UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (date of earliest event

reported): July 21, 2015

MGT CAPITAL INVESTMENTS, INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

001-32698 |

13-4148725 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

500 Mamaroneck Avenue, Suite 204,

Harrison, NY 10528

(Address of principal executive offices)

(914) 630-7431

(Registrant’s telephone number, including

area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

| o | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01. | Entry into a Material Definitive Agreement. |

As reported on a Current Report on Form

8-K filed with the Securities and Exchange Commission on June 12, 2015 by MGT Capital Investments, Inc. (the “Company”),

on June 11, 2015 MGT Sports, Inc., a wholly-owned subsidiary of the Company (“Sports”), entered into an Asset Purchase

Agreement (the “Agreement”) with Random Outcome USA Inc., a Delaware corporation (“RO”). Also as reported

on a Current Report on Form 8-K filed with the Securities and Exchange Commission on July 6, 2015, on June 30, 2015 Sports and

RO entered into an amendment to the Agreement (the “First Amendment”).

The First Amendment, among other things:

(i) extended the closing date for the transaction contemplated by the Agreement to July 15, 2015 (from June 30, 2015); (ii) modified

a portion of the purchase price from a cash payment to the Company of $4,000,000 to a cash payment to the Company of $2,000,000

plus the issuance to the Company of a senior secured promissory note in the principal amount of $2,000,000, with a maturity date

not to exceed 90 days from the issuance of the senior secured promissory note; and (iii) increased the number of shares under the

one year warrant to be issued to the Company pursuant to the Agreement from 1,000,000 shares of the common stock of RO (the “RO

Common Stock”) to 1,250,000 shares of RO Common Stock.

On July 21, 2015, Sports and RO entered

into an additional amendment to the Agreement (the “New Amendment”). Pursuant to the New Amendment, the First Amendment

is null and void and (i) the closing date for the transaction contemplated by the Agreement shall be extended to on or before August

31, 2015 at the election of RO; (ii) the Company shall receive a cash payment equal to the sum of (a) $4,000,000 and (b) $10,000

per day for the period starting July 15, 2015 and ending on the closing date; (iii) instead of a one-year warrant to purchase 1,000,000

shares of RO common stock, RO shall issue to the Company a three-year warrant to purchase 500,000 shares of RO Common Stock at

an exercise price of $1.00, a three-year warrant to purchase 500,000 shares of RO Common Stock at an exercise price of $1.33, and

a three-year warrant to purchase 500,000 shares of RO Common Stock at an exercise price of $1.66; and (iv) the termination date

of the Agreement shall be extended to August 31, 2015 (from July 15, 2015). Between July 15, 2015 and July 21, 2015, the parties

entered into other amendments that did not become effective.

The New Amendment became effective on

July 22, 2015, upon Sports’ entry into a binding memorandum of understanding (the "Memorandum") to sell shares of its

Series A Preferred Stock (the “Preferred Stock”) to a third party investor for a purchase price of $250,000, and

the payment to Sports of the $250,000. The Preferred Stock shall have a stated value of $250,000, a liquidation preference of

$250,000 and be senior to all existing and future equity of Sports. Holders of Series A Preferred Stock may convert the

Preferred Stock into 6.25% of Sports’ issued and outstanding common stock at any time and shall not be entitled to

voting rights.. Sports may redeem the Preferred Stock at 100% of the stated value, and holders may redeem the Preferred Stock

at 100% of the stated value following consummation of the transactions contemplated by the Agreement.

The foregoing descriptions of the

New Amendment and the Memorandum do not purport to be complete and are qualified in their entirety by reference to the full text

of the New Amendment and the full text of the Memorandum, copies of which are attached as Exhibit 10.1 and 10.2, respectively,

and are incorporated herein by reference.

| Item 9.01. | Financial Statements and Exhibits. |

| 10.1 |

Amendment to the Asset Purchase Agreement by and between MGT Sports, Inc. and Random Outcome USA Inc., dated July 21, 2015. |

| |

|

| 10.2 |

Binding Memorandum of Understanding by and between MGT Sports, Inc. and Kuusamo Capital Ltd., dated July 21, 2015. |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MGT CAPITAL INVESTMENTS, INC. |

| |

|

| Dated: July 22, 2015 |

By: |

/s/ Robert B. Ladd |

| |

|

Robert B. Ladd,

President and Chief Executive Officer |

| |

|

|

Exhibit 10.1

FOURTH AMENDMENT TO ASSET PURCHASE

AGREEMENT

This FOURTH AMENDMENT

TO THE ASSET PURCHASE AGREEMENT (this “Amendment”) dated as of July 21, 2015, is by and between MGT Sports,

Inc. (the “Seller”), and Random Outcome USA Inc. (the “Purchaser”).

WHEREAS, the Seller

and the Purchaser are party to that certain Asset Purchase Agreement, dated as of June 11, 2015 (the “Asset Purchase Agreement”);

and

WHEREAS, the Seller

and the Purchaser are party to that certain Amendment to Asset Purchase Agreement, dated as of June 30, 2015 (the “First

Amendment Agreement”), a certain Second Amendment to Asset Purchase Agreement, dated July 15, 2015 (the “Second

Amendment Agreement”), and a certain Third Amendment to Asset Purchase Agreement, dated July 20, 2015 (the “Third

Amendment Agreement”); and

WHEREAS, the relevant provisions of both

the Second Amendment Agreement and the Third Amendment Agreement are null and void, having reached contractual time limited terminations;

and

WHEREAS, the Asset

Purchase Agreement may be amended by a writing signed by the Seller and the Purchaser pursuant to Section 9.6 of the Asset Purchase

Agreement; and

WHEREAS, the Seller

and the Purchaser desire to amend the Asset Purchase Agreement as set forth below:

NOW, THEREFORE, in consideration of the foregoing

and the mutual promises of the parties, and other good and valuable consideration, the undersigned agree as follows:

1. The provisions of the First Amendment

Agreement, the Second Amendment Agreement, and the Third Amendment Agreement that previously amended provisions being amended under

this Amendment shall be null and void.

2. The parties agree the Asset Purchase

Agreement shall be amended as follows:

| a. | The first sentence in Section 4.1 is hereby amended to replace the words “June 30, 2015” with “on or before

August 31, 2015 at the election of the Purchaser.” |

| b. | Before the last sentence in Section 4.1 add the following: “The Seller shall cooperate with the Purchaser and use reasonable

efforts to ensure that the Closing occurs as soon as the Purchaser is in a position to close the transactions contemplated in this

Agreement.” |

| c. | The Cash Payment amount in Section 3.3(i) is hereby amended to include the following words directly following “Four Million

USD ($4,000,000)”: |

| d. | “plus Ten Thousand USD ($10,000) per calendar day for the period starting on July 15, 2015 and ending on the Closing

Date,” The number of Warrants to be issued to Seller in Section 3.3(iv) is hereby amended to replace “One Million (1,000,000)”

with “One Million Five Hundred Thousand (1,500,000).” Section 3.3(iv) is hereby further amended to replace “Each

Warrant entitles the holder of the Warrant the right, but not the obligation, to purchase one (1) share of Common Stock for one

(1) dollar, and each Warrant shall expire on the date that is twelve (12) months from the Closing Date.” with: |

| i. | Each of Five Hundred Thousand (500,000) of such Warrants

entitles the holder of the Warrant the right, but not the obligation, to purchase one (1) share of Common Stock for one dollar

($1.00), and each Warrant shall expire on the date that is thirty-six (36) months from the Closing Date; and, |

| ii. | Each of Five Hundred Thousand (500,000) of such Warrants

entitles the holder of the Warrant the right, but not the obligation, to purchase one (1) share of Common Stock for one dollar

thirty three cents ($1.33), and each Warrant shall expire on the date that is thirty-six (36) months from the Closing Date; and, |

| iii. | Each of Five Hundred Thousand (500,000) of such Warrants

entitles the holder of the Warrant the right, but not the obligation, to purchase one (1) share of Common Stock for one dollar

sixty-six ($1.66), and each Warrant shall expire on the date that is thirty-six (36) months from the Closing Date. |

| e. | The first sentence in Section 4.5(b) is hereby amended to replace the words “July 15, 2015” with “August

31, 2015” |

3. Except as herein provided, the terms

of the Asset Purchase Agreement shall remain in full force and effect.

4. Capitalized terms used but not defined

herein shall have the meaning ascribed to such terms in the Asset Purchase Agreement.

5. This Amendment shall be null and void,

and without further effect, unless the Seller and Kuusamo Capital Ltd. execute and Kuusamo Capital Ltd. funds the attached Binding

Memorandum of Understanding (Exhibit A), on or before July 22, 2015.

6. This Amendment may be executed in

counterparts (including by facsimile or pdf signature pages or other means of electronic transmission) each of which shall be deemed

an original but all of which together will constitute one and the same instrument.

7. Should any provision of this Amendment

be declared illegal, invalid or unenforceable in any jurisdiction, then such provision shall be deemed to be severable from

this Amendment as to such jurisdiction (but, to the extent permitted by law, not elsewhere) and in any event such illegality, invalidity

or unenforceability shall not affect the remainder hereof.

IN WITNESS WHEREOF, the parties hereto have caused

this Amendment to be duly executed as of the date first above written.

| |

MGT SPORTS,

INC. |

| |

By: | |

/s/ Robert

Ladd |

| |

| |

Name: | |

Robert Ladd |

| |

| |

Title: | |

President |

| |

| |

| |

|

| |

| |

| |

|

| |

RANDOM OUTCOME

USA INC. |

| |

By: | |

/s/ Curtiss

Wm. Krawetz |

| |

| |

Name: | |

Curtiss Wm. Krawetz |

| |

| |

Title: | |

Chief Executive Officer |

Exhibit 10.2

Binding Memorandum of Understanding

The purpose of this memorandum is to

set forth the terms pursuant to which, subject to certain conditions set forth herein, MGT Sports, Inc. (the "Issuer")

will sell certain securities to Investor. The terms and conditions set forth herein are binding. The parties contemplate that this

MOU may in the future be replaced by a more detailed agreement containing customary terms normally found in transactions of this

type but which in the interest of time have not been incorporated in this MOU. Unless and until the parties execute any such more

detailed agreement, this MOU shall constitute the exclusive binding agreement between the parties with respect to the sale of the

Securities.

| Issuer: | MGT Sports, Inc., a wholly owned subsidiary of parent company MGT Capital Investments, Inc. (NYSE

MKT: MGT), which entity owns all of the necessary assets to conduct the Draft Day business as set out in the Asset Purchase Agreement. |

| Investor: | Kuusamo Capital Ltd., 107 Strathallan Blvd., Toronto, ON |

| Securities: | $250,000 (the "Stated Value") of Series A Redeemable Convertible Preferred Stock, par

value $0.001 (the “Preferred Stock”). |

| No Further Investment: | The Investor is in no way bound to purchase any additional

securities, or to provide any further investment, contribution, or support except as set out in this MOU. |

| Use of Proceeds: | The Issuer will use the proceeds of the transactions

contemplated hereby for general corporate purposes. |

| Maturity: | The Preferred Stock shall be perpetual, subject to Conversion and the Redemption Rights (as described below). |

| Seniority: | The Preferred Stock will be senior to all existing and future equity of the Issuer, and contain

a $250,000 liquidation preference. While the Preferred Stock is outstanding, Issuer may incur no debt as of the date herein, with

the exception of trade debt in the normal course of operations, without the approval of the Investor. |

| Interest: | The Preferred Stock shall be non-interest bearing. |

| Conversion: | Investor may elect to convert the Preferred Stock into 6.25% (six and one-quarter percent) of the

Issuer's Common Stock, at any time. Common Stock will have quarterly information rights, tag along and drag along rights and obligations,

and similar minority investor protections. |

| Voting Rights: | The Preferred Stock shall be not be entitled to vote

on any matter submitted to holders of Common Stock. |

| Redemption Rights: | The Issuer shall be entitled to redeem the Preferred

Stock, in whole or in part, at any time, at 100% of Stated Value. Investor shall be entitled to the same redemption rights, after

such time as the Issuer receives cash equal to or exceeding $4,000,000 for the contemplated sale of its fantasy sports assets.

Upon any redemption by the Issuer, the Investor will have a preemptive right to elect Conversion. |

| Registration Rights: | None. The Common Stock to be issued upon conversion of

the Preferred Stock being offered will be "restricted" under the Securities Act of 1933, and cannot be sold until Registered

with the SEC, unless sold pursuant to Rule 144, or other allowed exemption. |

| Certification: | The Issuer shall provide the Investor documentary evidence (satisfactory in form and substance

to the Investor) of ownership of the Preferred Stock. |

| Other Rights: | If the Asset Purchase Agreement between the Issuer (as

Seller) and Random Outcome USA Inc. (as Purchaser) is not consummated by the date agreed between the parties (as amended),

then the Investor will have the exclusive right to market the Issuer’s fantasy sports assets for six months from the date

that the abovementioned date by which the Asset Purchase Agreement was to be consummated. |

| Further Assurances: | If the constating documents of the Issuer do not reflect

the terms of the Preferred Stock as set out in this MOU, then the Issuer will do all things necessary and obtain all approvals

necessary to amend the relevant constating document to make them consistent with the terms of this MOU. |

| Expense Reimbursement: | Each party pays for their own expenses incurred in the

research, preparation and review of this investment opportunity. |

| Confidentiality: | The existence and terms of this Term Sheet shall be kept confidential and not disclosed unless

required by law, regulation, rule of stock exchange or trading system. |

| Broker Fees: | No broker fee, investment banking fee, or similar fee

shall be paid in conjunction with the transactions contemplated herein. |

| Payment Terms: | Receipt by the Issuer of confirmation from counsel to

the Investor that the amount of $250,000 USD has been sent by wire transfer on or before July 22, 2015 (9:20 AM EDT) shall constitute

full execution of this MOU by the Investor. |

MGT SPORTS,

INC.

By: /s/

Robert Ladd

Name: Robert

Ladd

Title: President

Agreed and

Accepted

KUUSAMO CAPITAL

LTD.

By: /s/

Trevor Radomsky

Name: Trevor

Radomsky

Title: President

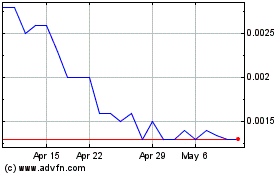

MGT Capital Investments (PK) (USOTC:MGTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

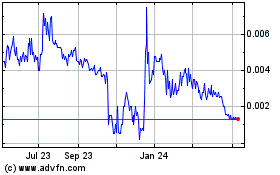

MGT Capital Investments (PK) (USOTC:MGTI)

Historical Stock Chart

From Apr 2023 to Apr 2024