UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant

to Section 14(c) of the Securities Exchange Act of 1934

Check

the appropriate box:

x Preliminary Information

Statement

¨ Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

¨ Definitive Information

Statement

Truli

Media Group, Inc.

(Name of Registrant as Specified In Its Charter)

Payment

of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on

table below per Exchange Act Rules 14c-5(g) and 0-11.

1) Title of each class of securities to which transaction

applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on

which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

¨ Fee

paid previously with preliminary materials.

¨ Check box if any

part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was

paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

TRULI MEDIA GROUP, INC.

515 Chalette Drive

Beverly Hills, CA 90210

NOTICE OF ACTION TO BE TAKEN PURSUANT

TO THE WRITTEN CONSENT OF THE MAJORITY STOCKHOLDERS IN LIEU OF A SPECIAL MEETING OF THE STOCKHOLDERS

NOTICE IS HEREBY GIVEN to inform the

holders of record of shares of our common stock that the holders of more than a majority of the issued and outstanding shares of

common stock entitled to vote on the action, of Truli Media Group, Inc., an Oklahoma corporation (the “Company” “we”,

“us,” or “our”), have approved the following actions without a meeting of the stockholders in accordance

with Section 18-1073 of the Oklahoma General Corporation Act:

1. Plan of Merger with Truli Media Group, Inc., a Delaware corporation (“Truli Delaware”) to be

formed exclusively for the purpose of merging with the Company, pursuant to which the Company will merge with and into Truli

Delaware;

2. Reverse stock split whereby at the discretion of the board of directors, an amount up to every fifty shares of the Company’s

common stock will be exchanged for one share of common stock of Truli Delaware (effectively resulting in up to a fifty for one

reverse split of the Company’s common stock);

3. Adoption

of the Company’s 2014 Equity Compensation Plan.

Your vote or consent is not requested or required. Our board of directors

is not soliciting your proxy. Section 18-1073 of the Oklahoma General Corporation Act and the Company’s bylaws provide that

any action required or permitted to be taken at a meeting of the stockholders may be taken without a meeting if shareholders holding

at least a majority of the voting power sign a written consent approving the action. The written consent of a majority of the

outstanding shares of our common stock is sufficient to approve these matters.

The enclosed information statement contains

information pertaining to the matters acted upon.

THIS IS NOT A NOTICE OF A

SPECIAL MEETING OF THE STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO COSNSIDER ANY MATTER WHICH IS DESCRIBED

HEREIN

WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY

| |

By |

Order of the Board of Directors |

| |

|

Michael Jay Solomon |

| |

|

Chief Executive Officer and Director |

| [*] 2015 |

|

|

TRULI MEDIA GROUP, INC.

515 Chalette Drive

Beverly Hills, CA 90210

INFORMATION STATEMENT

Date first mailed to stockholders:

[____], 2015

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

ABOUT THIS INFORMATION STATEMENT

INTRODUCTION

This information statement (the “Information

Statement”) has been filed with the United States Securities and Exchange Commission (“SEC”) and is being mailed

or otherwise furnished to the registered shareholders of Truli Media Group, Inc., an Oklahoma corporation (the “Company,”

“we,” or “us”), solely for the purpose of informing you, as one of our shareholders, in the manner required

under Regulation 14(c) promulgated under the Securities Exchange Act of 1934, as amended, (“Exchange Act”) that the

holders of a majority of the issued and outstanding shares of our common stock, par value $0.001, per share (the “Common

Stock”) have executed a joint written consent with the board of directors approving certain corporate actions described

herein.

The proposed corporate actions were approved

by a joint consent of a single shareholder holding a majority of shares of Common Stock entitled to vote on the proposed actions

and our board of directors (“Board”) on December 19, 2014. In order to eliminate the costs and time involved in holding

a special meeting, and in order to consummate the proposed corporate actions as quickly as possible, these actions are being taken

by a written consent. December 19, 2014, is the record date (“Record Date”) for the determination of shareholders who

are entitled to receive this Information Statement.

WHAT IS THE PURPOSE OF THE INFORMATION STATEMENT?

This Information Statement is being furnished to you pursuant

to Section 14 of the Exchange Act, to notify the Company’s shareholders as of the close of business on the Record Date

of corporate actions taken by a majority of the voting capital stock of the Company’s shareholders. Shareholders holding

a majority of the Company’s outstanding voting capital stock entitled to vote on the matters have voted in favor of all

of the proposals set forth herein.

WHO IS ENTITLED TO NOTICE?

Each outstanding share of the Company’s voting capital

stock on the close of business on the Record Date is entitled to notice of each matter voted on by the shareholders. Shareholders

as of the close of business on the Record Date that held the authority to cast votes in excess of fifty percent (50%) of the Company’s

outstanding voting capital stock have voted in favor of all of the proposals herein. Under Oklahoma law, stockholder approval

may be taken by obtaining the written consent and approval of more than 50% of the holders of voting stock in lieu of a meeting

of the shareholders.

WHAT CONSTITUTES THE VOTING SHARES OF THE COMPANY?

The voting power entitled to vote on the proposals consists

of the vote of the holders of a majority of the Company’s voting capital stock as of the Record Date. As of the Record Date,

the Company’s voting capital stock consisted of 127,682,295 shares of Common Stock. Each share of Common Stock was entitled

to one (1) vote per share on matters discussed in this Information Statement.

WHAT CORPORATE MATTERS WERE APPROVED?

Shareholders holding a majority of our

outstanding voting capital stock have voted in favor of the following proposals:

1. Plan

of Merger with the Company’s wholly-owned subsidiary (Truli Delaware) formed exclusively for the purpose of reincorporating

in Delaware, pursuant to which the subsidiary will be the surviving corporation;

2. Reverse

stock split of up to fifty (50) shares for one (1) share of common stock post-merger at the discretion of the Board;

3. Adoption

of the Company’s 2014 Equity Compensation Plan.

All of the foregoing three proposals

have been approved and are discussed in further detail under its respective headings below.

WHAT VOTE IS REQUIRED BY SHAREHOLDERS TO APPROVE THE PROPOSALS?

No further vote is required for approval any of the proposals.

APPROVAL OF THE CORPORATE ACTIONS

Under Section 18-1083 of the Oklahoma General Corporation

Act, a corporation may merge into one of its wholly-owned subsidiaries provided it is approved by the board of directors and a

majority of the outstanding shares of capital stock of the corporation.

Under Section 18-1080 of the Oklahoma General Corporation

Act, a corporation may amend or restate its certificate of incorporation to decrease the number of shares of capital stock outstanding

provided it is approved by the board of directors and a majority of the outstanding shares of capital stock of the corporation.

Under Section 18-1073 of the Oklahoma

General Corporation Act, a corporation may take any action required or permitted to be taken at a meeting of the stockholders

by a written consent if stockholders holding at least a majority of the voting power sign the written consent approving the action.

OUTSTANDING VOTING SECURITIES

As of the Record Date, the Company’s authorized capital

consisted of 500,000,000 shares of capital stock, 495,000,000 of which are authorized as Common Stock and 5,000,000 of which are

authorized as preferred stock. As of the Record Date, 127,682,295 shares of Common Stock were issued and outstanding and 0 shares

of preferred stock were issued and outstanding. Each share of outstanding Common Stock is entitled to one vote on matters submitted

to the shareholders. The following shareholder voted in favor of the proposals:

| (a) | Proposal No. 1: Merger with Subsidiary and Change of Domicile; approved based upon the following votes:

|

| Votes For | | |

Votes Against | | |

Votes Not Cast | |

| | 65,443,847 | | |

| 0 | | |

| 62,238,448 | |

| (b) | Proposal No. 2: Reverse Stock Split; approved based upon the following votes:

|

| Votes For | | |

Votes Against | | |

Votes Not Cast | |

| | 65,443,847 | | |

| 0 | | |

| 62,238,448 | |

| (c) | Proposal No. 3: Adoption of Equity Compensation Plan; approved based upon the following votes:

|

| Votes For | | |

Votes Against | | |

Votes Not Cast | |

| | 65,443,847 | | |

| 0 | | |

| 62,238,448 | |

Pursuant to Rule 14c-2 under the

Exchange Act, the proposals will not be adopted until a date at least 20 days after the date on which this Information Statement

has been mailed to the shareholders. The Company anticipates that the actions contemplated herein will be effected on or after

the close of business on February 12, 2015.

PROPOSAL NO. 1

MERGER AGREEMENT OF TRULI MEDIA GROUP, INC., AN OKLAHOMA

CORPORATION, WITH AND INTO TRULI MEDIA GROUP, INC., A DELAWARE CORPORATION

On December 19, 2014, the Board and a

majority of the voting capital stock of the Company approved the reincorporation via a joint written consent in lieu of a special

meeting of shareholders. The shareholders approved an Agreement and Plan of Merger, in substantially the same form annexed hereto

as Appendix A (“Merger Agreement”). Pursuant to the Merger Agreement, the Company will merge with its wholly-owned

subsidiary, Truli Media Group, Inc., a Delaware corporation (Truli Delaware) for the purpose of changing the state of incorporation

of the Company to Delaware. Truli Delaware is anticipated to be formed immediately prior to the closing of the merger transaction.

Pursuant to the Merger Agreement, the Company will be merged with and into Truli Delaware with Truli Delaware continuing as the

surviving corporation (the “Merger”). Following the completion of the Merger, the Company’s corporate existence

shall be governed by the laws of the State of Delaware, the certificate of incorporation of Truli Delaware (“Certificate

of Incorporation”), a substantially complete copy of which is included hereto as Appendix B, and the bylaws of Truli

Delaware (“Bylaws”), a substantially complete copy of which is annexed hereto as Appendix C.

The proposed reincorporation will effect

a change in the legal domicile of the Company and other changes of a legal nature, the most significant of which are described

below. However, the reincorporation will not result in any change in the Company’s business, management, location of its

principal executive offices, assets, liabilities or net worth (other than as a result of the costs incident to the reincorporation

and Merger).

The surviving corporation will be Truli Delaware, which will be incorporated by the Company under the Delaware General

Corporation Law (“DGCL”), exclusively for the purpose of merging with the Company. The authorized capital of Truli

Delaware will consist of 100,000,000 shares of common stock, par value $0.0001 per share (“Truli Delaware Common Stock”)

and 10,000,000 shares of preferred stock, par value $0.0001 (“Truli Delaware Preferred Stock”).

Immediately prior to the closing of the

Merger, Truli Delaware shall have one share of Truli Delaware Common Stock outstanding, which will be held by the Company. The

terms of the Merger Agreement provide that the currently issued and outstanding shares of Truli Delaware will be cancelled. As

a result, following the Merger, the Company’s current shareholders will be the only shareholders of Truli Delaware.

Filing of Certificate of Merger

The Company intends to file a certificate

of merger with the Secretary of State of Oklahoma and Delaware when the actions taken by the Company’s Board and shareholders

become effective, which will be at least 20 days from the mailing of this Information Statement to the shareholders of record on

the Record Date.

Principal Reasons for Change

of Domicile

The Company’s Board believes that

the change of domicile will give the Company a greater measure of flexibility and simplicity in corporate governance than is available

under Oklahoma law and will increase the marketability of the Company’s securities. The State of Delaware is recognized for

adopting comprehensive modern and flexible corporate laws which are periodically revised to respond to the changing legal and business

needs of corporations. For this reason, many major corporations have initially incorporated in Delaware or have changed their corporate

domiciles to Delaware in a manner similar to that proposed by the Company. Consequently, the Delaware judiciary has become particularly

familiar with corporate law matters and a substantial body of court decisions has developed construing Delaware law. Delaware corporate

law, accordingly, has been, and is likely to continue to be, interpreted in many significant judicial decisions, a fact which may

provide greater clarity and predictability with respect to the Company’s corporate legal affairs. For these reasons, the

Company’s Board believes that the Company’s business and affairs can be conducted to better advantage if the Company

is able to operate under Delaware law. See “Certain Significant Differences between the Corporation Laws of Delaware and

Oklahoma.”

Principal Features of Merger and Reincorporation

The Reincorporation will be effected

by the Merger of the Company, an Oklahoma corporation, with and into, Truli Delaware, a yet to be formed wholly-owned subsidiary

of the Company that will be incorporated under the DGCL for the purpose of effecting the reincorporation. The reincorporation

will become effective upon the filing of the requisite merger documents in Oklahoma and Delaware. Following the Merger, Truli

Delaware will be the surviving corporation and will operate under the name “Truli Media Group, Inc.”

On the effective date of the Merger the

outstanding share of Truli Delaware Common Stock to be held by the Company shall be retired and canceled and shall resume the status

of authorized and unissued Truli Delaware Common Stock.

No certificates or scrip representing

fractional shares of Truli Delaware Common Stock will be issued upon the surrender for exchange of Common Stock (see Proposal

No. 2 “Reverse Stock Split of Common Shares”).

On the effective date of the Merger, the Company will be governed by

the Certificate of Incorporation, the Bylaws and the DGCL, which include a number of provisions that are not present in the Company’s

current certificate of incorporation, the Company’s current bylaws or the Oklahoma General Corporation Act. Accordingly,

as described below, a number of significant changes in stockholders’ rights will occur in connection with the reincorporation.

Upon consummation of the Merger and

resulting reincorporation, the daily business operations of the Company will continue as they are presently conducted by the Company,

at the Company’s principal executive offices at 515 Chalette Drive, Beverly Hills, CA 90210. The telephone number of Truli

Delaware will remain that of the Company, which is (310) 274-0224. Truli Delaware’s sole officer will be Michael Jay Solomon,

the Chief Executive Officer and Principal Accounting Officer of the Company. The members of the Company’s Board will become

the directors of Truli Delaware.

Pursuant to the terms of the Merger

Agreement, the Merger may be abandoned by the Board and the directors of Truli Delaware at any time prior to the effective date

of the Merger. In addition, the Board and directors of Truli Delaware may amend the Merger Agreement at any time prior to the effective

date of the Merger provided that any amendment made may not, without approval by the shareholders of the Company who have consented

in writing to approve the Merger, alter or change the amount or kind of Truli Delaware Common Stock to be received in exchange

for or on conversion of all or any of the Common Stock, alter or change any term of the Certificate or Bylaws or alter or change

any of the terms and conditions of the Merger Agreement if such alteration or change would adversely affect the holders of our

Common Stock.

Truli Delaware Share Certificates

Share certificates representing shares

of the Company’s Common Stock before the Merger shall automatically be converted into shares of Truli Delaware Common Stock

without further action required by any stockholder, subject to the terms of the reverse stock split as discussed in Proposal No.

2 below and as described further in the Merger Agreement. Failure by a shareholder of the Company to surrender certificates representing

Common Stock will not affect such person’s rights as a stockholder, as such stockholder certificate representing Common Stock,

following the reincorporation will represent the right to receive shares of Truli Delaware Common Stock.

Capitalization

The authorized capital of the Company,

on the Record Date, consisted of 495,000,000 shares of Common Stock, par value $0.0001 per share and 5,000,000 shares of preferred

stock, par value $0.0001 per share. The authorized capital of Truli Delaware, which will be the authorized capital of the Company

after the Merger, will consist of 100,000,000 shares of Truli Delaware Common Stock and 10,000,000 shares of Truli Delaware Preferred

Stock.

After the Merger, and assuming the maximum

reverse stock split as contemplated in Proposal No. 2 “Reverse Stock Split of Common Shares,” Truli Delaware will have

outstanding approximately 2,553,646 shares of Truli Delaware Common Stock and 0 shares of Truli Delaware Preferred Stock. Furthermore,

Truli Delaware will have outstanding approximately 93,760 options to purchase Truli Delaware Common Stock and 358,205 warrants

to purchase Truli Delaware Common Stock. For a further discussion, see the section of Proposal No. 2 entitled “Effect of

Reverse Stock Split.”

The board of directors of Truli Delaware

may in the future authorize, without further shareholder approval, the issuance of such shares of Truli Delaware Common Stock or

Truli Delaware Preferred Stock to such persons and for such consideration upon such terms as the board determines. Such issuance

could result in significant dilution of the voting rights and, possibly, the stockholders’ equity, of then existing shareholders.

Certain Significant Differences Between

Corporation Laws of Delaware and Oklahoma

The corporation laws of Oklahoma

and Delaware differ in some respects. Although all the differences are not described in this Information Statement, the most

significant differences, in the judgment of the Company, are summarized below. Shareholders should refer to the DGCL and the

Oklahoma General Corporation Act to understand how these laws apply to the Truli Delaware and the Company, respectively.

Appraisal Rights.

| Oklahoma Law |

Delaware Law |

|

Under Oklahoma law, in the

event of a merger or consolidation, stockholders who did not vote in favor of, or consent to the merger are, after compliance

with statutory procedures, entitled to have a district court determine the fair value of their shares and to receive such fair

value from the surviving company in exchange for their shares. However, stockholders are not entitled to appraisal rights if,

the stockholder’s shares are (i) listed on a national securities exchange or designated as a national market system security

on an inter-dealer quotation system by the National Association of Securities Dealers, Inc., or (ii) held of record by more than

2,000 stockholders, unless the stockholders are required by the terms of the merger agreement to accept anything other than any

one or a combination of the following:

● Shares of stock of the surviving corporation;

● shares of stock of any other corporation that will either not be listed on a national securities exchange or designated as

a national market system security on an interdealer quotation system by the National Association of Securities Dealers, Inc., or

held of record by more than two thousand holders; or

● Any cash in lieu of fractional shares or fractional depository receipts.

|

Under

Delaware law, stockholders have no appraisal rights in the event of a merger or consolidation of the corporation if the stock

of the Delaware corporation is listed on a national securities exchange or if such stock is held of record by more than 2,000

stockholders, or in the case of a merger in which a Delaware corporation is the surviving corporation, if:

● the agreement of merger does not amend the

certificate of incorporation of the surviving corporation;

● each share of stock of the surviving

corporation outstanding immediately prior to the effective date of the merger is to be an identical outstanding share of the

surviving corporation after the effective date of the merger; and

● the increase in the outstanding shares as a result of the merger does not exceed 20% of the shares of the surviving corporation outstanding immediately prior to the merger. |

| |

Even if appraisal rights would not otherwise be available under Delaware law in the cases described above, shareholders would still have appraisal rights if they are required by the terms of the agreement of merger or consolidation to accept for their stock anything other than: |

| |

|

| |

● shares of stock of the surviving

corporation; |

| |

|

| |

● of any other corporation whose shares will be either listed on a national securities exchange; or |

| |

|

| |

● held of record by more than 2,000 stockholders; cash in lieu of fractional shares; or |

| |

|

| |

● a combination of such shares and cash. |

| |

|

| |

Otherwise, stockholders of a Delaware corporation have appraisal rights in consolidations and mergers. |

Federal Income Tax Consequences of the Merger and Reincorporation

The Company believes that, for federal

income tax purposes, no gain or loss will be recognized by the Company, Truli Delaware or the shareholders of the Company who receive

Truli Delaware Common Stock for their Common Stock in connection with the Merger. You are urged to consult your own tax advisor

as to the consequences of the Merger and reincorporation under all applicable tax laws.

Dissenter’s Rights of Appraisal

Under Oklahoma law, in the event of

a merger or consolidation, stockholders who did not vote in favor of, or consent to the merger are, after compliance with statutory

procedures, entitled to have a district court determine the fair value of their shares and to receive such fair value from the

surviving company in exchange for their shares. However, stockholders are not entitled to appraisal rights if the stockholder’s

shares are (i) listed on a national securities exchange or designated as a national market system security on an inter-dealer quotation

system by the National Association of Securities Dealers, Inc., or (ii) held of record by more than 2,000 stockholders, unless

the stockholders are required by the terms of the Merger Agreement to accept anything other than any one or a combination of the

following:

| ● | Shares of stock of the surviving corporation; |

| ● | shares of stock of any other corporation that will either

not be listed on a national securities exchange or designated as a national market system security on an interdealer quotation

system by the National Association of Securities Dealers, Inc., or held of record by more than two thousand holders; or |

| | |

| ● | Any cash in lieu of fractional shares or fractional depository

receipts. |

Accordingly, appraisal rights are available

in connection with our Merger, and a summary of these procedures follows immediately below. The summary is qualified in its entirety

by the text of the Oklahoma General Corporation Act describing these rights, a copy of which is annexed hereto as Appendix D

to this Information Statement. All shareholders are urged to read the summary and the statute carefully. Failure to follow the

procedures outlined therein can result in the loss of your appraisal right.

YOU ARE ENTITLED TO DISSENT FROM

THE ACTIONS DESCRIBED IN THIS INFORMATION STATEMENT OR TO DEMAND APPRAISAL OF YOUR SHARES AS A RESULT OF SUCH ACTIONS

Exercise of Appraisal Rights

If the Merger is completed, our shareholders

are entitled to appraisal rights under Section 18-1091 of the Oklahoma General Corporation Act, provided that they

comply with the conditions established by Section 18-1091.

The discussion below is not a complete

summary regarding a Company shareholder’s appraisal rights under Oklahoma law and is qualified in its entirety

by reference to the text of the relevant provisions of Oklahoma law, which is annexed to this Information Statement as Appendix

D. Shareholders intending to exercise appraisal rights should carefully review Appendix D. Failure to follow precisely

any of the statutory procedures set forth therein may result in a termination or waiver of these rights. A record holder of shares

of the Company’s capital stock who makes the demand described below with respect to such shares, who continuously is the

record holder of such shares through the Merger, who otherwise complies with the statutory requirements of Section 18-1091 and

who neither votes in favor of the merger nor consents thereto in writing will be entitled to an appraisal by the Oklahoma State

Court, of the fair value of his, her or its shares of the Company’s Common Stock in lieu of the consideration that such shareholder

would otherwise be entitled to receive pursuant to the Merger Agreement. All references in this summary of appraisal rights to

a “shareholder” or “holders of shares of the Company’s capital stock” are to the record holder or

holders of shares of the Company’s Common Stock. Except as described herein, shareholders of the Company will not be entitled

to appraisal rights in connection with the Merger.

Under Section 18-1091, where a merger

is to be submitted for approval at a meeting of shareholders, not fewer than 20 days prior to the meeting, a constituent corporation

must notify each of the holders of its stock for whom appraisal rights are available that such appraisal rights are available and

include in each such notice a copy of Section 18-1091. This Information Statement shall constitute such notice to the record holders

of the Company’s capital stock.

Shareholders who desire to exercise

their appraisal rights must satisfy all of the conditions of Section 18-1091. Those conditions include the following:

| |

· |

Shareholders electing to exercise appraisal rights must not vote “for” the adoption of the merger agreement. Voting “for” the adoption of the merger agreement will result in the waiver of appraisal rights. |

| |

· |

A written demand for appraisal of shares must be filed with the Company before the effective date for the Merger Agreement described in the Information Statement. The written demand for appraisal should specify the shareholder’s name and mailing address, and that the shareholder is thereby demanding appraisal of his or her shares of the Company’s Common Stock. The written demand for appraisal of shares is separate from a vote against the Merger Agreement or an abstention from such vote. That is, failure to vote against, or abstain from voting on, the Merger will not satisfy your obligation to make a written demand for appraisal. |

| |

· |

A demand for appraisal must be executed by or for the shareholder of record, fully and correctly, as such shareholder’s name appears on the stock certificate. If the shares are owned of record in a fiduciary capacity, such as by a trustee, guardian or custodian, this demand must be executed by or for the fiduciary. If the shares are owned by or for more than one person, as in a joint tenancy or tenancy in common, such demand must be executed by or for all joint owners. An authorized agent, including an agent for two or more joint owners, may execute the demand for appraisal for a shareholder of record. However, the agent must identify the record owner and expressly disclose the fact that, in exercising the demand, he is acting as agent for the record owner. A person having a beneficial interest in the Company’s capital stock held of record in the name of another person, such as a broker or nominee, must act promptly to cause the record holder to follow the steps summarized below in a timely manner to perfect whatever appraisal rights the beneficial owners may have. |

| |

· |

A shareholder who elects to exercise appraisal rights should mail or deliver his, her or its written demand to Truli Media Group, Inc. 515 Chalette Drive, Beverly Hills, CA 90210. |

Within 10 days after the date of the

Merger, the Company must provide notice of the effective time of the Merger to all Company shareholders who have complied with

Section 18-1091 and have not voted in favor of the adoption of the Merger Agreement.

Within 120 days after the effective

time of the Merger, either Truli Delaware or any shareholder who has complied with the required conditions of Section 18-1091 may

file a petition in the Oklahoma District Court, with a copy served on the Company in the case of a petition filed by a shareholder,

demanding a determination of the fair value of the shares of all shareholders seeking to exercise appraisal rights. There is no

present intent on the part of Truli Delaware to file an appraisal petition, and shareholders seeking to exercise appraisal rights

should not assume that Truli Delaware will file such a petition or that Truli Delaware will initiate any negotiations with respect

to the fair value of such shares. Accordingly, holders of the Company’s capital stock who desire to have their shares appraised

should initiate any petitions necessary for the perfection of their appraisal rights within the time periods and in the manner

prescribed in Section 18-1091.

Within 120 days after the effective

time of the Merger, any shareholder who has satisfied the requirements of Section 18-1091 will be entitled, upon written request,

to receive from the Company a statement setting forth the aggregate number of shares of the Company’s Common Stock not voting

in favor of the adoption of the Merger Agreement and with respect to which demands for appraisal were received by the Company and

the aggregate number of holders of such shares. Such statement must be mailed within 10 days after the shareholder’s request

has been received by the Company or within 10 days after the expiration of the period for the delivery of demands as described

above, whichever is later.

If a petition for an appraisal is timely

filed and a copy thereof is served upon the Company, then the Company will be obligated, within 20 days after service, to file

in the office of the Oklahoma court a duly verified list containing the names and addresses of all shareholders who have demanded

an appraisal of their shares and with whom agreements as to the value of their shares have not been reached. After notice to shareholders,

as required by the Oklahoma Court, at the hearing on such petition, the Oklahoma Court will determine which shareholders are entitled

to appraisal rights. The Oklahoma Court may require the shareholders who have demanded an appraisal for their shares and who hold

stock represented by certificates to submit their certificates of stock to the Oklahoma Court for notation thereon of the pendency

of the appraisal proceedings; and if any shareholder fails to comply with such direction, the Oklahoma Court may dismiss the proceedings

as to such shareholder. Where proceedings are not dismissed, the Oklahoma Court will appraise the shares of the Company’s

Common Stock owned by such shareholders, determining the fair value of such shares exclusive of any element of value arising from

the accomplishment or expectation of the merger, together with a fair rate of interest, if any, to be paid upon the amount determined

to be the fair value.

Although the Board of the Company believes

that the Merger consideration is fair, no representation is made as to the outcome of the appraisal of fair value as determined

by the Oklahoma Court, and shareholders should recognize that such an appraisal could result in a determination of a value higher

or lower than, or the same as, the consideration they would receive pursuant to the Merger Agreement. Moreover, the Company does

not anticipate offering more than the Merger consideration to any shareholder exercising appraisal rights and reserves the right

to assert, in any appraisal proceeding, that, for purposes of Section 18-1091, the “fair value” of a share of the Company’s

Common Stock is less than the Merger consideration. In determining “fair value,” the Oklahoma Court is required to

take into account all relevant factors. The cost of the appraisal proceeding, which does not include attorneys’ or experts’

fees, may be determined by the Oklahoma Court and taxed against the dissenting stockholder and/or the Company as the Oklahoma Court

deems equitable under the circumstances. Each dissenting shareholder is responsible for his or her attorneys’ and expert

witness expenses, although, upon application of a dissenting shareholder, the Oklahoma Court may order that all or a portion of

the expenses incurred by any dissenting shareholder in connection with the appraisal proceeding, including without limitation,

reasonable attorneys’ fees and the fees and expenses of experts, be charged pro rata against the value of all shares of stock

entitled to appraisal.

Any shareholder who has duly demanded

appraisal in compliance with Section 18-1091 will not, after the effective time of the Merger, be entitled to vote for any purpose

any shares subject to such demand or to receive payment of dividends or other distributions on such shares, except for dividends

or distributions payable to shareholders of record at a date prior to the effective time of the Merger.

At any time within 60 days after the

effective time of the merger, any shareholder will have the right to withdraw his, her or its demand for appraisal and to accept

the terms offered in the Merger Agreement. After this period, a shareholder may withdraw his, her or its demand for appraisal and

receive payment for his, her or its shares as provided in the Merger Agreement only with the consent of the Company. If no petition

for appraisal is filed with the court within 120 days after the effective time of the Merger, shareholders’ rights to appraisal,

if available, will cease. Truli Delaware will have no obligation to file such a petition, any shareholder who desires a petition

to be filed is advised to file it on a timely basis. Any shareholder may withdraw such shareholder’s demand for appraisal

by delivering to the Company a written withdrawal of his, her or its demand for appraisal and acceptance of the Merger consideration,

except (i) that any such attempt to withdraw made more than 60 days after the effective time of the Merger will require written

approval of Truli Delaware and (ii) that no appraisal proceeding in the Oklahoma Court shall be dismissed as to any shareholder

without the approval of the Oklahoma Court, and such approval may be conditioned upon such terms as the Oklahoma Court deems just.

Failure by any Company shareholder

to comply fully with the procedures described above and set forth in Appendix D to this Information Statement may result

in termination of such shareholder’s appraisal rights. In view of the complexity of exercising appraisal rights under Oklahoma

law, any Company shareholder considering exercising these rights should consult with legal counsel.

PROPOSAL NO. 2

REVERSE STOCK SPLIT OF COMMON SHARES

General Information Regarding

Reverse Stock Split

Pursuant to the terms of the Merger

Agreement, the number of shares of Common Stock of the Company held by each shareholder of record on the effective date, will be

reverse split on the basis that up to fifty (50) issued and outstanding shares of Common Stock will become one (1) issued and outstanding

share of Truli Delaware Common Stock (“Reverse Stock Split”). The actual basis of the Reverse Stock Split may be less

than fifty (50) for one (1) at the discretion of the Board at the time of the Merger.

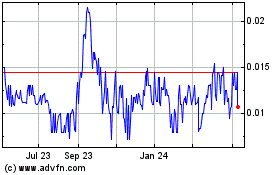

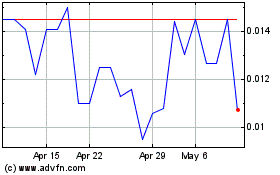

Principal Reasons for Reverse

Stock Split

The Board and shareholders of the Company

believe that it is advisable and in the best interests of the Company and its shareholders to effect the Reverse Stock Split in

conjunction with the Merger in order to reduce the number of issued and outstanding shares of capital stock post-Merger. The Company

believes that an increased market price of its stock post-Merger will encourage interest and trading in the stock. Due to the trading

volatility often associated with low-priced stocks, many brokerage houses and institutional investors have internal policies and

practices that either prohibit them from investing in low priced (sub-penny) stocks or tend to discourage individual brokers from

recommending low-priced stocks to their customers. Some of those policies and practices may function to make the processing of

trades in low-priced stocks economically unattractive to brokers. Additionally, because brokers’ commissions on low-priced

stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average

price per share of the common stock can result in individual shareholders paying transaction costs representing a higher percentage

of their total share value than would be the case if the share price were substantially higher. It should be noted that the liquidity

of the common stock may be adversely affected by the reverse split given the reduced number of shares that would be outstanding

after the Reverse Stock Split. The Board anticipates, however, that the expected higher market price will reduce, to some extent,

the negative effects on the liquidity and marketability of the stock inherent in some of the policies and practices of institutional

investors and brokerage houses described above.

Effect of Reverse Stock Split

The Reverse Stock Split will affect all

of our shareholders uniformly and will not affect any shareholder’s proportion voting power or percentage ownership interest

of the Company, or Truli Delaware, subsequent to the Merger, except to the extent that the Reverse Stock Split results in any of

our shareholders owning a fractional of a share which shall be rounded up the next whole share as discussed below.

The Reverse Stock Split will not

affect the number of shares of Truli Delaware Common Stock is authorized to issue, but will reduce the number of shares each Company

shareholder held prior to the Merger. As of the Record Date, the Company was authorized to issue 495,000,000 shares of Common Stock,

par value $0.0001 and 5,000,000 shares of preferred stock, par value $0.0001. Of this amount, 127,682,295 shares of Common Stock

are issued and outstanding.

Upon completion of the Merger, Truli

Delaware will be authorized to issue 100,000,000 shares of Truli Delaware Common Stock, par value $0.0001, and 10,000,000 shares

of Truli Delaware Preferred Stock, par value $0.0001. Of this amount, it is estimated that (i) 2,553,646 shares of Truli Delaware

Common Stock, (ii) options to purchase 93,670 shares of Truli Delaware Common Stock at an average exercise price of $6.86, and

(iii) warrants to purchase 358,205 shares of Truli Delaware Common Stock at an average exercise price of $0.35 will be outstanding

upon completion of the Reverse Stock Split assuming the maximum reverse split. The table below summarizes the foregoing information:

| | |

Pre-Merger and Reverse Stock Split (1)(2) | | |

Post-Merger and Reverse Stock Split (1)(2) | |

| Common Shares (3) | |

| | |

| |

| Issued and Outstanding | |

| 127,682,295 | | |

| 2,553,646 | |

| Common Stock Options | |

| 4,688,000 | | |

| 93,760 | |

| Common Stock Warrants | |

| 17,910,257 | | |

| 358,205 | |

| Authorized | |

| 495,000,000 | | |

| 100,000,000 | |

| | |

| | | |

| | |

| Preferred Shares | |

| | | |

| | |

| Issued and Outstanding | |

| 0 | | |

| 0 | |

| Authorized | |

| 5,000,000 | | |

| 10,000,000 | |

| (1) | Number of Shares does not take into account convertible debt securities that may be converted into

shares of common stock pre and post-Merger. |

| (2) | Number of Shares does not take into account rounding up of fractional shares, if any. |

| (3) | A total of 22,598,257 Options and Warrants are convertible into common stock pre-Merger at a weighted

average exercise price of $0.03 per share. |

Fractional Shares

No fractional shares of Truli Delaware

Common Stock will be issued as a result of the Reverse Stock Split. Instead, shareholders who otherwise would be entitled to receive

fractional shares will be entitled to receive an additional share by rounding up to the nearest whole number of shares.

Potential Anti-Takeover Effects

The Reverse Stock Split and the Merger

will have the effect of increasing the proportion of unissued authorized shares to issued shares. Under certain circumstances

this may have an anti-takeover effect. These authorized but unissued shares could

be used by Truli Delaware (post-Merger) to oppose a hostile takeover attempt or to delay or prevent a change

of control or changes in or removal of the board of directors, including a transaction that

may be favored by a majority of our shareholders or in which our shareholders might

receive a premium for their shares over then-current market prices or benefit in some other manner. For example, without further

stockholder approval, the board of directors could issue and sell shares thereby diluting the stock ownership of a person seeking

to effect a change in the composition of our board of directors or to propose or complete a tender offer or business combination

involving us and potentially strategically placing shares with purchasers who would oppose such a change in the board of directors

or such a transaction.

Although an increased proportion of

unissued authorized shares to issued shares could, under certain circumstances, have a potential anti-takeover effect, the Merger

and Reverse Stock Split are not in response to any effort of which we are aware to accumulate the shares of our Common Stock or

obtain control of the Company. There are no plans or proposals to adopt other provisions or enter into other arrangements

that may have material anti-takeover consequences.

The Board does not intend for this transaction to be the first step in a series

of plans or proposals of a “going private transaction” within the meaning of Rule 13e-3 of the Exchange Act. Moreover,

we are currently not engaged in any negotiations or otherwise have no specific plans to use additional authorized shares of Truli

Delaware, our surviving entity in the Merger and Reverse Stock Split, for any future acquisition, merger or consolidation.

PROPOSAL NO. 3

ADOPTION OF COMPANY’S 2014 EQUITY COMPENSATION PLAN

On November 19, 2014, our Board, and

on December 19, 2014, holders of a majority of the Common Stock of the Company approved the adoption of the Company’s 2014

equity compensation plan and form of grants (“Plan”), a copy of which is annexed hereto as Appendix E. Subsequent

to the Merger, the Plan will be adopted by Truli Delaware pursuant to the terms of the Merger Agreement.

Summary of the Plan

The following summary of the Plan is

qualified in its entirety by the specific language of the Plan:

General.

The Plan provides for the grant of incentive

stock options, within the meaning of Section 422 of the United States Code, to our employees and nonstatutory stock options,

restricted stock, performance units, performance shares, RSUs, and other stock based awards to our employees, directors, and consultants.

The purpose of the Plan is to attract and retain the best available personnel for positions of substantial responsibility, to provide

additional incentive to our employees, directors, and consultants and to promote the success of our business.

Common Stock Available Under the

Plan.

As of the date of adoption of the Plan

by the shareholders of the Company, there are 25,536,459 shares of Common Stock reserved for issuance pursuant to awards under

the Plan. This number shall be adjusted appropriately pursuant to the terms of the Merger described herein.

If an award expires or is terminated

or canceled without having been exercised or settled in full, or is forfeited back to or repurchased by us, the terminated portion

of the award (or forfeited or repurchased shares subject to the award) will become available for future grant or sale under the

Plan (unless the Plan has terminated). Shares are not deemed to be issued under the Plan with respect to any portion of an award

that is settled in cash or to the extent such shares are withheld in satisfaction of tax withholding obligations. If the exercise

or purchase price of an award is paid for through the tender of shares, or tax withholding obligations are met through the tender

or withholding of shares, those shares tendered or withheld will again be available for issuance under the Plan. However, shares

that have actually been transferred to a financial institution or other person or entity selected by the Plan administrator will

not be returned to the Plan and will not be available for future distribution under the Plan.

Administration of the Plan.

Our Board, or one or more committees

appointed by the Board, will administer our Plan (the “administrator”). The administrator has the power to determine

the terms of the awards, including the exercise price (which may be changed by the administrator after the date of grant), the

number of shares subject to each award (subject to the limits under the Plan), the exercisability of the awards and the form of

consideration payable upon exercise. The administrator also has the power to implement an award exchange program, an award transfer

program (whereby awards may be transferred to a financial institution or other person or entity selected by the Plan administrator),

and a program through which participants may reduce cash compensation payable in exchange for awards, and to create other stock

based awards that are valued in whole or in part by reference to (or are otherwise based on) shares of our common stock (or the

cash equivalent of such shares).

Eligibility.

Nonstatutory stock

options, restricted stock, stock appreciation rights, performance units, performance shares, RSUs, and other stock based awards

may be granted under the Plan to our employees, directors, and consultants. Incentive stock options may be granted only to employees.

Limitations.

Section 162(m) of the Code places

limits on the deductibility for federal income tax purposes of compensation paid to certain of our executive officers. In order

to preserve our ability to deduct the compensation income associated with certain awards granted to such persons.

Options.

A stock option is the right to purchase

shares of our Common Stock at a fixed exercise price for a fixed period of time. Each option is evidenced by a stock option agreement

and is subject to the following terms and conditions:

Number of

Options. The administrator will determine the number of shares granted to any eligible individual pursuant to a stock option.

Exercise

Price. The administrator will determine the exercise price of options granted under our Plan at the time the options are

granted, but with respect to nonstatutory stock options intended to qualify as “performance-based compensation” within

the meaning of Section 162(m) of the Code and all incentive stock options, the exercise price generally must be at least equal

to the fair market value of our Common Stock on the date of grant. The exercise price of an incentive stock option granted to a

10% stockholder may not be less than 110% of the fair market value on the date such option is granted. The fair market value of

common stock generally is determined with reference to the closing sale price for our common stock (or the closing bid if no sales

were reported) on the day the option is granted.

Exercise

of Option; Form of Consideration. The administrator determines when options become exercisable, and may in its discretion,

accelerate the vesting of any outstanding option. The means of payment for shares issued upon exercise of an option is specified

in each option agreement. To the extent permitted by applicable law, the Plan permits payment to be made by cash, check, promissory

note, other shares of our Common Stock (with some restrictions), cashless exercises, a reduction in the amount of our liability

to the participant, any combination of the prior methods of payment or any other form of consideration permitted by applicable

law.

Term of Option.

The term of stock options will be stated in the stock option agreement. However, the term of an incentive stock option may not

exceed ten years, except that with respect to any participant who owns 10% of the voting power of all classes of our outstanding

capital stock, the term must not exceed five years. No option may be exercised after the expiration of its term.

Termination

of Service. After termination of service, an option holder may exercise his or her option for the period of time determined

by the administrator and stated in the option agreement. In the absence of a time specified in a participant’s award agreement,

a participant may exercise the option within three months of such termination, to the extent that the option is vested on the date

of termination (but in no event later than the expiration of the term of such option as set forth in the option agreement), unless

such participant’s service terminates due to the participant’s death or disability, in which case the participant or,

if the participant has died, the participant’s estate, beneficiary designated in accordance with the administrator’s

requirements or the person who acquires the right to exercise the option by bequest or inheritance may exercise the option, to

the extent the option was vested on the date of termination (or to the extent the vesting is accelerated upon the participant’s

death), within one year from the date of such termination.

Nontransferability

of Options. Unless otherwise determined by the administrator, options granted under the Plan are not transferable other

than by will or the laws of descent and distribution, and may be exercised during the optionee’s lifetime only by the optionee.

However, the administrator may at any time implement an award transfer program (whereby awards may be transferred to a financial

institution or other person or entity selected by the Plan administrator).

Restricted Stock.

Restricted stock awards are awards of

shares of our Common Stock that vest in accordance with terms and conditions established by the administrator. The administrator

may impose whatever conditions to vesting it determines to be appropriate including, if the administrator has determined it is

desirable for the award to qualify as “performance-based compensation” for purposes of Section 162(m) of the Code,

that the restricted stock will vest based on the achievement of performance goals. Each award of restricted stock is evidenced

by an award agreement specifying the terms and conditions of the award. The administrator will determine the number of shares of

restricted stock granted to any employee. The administrator also determines the purchase price of any grants of restricted stock

and, unless the administrator determines otherwise, shares that do not vest typically will be subject to forfeiture or to our right

of repurchase, which we may exercise upon the voluntary or involuntary termination of the purchaser’s service with us for

any reason including death or disability.

Restricted Stock Units.

Restricted Stock Units (“RSUs”)

are awards of restricted stock, performance shares, or performance units that are paid out in installments or on a deferred basis.

The administrator determines the terms and conditions of RSUs. Each RSU award will be evidenced by an award agreement that will

specify terms and conditions as the administrator may determine in its sole discretion, including, without limitation whatever

conditions to vesting it determines to be appropriate. As with awards of restricted stock, performance shares, and performance

units, the administrator may set restrictions with respect to the RSUs based on the achievement of specific performance goals.

The administrator also determines the number of shares granted pursuant to a RSU award.

Performance Shares and Performance

Units.

Performance units and performance shares

are awards that will result in a payment to a participant only if performance goals established by the administrator are achieved

or the awards otherwise vest. The administrator will establish performance goals in its discretion, which, depending on the extent

to which they are met, will determine the number and/or the value of performance units and performance shares to be paid out to

participants. The performance goals may be based upon the achievement of company-wide, divisional, or individual goals (including

solely continued service), applicable securities laws or other basis determined by the administrator. Payment for performance units

and performance shares may be made in cash or in shares of our common stock with equivalent value, or in some combination, as determined

by the administrator. Performance units will have an initial dollar value established by the administrator prior to the grant date.

Performance shares will have an initial value equal to the fair market value of our common stock on the grant date. The administrator

also determines the number of performance shares and performance units granted to any employee. Each performance unit and performance

share is evidenced by an award agreement, and is subject to the terms and conditions determined by the administrator.

Other Stock Based Awards.

The administrator has the authority

to create awards under the Plan in addition to those specifically described in the Plan. These awards must be valued in whole or

in part by reference to, or must otherwise be based on, the shares of our common stock (or the cash equivalent of such shares).

These awards may be granted either alone, in addition to, or in tandem with, other awards granted under the Plan and/or cash awards

made outside the Plan. Each other stock based award will be evidenced by an award agreement that will specify terms and conditions

as the administrator may determine.

Transferability of Awards.

Unless the administrator determines

otherwise, our Plan does not allow for the transfer of awards other than by will, by the laws of descent and distribution, or pursuant

to an award transfer program which the administrator has reserved the discretion to implement from time to time. Only the participant

may exercise an award during his or her lifetime.

Performance Goals.

Under Section 162(m) of the Code,

the annual compensation paid to the chief executive officer, the chief financial officer, and each of the other three most highly

compensated executive officers, if and when applicable, (our named executive officers) may not be deductible to the extent it exceeds

$1,000,000. However, we are able to preserve the deductibility of compensation in excess of $1,000,000 if the conditions of Section 162(m)

of the Code are met. These conditions include stockholder approval of the Plan, setting limits on the number of awards that any

individual may receive, and for awards other than options establishing performance criteria that must be met before the award actually

will vest or be paid. The administrator (in its discretion) may make performance goals applicable to a participant. The performance

goals may differ from participant to participant and from award to award. Any criteria used may be measured, as applicable, in

absolute terms or in relative terms (including passage of time and/or against another company or companies), on a per-share basis,

against the performance of the company as a whole or any segment of the company, and on a pre-tax or after-tax basis.

Adjustments upon Changes in Capitalization.

In the event that

our stock changes by reason of any dividend (excluding an ordinary dividend) or other distribution, recapitalization, stock split,

reverse stock split, reorganization, merger, consolidation, split-up, spin-off, combination, repurchase, or exchange of our securities,

or other similar change in our capital structure, the administrator will make the adjustments to the number and class of shares

of common stock subject to the Plan, the maximum number of shares of Common Stock that may be issued to any individual in any fiscal

year pursuant to awards, and the number, class, and price of shares of common stock subject to any outstanding award.

Adjustments upon Liquidation or

Dissolution.

In the event of

our liquidation or dissolution, any unexercised award will terminate. The administrator may, in its sole discretion, provide that

each participant will have the right to exercise all or any part of the award, including shares as to which the award would not

otherwise be exercisable.

Adjustments upon Merger or Change

in Control.

Our Plan provides that in the event

of a merger with or into another corporation or our “change in control,” including the sale of all or substantially

all of our assets, the successor corporation will assume or substitute an equivalent award for each outstanding award. Unless determined

otherwise by the administrator, any outstanding options not assumed or substituted for will be fully vested and exercisable, including

as to shares that would not otherwise have been vested and exercisable, for a period of up to 15 days from the date of notice to

the holder of such award. The option or stock appreciation right will terminate at the end of such period. Unless determined otherwise

by the administrator, any restricted stock, performance shares, performance units, RSUs, or other stock based awards not assumed

or substituted for will be fully vested as to all of the shares subject to the award, including shares which would not otherwise

be vested. In the event an outside director is terminated immediately prior to or following a change in control, other than pursuant

to a voluntary resignation, the awards he or she received under the Plan will fully vest and become immediately exercisable.

Amendment and Termination of Our Plan.

Our Plan will automatically terminate

in 2016, unless we terminate it sooner. In addition, our board of directors has the authority to amend, suspend, or terminate our

Plan provided it does not adversely affect any award previously granted under our Plan.

Plan Benefits

Except as set forth below, the amount

and timing of awards granted under the Plan are determined in the sole discretion of the administrator and therefore cannot be

determined in advance. The future awards that would be received under the Plan by executive officers and other employees are discretionary

and are therefore not determinable at this time.

U.S. Federal Income Tax Information

Incentive Stock

Options.

An optionee who is granted an incentive

stock option does not recognize taxable income at the time the option is granted or upon its exercise, although the exercise is

an adjustment item for alternative minimum tax purposes and may subject the optionee to the alternative minimum tax. Upon a disposition

of the shares more than two years after grant of the option and one year after exercise of the option, any gain or loss is treated

as long-term capital gain or loss. If these holding periods are not satisfied, the optionee recognizes ordinary income at the time

of disposition equal to the difference between the exercise price and the lower of (i) the fair market value of the shares

at the date of the option exercise, or (ii) the sale price of the shares. Any gain or loss recognized on such a premature

disposition of the shares in excess of the amount treated as ordinary income is treated as long-term or short-term capital gain

or loss, depending on the holding period. Unless limited by Section 162(m) of the Code, we are generally entitled to a deduction

in the same amount as the ordinary income recognized by the optionee.

Nonstatutory

Stock Options.

An optionee does not recognize any taxable

income at the time he or she is granted a nonstatutory stock option. Upon exercise, the optionee recognizes taxable income generally

measured by the excess of the then fair market value of the shares over the exercise price. Any taxable income recognized in connection

with an option exercise by an employee is subject to tax withholding. Unless limited by Section 162(m) of the Code, we are

generally entitled to a deduction in the same amount as the ordinary income recognized by the optionee. Upon a disposition of such

shares by the optionee, any difference between the sale price and the optionee’s exercise price, to the extent not recognized

as taxable income as provided above, is treated as long-term or short-term capital gain or loss, depending on the holding period.

Restricted Stock,

Restricted Stock Units, Performance Shares and Performance Units.

A participant generally will not have

taxable income at the time an award of restricted stock and RSUs are granted. Instead, he or she will recognize ordinary income

in the first taxable year in which his or her interest in the shares underlying the award becomes either (i) freely transferable,

or (ii) no longer subject to substantial risk of forfeiture (e.g., vested). However, a holder of a restricted stock award

may elect to recognize income at the time he or she receives the award in an amount equal to the fair market value of the shares

underlying the award less any amount paid for the shares on the date the award is granted.

Our Tax Impact

from Awards.

We generally will

be entitled to a tax deduction in connection with an award under the Plan in an amount equal to the ordinary income realized by

a participant and at the time the participant recognizes such income (for example, the exercise of a nonstatutory stock option).

Special rules limit the deductibility of compensation paid to our named executive officers. Under Section 162(m) of the Code,

the annual compensation paid to named executive officers may not be deductible to the extent it exceeds $1,000,000. However, we

can preserve the deductibility of certain compensation in excess of $1,000,000 if the conditions of Section 162(m) of the

Code are met. These conditions include stockholder approval of the Plan and setting limits on the number of awards that any individual

may receive per year. The Plan has been designed to permit the administrator to grant awards that qualify as performance-based

for purposes of satisfying the conditions of Section 162(m) of the Code, which permits us to continue to receive a federal

income tax deduction in connection with such awards.

THE FOREGOING IS ONLY A SUMMARY OF THE

EFFECT OF U.S. FEDERAL INCOME TAXATION WITH RESPECT TO THE GRANT AND EXERCISE OF AWARDS UNDER THE PLAN. IT DOES NOT PURPORT TO

BE COMPLETE, AND DOES NOT DISCUSS THE TAX CONSEQUENCES OF AN INDIVIDUAL’S DEATH OR THE PROVISIONS OF THE INCOME TAX LAWS

OF ANY MUNICIPALITY, STATE OR FOREIGN COUNTRY IN WHICH ANY ELIGIBLE INDIVIDUAL MAY RESIDE.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth information concerning the

total compensation paid during our fiscal year ended March 31, 2014, and our fiscal year ended March 31, 2013, for (i) our Chief

Executive Officer, Michael Jay Solomon.

| Position | |

| Year Ended | | |

| Salary ($) | | |

| Bonus ($) | | |

| Stock ($) | | |

| All Other ($) | | |

| Total ($) | |

| Michael Jay Solomon (CEO) | |

| March 31, 2014 | | |

| * | | |

| -- | | |

| -- | | |

| -- | | |

| -- | |

| | |

| March 31, 2013 | | |

| * | | |

| -- | | |

| -- | | |

| -- | | |

| -- | |

* Michael Jay Solomon has forgone of $375,000 per annum due

to the limited capital of the company.

EMPLOYMENT AGREEMENTS AND CHANGE IN

CONTROL AGREEMENTS

We currently have an outstanding oral contract with our CEO,

Michael Jay Solomon. Mr. Solomon has forgone payments for the last two fiscal years ended March 31, 2014 and 2013 respectively

of $375,000 per annum due to the limited capital of the company.

Director Compensation

Non-employee director compensation for a new director is

determined on a case by case basis by the existing members of the board of directors at the time a director is elected. Any subsequent

compensation in the form of stock options are issued on a case by case basis.

INTEREST OF CERTAIN PERSONS IN OR

OPPOSITION TO MATTERS TO BE ACTED UPON

None of our officers, directors or any of their respective

affiliates has any interest in any of the matters to be acted upon, as set forth in this Information Statement.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table sets forth information

regarding the beneficial ownership of our common stock as of December 19, 2014, by (a) each person who is known by us to beneficially

own 5% or more of our common stock, (b) each of our directors and executive officers, and (c) all of our directors and executive

officers as a group.

| Name and Address of Beneficial Owner(1) | |

Shares | | |

Shares

Underlying

Convertible

Securities(2) | | |

Total | | |

Percent of

Class(2) | |

| Directors and named Executive Officers | |

| | |

| | |

| | |

| |

| Michael Jay Solomon | |

| 65,443,847 | | |

| - | | |

| 65,443,847 | | |

| 51.3 | % |

| Martin Pompadour | |

| - | | |

| 300,000 | | |

| 300,000 | | |

| * % | |

| All directors and executive officers as a group (2 persons) | |

| 65,443,847 | | |

| 300,000 | | |

| 65,743,847 | | |

| 51.4 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Beneficial Owners of 5% or more | |

| | | |

| | | |

| | | |

| | |

| Ryan Tedder (3) | |

| 9,433,963 | | |

| - | | |

| 9,433,963 | | |

| 7.4 | % |

| Legend Securities, Inc. (4) | |

| - | | |

| 17,904,857 | | |

| 17,904,857 | | |

| 12.3 | % |

| * |

Less than one percent. |

| |

|

| (1) |

Except as otherwise indicated, the persons named in this table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject to community property laws where applicable and to the information contained in the footnotes to this table. Unless otherwise indicated, the address of the beneficial owner is Truli Media Group, Inc., 515 Chalette Drive, Beverly Hills, CA 90210. |

| |

|

| (2) |

Pursuant to Rules 13d-3 and 13d-5 of the Exchange Act, beneficial ownership includes any shares as to which a shareholder has sole or shared voting power or investment power, and also any shares which the shareholder has the right to acquire within 60 days, including upon exercise of common shares purchase options or warrants. There are 127,682,295 shares of common stock issued and outstanding as of December 19, 2014. |

| |

|

| (3) |

45 Broadway, 32nd

Floor, New York, New York 10006 |

| |

|

| (4) |

45 Broadway, 32nd

Floor, New York, New York 10006 |

EFFECITVE DATE

The proposed corporate actions will become effective

as follows:

| (i) |

Merger and Reincorporation into Delaware |

At least 20 days after the date in which this Information Statement is mailed to our shareholders |

| |

|

|

| (ii) |

Reverse Stock Split |

At least 20 days after the date in which this Information Statement is mailed to our shareholders |

| (iii) |

Adoption of 2014 Equity Compensation Plan |

At least 20 days after the date in which this Information Statement is mailed to our shareholders |

NOTICE OF INTERNET AVAILABILITY

This Information Statement and all

accompanying appendices will be available in full on the Company’s website at www.truli.com under the hyperlink entitled

“Investors” or at http://www.truli.com/corporate/investors.

FORWARD-LOOKING STATEMENTS

This Information

Statement may contain certain “forward-looking” statements as such term is defined by the U.S. Securities and Exchange

Commission in its rules, regulations and releases, which represent our expectations or beliefs, including but not limited to, statements

concerning our operations, economic performance, financial condition, growth and acquisition strategies, investments, and future

operational plans. For this purpose, any statements contained herein that are not statements of historical fact may be deemed to

be forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,”

“expect,” “believe,” “anticipate,” “intend,” “could,” “estimate,”

“might,” or “continue” or the negative or other variations thereof or comparable terminology are intended

to identify forward-looking statements. These statements, by their nature, involve substantial risks and uncertainties, certain

of which are beyond our control, and actual results may differ materially depending on a variety of important factors, including

uncertainty related to acquisitions, governmental regulation, managing and maintaining growth, volatility of stock prices and any

other factors discussed in this and other of our filings with the Securities and Exchange Commission.

| By Order of the Board of Directors |

|

|

Of Truli Media Group, Inc. |

|

| |

|

|

/s/ Michael Jay Solomon

|

|

| Michael Jay Solomon |

|

| Chief Executive Officer |

|

|

Beverly Hills, California

[*], 2015 |

|

Appendix A

AGREEMENT

AND PLAN OF MERGER

OF

TRULI

MEDIA GROUP, INC., AN OKLAHOMA CORPORATION

AND

TRULI

MEDIA GROUP, INC., A DELAWARE CORPORATION

THIS

AGREEMENT AND PLAN OF MERGER (the "Agreement") dated as of January [*],

2015 made and entered into by and between Truli Media Group, Inc., an Oklahoma corporation ("Truli"),

and Truli Media Group, Inc., a Delaware corporation ("TMG"), which corporations are sometimes referred

to herein as the "Constituent Corporations."

W

I T N E S S E T H:

WHEREAS,

Truli is a corporation organized and existing under the laws of the State of Oklahoma, having been incorporated on July 28, 2008,

under the laws of the State of Oklahoma under the name S.A. Recovery Corp under the Oklahoma General Corporation Act (the “OGCA”);

and

WHEREAS,

TMG is a wholly-owned subsidiary corporation of Truli, having been incorporated under the laws of the State of Delaware under

the Delaware General Corporation Law (the “DGCL”) on January [*],

2015; and

WHEREAS,

the respective Boards of Directors of Truli and TMG have determined that it is desirable to merge TRULI with and into TMG and

that TMG shall be the surviving corporation (the "Merger"); and

WHEREAS,

the parties intend by this Agreement to effect a reorganization under Section 368 of the Internal Revenue Code of 1986, as amended;

NOW,

THEREFORE, in consideration of the mutual covenants and promises contained in this Agreement, and for other valuable consideration,

the receipt and adequacy of which are hereby acknowledged, and intending to be legally bound, Truli and TMG hereto agree as follows:

ARTICLE

I

MERGER

1.1

On the effective date of the Merger (the "Effective Date"), as provided herein, Truli shall be merged

with and into TMG, the separate existence of Truli shall cease and TMG (hereinafter sometimes referred to as the "Surviving

Corporation") shall continue to exist under the name of Truli Media Group, Inc. by virtue of, and shall be governed

by, the laws of the State of Delaware. The address of the registered office of the Surviving Corporation in the State of Delaware

will be [*].

ARTICLE

II

CERTIFICATE OF INCORPORATION OF SURVIVING CORPORATION

2.1

The name of the Surviving Corporation shall be "Truli Media Group, Inc." The Certificate of Incorporation of the Surviving

Corporation, attached hereto as Exhibit A, as in effect on the date hereof, shall be the Certificate of Incorporation

of TMG (the "TMG Charter") without change, unless and until amended in accordance with Article VIII of

this Agreement or otherwise amended in accordance with applicable law.

ARTICLE

III

BYLAWS OF THE SURVIVING CORPORATION

3.1

The Bylaws of the Surviving Corporation, as in effect on the date hereof shall be the Bylaws of TMG (the "TMG Bylaws")

without change, unless and until amended in accordance with Article VIII of this Agreement or otherwise amended in accordance

with applicable law.

ARTICLE

IV

EFFECT OF MERGER ON STOCK OF CONSTITUENT CORPORATIONS

4.1

On the Effective Date, up to, at the discretion of the board of directors, every fifty (50) shares of Common Stock of Truli, par

value $0.001 per share (the "Truli Common Stock") shall be converted into one (1) share of Common Stock,

par value $0.0001 per share, of TMG (the "TMG Common Stock") (“Split Ratio”),