UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 23,

2015

THE GORMAN-RUPP COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Ohio |

|

1-6747 |

|

34-0253990 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 600 South Airport Road, Mansfield, Ohio |

|

44903 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

(419) 755-1011

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 |

RESULTS OF OPERATIONS AND FINANCIAL CONDITION |

On October 23, 2015, The Gorman-Rupp

Company issued a news release announcing its financial results for the third quarter and nine months ended September 30, 2015. This news release is included as Exhibit 99 and is being furnished, not filed, with the Current Report on Form 8-K.

| Item 9.01 |

FINANCIAL STATEMENTS AND EXHIBITS |

(d) Exhibits

Exhibit

(99) News Release dated October 23, 2015

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| THE GORMAN-RUPP COMPANY |

|

|

| By |

|

/s/ Brigette A. Burnell |

|

|

Brigette A. Burnell |

|

|

General Counsel and Secretary |

October 27, 2015

3

EXHIBIT INDEX

|

|

|

| Exhibit |

|

Page |

| (99) News Release dated October 23, 2015 |

|

5 |

4

Exhibit 99

GORMAN-RUPP REPORTS THIRD QUARTER 2015 FINANCIAL RESULTS AND

ANNOUNCES CASH DIVIDEND INCREASE

Mansfield, Ohio – October 23, 2015 – The Gorman-Rupp Company (NYSE MKT: GRC) reports financial results for the third quarter and nine months ended

September 30, 2015.

Net sales during the third quarter were $104.2 million compared to a record $110.2 million during the third quarter of 2014. Domestic

sales decreased 7.9% or $6.2 million while international sales were comparable between periods as they increased $237,000. Sales in the water end markets decreased 2.9% or $2.2 million and sales in non-water end markets decreased 10.8% or $3.8

million during the quarter. Of the total $5.9 million decrease in net sales in the third quarter, $1.7 million or 28.8% of the decrease was due to unfavorable foreign currency translation.

The third quarter activity in water end market sales included $5.3 million of increased sales in the fire protection market due to higher international and

domestic sales of $3.2 million and $2.1 million, respectively. Despite increased shipments of $6.4 million related to the Permanent Canal Closures and Pumps (“PCCP”) project in New Orleans, sales in the municipal market decreased $3.9

million overall driven primarily by reduced demand for large volume pumps for wastewater and flood control projects. Also, sales in the construction market decreased $3.5 million due primarily to the decline in drilling of oil and gas in North

America. Decreased sales in the non-water end markets during the third quarter of 2015 were primarily due to $2.3 million of lower sales in the industrial market also largely due to the downturn in oil and gas. In addition, sales in the OEM market

decreased $1.1 million primarily due to lower sales of pumps for military applications.

Net sales for the nine months ended September 30, 2015 were

$307.4 million compared to a record $330.0 million during the same period in 2014, a decrease of 6.8%. Domestic sales decreased 9.3% or $21.2 million and international sales decreased 1.3% or $1.4 million. Of the total decrease in net sales during

the nine month period ended September 30, 2015, $6.0 million or 26.7% was due to unfavorable currency translation. Sales in water end markets decreased 4.6% or $10.7 million. Activity in the water end markets included $12.0 million of increased

sales in the fire protection market principally due to higher international sales. This increase was offset by $11.6 million of lower sales in the construction market due primarily to the global decline in new oil and gas drilling which affected

both domestic and international sales. Despite increased shipments of $22.9 million related to the PCCP project, sales in the municipal market decreased $7.7 million overall driven by reduced demand for large volume pumps for wastewater and water

supply projects. Also, sales decreased $5.1 million in the agricultural market primarily due to unseasonably wet weather conditions in most locations domestically and lower commodity prices. Sales decreased 11.9% or $11.9 million in non-water

markets primarily due to lower sales in the OEM market related to power generation equipment and pumps for military applications and residential appliances.

Due to recent increased retirements and a related surge in lump sum pension payments, the Company recorded a U.S. GAAP-required $1.9 million non-cash pension

settlement charge during the third quarter of 2015 relating to its defined benefit pension plan. The Company recorded a total of $3.3 million in non-cash pension settlement charges during the first nine months of 2015. We expect that a similar

non-cash charge of approximately $1.0 million will occur during the fourth quarter of this year as additional expected retirements and related lump sum payments are made. The rate of retirements was less in 2014 and in the first quarter of 2015 and

settlement charges were not required in those periods.

Gross profit was $23.3 million for the third quarter of 2015, resulting in gross margin of 22.4%

compared to 25.5% for the same period in 2014. Operating income was $8.9 million, resulting in operating margin of 8.6% for the third quarter of 2015 compared to 12.7% for the same period in 2014. The quarter’s gross profit and operating income

margin declines were due principally to the sales volume decreases from 2014 to 2015, sales mix changes due to increased shipments and percentages of shipments of lower margin engine and motor equipped systems, and the non-cash pension settlement

charge described above of 120 and 180 basis points, respectively. Net income was $5.9 million during the third quarter of 2015 compared to $9.4 million in the third quarter of 2014 and earnings per share were $0.22 and $0.36 for the respective

periods. The non-cash pension settlement charge described above negatively impacted current quarter earnings per share by $0.05 per share.

Gross profit was $71.4 million for the first nine months of 2015, resulting in gross margin of 23.2% compared to

25.0% for the same period in 2014. Operating income was $29.4 million, resulting in operating margin of 9.6% for the first nine months of 2015 compared to 12.8% for the same period in 2014. The nine months gross profit and operating income margin

declines were due principally to the sales volume decreases from the records in 2014, sales mix changes due to increased shipments and percentages of shipments of lower margin engine and motor equipped systems, and the non-cash pension settlement

charge described above of 80 and 110 basis points, respectively. Net income was $19.8 million during the first nine months of 2015 compared to a record $28.3 million for 2014 and earnings per share were $0.75 and $1.08 for the respective periods.

The non-cash pension settlement charge described above and currency translation negatively impacted the first nine months of 2015 earnings per share by $0.09 and $0.02 per share, respectively.

The Company’s backlog of orders was $138.8 million at September 30, 2015 compared to $170.0 million a year ago and $160.7 million at December 31, 2014.

The decrease in backlog from a year ago is due primarily to approximately $37.5 million of shipments related to the PCCP project in the last twelve months. Although not yet enough to offset our order slowness compared to 2014, we did experience our

highest amount of incoming orders of the last four quarters in the current quarter ended September 30, 2015. Approximately $17.8 million of orders related to the PCCP project remain in the September 30, 2015 backlog total. Approximately $8.1 million

of the remaining PCCP project orders are scheduled to ship during the fourth quarter of 2015 and $9.7 million of related installation services are scheduled during the first three quarters of 2016.

Cash and cash equivalents totaled $33.8 million and short-term bank debt was $2.0 million at September 30, 2015, having been reduced by $12.0 million since

December 31, 2014. The Company also assumed $2.0 million in bank debt as part of the previously announced acquisition of Hydro+ SA and Hydro+ Rental SPRL (collectively the “Hydro companies”) in the third quarter. The Company has generated

$44.9 million of operating cash flow year-to-date and working capital has risen $11.1 million from December 31, 2014 to $147.4 million at September 30, 2015. Net capital expenditures for the first nine months of 2015 of $6.6 million consisted

primarily of machinery and equipment, a new operations facility in Ireland, and other building improvements. The Company also completed the acquisition of the Hydro companies for $3.4 million. Capital expenditures for the fourth quarter of 2015 are

currently estimated to be in the range of $2 to $4 million and are expected to be financed through internally-generated funds.

Jeffrey S. Gorman,

President and CEO commented, “During the third quarter we continued to experience uphill sales challenges across a number of the markets we serve compared to record prior year periods, especially those markets with close relationships to oil,

gas and agriculture. However, fire protection pumps remained a positive source of growth during the quarter as related building construction markets improved and the Company gained market share, both in domestic and international areas. While we

expect the near-term, including most of 2016, to be challenging, our outlook for the long-term is positive based on our proven track record of providing industry leading high quality products, a long-standing commitment to customer service and a

very strong and flexible balance sheet. Our longer range outlook was enhanced in September by our acquisition of the Hydro companies in Belgium which, combined with our European operations based in The Netherlands, should position us well in the

recovery of the Euro-zone. We also are proud to make the following announcement regarding our next dividend increase.”

At its October 22, 2015

meeting, the Board of Directors of the Company declared a quarterly cash dividend of $0.105 per share on the common stock of the Company, payable December 10, 2015, to shareholders of record November 13, 2015. The cash dividend represents a 5.0%

increase over the dividend paid in the previous quarter. This marks the 263rd consecutive dividend paid by The Gorman-Rupp Company and the 43rd consecutive year of increased dividends paid to its shareholders.

Safe Harbor Statement

In connection with the “safe

harbor” provisions of the Private Securities Litigation Reform Act of 1995, The Gorman-Rupp Company provides the following cautionary statement: This news release contains various forward-looking statements based on assumptions concerning The

Gorman-Rupp Company’s operations, future results and prospects.

These forward-looking statements are based on current expectations about important economic, political, and technological factors, among others, and are subject to risks and uncertainties, which

could cause the actual results or events to differ materially from those set forth in or implied by the forward-looking statements and related assumptions. Such factors include, but are not limited to: (1) continuation of the current and projected

future business environment, including interest rates, changes in foreign exchange rates, commodity pricing and capital and consumer spending and volatility in domestic oil production activity; (2) competitive factors and competitor responses to

initiatives of The Gorman-Rupp Company; (3) successful development and market introductions of anticipated new products; (4) stability of government laws and regulations, including taxes; (5) stable governments and business conditions in emerging

economies; (6) successful penetration of emerging economies; (7) unforeseen delays or disruptions in the PCCP project, including any further revisions to the timing of shipments for the project; (8) continuation of the favorable environment to make

acquisitions, domestic and foreign, including regulatory requirements and market values of potential candidates and our ability to successfully integrate and realize the anticipated benefits of completed acquisitions; and (9) risks described from

time to time in our reports filed with the Securities and Exchange Commission. Except to the extent required by law, we do not undertake and specifically decline any obligation to review or update any forward-looking statements or to publicly

announce the results of any revisions to any of such statements to reflect future events or developments or otherwise.

Brigette A. Burnell

Corporate Secretary

The Gorman-Rupp Company

Telephone (419) 755-1246

NYSE MKT: GRC

For additional information, contact Wayne L. Knabel, Chief Financial Officer, Telephone

(419) 755-1397.

The Gorman-Rupp Company is a leading designer, manufacturer and

international marketer of pumps and pump systems for use in diverse water, wastewater, construction, dewatering, industrial, petroleum, original equipment, agriculture, fire protection, heating, ventilating and air conditioning (HVAC), military and

other liquid-handling applications.

The Gorman-Rupp Company and Subsidiaries

Condensed Consolidated Statements of Income (Unaudited)

(in thousands of dollars, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Net sales |

|

$ |

104,229 |

|

|

$ |

110,159 |

|

|

$ |

307,354 |

|

|

$ |

329,951 |

|

| Cost of products sold |

|

|

80,917 |

|

|

|

82,093 |

|

|

|

235,986 |

|

|

|

247,427 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

23,312 |

|

|

|

28,066 |

|

|

|

71,368 |

|

|

|

82,524 |

|

| Selling, general and administrative expenses |

|

|

14,363 |

|

|

|

14,046 |

|

|

|

41,933 |

|

|

|

40,390 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

8,949 |

|

|

|

14,020 |

|

|

|

29,435 |

|

|

|

42,134 |

|

| Other (expense) income - net |

|

|

99 |

|

|

|

261 |

|

|

|

391 |

|

|

|

207 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

9,048 |

|

|

|

14,281 |

|

|

|

29,826 |

|

|

|

42,341 |

|

| Income taxes |

|

|

3,155 |

|

|

|

4,842 |

|

|

|

10,029 |

|

|

|

14,088 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

5,893 |

|

|

$ |

9,439 |

|

|

$ |

19,797 |

|

|

$ |

28,253 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share |

|

$ |

0.22 |

|

|

$ |

0.36 |

|

|

$ |

0.75 |

|

|

$ |

1.08 |

|

The Gorman-Rupp Company and Subsidiaries

Condensed Consolidated Balance Sheets (Unaudited)

(in thousands of dollars)

|

|

|

|

|

|

|

|

|

| |

|

September 30,

2015 |

|

|

December 31,

2014 |

|

| Assets |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

33,822 |

|

|

$ |

24,491 |

|

| Accounts receivable - net |

|

|

74,544 |

|

|

|

70,734 |

|

| Inventories |

|

|

82,790 |

|

|

|

94,760 |

|

| Deferred income taxes and other current assets |

|

|

9,051 |

|

|

|

10,724 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

200,207 |

|

|

|

200,709 |

|

| Property, plant and equipment - net |

|

|

131,995 |

|

|

|

133,964 |

|

| Deferred income taxes and other |

|

|

4,481 |

|

|

|

6,313 |

|

| Goodwill and other intangible assets |

|

|

41,141 |

|

|

|

39,918 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

377,824 |

|

|

$ |

380,904 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and shareholders’ equity |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

16,330 |

|

|

$ |

17,908 |

|

| Short-term debt |

|

|

1,970 |

|

|

|

12,000 |

|

| Accrued liabilities and expenses |

|

|

34,488 |

|

|

|

34,438 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

52,788 |

|

|

|

64,346 |

|

| Pension benefits |

|

|

5,666 |

|

|

|

4,496 |

|

| Postretirement benefits |

|

|

21,720 |

|

|

|

21,297 |

|

| Deferred and other income taxes |

|

|

8,834 |

|

|

|

8,798 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

89,008 |

|

|

|

98,937 |

|

| Shareholders’ equity |

|

|

288,816 |

|

|

|

281,967 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and shareholders’ equity |

|

$ |

377,824 |

|

|

$ |

380,904 |

|

|

|

|

|

|

|

|

|

|

| Shares outstanding |

|

|

26,083,623 |

|

|

|

26,260,543 |

|

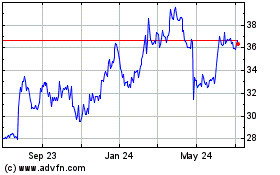

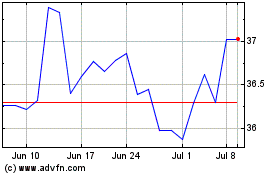

Gorman Rupp (NYSE:GRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gorman Rupp (NYSE:GRC)

Historical Stock Chart

From Apr 2023 to Apr 2024