of two alternative routes would be mitigated thereby allowing a Finding of No Significant Impacts. The Draft Decision Notice is subject to a final objection period of 45 days as mandated by federal law.

In the first quarter of 2014, a “Nationwide 404” Permit was granted by the US Army Corp of Engineers (ACOE), as was a Conservation District 310 Permit (pending final engineering design submittals), to BHJV to allow needed road improvements across stream crossings and associated minor wetlands.

With receipt of the ROD for the project and a revised schedule from the USFS, pending favorable gold price, we anticipate that BHJV will post the required bond and re-initiate final pre-development planning and work in the second quarter of 2015. BHJV has already initiated planning for implementation of mitigation measures identified by the MDEQ in the ROD. Upgrades to the road are anticipated to begin shortly after receipt of the final decision from the USFS on the proposed Plan of Operations. Final approval by the USFS for road use is the remaining step to permit the project for full-scale mining. Once approved, and subject to a positive extraction decision by the joint venture, road improvements and final mine construction are expected to be completed in the second half of 2015.

Timberline's joint venture operating agreement at the Butte Highlands Project calls for Timberline to retain a 50-percent project interest while being carried to production (as defined in the joint venture agreement) by Highland. Once in production, as defined in the joint venture agreement, Timberline is to receive 20-percent of project cash flow until Highland recovers its initial capital expenditures, at which time Timberline will receive 50-percent of cash flow.

A feasibility study has not been completed on the Butte Highlands project, and there are no proven and probable reserves at the property under Guide 7. Our activities there remain exploratory in nature and there is no certainty the proposed operations will be economically viable.

Our Company

We were incorporated in the State of Idaho on August 28, 1968 under the name Silver Crystal Mines, Inc., to engage in the business of exploring for precious metal deposits and advancing them toward production. We ceased exploration activities during the 1990s. In December 2003, a group of investors purchased 80 percent of our issued and outstanding common stock from the then-controlling management team. In January 2004, we affected a one-for-four reverse split of our issued and outstanding shares of common stock and increased our authorized common stock to 100 million shares of common stock, with a par value of $.001 per share. Unless otherwise indicated, all references herein to shares outstanding and share issuances have been adjusted to give effect to the aforementioned stock split. On February 2, 2004, our name was changed to Timberline Resources Corporation. On August 27, 2008, we reincorporated into the State of Delaware pursuant to a merger agreement approved by our shareholders on August 22, 2008.

We currently maintain an administrative office at 101 East Lakeside Ave., Coeur d’Alene, Idaho 83814. The telephone number of our administrative office is (866) 513-4859 (toll free) or (208) 664-4859.

Recent Developments

| ● |

On March 12, 2015 (the “Effective Date”), we entered into a property option agreement (the “Option Agreement”) by and among us and Talapoosa Development Corp., as buyers, and American Gold Capital US Inc., Gunpoint Exploration US Ltd. and Gunpoint Exploration Ltd. (“Gunpoint”), as sellers, pursuant to which |

| |

the sellers granted the Company an exclusive and irrevocable option (the “Option”) to purchase a 100% interest in and to the sellers’ Talapoosa project (the “Project”). Pursuant to the Option Agreement, the Company has the right to exercise the option at any time beginning on the Initial Closing Date (as defined in the Option Agreement, currently anticipated to be March 27, 2015) and ending within thirty (30) months of the Effective Date, unless sooner terminated, or until the earlier exercise of the Option (“Option Period”). Pursuant to the Option Agreement, we have the right to exercise the Option at any time. The Company has agreed to use its reasonable efforts to complete a feasibility study on the Project during the Option Period, but completion of the feasibility study is not a condition to the Company’s right to exercise the Option; provided however, that if during the Option Period the Company determines not to exercise the Option or not to work towards the completion of a feasibility study, the Option will terminate and the Project will revert back to sellers. |

Further Information

Prospective purchasers should read the description of our company and our business under the headings “ITEM 1.DESCRIPTION OF BUSINESS” and “ITEM 2. DESCRIPTION OF PROPERTIES” in our Annual Report on Form 10-K for the year ended September 30, 2014, filed with the SEC on December 23, 2014 and incorporated by reference into this prospectus.

The Securities Offered under this Prospectus

We may offer the shares of common stock, warrants or any combination thereof with a total value of up to $30,000,000 from time to time under this prospectus, together with any applicable prospectus supplement, at prices and on terms to be determined by market conditions at the time of offering. This prospectus provides you with a general description of the securities we may offer. Each time we offer securities, we will provide a prospectus supplement that will describe the specific amounts, prices and other important terms of the securities.

A prospectus supplement may also add, update or change information contained in this prospectus or in documents we have incorporated by reference. However, no prospectus supplement will offer a security that is not described in this prospectus.

We may sell the securities on a continuous or delayed basis to or through underwriters, dealers or agents or directly to purchasers. The prospectus supplement, which we will provide each time we offer securities, will set forth the names of any underwriters, dealers or agents involved in the sale of the securities, and any applicable fee, commission or discount arrangements with them.

Shares of Common Stock

We may offer shares of common stock. Holders of shares of common stock are entitled to one vote per share of common stock on all matters that require shareholder approval. Holders of shares of common stock are entitled to dividends when and if declared by our board of directors. The shares of common stock are described in greater detail in this prospectus under “Description of Shares of Common Stock.”

Warrants

We may offer warrants for the purchase of shares of common stock, in one or more series, from time to time. We may issue warrants independently or together with shares of common stock, and the warrants may be attached to or separate from such securities.

The warrants will be evidenced by warrant certificates and may be issued under one or more warrant indentures, which are contracts between us and a warrant trustee for the holders of the warrants. In this prospectus, we have summarized certain general features of the warrants under “Description of Warrants.” We urge you, however, to read any prospectus supplement related to the series of warrants being offered, as well as the complete warrant indentures and warrant certificates that contain the terms of the warrants. Specific warrant indentures will contain additional important terms and provisions and, if entered into in connection with a series of warrants, will be filed on Form 8-K with the SEC before the issuance of the related series of warrants.

THIS PROSPECTUS MAY NOT BE USED TO OFFER OR SELL ANY SECURITIES UNLESS ACCOMPANIED BY A PROSPECTUS SUPPLEMENT.

RISK FACTORS

Investing in the securities involves a high degree of risk. Prospective investors in a particular offering of securities should carefully consider the following risks as well as the other information contained in this prospectus, any applicable prospectus supplement, and the documents incorporated by reference herein and therein before investing in the securities. If any of the following risks actually occurs, our business could be materially harmed. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties, including those of which we are currently unaware or that we deem immaterial, may also adversely affect our business.

An investment in a mine service and an exploration stage mining company with a short history of operations such as ours involves an unusually high amount of risk, both known and unknown, present and potential, including, but not limited to the risks enumerated below.

Failure to successfully address the risks and uncertainties described below would have a material adverse effect on our business, financial condition and/or results of operations, and the trading price of our common stock may decline and investors may lose all or part of their investment. We cannot assure you that we will successfully address these risks or other unknown risks that may affect our business.

Estimates of mineralized material are forward-looking statements inherently subject to error. Although resource estimates require a high degree of assurance in the underlying data when the estimates are made, unforeseen events and uncontrollable factors can have significant adverse or positive impacts on the estimates. Actual results will inherently differ from estimates. The unforeseen events and uncontrollable factors include: geologic uncertainties including inherent sample variability, metal price fluctuations, variations in mining and processing parameters, and adverse changes in environmental or mining laws and regulations. The timing and effects of variances from estimated values cannot be accurately predicted.

Risks Related To Our Company

Our ability to operate as a going concern is in doubt.

The audit opinion and notes that accompany our consolidated financial statements for the year ended September 30, 2014, disclose a ‘going concern’ qualification to our ability to continue in business. The accompanying consolidated financial statements have been prepared under the assumption that we will continue as a going concern. We are an exploration stage company and we have incurred losses since our inception. We do not have sufficient cash to fund normal operations and meet debt obligations for the next 12 months without deferring payment on certain current liabilities and raising additional funds. We currently have no historical recurring source of revenue and our ability to continue as a going concern is dependent on our ability to raise capital to fund our future exploration and working capital requirements or our ability to profitably execute our business plan. Our plans for the long-term return to and continuation as a going concern include financing our future operations through sales of our common stock and/or debt and the eventual profitable exploitation of our mining properties. Additionally, the current capital markets and general economic conditions in the United States are significant obstacles to raising the required funds. These factors raise substantial doubt about our ability to continue as a going concern.

The consolidated financial statements do not include any adjustments that might be necessary should the Company be unable to continue as a going concern. If the going concern basis were not appropriate for these financial statements, adjustments would be necessary in the carrying value of assets and liabilities, the reported expenses and the balance sheet classifications used.

We have a limited operating history on which to base an evaluation of our business and prospects.

Although we have been in the business of exploring mineral properties since our incorporation in 1968, we were inactive for many years prior to our new management in 2004. Since 2004 we have not yet located any mineral reserves. As a result, we have not had any revenues from our exploration division. However, we have had a drilling services wholly-owned subsidiary which has generated revenues in past fiscal years. In addition, our operating history has been restricted to the acquisition and exploration of our mineral properties, and this does not provide a

meaningful basis for an evaluation of our prospects if we ever determine that we have a mineral reserve and commence the construction and operation of a mine. Other than through conventional and typical exploration methods and procedures, we have no additional way to evaluate the likelihood of whether our mineral properties contain any mineral reserves or, if they do that they will be operated successfully. As a result, we are subject to all of the risks associated with developing and establishing new mining operations and business enterprises including:

|

·

|

completion of feasibility studies to verify reserves and commercial viability, including the ability to find sufficient gold reserves to support a commercial mining operation;

|

|

·

|

the timing and cost, which can be considerable, of further exploration, preparing feasibility studies, permitting and construction of infrastructure, mining, and processing facilities;

|

|

·

|

the availability and costs of drill equipment, exploration personnel, skilled labor, and mining and processing equipment, if required;

|

|

·

|

compliance with environmental and other governmental approval and permit requirements;

|

|

·

|

the availability of funds to finance exploration, development, and construction activities, as warranted;

|

|

·

|

potential opposition from non-governmental organizations, environmental groups, local groups, or local inhabitants which may delay or prevent development activities;

|

|

·

|

potential increases in exploration, construction, and operating costs due to changes in the cost of fuel, power, materials, and supplies; and

|

|

·

|

potential shortages of mineral processing, construction, and other facilities-related supplies.

|

The costs, timing, and complexities of exploration, development, and construction activities may be increased by the location of our properties and demand by other mineral exploration and mining companies. It is common in exploration programs to experience unexpected problems and delays during drill programs and, if warranted, development, construction, and mine start-up. Accordingly, our activities may not result in profitable mining operations and we may not succeed in establishing mining operations or profitably producing metals at any of our properties. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations.

We have a history of losses and expect to continue to incur losses in the future.

We have incurred losses since inception and expect to continue to incur losses in the future. We incurred the following losses during each of the following periods:

|

·

|

$2,777,886 for the year ended September 30, 2014;

|

|

·

|

$3,724,582 for the year ended September 30, 2013; and

|

|

·

|

$7,171,572 for the year ended September 30, 2012;

|

We had an accumulated deficit of approximately $45 million as of September 30, 2014. We expect to continue to incur losses unless and until such time as one of our properties enters into commercial production and generates sufficient revenues to fund continuing operations. We recognize that if we are unable to generate significant revenues from mining operations and dispositions of our properties, we will not be able to earn profits or continue operations. At this early stage of our operation, we also expect to face the risks, uncertainties, expenses, and difficulties frequently encountered by companies at the start-up stage of their business development. We cannot be sure that we will be successful in addressing these risks and uncertainties and our failure to do so could have a materially adverse effect on our financial condition.

Risks Associated With Mining and the Exploration Portion of Our Business

All of our properties are in the exploration stage. There is no assurance that we can establish the existence of any mineral reserve on any of our properties in commercially exploitable quantities. Until we can do so, we cannot earn any revenues from these properties, and if we do not do so, we will lose all of the funds that we expend on exploration. If we do not discover any mineral reserve in a commercially exploitable quantity, the exploration component of our business could fail.

We have not established that any of our mineral properties contain any mineral reserves according to recognized reserve guidelines, nor can there be any assurance that we will be able to do so. A mineral reserve is defined by the Securities and Exchange Commission in its Industry Guide 7 as that part of a mineral deposit, which could be economically and legally extracted or produced at the time of the reserve determination. The probability of an individual prospect ever having a "reserve" that meets the requirements of the Securities and Exchange

Commission's Industry Guide 7 is extremely remote; in all probability our mineral properties do not contain any “reserve” and any funds that we spend on exploration will probably be lost. Even if we do eventually discover a mineral reserve on one or more of our properties, there can be no assurance that they can be developed into producing mines to extract those minerals. Both mineral exploration and development involve a high degree of risk and few properties which are explored are ultimately developed into producing mines.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade, and other attributes of the mineral deposit, the proximity of the mineral deposit to infrastructure such as a smelter, roads, and a point for shipping, government regulation, and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral deposit unprofitable.

Mineral operations are subject to applicable law and government regulation. Even if we discover a mineral reserve in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of that mineral reserve. If we cannot exploit any mineral reserve that we might discover on our properties, our business may fail.

Both mineral exploration and extraction require permits from various foreign, federal, state, provincial, and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety, and other matters. Regarding our future ground disturbing activity on federal land, we will be required to obtain a permit from the US Forest Service or the Bureau of Land Management prior to commencing exploration. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration of our mineral properties or for the construction and operation of a mine on our properties at economically viable costs. If we cannot accomplish these objectives, our business could face difficulty and/or fail.

We believe that we are in compliance with all material laws and regulations that currently apply to our activities, but there can be no assurance that we can continue to do so. Current laws and regulations could be amended and we might not be able to comply with them, as amended. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that we will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of our mineral properties.

Environmental hazards unknown to us, which have been caused by previous or existing owners or operators of the properties, may exist on the properties in which we hold an interest. In past years we have been engaged in exploration in northern Idaho, which is currently the site of a Federal Superfund cleanup project. Although we are no longer involved in this or other areas at present, it is possible that environmental cleanup or other environmental restoration procedures could remain to be completed or mandated by law, causing unpredictable and unexpected liabilities to arise. At the date of prospectus, we are not aware of any environmental issues or litigation relating to any of our current or former properties.

Future legislation and administrative changes to the mining laws could prevent us from exploring our properties.

New state and U.S. federal laws and regulations, amendments to existing laws and regulations, administrative interpretation of existing laws and regulations, or more stringent enforcement of existing laws and regulations, could have a material adverse impact on our ability to conduct exploration and mining activities. Any change in the regulatory structure making it more expensive to engage in mining activities could cause us to cease operations.

Regulations and pending legislation governing issues involving climate change could result in increased operating costs, which could have a material adverse effect on our business.

A number of governments or governmental bodies have introduced or are contemplating regulatory changes in response to various climate change interest groups and the potential impact of climate change. Legislation and increased regulation regarding climate change could impose significant costs on us, our venture partners, and our suppliers, including costs related to increased energy requirements, capital equipment, environmental monitoring and reporting, and other costs to comply with such regulations. Any adopted future climate change regulations could also negatively impact our ability to compete with companies situated in areas not subject to such limitations. Given the political significance and uncertainty around the impact of climate change and how it should be dealt with, we cannot predict how legislation and regulation will affect our financial condition, operating performance and ability to compete. Furthermore, even without such regulation, increased awareness and any adverse publicity in the global

marketplace about potential impacts on climate change by us or other companies in our industry could harm our reputation. The potential physical impacts of climate change on our operations are highly uncertain, and would be particular to the geographic circumstances in areas in which we operate. These may include changes in rainfall and storm patterns and intensities, water shortages, changing sea levels, and changing temperatures. These impacts may adversely impact the cost, production, and financial performance of our operations.

If we establish the existence of a mineral reserve on any of our properties in a commercially exploitable quantity, we will require additional capital in order to develop the property into a producing mine. If we cannot raise this additional capital, we will not be able to exploit the reserve, and our business could fail.

If we do discover mineral reserves in commercially exploitable quantities on any of our properties, we will be required to expend substantial sums of money to establish the extent of the reserve, develop processes to extract it, and develop extraction and processing facilities and infrastructure. There can be no assurance that a mineral reserve will be large enough to justify commercial operations, nor can there be any assurance that we will be able to raise the funds required for development on a timely basis. If we cannot raise the necessary capital or complete the necessary facilities and infrastructure, our business may fail.

Land reclamation requirements for our properties may be burdensome and expensive.

Although variable depending on location and the governing authority, land reclamation requirements are generally imposed on mineral exploration companies (as well as companies with mining operations) in order to minimize long term effects of land disturbance.

Reclamation may include requirements to:

|

·

|

control dispersion of potentially deleterious effluents; and

|

|

·

|

reasonably re-establish pre-disturbance land forms and vegetation.

|

In order to carry out reclamation obligations imposed on us in connection with our potential development activities, we must allocate financial resources that might otherwise be spent on further exploration and development programs. We plan to set up a provision for our reclamation obligations on our properties, as appropriate, but this provision may not be adequate. If we are required to carry out unanticipated reclamation work, our financial position could be adversely affected.

Mining exploration and development is inherently dangerous and subject to conditions or events beyond our control, which could have a material adverse effect on our business and plans.

Mining and mineral exploration involves various types of risks and hazards, including:

|

|

metallurgical and other processing problems;

|

|

·

|

unusual or unexpected geological formations;

|

|

·

|

personal injury, flooding, fire, explosions, cave-ins, landslides, and rock-bursts;

|

|

·

|

inability to obtain suitable or adequate machinery, equipment, or labor;

|

|

·

|

fluctuations in exploration, development, and production costs;

|

|

·

|

unanticipated variations in grade;

|

|

·

|

mechanical equipment failure; and

|

|

·

|

periodic interruptions due to inclement or hazardous weather conditions.

|

These risks could result in damage to, or destruction of, mineral properties, production facilities, or other properties, personal injury, environmental damage, delays in mining, increased production costs, monetary losses, and possible legal liability.

Mineral exploration and development is subject to extraordinary operating risks. We do not currently insure against these risks. In the event of a cave-in or similar occurrence, our liability may exceed our resources, which would have an adverse impact on our Company.

Mineral exploration, development, and production involve many risks, which even a combination of experience, knowledge, and careful evaluation may not be able to overcome. Our operations will be subject to all the hazards and risks inherent in the exploration, development and production of minerals, including liability for pollution, cave-ins or similar hazards against which we cannot insure or against which we may elect not to insure. Any such event could result in work stoppages and damage to property, including damage to the environment. We do not currently maintain any insurance coverage against these operating hazards. The payment of any liabilities that arise from any such occurrence would have a material, adverse impact on our Company.

Increased costs could affect our financial condition.

We anticipate that costs at our projects that we may explore or develop, will frequently be subject to variation from one year to the next due to a number of factors, such as changing ore grade, metallurgy, and revisions to mine plans, if any, in response to the physical shape and location of the ore body. In addition, costs are affected by the price of commodities such as fuel, rubber, and electricity. Such commodities are at times subject to volatile price movements, including increases that could make production at certain operations less profitable. A material increase in costs at any significant location could have a significant effect on our profitability.

A shortage of equipment and supplies could adversely affect our ability to operate our business.

We are dependent on various supplies and equipment to carry out our mining exploration and, if warranted, development operations. The shortage of such supplies, equipment, and parts could have a material adverse effect on our ability to carry out our operations and therefore limit or increase the cost of production.

Estimates of mineralized material are subject to evaluation uncertainties that could result in project failure.

Our exploration and future mining operations, if any, are and would be faced with risks associated with being able to accurately predict the quantity and quality of mineralized material within the earth using statistical sampling techniques. Estimates of any mineralized material on any of our properties would be made using samples obtained from appropriately placed trenches, test pits, and underground workings and intelligently designed drilling. There is an inherent variability of assays between check and duplicate samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated. Additionally, there also may be unknown geologic details that have not been identified or correctly appreciated at the current level of accumulated knowledge about our properties. This could result in uncertainties that cannot be reasonably eliminated from the process of estimating mineralized material. If these estimates were to prove to be unreliable, we could implement an exploitation plan that may not lead to commercially viable operations in the future.

Mineral prices are subject to dramatic and unpredictable fluctuations.

We expect to derive revenues, if any, from the eventual extraction and sale of precious metals such as gold and silver. The price of those commodities has fluctuated widely in recent years, and is affected by numerous factors beyond our control including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities and increased production due to new extraction developments, and improved extraction and production methods. The effect of these factors on the price of precious metals, and, therefore, the economic viability of any of our exploration projects, cannot accurately be predicted.

The mining industry is highly competitive and there is no assurance that we will continue to be successful in acquiring mineral claims. If we cannot continue to acquire properties to explore for mineralized material, we may be required to reduce or cease exploration activity and/or operations.

The mineral exploration, development, and production industry is largely un-integrated. We compete with other exploration companies looking for mineral properties and the minerals that can be produced from them. While we compete with other exploration companies in the effort to locate and license mineral properties, we do not compete with them for the removal or sales of mineral products from our properties if we should eventually discover the presence of them in quantities sufficient to make production economically feasible. Readily available markets exist worldwide for the sale of gold and other mineral products. Therefore, we will likely be able to sell any gold or mineral products that we identify and produce.

There are hundreds of public and private companies that are actively engaged in mineral exploration. A representative sample of exploration companies that are similar to us in size, financial resources, and primary objective include such publicly traded mineral exploration companies as Corvus Gold Inc. (KOR.TO), Pilot Gold Inc. (PLG.TO), Gold Standard Ventures Corp. (GSV), Rye Patch Gold Corp. (RPM.TO), Canamex Resources Corp. (CSQ.V), Solitario Exploration and Royalty Corp. (XPL), and Mines Management (MGN).

Many of our competitors have greater financial resources and technical facilities. Accordingly, we will attempt to compete primarily through the knowledge and experience of our management. This competition could adversely affect our ability to acquire suitable prospects for exploration in the future. Accordingly, there can be no assurance that we will acquire any interest in additional mineral properties that might yield reserves or result in commercial mining operations.

Third parties may challenge our rights to our mineral properties or the agreements that permit us to explore our properties may expire if we fail to timely renew them and pay the required fees.

In connection with the acquisition of our mineral properties, we sometimes conduct only limited reviews of title and related matters, and obtain certain representations regarding ownership. These limited reviews do not necessarily preclude third parties from challenging our title and, furthermore, our title may be defective. Consequently, there can be no assurance that we hold good and marketable title to all of our mining concessions and mining claims. If any of our concessions or claims were challenged, we could incur significant costs and lose valuable time in defending such a challenge. These costs or an adverse ruling with regards to any challenge of our titles could have a material adverse effect on our financial position or results of operations. There can be no assurance that any such disputes or challenges will be resolved in our favor.

We are not aware of challenges to the location or area of any of our mining claims. There is, however, no guarantee that title to the claims will not be challenged or impugned in the future.

Acquisitions and integration issues may expose us to risks.

Our business strategy includes making targeted acquisitions. Any acquisition that we make may be of a significant size, may change the scale of our business and operations, and may expose us to new geographic, political, operating, financial, and geological risks. Our success in our acquisition activities depends on our ability to identify suitable acquisition candidates, negotiate acceptable terms for any such acquisition and integrate the acquired operations successfully with our own. Any acquisitions would be accompanied by risks. For example, there may be significant decreases in commodity prices after we have committed to complete the transaction and have established the purchase price or exchange ratio; a potential materialized property may prove to be below expectations; we may have difficulty integrating and assimilating the operations and personnel of any acquired companies, realizing anticipated synergies and maximizing the financial and strategic position of the combined enterprise and maintaining uniform standards, policies and controls across the organization; the integration of the acquired business or assets may disrupt our ongoing business and our relationships with employees, customers, suppliers, and contractors; and the acquired business or assets may have unknown liabilities which may be significant. If we choose to use equity securities as consideration for such an acquisition, existing shareholders may suffer dilution. Alternatively, we may choose to finance any such acquisition with our existing resources. There can be no assurance that we would be successful in overcoming these risks or any other problems encountered in connection with such acquisitions.

Joint ventures and other partnerships in relation to our properties may expose us to risks.

We are currently involved in, and may enter into in the future, joint ventures or other partnership arrangements with other parties in relation to the exploration, development, and production of certain of the properties in which we have an interest, particularly the Butte Highlands project. Joint ventures can often require unanimous approval of the parties to the joint venture or their representatives for certain fundamental decisions such as an increase or reduction of registered capital, merger, division, dissolution, amendments of constating documents, and the pledge of joint venture assets, which means that each joint venture party may have a veto right with respect to such decisions which could lead to a deadlock in the operations of the joint venture or partnership. Further, we may be unable to exert control over strategic decisions made in respect of such properties. Any failure of such other companies to meet their obligations to us or to third parties, or any disputes with respect to the parties' respective rights and obligations, could have a material adverse effect on the joint ventures or their properties and therefore could have a material adverse effect on our results of operations, financial performance, cash flows, and the price of our common stock.

Risks Related To Our Company

Conflicts of Interest

Certain of our officers and directors may be or become associated with other businesses, including natural resource companies that acquire interests in mineral properties. Such associations may give rise to conflicts of interest from time to time. Our directors are required by Delaware Corporation law to act honestly and in good faith with a view to our best interests and to disclose any interest, which they may have in any of our projects or opportunities. In general, if a conflict of interest arises at a meeting of the board of directors, any director in a conflict will disclose his interest and abstain from voting on such matter or, if he does vote, his vote will not be counted.

We have not adopted any separate formal corporate policy regarding conflicts of interest; however other corporate governance measures have been adopted, such as creating a directors’ audit committee requiring independent directors. Additionally, our Code of Ethics does address areas of possible conflicts of interest. As of the date of filing of this report, we had four independent directors on our board of directors (William M. Sheriff, John E. Watson, Robert Martinez and Leigh Freeman). We have formed three committees to ensure our compliance with the requirements of the NYSE MKT. We established an independent audit committee consisting of two independent directors, both of whom were determined to be “financially literate” and one of whom was designated as the “financial expert.” We also formed a compensation committee and a corporate governance and nominating committee, both of which are comprised entirely of independent directors. At this time, we feel that these committees and our Code of Ethics provide sufficient corporate governance for our purposes and will meet the specific requirements of the NYSE MKT.

Dependence on Key Management Employees

The nature of both sides of our business, our ability to continue our exploration and development activities and to develop a competitive edge in the marketplace, depends, in large part, on our ability to attract and maintain qualified key management personnel. Competition for such personnel is intense, and there can be no assurance that we will be able to attract and retain such personnel. Our development now and in the future will depend on the efforts of key management figures such as Paul Dircksen, Randal Hardy, and Steven Osterberg. The loss of any of these key people could have a material adverse effect on our business. In this regard, we have attempted to reduce the risk associated with the loss of key personnel and have obtained directors and officers insurance coverage. In addition, we have expanded the provisions of our equity incentive plan so that we can provide incentives for our key personnel.

We may not realize the benefits of the Talapoosa, Lookout Mountain and other acquired growth projects.

As part of our strategy, we will continue existing efforts and initiate new efforts to develop gold and other mineral projects. We have a large number of such projects, including the Talapoosa and Lookout Mountain projects. A number of risks and uncertainties are associated with the development of these types of projects, including political, regulatory, design, construction, labor, operating, technical and technological risks, and uncertainties relating to capital and other costs and financing risks. The failure to successfully develop any of these initiatives could have a material adverse effect on our financial position and results of operations.

As part of our business model, we pursue a strategy that may cause us to expend significant resources exploring properties that may not become revenue-producing sites, including the Talapoosa and Lookout Mountain projects.

Part of our business model is to pursue a strategy which includes significant exploration activities, such as proposed exploration at the Lookout Mountain project. Because of the nature of exploration for precious metals, a property’s exploration potential is not known until a significant amount of geologic information has been generated. We may spend significant resources exploring the Talapoosa and Lookout Mountain projects and gathering certain geologic information only to determine that the project is not capable of being a revenue-producing property for us.

Our business is subject to evolving corporate governance and public disclosure regulations that have increased both our compliance costs and the risk of noncompliance, which could have an adverse effect on our stock price.

We are subject to changing rules and regulations promulgated by a number of governmental and self-regulated organizations, including the SEC, the NYSE MKT, and the Financial Accounting Standards Board. These rules and regulations continue to evolve in scope and complexity, and many new requirements have been created in response to laws enacted by Congress, making compliance more difficult and uncertain. For example, on July 21, 2010, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) with increased disclosure obligations for public companies and mining companies in the United States. Our efforts to comply with the Dodd-Frank Act and other new regulations have resulted in, and are likely to continue to result in, increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities.

We are required to comply with Canadian securities regulations and be subject to additional regulatory scrutiny in Canada.

We are a “reporting issuer” in the Canadian provinces of British Columbia and Alberta. As a result, our disclosure outside the United States differs from the disclosure contained in our SEC filings. Our reserve and resource estimates disseminated outside the United States are not directly comparable to those made in filings subject to SEC reporting and disclosure requirements, as we generally report reserves and resources in accordance with Canadian practices. These practices are different from the practices used to report reserve and resource estimates in reports and other materials filed with the SEC. It is Canadian practice to report measured, indicated, and inferred resources, which are generally not permitted in disclosure filed with the SEC. In the United States, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. United States investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. Further, “inferred resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Disclosure of “contained ounces” is permitted disclosure under Canadian regulations; however, the SEC only permits issuers to report “resources” as in place tonnage and grade without reference to unit measures. Accordingly, information concerning descriptions of mineralization, reserves, and resources contained in disclosure released outside the United States may not be comparable to information made public by other United States companies subject to the reporting and disclosure requirements of the SEC.

We are also subject to increased regulatory scrutiny and costs associated with complying with securities legislation in Canada. For example, we are subject to civil liability for misrepresentations in written disclosure and oral statements. Legislation has been enacted in these provinces which creates a right of action for damages against a reporting issuer, its directors and certain of its officers in the event that the reporting issuer or a person with actual, implied, or apparent authority to act or speak on behalf of the reporting issuer releases a document or makes a public oral statement that contains a misrepresentation or the reporting issuer fails to make timely disclosure of a material change. We do not anticipate any particular regulation that would be difficult to comply with. However, failure to comply with regulations may result in civil awards, fines, penalties, and orders that could have an adverse effect on us.

Risks Associated With Our Common Stock

Our stock price has been volatile and your investment in our common stock could suffer a decline in value.

Our common stock is traded on the NYSE MKT and the TSX.V. The market price of our common stock may fluctuate significantly in response to a number of factors, some of which are beyond our control. These factors include price fluctuations of precious metals, government regulations, disputes regarding mining claims, broad stock market fluctuations, and economic conditions in the United States and Canada.

We do not intend to pay any dividends on shares of our common stock in the near future.

We do not currently anticipate declaring and paying dividends to our shareholders in the near future, and any future decision as to the payment of dividends will be at the discretion of our board of directors and will depend upon our earnings, financial position, capital requirements, plans for expansion, and such other factors as our board of directors deems relevant. It is our current intention to apply net earnings, if any, in the foreseeable future to finance the growth and development of our business.

Investors’ interests in our Company will be diluted and investors may suffer dilution in their net book value per share if we issue additional employee/director/consultant options or if we sell additional shares to finance our operations.

We have not generated revenue from exploration since the commencement of our exploration stage in January 2004. In order to further expand our company and meet our objectives, any additional growth and/or expanded exploration activity may need to be financed through sale and issuance of additional shares, including, but not limited to, raising finances to explore our Eureka property. Furthermore, to finance any acquisition activity, should that activity be properly approved, and depending on the outcome of our exploration programs, we may also need to issue additional shares to finance future acquisitions, growth and/or additional exploration programs of any or all of our projects or to acquire additional properties. We may also in the future grant to some or all of our directors, officers, insiders, and key employees options to purchase our common shares as non-cash incentives. The issuance of any equity securities could, and the issuance of any additional shares will, cause our existing shareholders to experience dilution of their ownership interests.

If we issue additional shares or decide to enter into joint ventures with other parties in order to raise financing through the sale of equity securities, investors' interests in our Company will be diluted and investors may suffer dilution in their net book value per share depending on the price at which such securities are sold. As of the date of the filing of this prospectus there are also outstanding options and warrants granted that are exercisable into 619,189 common shares. If all of these were exercised or converted, these would represent approximately 5% of our issued and outstanding shares. If all of these warrants and options are exercised and the underlying shares are issued, such issuance will cause a reduction in the proportionate ownership and voting power of all other shareholders. The dilution may result in a decline in the market price of our shares.

We are subject to the continued listing criteria of the NYSE MKT and the TSX.V and our failure to satisfy these criteria may result in delisting of our shares of common stock.

Our shares of common stock are currently listed on the NYSE MKT and the TSX.V. In order to maintain the listing, we must maintain certain share prices, financial, and share distribution targets, including maintaining a minimum amount of shareholders’ equity and a minimum number of public shareholders. In addition to objective standards, the NYSE MKT and the TSX.V may delist the securities of any issuer if, in its opinion, the issuer’s financial condition and/or operating results appear unsatisfactory; if it appears that the extent of public distribution or the aggregate market value of the security has become so reduced as to make continued listing on the NYSE MKT or TSX.V inadvisable; if the issuer sells or disposes of principal operating assets or ceases to be an operating company; if an issuer fails to comply with the listing requirements of the NYSE MKT or TSX.V; if an issuer’s shares of common stock sell at what the NYSE MKT or the TSX.V considers a “low selling price” and the issuer fails to correct this via a reverse split of shares after notification by the NYSE MKT or TSX.V; or if any other event occurs or any condition exists which makes continued listing on the NYSE MKT or TSX.V, in their opinion, inadvisable.

On April 5, 2013, we announced that we had received notice from the NYSE MKT that if we did not adequately address the low selling price of our shares of common stock within a reasonable amount of time to the satisfaction of the NYSE MKT, we would not satisfy the continued listing standards of the NYSE MKT set forth in Section 1003(f)(v) of the NYSE MKT Company Guide. On May 23, 2014 we received notice from the NYSE MKT that we were not satisfying the continued listing requirements of the NYSE MKT as a result of the continued low selling price of our shares of common stock. On October 31, 2014, in order to increase the selling price of our shares of common stock, we completed a one-for-twelve reverse stock split, and our stock began trading on a reverse-split adjusted basis on November 3, 2014.

On February 8, 2014, we announced that we had received notice from the NYSE MKT that we were not in compliance with one of the NYSE MKT’s continued listing requirements as set forth in Section 1003(a)(iv) of the Company Guide in that we had sustained losses which were substantial in relation to our overall operations or our existing financial resources, or that our financial condition had become impaired such that it appeared questionable,

in the opinion of the NYSE MKT, as to whether we would be able to continue operations and/or meet our obligations as they matured. On March 25, 2014, we announced that the NYSE MKT had accepted our proposed plan of compliance for us to meet the continued listing requirements of the NYSE MKT. With the acquisition of Wolfpack Nevada on August 15, 2014, we completed our plan to regain compliance with the continued listing requirements of the NYSE MKT.

On November 21, 2014, we were advised by the NYSE MKT that we had regained compliance with their continued listing standards regarding both our financial condition and the low selling price of our shares of common stock.