TIDMCBOX

RNS Number : 2240G

Cake Box Holdings PLC

14 November 2022

Cake Box Holdings plc

("Cake Box", "the Company" or "the Group")

Unaudited Half Year Results for the six months ended 30

September 2022

Revenue growth against strong comparative period, continued

investment in infrastructure whilst maintaining a

strong cash position

Cake Box Holdings plc, the specialist retailer of fresh cream

cakes, today announces its half year results for the six months

ended 30 September 2022.

Sukh Chamdal, Chief Executive Officer, commented

"Although revenue increased, trading in the first half of the

period was against a very strong comparative period last year, and

was impacted by exceptionally hot weather which went on for a far

longer period than normal. In addition, higher levels of

international travel in July and August, were coupled with the

rising cost of living and inflation. Once the summer holiday period

finished, we began to see a recovery in our sales, alongside the

continued growth of our franchise store estate.

Encouragingly, the improvement in trading seen towards the end

of the half year has continued into October. Whilst the Board

remains cautious in light of the uncertain economic climate and the

unpredictability in consumer spending, the Group's current trading

is on track to achieve full year market expectations.

Longer term, the Board is confident in Cake Box's significant

potential, underpinned by its attractive customer and franchisee

proposition and bolstered by ongoing investment in the Group's

functions and capabilities, and a strengthened leadership

team."

Financial Highlights

Half year Half year Change(1)

ended ended

30 September 30 September

2022 2021

------------- ----------

Revenue GBP16.8m GBP16.5m 2.1%

------------- ------------- ----------

Gross profit GBP8.0m GBP7.6m 5.5%

------------- ------------- ----------

EBITDA* GBP2.8m GBP4.1m (32.4%)

------------- ------------- ----------

Pre-tax profit GBP2.0m GBP3.7m (45.1%)

------------- ------------- ----------

Net cash GBP4.2m GBP4.1m 1.2%

------------- ------------- ----------

Cash at Bank GBP5.5m GBP5.6m (2.0%)

------------- ------------- ----------

Earnings per share 3.72p 7.46p (50.0%)

------------- ------------- ----------

Interim dividend 2.625p 2.5p 5.0%

------------- ------------- ----------

(1) Change % is calculated on the figures included in

consolidated statement of comprehensive income and consolidated

statement of financial position

* EBITDA is calculated as operating profit before depreciation

and amortisation

-- Group revenues up 2.1% to GBP16.8m (H1 FY22: GBP16.5m)

o Sustained recovery in trading towards the end of the period

against a very strong comparative, with like-for-like(1) sales

growth of 3.6% in September

-- Gross margins increased to 47.7% (H1 FY22: 46.2%) despite input cost increases

-- Reduction in EBITDA and pre-tax profit, reflects the

previously reported challenging trading environment in H1, cost

pressures and increased investment in the business

-- Continued balance sheet strength with net cash increasing to GBP4.2m (H1 FY22: GBP4.1m)

-- Interim dividend up 5% at 2.625p reflecting the Group's

progressive dividend policy and continued cash generation despite

continued investment in infrastructure to underpin future

growth

Operational highlights

-- 196 franchise stores in operation at 30 September 2022 (30 September 2021: 174)

-- 11 new franchise stores added in the period (H1 FY22: 20 new franchise stores)

-- Significant investment in production and distribution assets to improve efficiency

-- Managing cost pressures, particularly though established supplier relationships

Franchise store highlights

-- Like-for-like sales slight decline of 1.1% in the period

against very strong comparative period

-- Franchisee store sales in the period, up 7.9% to GBP31.8m (H1 FY22: GBP29.5m)

-- Franchisee total sales including kiosks in the period up 9.9% to GBP34.7m (H1 FY22 GBP31.6m)

-- Despite the lifting of lockdown last year, Franchisee online

sales have been maintained at GBP6.7m (H1 FY22: GBP6.7m)

-- Number of kiosks at 30 September 2022 is 33, with an increase

in the number of supermarket kiosks to 20 (H1 FY22: 7 supermarket

kiosks and 15 supermarket kiosks at 31 March 2022)

-- Number of multi-site franchisees has increased to 43 (H1 FY22: 40)

Current trading and outlook

-- Trading has improved post summer, with franchise sales up

like-for-like 4.6% and online sales increasing 6.8% in October

versus last year

-- Whilst macro-economic challenges continue and consumer

spending is likely to remain unpredictable, the Group's current

trading is on track to achieve full year market expectations

-- Three new stores have opened since the period end, with a

strong pipeline for future openings (44 deposits held at period

end)

-- Further supermarket kiosk openings being negotiated

(1) Like-for-like: Stores trading for at least one full

financial year prior to 30 September 2022

There will be a virtual presentation for analysts and

institutional investors this morning at 9.30am. For details, please

contact cakebox@mhpc.com .

For further information, please contact:

Cake Box Holdings plc Enquiries via MHP Communications

Sukh Chamdal, CEO

Martin Blair, Acting CFO

Shore Capital (Broker and NOMAD)

Stephane Auton

Patrick Castle

Rachel Goldstein

Fiona Conroy - Corporate Broking +44 (0) 20 7408 4090

Liberum (Joint Broker)

Clayton Bush

Edward Thomas +44 (0) 20 3100 2000

MHP Communications (Financial PR)

Simon Hockridge

Pete Lambie +44 (0) 20 3128 8570

Operational Review

Results overview

Last financial year was an exceptionally strong year for Cake

Box with many retailers shut because of the Covid-19 pandemic.

However, we were permitted to open and as a result trading was

strong, both in stores and online. Against this good performance,

we started the year with challenging comparatives; during the first

few months we were trading at or slightly below last year on a

like-for-like basis. We continued to open new stores and trading

was starting to improve in June. However, July and August were

exceptionally hot and sunny and, as we have found in the past, this

is not particularly conducive to cake sales. Sentiment around the

cost of living, inflation and utilities price rises also weighed on

the consumer. In addition, many customers took advantage of the

relaxation in travel restrictions to take holidays they had been

planning for the last two years, which also contributed to lower

sales. We were, however, encouraged to see our customers returning

in September with like-for-like franchisee sales up 3.6%.

Reflecting the wider inflationary environment, we have

inevitably seen significant increases in our raw material costs,

namely cake mix and fresh cream. We have absorbed some of these

costs, however, we have had to pass some of these onto our

franchisees and have made considered increases to our retail

prices, whilst ensuring the value proposition that Cake Box is

known for, remains. Customers have been accepting of these

increases, in line with the wider sector, and are still returning

to enjoy our cakes, albeit we keep our pricing strategy continually

under review.

Under the tough consumer-spending conditions it is encouraging

to see an increase in overall revenues to GBP16.8m from GBP16.5m

for the equivalent period last year and that we have achieved a

small increase in gross margin.

Continued investment for growth

We have continued investing for future growth in the business.

We had already enhanced our management team, bringing in a new

Chief Operating Officer and a Marketing Director, as well as

bolstering the production and food hygiene teams. In the last six

months, we have made a significant investment in our Enfield bakery

by bringing in new state-of-the-art production facilities for

cheesecakes, whilst also making other improvements to provide a

better environment for our baking and production staff . This

investment is reflected in the significantly higher admin costs in

the period of GBP5.9m compared to GBP3.9m last year.

We are also continuing to look at ways to improve our baking

process to reduce waste and the cost of ingredients. We have

invested in our delivery van fleet, replacing older vans, and

adding more refrigerated vehicles to reflect increased demand.

Planned van replacement last year was delayed into this year due to

unavailability of new vehicles in the market.

Online Sales and new website

Online sales were flat compared to H1 FY22 due to much stronger

trading conditions in the same period last year in the aftermath of

Covid. During H2, we are investing in digital advertising, and this

is now increasing online sales month by month. We expect this to

accelerate with a new website which is planned to launch next

month. The new site will give the customer a better user experience

and in doing so, increase conversion rate and customer loyalty. The

site will be data driven and automated to deliver bespoke marketing

campaigns to increase customer lifetime value.

Franchisees and new stores

We now have 96 franchisees with 43 of them owning more than one

store and between them managing 147 sites (out of the total 196

stores). Where we know franchisees are performing well, we are

actively encouraging them to take on additional sites so as to

harness their entrepreneurial skills.

The Group opened 11 new franchise stores in the period

(excluding kiosk openings), with the total number of stores at 30

September 2022 being 196 (H1 FY22: 174). New locations added in the

period include St. Neots, Gateshead, Nottingham, and Norwood

(London).

The appeal of the Group's franchise proposition is reflected in

the continuing strength of our pipeline of new potential

franchisees, with 44 deposits held at period end. Of these 44

deposits, 20 are from existing franchisees.

Balance Sheet and cashflow

The Group's balance sheet remains strong, underpinned by the

highly cash generative nature of our business model. Cash at period

end was GBP5.5m, down only 2% from the same point last year,

despite making significant investments in production and

distribution facilities and paying a higher dividend. The Group's

net cash position increased, by 1.2% to GBP4.2m (H1 FY22:

GBP4.1m).

Dividends

In line with our progressive dividend policy to reflect the cash

generation and earnings of the Group, today we are declaring an

interim dividend of 2.625 pence per share representing an increase

of 5.0% from last year.

The interim dividend will be paid on 9th December 2022 to those

shareholders on the register at the close of business on 18th

November 2022. The ex-dividend date is therefore 17th November

2022.

Outlook

The improvement in trading towards the end of H1 has continued

into H2 with October like-for-like franchisee sales up 4.6%.and

total franchisee sales in the six weeks to 6 November 2022 up

12.9%.

The Group's franchise store estate has continued to grow, with

three new stores opened since the period end and a further 11

expected to open in the second half.

While the Board remains cognisant of the current economic

climate and the unpredictability in consumer spending, the Group's

current trading is on track to achieve full year market

expectations .

Longer term, the Board is confident in Cake Box's significant

potential, underpinned by its attractive customer and franchisee

proposition and bolstered by ongoing investment in the Group's

functions and capabilities, and a stronger leadership team.

CAKE BOX HOLDINGS PLC

UNAUDITED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 SEPTEMBER 2022

6 months 6 months 12 months

to 30 September to 30 September to 31 March

2022 2021 2022

(unaudited) (unaudited) (audited)

Note GBP GBP GBP

Revenue 2 16,822,209 16,471,577 32,964,846

Cost of sales (8,791,924) (8,863,477) (17,133,685)

----------------- ----------------- -------------

Gross profit 8,030,285 7,608,100 15,831,161

Administrative expenses (5,933,111) (3,889,519) (8,012,448)

Operating profit 2,097,174 3,718,581 7,818,713

Net finance costs (67,128) (19,202) (81,388)

----------------- ----------------- -------------

Profit before income tax 2,030,046 3,699,379 7,737,325

Income tax expense (541,563) (717,333) (1,425,709)

----------------- ----------------- -------------

PROFIT AFTER INCOME TAX 1,488,483 2,982,046 6,311,616

OTHER COMPREHENSIVE INCOME

FOR THE PERIOD

Items that will not be reclassified

to profit and loss, net of

tax

Revaluation of freehold property - - 1,250,175

Deferred tax on revaluation

of freehold property - - (237,533)

----------------- ----------------- -------------

TOTAL COMPREHENSIVE INCOME

FOR THE PERIOD 1,488,483 2,982,046 7,324,258

================= ================= =============

EARNINGS PER SHARE

Basic 4 3.72p 7.46p 15.78p

Diluted 4 3.72p 7.46p 15.78p

CAKE BOX HOLDINGS PLC

UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 SEPTEMBER 2022

30 September 30 September 31 March

2021

2022 (unaudited) 2022

(unaudited) (audited)

Note GBP GBP GBP

ASSETS

Non-current assets

Property, plant and equipment 10,750,275 8.707,374 10,029,209

Right-of-use assets 2,724,460 - 2,874,430

Other financial assets 595,314 564,194 710,059

Deferred tax asset - 95,447 -

-------------- ------------- -----------

14,070,049 9,367,015 13,613,698

-------------- ------------- -----------

Current assets

Inventories 2,577,643 2,111,194 2,468,921

Trade and other receivables 2,962,332 2,861,845 2,553,209

Other financial assets 252,488 237,994 357,548

Cash and cash equivalents 5,464,364 5,565,501 6,571,558

11,256,827 10,776,534 11,951,236

-------------- ------------- -----------

TOTAL ASSETS 25,326,876 20,143,549 25,564,934

============== ============= ===========

EQUITY AND LIABILITIES

Share capital and reserves

Issued share capital 4 400,000 400,000 400,000

Capital redemption reserve 40 40 40

Revaluation reserve 3,616,383 2,622,092 3,634,734

Share option reserve - 488,596 -

Retained earnings 11,941,865 10,145,461 12,475,031

-------------- ------------- -----------

TOTAL EQUITY 15,958,288 13,656,189 16,509,805

-------------- ------------- -----------

Current liabilities

Trade and other payables 2,996,742 3,313,081 2,661,372

Lease liabilities 213,963 - 260,191

Short-term borrowings 167,754 167,754 167,754

Current tax payable 749,834 740,415 837,946

Provisions 243,100 243,100 243,100

-------------- ------------- -----------

4,371,393 4,464,350 4,170,363

Non-current liabilities

Lease liabilities 2,617,568 - 2,699,958

Borrowings 1,101,223 1,252,336 1,185,978

Deferred tax liabilities 1,278,404 770,674 998,830

-------------- ------------- -----------

4,997,195 2,023,010 4,884,766

TOTAL LIABILITES 9,368,588 6,487,360 9,055,129

-------------- ------------- -----------

TOTAL EQUITY & LIABILITIES 25,326,876 20,143,549 25,564,934

============== ============= ===========

.

CAKE BOX HOLDINGS PLC

UNAUDITED CO NS OLIDATED S TAT E M ENT OF CHANGES IN EQUITY

FO R THE SIX M ONTHSED 30 SEPTEMBER 2022

Share Capital Share Revaluation Retained Total

capital redemption option reserve earnings

reserve reserve

GBP GBP GBP GBP GBP GBP

B a la n c e at 1 April

2 0 21 400,000 40 488,596 1,609,592 8,643,415 11,141,643

T o ta l c omp r e h

e nsi ve income - - - - 2,982,046 2,982,046

Dividends paid - - - - (1,480,000) (1,480,000)

B a la n c e at 30 September

2 021 (as previously

stated) 400,000 40 488,596 1,609,592 10,145,461 12,643,689

-------- ----------- --------- ----------- ----------- -----------

Revaluation of freehold

property (1) 1,250,000 1,250,000

Deferred tax on revaluation

of freehold properties

(1) (237,500) (237,500)

-------- ----------- --------- ----------- ----------- -----------

Restated b a la n c

e at 30 September 2 021

(as restated) 400,000 40 488,596 2,622,092 10,145,461 13,656,189

-------- ----------- --------- ----------- ----------- -----------

T o ta l c omp r e h

e nsi ve income - - - - 3,329,570 3,329,570

Share based payments - - (486,368) - - (486,368)

Deferred tax on share

based payments - - (2,228) - - (2,228)

Revaluation of freehold

property - - - 1,250,175 - 1,250,175

Deferred tax on revaluation

of freehold properties - - - (237,533) - (237,533)

Dividends paid - - - - (1,000,000) (1,000,000)

-------- ----------- --------- ----------- ----------- -----------

B a la n c e at 31 March

2 0 22 400,000 40 - 3,634,734 12,475,031 16,509,805

-------- ----------- --------- ----------- ----------- -----------

T o ta l c omp r e h

e nsi ve income - - - - 1,488,483 1,488,483

Dividends paid - - - - (2,040,000) (2,040,000)

Transfer of excess depreciation

on revalued assets - - - (18,351) 18,351 -

B a la n c e at 30 September

2 022 400,000 40 - 3,616,383 11,941,865 15,958,288

======== =========== ========= =========== =========== ===========

(1) During the year to 31 March 2022 it was discovered that an

uplift to value of freehold properties was not properly reflected

in the financial statements in the prior year. This was reflected

in the financial statements to 31 March 2022

CAKE BOX HOLDINGS PLC

UNAUDITED CONSOLIDATED CASH FLOW STATEMENT

FOR THE SIX MONTHSED 30 SEPTEMBER 2022

6 months to 6 months to 12 months

to

30 September 30 September 31 March

2022 2021 2022

(unaudited) (unaudited) (audited)

GBP GBP GBP

Cash from operating activities:

Profit before income tax 2,030,046 3,699,379 7,737,325

Adjusted for:

Depreciation 546,344 425,833 853,633

Amortisation of right-of-use

assets 149,970 - 124,975

Profit on disposal of tangible

fixed assets (34,204) (13,515) (13,154)

(Increase) in inventories (108,722) (209,023) (566,749)

(Increase) in trade and other

receivables (409,123) (371,630) (82,993)

(Increase) in other financial

assets 219,804 236,626 (28,794)

Increase / (decrease) in trade

and other payables 335,371 (283,886) (915,596)

Share based payment provision - - (486,368)

Finance income (6,711) (1,021) (1,802)

Finance costs 73,839 20,223 83,190

--------------- -------------- --------------

Cash generated by operations 2,796,614 3,502,986 6,703,667

Taxation paid (350,100) (880,387) (1,407,391)

Net cash inflow

from operating

activities 2,446,514 2,622,599 5,296,276

--------------- -------------- --------------

Cash flows from investing activities

Proceeds from sale of property,

plant and equipment 34,204 16,375 16,014

Purchase of property, plant

and equipment (1,267,412) (634,466) (1,133,926)

Interest received 6,711 1,021 1,802

Net cash flows

used in

investing

activities (1,226,497) (617,070) (1,116,110)

--------------- -------------- --------------

Cash flows from financing activities:

Repayment of finance leases (128,618) - (39,255)

Repayment of borrowings (84,754) (65,669) (132,027)

Dividends paid (2,040,000) (1,480,000) (2,480,000)

Interest paid (73,839) (20,223) (83,190)

--------------- -------------- --------------

Net cash flows used in financing

activities (2,327,211) (1,565,892) (2,734,472)

Net increase in cash and cash

equivalents (1,107,194) 439,637 1,445,694

Cash and cash equivalents brought

forward 6,571,558 5,125,864 5,125,864

--------------- -------------- --------------

Cash and cash equivalents carried

forward 5,464,364 5,565,501 6,571,558

=============== ============== ==============

For the purposes of the cash flow statement, cash and cash

equivalents comprise the following:

Cash at bank and in hand 5,464,364 5,565,501 6,571,558

========== ========== ==========

CAKE BOX HOLDINGS PLC

NOTES TO THE INTERIM ACCOUNTS

FOR THE SIX MONTHS ENDED 30 SEPTEMBER 2022

1. Notes to the Interim Report

B a s is of preparation

T h e co ns olidated half-yearly fin a ncial state men t s do n

ot con stit ute s tatuto ry accou n ts wit h in t he meaning of

Section 434 of t he C o m p a nies Act 2006. T he statuto ry accou

nts f or t he year en ded 31 March 2022 have been filed with t he

Regis t rar of Co m panies at C o m panies Hou se. T he au ditor's

report on t he statuto ry accou n ts f or the year en ded 31 March

2022 was u n q ualified, did not include any matters to which the

auditor drew attention by way of emphasis and did n ot co ntain a

ny state men ts un der Section 498 (2) or ( 3) of the C o m panies

Act 2006.

The published financial statements for the year ended 31 March

2022 were prepared in accordance with the recognition and

measurement principles of UK adopted International Financial

Reporting Standards ("UK adopted IFRS") that are expected to be

applied in the preparation of the next annual report.

T h e co ns olidated annual fin a ncial state men t s of Cake

Box Holdings Plc f or the year en ded 31 March 2023 w ill be prepar

ed in accordance w ith I F RS. Accordin g l y, these inter im f i

nan cial state ments h a ve been prepared us i ng accou nti ng

policies con siste nt with t h o se w hich will be adopted by t he

Gro up in t he f i nancial statements for the year ended 31 March

2023, but do not contain all the information necessary for full

compliance with IFRS.

The co ns olidated half-yearly fin a ncial state men t s for the

six months to 30 September 2022 have not been audited or reviewed

by auditors, pursuant to the Auditing Practices Board guidance on

Review of Interim Financial Information.

The consolidated half-yearly financial statements have been

prepared under the going concern assumption and historical cost

convention as modified by fair value for property, plant and

equipment.

B a s is of cons olidation

The Group consolidated half-yearly financial statements

consolidates the company and its subsidiaries. All intra-group

transactions, balances, income and expenses are eliminated on

consolidation.

2. Segment reporting

Components reported to the chief operating decision maker, the

board of directors, are not separately identifiable. The Group

makes varied sales to its customers, but none are a separately

identifiable component. The following information is disclosed:

6 months 6 months to 12 months to

to

30 September 30 September 31 March

2022

(unaudited) 2021 2022

(unaudited) (audited)

GBP GBP GBP

Sales of sponge 6,170,612 5,991,526 12,301,051

Sales of food 2,930,966 2,717,955 5,479,076

Sales of fresh cream 1,761,069 1,707,951 3,442,619

Sales of other goods 3,686,104 3,309,034 7,023,665

Online sales commission 487,168 453,379 937,640

Franchise packages 1,786,290 2,291,732 3,780,795

16,822,209 16,471,577 32,964,846

--------------- ------------- ------------

CAKE BOX HOLDINGS PLC

NOTES TO THE INTERIM ACCOUNTS (cont'd)

FOR THE SIX MONTHS ENDED 30 SEPTEMBER 2022

3. Dividends

6 months 6 months 12 months

to 30 September to 30 September to 31 March

2022 2021 2022

(unaudited) (unaudited) (audited)

GBP GBP GBP

Dividends paid 2,040,000 1,480,000 2,480,000

================= ================= ===================

4. Share Capital

6 months 6 months 12 months

to 30 September to 30 September to 31 March

2022 2021 2022

(unaudited) (unaudited) (audited)

GBP GBP GBP

40,000,000 Ordinary Shares

of GBP0.01 each 400,000 400,000 400,000

================= ================= ===================

Earnings per share

The basic earnings per share is calculated by dividing the

earnings attributable to equity shareholders by the weighted

average number of shares in issue. In calculating the diluted

earnings per share, share options outstanding have been taken into

account where the impact of these is dilutive.

6 months 6 months 12 months

to 30 September to 30 September to

2022 2021 31 March

2022

(unaudited) (unaudited) (audited)

GBP GBP GBP

Basic earnings per share 3.72p 7.46p 15.78p

Diluted earnings per share 3.72p 7.46p 15.78p

================= ================= ===================

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BKNBQKBDBNDD

(END) Dow Jones Newswires

November 14, 2022 02:00 ET (07:00 GMT)

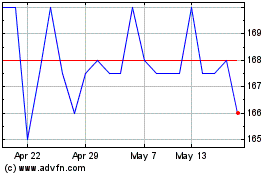

Cake Box (LSE:CBOX)

Historical Stock Chart

From Oct 2024 to Oct 2024

Cake Box (LSE:CBOX)

Historical Stock Chart

From Oct 2023 to Oct 2024