0001449349

false

Q2

--12-31

0001449349

2023-01-01

2023-06-30

0001449349

2023-08-04

0001449349

2023-06-30

0001449349

2022-12-31

0001449349

RDGL:SeriesAConvertiblePreferredStockMember

2023-06-30

0001449349

RDGL:SeriesAConvertiblePreferredStockMember

2022-12-31

0001449349

RDGL:SeriesBConvertiblePreferredStockMember

2023-06-30

0001449349

RDGL:SeriesBConvertiblePreferredStockMember

2022-12-31

0001449349

RDGL:SeriesCConvertiblePreferredStockMember

2023-06-30

0001449349

RDGL:SeriesCConvertiblePreferredStockMember

2022-12-31

0001449349

2022-01-01

2022-06-30

0001449349

2023-04-01

2023-06-30

0001449349

2022-04-01

2022-06-30

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2021-12-31

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesAPreferredMember

2021-12-31

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2021-12-31

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesBPreferredMember

2021-12-31

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2021-12-31

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesCPreferredMember

2021-12-31

0001449349

us-gaap:CommonStockMember

2021-12-31

0001449349

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001449349

us-gaap:RetainedEarningsMember

2021-12-31

0001449349

2021-12-31

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-03-31

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesAPreferredMember

2022-03-31

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2022-03-31

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesBPreferredMember

2022-03-31

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2022-03-31

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesCPreferredMember

2022-03-31

0001449349

us-gaap:CommonStockMember

2022-03-31

0001449349

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001449349

us-gaap:RetainedEarningsMember

2022-03-31

0001449349

2022-03-31

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-12-31

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesAPreferredMember

2022-12-31

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2022-12-31

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesBPreferredMember

2022-12-31

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2022-12-31

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesCPreferredMember

2022-12-31

0001449349

us-gaap:CommonStockMember

2022-12-31

0001449349

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001449349

us-gaap:RetainedEarningsMember

2022-12-31

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-03-31

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesAPreferredMember

2023-03-31

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-03-31

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesBPreferredMember

2023-03-31

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2023-03-31

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesCPreferredMember

2023-03-31

0001449349

us-gaap:CommonStockMember

2023-03-31

0001449349

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001449349

us-gaap:RetainedEarningsMember

2023-03-31

0001449349

2023-03-31

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-01-01

2022-03-31

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesAPreferredMember

2022-01-01

2022-03-31

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2022-01-01

2022-03-31

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesBPreferredMember

2022-01-01

2022-03-31

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2022-01-01

2022-03-31

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesCPreferredMember

2022-01-01

2022-03-31

0001449349

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001449349

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001449349

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001449349

2022-01-01

2022-03-31

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-04-01

2022-06-30

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesAPreferredMember

2022-04-01

2022-06-30

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2022-04-01

2022-06-30

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesBPreferredMember

2022-04-01

2022-06-30

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2022-04-01

2022-06-30

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesCPreferredMember

2022-04-01

2022-06-30

0001449349

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001449349

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001449349

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-01-01

2023-03-31

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesAPreferredMember

2023-01-01

2023-03-31

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-01-01

2023-03-31

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesBPreferredMember

2023-01-01

2023-03-31

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2023-01-01

2023-03-31

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesCPreferredMember

2023-01-01

2023-03-31

0001449349

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001449349

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001449349

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001449349

2023-01-01

2023-03-31

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-04-01

2023-06-30

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesAPreferredMember

2023-04-01

2023-06-30

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-04-01

2023-06-30

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesBPreferredMember

2023-04-01

2023-06-30

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2023-04-01

2023-06-30

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesCPreferredMember

2023-04-01

2023-06-30

0001449349

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001449349

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001449349

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-06-30

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesAPreferredMember

2022-06-30

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2022-06-30

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesBPreferredMember

2022-06-30

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2022-06-30

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesCPreferredMember

2022-06-30

0001449349

us-gaap:CommonStockMember

2022-06-30

0001449349

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001449349

us-gaap:RetainedEarningsMember

2022-06-30

0001449349

2022-06-30

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-06-30

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesAPreferredMember

2023-06-30

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-06-30

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesBPreferredMember

2023-06-30

0001449349

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2023-06-30

0001449349

us-gaap:PreferredStockMember

RDGL:AdditionalPaidInCapitalSeriesCPreferredMember

2023-06-30

0001449349

us-gaap:CommonStockMember

2023-06-30

0001449349

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001449349

us-gaap:RetainedEarningsMember

2023-06-30

0001449349

2021-09-14

2021-09-15

0001449349

2021-09-15

0001449349

2022-07-27

2022-07-31

0001449349

2022-07-31

0001449349

2022-10-30

2022-10-31

0001449349

2023-04-01

2023-04-30

0001449349

us-gaap:CommonStockMember

2023-04-01

2023-04-30

0001449349

RDGL:SeriesAWarrantMember

2023-04-01

2023-04-30

0001449349

RDGL:SeriesBWarrantMember

2023-04-01

2023-04-30

0001449349

srt:MaximumMember

2023-01-01

2023-06-30

0001449349

us-gaap:PreferredStockMember

2023-01-01

2023-06-30

0001449349

us-gaap:PreferredStockMember

2022-01-01

2022-12-31

0001449349

us-gaap:RestrictedStockUnitsRSUMember

2023-01-01

2023-06-30

0001449349

us-gaap:RestrictedStockUnitsRSUMember

2022-01-01

2022-12-31

0001449349

us-gaap:StockOptionMember

2023-01-01

2023-06-30

0001449349

us-gaap:StockOptionMember

2022-01-01

2022-12-31

0001449349

us-gaap:WarrantMember

2023-01-01

2023-06-30

0001449349

us-gaap:WarrantMember

2022-01-01

2022-12-31

0001449349

2022-01-01

2022-12-31

0001449349

srt:ChiefExecutiveOfficerMember

2022-03-31

0001449349

srt:ChiefExecutiveOfficerMember

us-gaap:CommonStockMember

2022-03-01

2022-03-31

0001449349

RDGL:SeriesBConvertiblePreferredStockMember

2018-10-08

0001449349

RDGL:SeriesCConvertiblePreferredStockMember

2019-03-27

0001449349

RDGL:SeriesAConvertiblePreferredStockMember

2015-06-30

0001449349

RDGL:SeriesAConvertiblePreferredStockMember

2016-03-30

0001449349

RDGL:SeriesAConvertiblePreferredStockMember

2016-03-31

0001449349

RDGL:SeriesAConvertiblePreferredStockMember

2015-06-01

2015-06-30

0001449349

RDGL:SeriesBConvertiblePreferredStockMember

2018-10-31

0001449349

RDGL:SeriesBConvertiblePreferredStockMember

2018-10-01

2018-10-31

0001449349

RDGL:SeriesCConvertiblePreferredStockMember

2019-03-31

0001449349

RDGL:SeriesCConvertiblePreferredStockMember

2019-03-01

2019-03-31

0001449349

us-gaap:CommonStockMember

2022-03-01

2022-03-31

0001449349

us-gaap:WarrantMember

2022-03-01

2022-03-31

0001449349

2022-05-31

2022-06-30

0001449349

srt:MinimumMember

2021-12-31

0001449349

srt:MaximumMember

2021-12-31

0001449349

2021-01-01

2021-12-31

0001449349

srt:MinimumMember

2022-12-31

0001449349

srt:MaximumMember

2022-12-31

0001449349

srt:MinimumMember

2023-06-30

0001449349

srt:MaximumMember

2023-06-30

0001449349

us-gaap:StockOptionMember

2023-01-01

2023-06-30

0001449349

us-gaap:StockOptionMember

2022-01-01

2022-06-30

0001449349

us-gaap:RestrictedStockUnitsRSUMember

srt:ChiefExecutiveOfficerMember

2022-02-02

2022-02-03

0001449349

us-gaap:RestrictedStockUnitsRSUMember

srt:ChiefExecutiveOfficerMember

2022-05-02

2022-05-03

0001449349

RDGL:ConsultantMember

us-gaap:RestrictedStockUnitsRSUMember

2022-05-31

2022-06-01

0001449349

us-gaap:RestrictedStockUnitsRSUMember

2023-05-01

2023-05-01

0001449349

srt:ScenarioForecastMember

us-gaap:RestrictedStockUnitsRSUMember

2023-12-31

2023-12-31

0001449349

srt:ScenarioForecastMember

us-gaap:RestrictedStockUnitsRSUMember

2024-12-31

2024-12-31

0001449349

srt:ScenarioForecastMember

us-gaap:RestrictedStockUnitsRSUMember

2025-12-31

2025-12-31

0001449349

us-gaap:WarrantMember

2021-12-31

0001449349

us-gaap:WarrantMember

srt:MinimumMember

2021-12-31

0001449349

us-gaap:WarrantMember

srt:MaximumMember

2021-12-31

0001449349

us-gaap:WarrantMember

2022-01-01

2022-12-31

0001449349

us-gaap:WarrantMember

srt:MinimumMember

2022-01-01

2022-12-31

0001449349

us-gaap:WarrantMember

srt:MaximumMember

2022-01-01

2022-12-31

0001449349

us-gaap:WarrantMember

2022-12-31

0001449349

us-gaap:WarrantMember

srt:MinimumMember

2022-12-31

0001449349

us-gaap:WarrantMember

srt:MaximumMember

2022-12-31

0001449349

us-gaap:WarrantMember

2023-01-01

2023-06-30

0001449349

us-gaap:WarrantMember

2023-06-30

0001449349

us-gaap:WarrantMember

srt:MinimumMember

2023-06-30

0001449349

us-gaap:WarrantMember

srt:MaximumMember

2023-06-30

0001449349

srt:MinimumMember

2022-01-01

2022-12-31

0001449349

srt:MaximumMember

2022-01-01

2022-12-31

0001449349

RDGL:RestrictedStockUnitsMember

2021-12-31

0001449349

RDGL:RestrictedStockUnitsMember

2022-01-01

2022-12-31

0001449349

RDGL:RestrictedStockUnitsMember

2022-12-31

0001449349

RDGL:RestrictedStockUnitsMember

2023-01-01

2023-06-30

0001449349

RDGL:RestrictedStockUnitsMember

2023-06-30

0001449349

RDGL:EmploymentAgreementMember

RDGL:DrMichaelKKorenkoMember

2019-06-03

2019-06-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

Form

10-Q

(Mark

One)

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR

THE QUARTERLY PERIOD ENDED: June 30, 2023

OR

☐

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR

THE TRANSITION PERIOD FROM __________ TO __________

COMMISSION

FILE NUMBER 000-53497

VIVOS

INC

(Exact

name of registrant as specified in its charter)

| Delaware |

|

80-0138937 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

719

Jadwin Avenue,

Richland,

WA 99352

(Address

of principal executive offices, Zip Code)

(509)

222-9268

(Registrant’s

telephone number, including area code)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”,

and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| |

Large

accelerated filer ☐ |

Accelerated

filer ☐ |

|

| |

|

|

|

| |

Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

|

| |

|

|

|

| |

|

Emerging

growth company ☐ |

|

If

an emerging growth company, indicate by check mark if the company has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Securities

registered pursuant to Section 12(b) of the Act: None

| Title

of Each Class |

|

Trading

Symbol |

|

Name

of Each Exchange on which registered |

| |

|

|

|

|

As

of August 4, 2023, there were 370,541,528 shares of the registrant’s common stock outstanding, 2,071,007 shares of the registrant’s

Series A Convertible Preferred Stock outstanding, 200,363 of the registrant’s Series B Convertible Preferred Stock outstanding

and 385,302 of the registrant’s Series C Convertible Preferred Stock outstanding.

TABLE

OF CONTENTS

PART

I – FINANCIAL INFORMATION

VIVOS

INC

CONDENSED

BALANCE SHEETS

JUNE

30, 2023 (UNAUDITED) AND DECEMBER 31, 2022

| | |

JUNE 30, | | |

DECEMBER 31, | |

| | |

2023 | | |

2022 | |

| | |

(UNAUDITED) | | |

| |

| ASSETS | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash | |

$ | 1,748,767 | | |

$ | 1,706,065 | |

| Accounts receivable | |

| 6,000 | | |

| 11,000 | |

| Prepaid expenses | |

| 34,883 | | |

| 25,671 | |

| | |

| | | |

| | |

| Total Current Assets | |

| 1,789,650 | | |

| 1,742,736 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 1,789,650 | | |

$ | 1,742,736 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| LIABILITIES | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 112,810 | | |

$ | 81,692 | |

| | |

| | | |

| | |

| Total Current Liabilities | |

| 112,810 | | |

| 81,692 | |

| | |

| | | |

| | |

| Total Liabilities | |

| 112,810 | | |

| 81,692 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| - | | |

| - | |

| | |

| | | |

| | |

| STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Preferred stock, par value, $0.001, 20,000,000 shares authorized, Series A Convertible Preferred,

5,000,000 shares authorized, 2,071,007 shares issued and outstanding, respectively | |

| 2,071 | | |

| 2,071 | |

| Additional paid in capital - Series A Convertible preferred stock | |

| 8,842,458 | | |

| 8,842,458 | |

| Series B Convertible Preferred, 5,000,000 shares authorized, 200,363 shares issued and

outstanding, respectively | |

| 200 | | |

| 200 | |

| Additional paid in capital - Series B Convertible preferred stock | |

| 290,956 | | |

| 290,956 | |

| Series C Convertible Preferred, 5,000,000 shares authorized, 385,302 shares issued and

outstanding, respectively | |

| 385 | | |

| 385 | |

| Preferred

stock value | |

| 385 | | |

| 385 | |

| Additional paid in capital - Series C Convertible preferred stock | |

| 500,507 | | |

| 500,507 | |

| Additional paid in capital - Convertible preferred stock | |

| 500,507 | | |

| 500,507 | |

| Common stock, par value, $0.001, 950,000,000 shares authorized, 370,541,528 and 362,541,528

issued and outstanding, respectively | |

| 370,541 | | |

| 362,541 | |

| Additional paid in capital - common stock | |

| 72,376,594 | | |

| 71,217,954 | |

| Accumulated deficit | |

| (80,706,872 | ) | |

| (79,556,028 | ) |

| | |

| | | |

| | |

| Total Stockholders’ Equity | |

| 1,676,840 | | |

| 1,661,044 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 1,789,650 | | |

$ | 1,742,736 | |

VIVOS

INC

CONDENSED

STATEMENTS OF OPERATIONS (UNAUDITED)

FOR

THE SIX AND THREE MONTHS ENDED JUNE 30, 2023 AND 2022

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

SIX MONTHS ENDED | | |

THREE MONTHS ENDED | |

| | |

JUNE 30, | | |

JUNE 30, | | |

JUNE 30, | | |

JUNE 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues, net | |

$ | 12,500 | | |

$ | 23,500 | | |

$ | 6,500 | | |

$ | 10,500 | |

| Cost of Goods Sold | |

| (16,536 | ) | |

| (5,018 | ) | |

| (9,000 | ) | |

| (2,018 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Gross (loss) profit | |

| (4,036 | ) | |

| 18,482 | | |

| (2,500 | ) | |

| 8,482 | |

| | |

| | | |

| | | |

| | | |

| | |

| OPERATING EXPENSES | |

| | | |

| | | |

| | | |

| | |

| Professional fees, including stock-based compensation | |

| 692,963 | | |

| 1,098,507 | | |

| 608,747 | | |

| 521,470 | |

| Payroll expenses | |

| 144,521 | | |

| 140,656 | | |

| 72,013 | | |

| 69,869 | |

| Research and development | |

| 219,728 | | |

| 241,301 | | |

| 173,353 | | |

| 169,732 | |

| General and administrative expenses | |

| 101,475 | | |

| 73,049 | | |

| 57,792 | | |

| 34,949 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Operating Expenses | |

| 1,158,687 | | |

| 1,553,513 | | |

| 911,905 | | |

| 796,020 | |

| | |

| | | |

| | | |

| | | |

| | |

| OPERATING LOSS | |

| (1,162,723 | ) | |

| (1,535,031 | ) | |

| (914,405 | ) | |

| (787,538 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| NON-OPERATING INCOME (EXPENSE) | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 11,879 | | |

| - | | |

| 11,879 | | |

| - | |

| Gain on debt extinguishment | |

| - | | |

| 47,588 | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Non-Operating Income (Expenses) | |

| 11,879 | | |

| 47,588 | | |

| 11,879 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS | |

$ | (1,150,844 | ) | |

$ | (1,487,443 | ) | |

$ | (902,526 | ) | |

$ | (787,538 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share - basic and diluted | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding | |

| 365,370,257 | | |

| 343,761,071 | | |

| 368,167,902 | | |

| 343,906,505 | |

VIVOS

INC

CONDENSED

STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY (UNAUDITED)

FOR

THE SIX MONTHS ENDED JUNE 30, 2023 AND 2022

| | |

Shares | | |

Amount | | |

Series A Preferred | | |

Shares | | |

Amount | | |

Series B Preferred | | |

Shares | | |

Amount | | |

Series C Preferred | | |

Shares | | |

Amount | | |

Common | | |

Deficit | | |

Total | |

| | |

Series A Preferred | | |

Additional

Paid-In

Capital

- | | |

Series B Preferred | | |

Additional

Paid-In

Capital

- | | |

Series C Preferred | | |

Additional

Paid-In

Capital

- | | |

Common Stock | | |

Additional

Paid-In

Capital

- | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Series A Preferred | | |

Shares | | |

Amount | | |

Series B Preferred | | |

Shares | | |

Amount | | |

Series C Preferred | | |

Shares | | |

Amount | | |

Common | | |

Deficit | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance - December 31, 2021 | |

| 2,071,007 | | |

$ | 2,071 | | |

$ | 8,842,458 | | |

| 200,363 | | |

$ | 200 | | |

$ | 290,956 | | |

| 385,302 | | |

$ | 385 | | |

$ | 500,507 | | |

| 343,530,678 | | |

$ | 343,531 | | |

$ | 68,573,142 | | |

$ | (77,085,867 | ) | |

$ | 1,467,383 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock issued for: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Services | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 76,250 | | |

| 76 | | |

| 4,804 | | |

| - | | |

| 4,880 | |

| Warrant exercises | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 299,577 | | |

| 300 | | |

| (300 | ) | |

| - | | |

| - | |

| RSUs granted to consultants that have vested | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 450,000 | | |

| - | | |

| 450,000 | |

| Net loss for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (699,905 | ) | |

| (699,905 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance - March 31, 2022 | |

| 2,071,007 | | |

| 2,071 | | |

| 8,842,458 | | |

| 200,363 | | |

| 200 | | |

| 290,956 | | |

| 385,302 | | |

| 385 | | |

| 500,507 | | |

| 343,906,505 | | |

| 343,907 | | |

| 69,027,646 | | |

| (77,785,772 | ) | |

| 1,222,358 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| RSUs granted to consultants that have vested | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 458,200 | | |

| - | | |

| 458,200 | |

| Net loss for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (787,538 | ) | |

| (787,538 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance - June 30, 2022 | |

| 2,071,007 | | |

$ | 2,071 | | |

$ | 8,842,458 | | |

| 200,363 | | |

$ | 200 | | |

$ | 290,956 | | |

| 385,302 | | |

$ | 385 | | |

$ | 500,507 | | |

| 343,906,505 | | |

$ | 343,907 | | |

$ | 69,485,846 | | |

$ | (78,573,310 | ) | |

$ | 893,020 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance - December 31, 2022 | |

| 2,071,007 | | |

$ | 2,071 | | |

$ | 8,842,458 | | |

| 200,363 | | |

$ | 200 | | |

$ | 290,956 | | |

| 385,302 | | |

$ | 385 | | |

$ | 500,507 | | |

| 362,541,528 | | |

$ | 362,541 | | |

$ | 71,217,954 | | |

$ | (79,556,028 | ) | |

$ | 1,661,044 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (248,318 | ) | |

| (248,318 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance - March 31, 2023 | |

| 2,071,007 | | |

| 2,071 | | |

| 8,842,458 | | |

| 200,363 | | |

| 200 | | |

| 290,956 | | |

| 385,302 | | |

| 385 | | |

| 500,507 | | |

| 362,541,528 | | |

| 362,541 | | |

| 71,217,954 | | |

| (79,804,346 | ) | |

| 1,412,726 | |

| Beginning balance, value | |

| 2,071,007 | | |

| 2,071 | | |

| 8,842,458 | | |

| 200,363 | | |

| 200 | | |

| 290,956 | | |

| 385,302 | | |

| 385 | | |

| 500,507 | | |

| 362,541,528 | | |

| 362,541 | | |

| 71,217,954 | | |

| (79,804,346 | ) | |

| 1,412,726 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock issued for: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 8,000,000 | | |

| 8,000 | | |

| 632,000 | | |

| - | | |

| 640,000 | |

| Warrants purchased for cash | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 10,665 | | |

| - | | |

| 10,665 | |

| RSUs granted to consultants that have vested | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 515,975 | | |

| - | | |

| 515,975 | |

| Net loss for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (902,526 | ) | |

| (902,526 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance - June 30, 2023 | |

| 2,071,007 | | |

$ | 2,071 | | |

$ | 8,842,458 | | |

| 200,363 | | |

$ | 200 | | |

$ | 290,956 | | |

| 385,302 | | |

$ | 385 | | |

$ | 500,507 | | |

| 370,541,528 | | |

$ | 370,541 | | |

$ | 72,376,594 | | |

$ | (80,706,872 | ) | |

$ | 1,676,840 | |

| Ending balance, value | |

| 2,071,007 | | |

$ | 2,071 | | |

$ | 8,842,458 | | |

| 200,363 | | |

$ | 200 | | |

$ | 290,956 | | |

| 385,302 | | |

$ | 385 | | |

$ | 500,507 | | |

| 370,541,528 | | |

$ | 370,541 | | |

$ | 72,376,594 | | |

$ | (80,706,872 | ) | |

$ | 1,676,840 | |

The

accompanying notes are an integral part of these unaudited condensed financial statements.

VIVOS

INC

CONDENSED

STATEMENTS OF CASH FLOWS (UNAUDITED)

FOR

THE SIX MONTHS ENDED JUNE 30, 2023 AND 2022

| | |

2023 | | |

2022 | |

| CASH FLOW FROM OPERATING ACTIVITIES | |

| | | |

| | |

| Net loss | |

$ | (1,150,844 | ) | |

$ | (1,487,443 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities | |

| | | |

| | |

| Common stock, stock options and warrants for services | |

| - | | |

| 4,880 | |

| RSUs issued for services | |

| 515,975 | | |

| 908,200 | |

| (Gain) on conversion of debt | |

| - | | |

| (47,588 | ) |

| Changes in assets and liabilities | |

| | | |

| | |

| Accounts receivable | |

| 5,000 | | |

| (6,500 | ) |

| Prepaid expenses and other assets | |

| (9,212 | ) | |

| (22,732 | ) |

| Accounts payable and accrued expenses | |

| 31,118 | | |

| 95,766 | |

| Total adjustments | |

| 542,881 | | |

| 932,026 | |

| | |

| | | |

| | |

| Net cash used in operating activities | |

| (607,963 | ) | |

| (555,417 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| | | |

| | |

| Proceeds from common stock and warrants | |

| 650,665 | | |

| - | |

| Net cash provided by financing activities | |

| 650,665 | | |

| - | |

| | |

| | | |

| | |

| NET DECREASE IN CASH | |

| 42,702 | | |

| (555,417 | ) |

| | |

| | | |

| | |

| CASH - BEGINNING OF PERIOD | |

| 1,706,065 | | |

| 1,606,123 | |

| | |

| | | |

| | |

| CASH - END OF PERIOD | |

$ | 1,748,767 | | |

$ | 1,050,706 | |

| | |

| | | |

| | |

| CASH PAID DURING THE PERIOD FOR: | |

| | | |

| | |

| Interest expense | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| Income taxes | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| SUPPLEMENTAL INFORMATION - NON-CASH INVESTING AND FINANCING ACTIVITIES: | |

| | | |

| | |

| | |

| | | |

| | |

| Common stock issued in cashless exercise of warrants | |

$ | - | | |

$ | 300 | |

Vivos

Inc.

Notes

to Condensed Financial Statements

(Unaudited)

NOTE

1: BASIS OF PRESENTATION AND SIGNIFICANT ACCOUNTING POLICIES

The

accompanying condensed financial statements of Vivos Inc. (the “Company”) have been prepared without audit, pursuant

to the rules and regulations of the Securities and Exchange Commission. Certain information and disclosures required by accounting principles

generally accepted in the United States have been condensed or omitted pursuant to such rules and regulations. These condensed financial

statements reflect all adjustments that, in the opinion of management, are necessary to present fairly the results of operations of the

Company for the period presented. The results of operations for the six and three months ended June 30, 2023, are not necessarily indicative

of the results that may be expected for any future period or the fiscal year ending December 31, 2023 and should be read in conjunction

with the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, filed with the Securities and Exchange Commission

on March 1, 2023.

Business

Overview

The

Company was incorporated under the laws of Delaware on December 23, 1994 as Savage Mountain Sports Corporation (“SMSC”).

On September 6, 2006, the Company changed its name to Advanced Medical Isotope Corporation, and on December 28, 2017, the Company began

operating as Vivos Inc. The Company has authorized capital of 950,000,000 shares of common stock, $0.001 par value per share, and 20,000,000

shares of preferred stock, $0.001 par value per share.

Our

principal place of business is located at 719 Jadwin Avenue, Richland, WA 99352. Our telephone number is (509) 736-4000. Our corporate

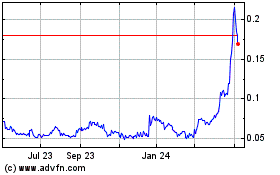

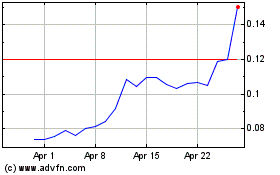

website address is http://www.radiogel.com. Our common stock is currently quoted on the OTC Pink Marketplace under the symbol “RDGL.”

The

Company is a radiation oncology medical device company engaged in the development of its yttrium-90 based brachytherapy device, RadioGel™,

for the treatment of non-resectable tumors. A prominent team of radiochemists, scientists and engineers, collaborating with strategic

partners, including national laboratories, universities and private corporations, lead the Company’s development efforts. The Company’s

overall vision is to globally empower physicians, medical researchers and patients by providing them with new isotope technologies that

offer safe and effective treatments for cancer.

In

January 2018, the Center for Veterinary Medicine Product Classification Group ruled that RadioGel ™should be classified

as a device for animal therapy of feline sarcomas and canine soft tissue sarcomas. Additionally, after a legal review, the Company believes

that the device classification obtained from the Food and Drug Administration (“FDA”) Center for Veterinary Medicine

is not limited to canine and feline sarcomas, but rather may be extended to a much broader population of veterinary cancers, including

all or most solid tumors in animals. We expect the result of such classification and label review will be that no additional regulatory

approvals are necessary for the use of IsoPet® for the treatment of solid tumors in animals. The FDA does not have premarket

authority over devices with a veterinary classification, and the manufacturers are responsible for assuring that the product is safe,

effective, properly labeled, and otherwise in compliance with all applicable laws and regulations.

Based

on the FDA’s recommendation, RadioGel™ will be marketed as “IsoPet®” for use by veterinarians

to avoid any confusion between animal and human therapy. The Company already has trademark protection for the “IsoPet®”

name. IsoPet® and RadioGel™ are used synonymously throughout this document. The only distinction between

IsoPet® and RadioGel™ is the FDA’s recommendation that we use “IsoPet®”

for veterinarian usage, and reserve “RadioGel™” for human therapy. Based on these developments, the Company

has shifted its primary focus to the development and marketing of Isopet® for animal therapy, through the Company’s

IsoPet® Solutions division.

IsoPet

Solutions

The

Company’s IsoPet Solutions division was established in May 2016 to focus on the veterinary oncology market, namely engagement of

university veterinarian hospital to develop the detailed therapy procedures to treat animal tumors and ultimately use of the technology

in private clinics. The Company has worked with three different university veterinarian hospitals on IsoPet® testing and

therapy. Washington State University treated five cats for feline sarcoma and served to develop the procedures which are incorporated

in our label. They concluded that the product was safe and effective in killing cancer cells. Colorado State University demonstrated

the CT and PET-CT imaging of IsoPet®. A contract was signed with University of Missouri to treat canine sarcomas and equine

sarcoids starting in November 2017.

The

dogs were treated for canine soft tissue sarcoma. Response evaluation criteria in solid tumors (“RECIST”) is a set

of published rules that define when tumors in cancer patients improve (respond), stay the same (stabilize), or worsen (progress) during

treatment. The criteria were published by an international collaboration including the European Organisation for Research and Treatment

of Cancer (“EORTC”), National Cancer Institute of the United States, and the National Cancer Institute of Canada Clinical

Trials Group.

The

testing at the University of Missouri met its objective to demonstrate the safety of IsoPet®. Using its advanced CT and

PET equipment it was able to demonstrate that the dose calculations were accurate and that the injections perfused into the cell interstices

and did not stay concentrated in a bolus. This results in a more homogeneous dose distribution. There was insignificant spread of Y-90

outside the points of injection demonstrating the effectiveness of the particles and the gel to localize the radiation with no spreading

to the blood or other organs nor to urine or fecal material. This confirms that IsoPet® is safe for same day therapy.

The

effectiveness of IsoPet® for life extension was not the prime objective, but it resulted in valuable insights. Of the

cases one is still cancer-free but the others eventually recurred since there was not a strong focus on treating the margins. The University

of Missouri has agreed to become a regional center to administer IsoPet® therapy and will incorporate the improvements

suggested by the testing program.

The

Company anticipates that future profits, if any, will be derived from direct sales of RadioGel™ (under the name IsoPet®)

and related services, and from licensing to private medical and veterinary clinics in the U.S. and internationally. The Company intends

to report the results from the IsoPet® Solutions division as a separate operating segment in accordance with GAAP.

Commencing

in July 2019, the Company recognized its first commercial sale of IsoPet®. A veterinarian from Alaska brought his cat

with a re-occurrent spindle cell sarcoma tumor on his face. The cat had previously received external beam therapy, but now the tumor

was growing rapidly. He was given a high dose of 400Gy with heavy therapy at the margins. This sale met the revenue recognition requirements

under ASC 606 as the performance obligation was satisfied. The Company completed sales for an additional four animals that received the

IsoPet® during 2019.

Our

plan is to incorporate the data assembled from our work with Isopet® in animal therapy to support the Company’s

efforts in the development of our RadioGel™ device candidate, including obtaining approval from the FDA to market

and sell RadioGel™ as a Class II medical device. RadioGel™ is an injectable particle-gel for brachytherapy

radiation treatment of cancerous tumors in people and animals. RadioGel™ is comprised of a hydrogel, or a substance

that is liquid at room temperature and then gels when reaching body temperature after injection into a tumor. In the gel are small, less

than two microns, yttrium-90 phosphate particles (“Y-90”). Once injected, these inert particles are locked in place

inside the tumor by the gel, delivering a very high local radiation dose. The radiation is beta, consisting of high-speed electrons.

These electrons only travel a short distance so the device can deliver high radiation to the tumor with minimal dose to the surrounding

tissue. Optimally, patients can go home immediately following treatment without the risk of radiation exposure to family members. Since

Y-90 has a half-life of 2.7 days, the radioactivity drops to 5% of its original value after ten days.

The

Company modified its Indication for Use from skin cancel to cancerous tissue or solid tumors pathologically associated with locoregional

papillary thyroid carcinoma and recurrent papillary thyroid carcinoma having discernable tumors associated with metastatic lymph nodes

or extranodal disease in patients who are not surgical candidates or who have declined surgery, or patients who require post-surgical

remnant ablation (for example, after prior incomplete radioiodine therapy). Papillary thyroid carcinoma belongs to the general class

of head and neck tumors for which tumors are accessible by intraoperative direct needle injection. The Company’s Medical Advisory

Board felt that demonstrating efficacy in clinical trials was much easier with this new indication.

Intellectual

Property

Our

original license with Battelle National Laboratory is reached its end of life in 2022. During the past several years, in anticipation

of this we have expanded our proprietary knowledge, our trademark and patent protection.

Our

RadioGel trademark protection is in 17 countries. We have expanded our trademark protection from RadioGel to now include IsoPet. We obtained

the International Certificate of Registration for ISOPET, which is the first step to file in several countries.

The

Company received the Patent Cooperation Treaty (“PCT”) International Search Report on our patent application (No.1811.191).

Seven of our claims were immediately ruled as having novelty, inventive step and industrial applicability. This gives us the basis to

extend for many years the patent protection for our proprietary Yttrium-90 phosphate particles utilized in Isopet® and

Radiogel™.

Our

patent team filed our particle patent in more than ten patent offices that collectively cover 63 countries throughout the world. We filed

a continuation-in-part applications number 1774054 in the USA to expand the claims on our particle patent. The US Patent office recently

gave us the Notice of Allowance for our patent to produce our yttrium phosphate microparticles, US Patent Application Serial No: 16-459,466.

We also filed an amendment to correct the wording on our claims at make them consistent with the USE claims. Ref: 4207-0005; European

Patent Application NO. 20 834 229.5; VIVOS INC; Our Ref: FS/53791.

We

filed a hydrogel utility patent in the USA (16309:17/943,311) and internationally (16389:PCT/US22/4374) based on the last eighteen months

of development work to optimize our hydrogel component. These include reducing the polymer production time and increasing the output

by a factor of three. We have also further reduced the level of trace contaminants to be well below the FDA guidelines.

We

filed a provisional patent (Serial Number 63436562) to protect our innovative improvements in our shipping container, our vial shield,

our syringe shield, and our Peltier chiller. Our objectives were to reduce shipping costs, decrease radiation exposure, and enhance sterility.

These devices will be preferentially used at Mayo Clinics for human clinical studies at and our IsoPet regional treatment centers.

We

anticipate that Precison Radionuclide Therapy will become increasingly important in the future and expand to other isotope and other

indications for use. Therefore, we filed an alternate particle utility patent (Serial number 18/152,137). Vivos Inc will focus its near-term

effort on the Yttrium-90 therapy, which we believe is the best beta emitter; however, we leveraged our hydrogel utility patent to incorporate

other promising isotopes and compounds for a range of future applications. This includes gamma and alpha particle emitters.

Going

Concern

The

accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets and satisfaction

of liabilities in the normal course of business. As shown in the accompanying financial statements, the Company has suffered recurring

losses and used significant cash in support of its operating activities and the Company’s cash position is not sufficient to support

the Company’s operations. Research and development of the Company’s brachytherapy product line has been funded with proceeds

from the sale of equity and debt securities as well as a series of grants. The Company requires funding of approximately $2.5 million

annually to maintain current operating activities.

The

Company completed its reverse stock split which was approved by FINRA and went effective on June 28, 2019.

The

Company’s stock offering under Regulation A+ was qualified by the Securities and Exchange Commission (“SEC”) on June

3, 2020. A second Regulation A+ was qualified by the SEC on September 15, 2021 to raise capital for 50,000,000 shares at a price of $0.10

for a maximum of $5,000,000. The Company amended this and was able to raise $1,200,000 in July 2022 at $0.08 per share (15,000,000 shares)

and sold 20,000,000 warrants for $20,000. An amended Regulation A+ was filed in October 2022 to raise the remaining $3,800,000 of the

$5,000,000. In April 2023, $640,000 was raised in the issuance of 8,000,000 common shares, 2,665,000 Series A warrants and 8,000,000

Series B warrants along with $10,665 in the sale of the warrants.

The

Company’s Regulation A+’s raised approximately $5,200,000 from the sale of shares and is using the proceeds generated as

follows:

For

the animal therapy market:

| |

● |

Fund

the effort to communicate the benefits of IsoPet® to the veterinary community and the pet parents. |

| |

● |

Conduct

additional clinical studies to generate more data for the veterinary community |

| |

● |

Subsidize

some IsoPet® therapies, if necessary, to ensure that all viable candidates are treated. |

| |

● |

Assist

new regional clinics with their license and certification training. |

For

the human market:

| |

● |

Enhance

the pedigree of the Quality Management System. |

| |

● |

Complete

the previously defined pre-clinical testing and additional testing on an animal model closely aligned with our revised indication

for use. Report the results to the FDA in a pre-submission meeting. |

| |

● |

Use

the feedback from that meeting to write the IDE (Investigational Device Exemption), which is required to initiate clinical trials. |

Research

and development of the Company’s brachytherapy product line has been funded with proceeds from the sale of equity and debt securities.

The Company may require additional funding of approximately $2.5

million annually to maintain current operating

activities. Over the next 12 to 48 months, the Company believes

it will cost approximately $9 million to: (1) fund the FDA approval process to conduct human clinical trials, (2) conduct Phase I, pilot,

clinical trials, (3) activate several regional clinics to administer IsoPet® across the county, (4) create an independent

production center within the current production site to create a template for future international manufacturing, and (5) initiate regulatory

approval processes outside of the United States.

The proceeds to be raised from the recent qualified Regulation A+ will be used to continue to fund this development.

The

continued deployment of the brachytherapy products and a worldwide regulatory approval effort will require additional resources and personnel.

The principal variables in the timing and amount of spending for the brachytherapy products in the next 12 to 24 months will be the FDA’s

classification of the Company’s brachytherapy products as Class II or Class III devices (or otherwise) and any requirements for

additional studies which may possibly include clinical studies. Thereafter, the principal variables in the amount of the Company’s

spending and its financing requirements would be the timing of any approvals and the nature of the Company’s arrangements with

third parties for manufacturing, sales, distribution and licensing of those products and the products’ success in the U.S. and

elsewhere. The Company intends to fund its activities through strategic transactions such as licensing and partnership agreements or

from proceeds to be raised from the recent qualified Regulation A+.

Following

receipt of required regulatory approvals and financing, in the U.S., the Company intends to outsource material aspects of manufacturing,

distribution, sales and marketing. Outside of the U.S., the Company intends to pursue licensing arrangements and/or partnerships to facilitate

its global commercialization strategy.

In

the longer-term, subject to the Company receiving adequate funding, regulatory approval for RadioGel™ and other brachytherapy

products, and thereafter being able to successfully commercialize its brachytherapy products, the Company intends to consider resuming

research efforts with respect to other products and technologies intended to help improve the diagnosis and treatment of cancer and other

illnesses.

Based

on the Company’s financial history since inception, the Company’s independent registered public accounting firm has expressed

substantial doubt as to the Company’s ability to continue as a going concern. The Company has limited revenue, nominal cash, and

has accumulated deficits since inception. If the Company cannot obtain sufficient additional capital, the Company will be required to

delay the implementation of its business strategy and may not be able to continue operations.

The

Company has been impacted from the effects of COVID-19. The Company’s headquarters are in Northeast Washington however there focus

of the animal therapy market has been the Northwestern sector of the United States. The Company continues their marketing to the animal

therapy market and attempt to increase the exposure to their product and generate revenue accordingly.

As

of June 30, 2023, the Company has $1,748,767 cash on hand. There are currently commitments to vendors for products and services purchased.

To continue the development of the Company’s products, the current level of cash may not be enough to cover the fixed and variable

obligations of the Company.

There

is no guarantee that the Company will be able to raise additional funds or to do so at an advantageous price.

The

financial statements do not include any adjustments relating to the recoverability and classification of liabilities that might be necessary

should the Company be unable to continue as a going concern. The Company’s continuation as a going concern is dependent upon its

ability to generate sufficient cash flow to meet its obligations on a timely basis and ultimately to attain profitability. The Company

plans to seek additional funding to maintain its operations through debt and equity financing and to improve operating performance through

a focus on strategic products and increased efficiencies in business processes and improvements to the cost structure. There is no assurance

that the Company will be successful in its efforts to raise additional working capital or achieve profitable operations. The financial

statements do not include any adjustments that might result from the outcome of this uncertainty.

Use

of Estimates

The

preparation of financial statements in accordance with generally accepted accounting principles requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at

the date of financial statements and the reported amounts of revenues and expenses during the reporting period. Estimates the Company

considers include criteria for stock-based compensation expense, and valuation allowances on deferred tax assets. Actual results could

differ from those estimates.

Financial

Statement Reclassification

Certain

account balances from prior periods have been reclassified in these financial statements so as to conform to current period classifications.

Cash

Equivalents

For

the purposes of the statement of cash flows, the Company considers all highly liquid debt instruments purchased with an original maturity

of three months or less to be cash equivalents.

The

Company occasionally maintains cash balances in excess of the FDIC insured limit. The Company does not consider this risk to be material.

Fair

Value of Financial Instruments

Fair

value of financial instruments requires disclosure of the fair value information, whether or not recognized in the balance sheet, where

it is practicable to estimate that value. As of June 30, 2023 and December 31, 2022, the balances reported for cash, prepaid expenses,

accounts receivable, accounts payable, and accrued expenses, approximate the fair value because of their short maturities.

Fair

value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between

market participants at the measurement date. Accounting Standards Codification (“ASC”) Topic 820 established a three-tier

fair value hierarchy which prioritizes the inputs used in measuring fair value. The hierarchy gives the highest priority to unadjusted

quoted prices in active markets for identical assets or liabilities (level 1 measurements) and the lowest priority to unobservable inputs

(level 3 measurements). These tiers include:

Level

1, defined as observable inputs such as quoted prices for identical instruments in active markets;

Level

2, defined as inputs other than quoted prices in active markets that are either directly or indirectly observable such as quoted prices

for similar instruments in active markets or quoted prices for identical or similar instruments in markets that are not active; and

Level

3, defined as unobservable inputs in which little or no market data exists, therefore requiring an entity to develop its own assumptions,

such as valuations derived from valuation techniques in which one or more significant inputs or significant value drivers are unobservable.

The

Company measures certain financial instruments including options and warrants issued during the period at fair value on a recurring basis.

Patents

and Intellectual Property

While

patents are being developed or pending, they are not being amortized. Management has determined that the economic life of the patents

to be ten years and amortization, over such 10-year period and on a straight-line basis will begin once the patents have been issued

and the Company begins utilization of the patents through production and sales, resulting in revenues.

The

Company evaluates the recoverability of intangible assets, including patents and intellectual property on a continual basis. Several

factors are used to evaluate intangibles, including, but not limited to, management’s plans for future operations, recent operating

results and projected and expected undiscounted future cash flows.

There

have been no such capitalized costs in the six months ended June 30, 2023 and 2022, respectively. However, a patent was filed on July

1, 2019 (No. 1811.191) filed by Michael Korenko and David Swanberg and assigned to the Company based on the Company’s proprietary

particle manufacturing process. The timing of this filing was important given the Company’s plans to make IsoPet®

commercially available, which it did on or about July 9, 2019. This additional patent protection will strengthen the Company’s

competitive position. It is the Company’s intention to further extend this patent protection to several key countries within one

year, as permitted under international patent laws and treaties.

Revenue

Recognition

In

May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standard Update (“ASU”)

No. 2014-09, Revenue from Contracts with Customers (Topic 606). This standard provides a single set of guidelines for revenue recognition

to be used across all industries and requires additional disclosures. The updated guidance introduces a five-step model to achieve its

core principal of the entity recognizing revenue to depict the transfer of goods or services to customers at an amount that reflects

the consideration to which the entity expects to be entitled in exchange for those goods or services. The Company adopted the updated

guidance effective January 1, 2018 using the full retrospective method.

Under

ASC 606, in order to recognize revenue, the Company is required to identify an approved contract with commitments to preform respective

obligations, identify rights of each party in the transaction regarding goods to be transferred, identify the payment terms for the goods

transferred, verify that the contract has commercial substance and verify that collection of substantially all consideration is probable.

The adoption of ASC 606 did not have an impact on the Company’s operations or cash flows.

The

Company recognized revenue as they (i) identified the contracts with each customer; (ii) identified the performance obligation in each

contract; (iii) determined the transaction price in each contract; (iv) were able to allocate the transaction price to the performance

obligations in the contract; and (v) recognized revenue upon the satisfaction of the performance obligation. Upon the sales of the product

to complete the procedures on the animals, the Company recognized revenue as that was considered the performance obligation.

All

revenue recognized in the six months ended June 30, 2023 and 2022 relate to consulting income with respect to the IsoPet® therapies.

Loss

Per Share

The

Company accounts for its loss per common share by replacing primary and fully diluted earnings per share with basic and diluted earnings

per share. Basic loss per share is computed by dividing loss available to common stockholders (the numerator) by the weighted-average

number of common shares outstanding (the denominator) for the period, and does not include the impact of any potentially dilutive common

stock equivalents since the impact would be anti-dilutive. The computation of diluted earnings per share is similar to basic earnings

per share, except that the denominator is increased to include the number of additional common shares that would have been outstanding

if potentially dilutive common shares had been issued. For the given periods of loss, of the periods ended in the six months ended June

30, 2023 and 2022, the basic earnings per share equals the diluted earnings per share.

The

following represent common stock equivalents that could be dilutive in the future as of June 30, 2023 and December 31, 2022, which include

the following:

SCHEDULE

OF DILUTIVE EARNINGS PER SHARE

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Preferred stock | |

| 9,909,570 | | |

| 9,909,570 | |

| Restricted stock units | |

| 28,262,500 | | |

| 25,362,500 | |

| Common stock options | |

| 2,252,809 | | |

| 2,252,809 | |

| Common stock warrants | |

| 25,665,000 | | |

| 26,737,500 | |

| Total potential dilutive securities | |

| 66,089,879 | | |

| 64,762,379 | |

Research

and Development Costs

Research

and developments costs, including salaries, research materials, administrative expenses and contractor fees, are charged to operations

as incurred. The cost of equipment used in research and development activities which has alternative uses is capitalized as part of fixed

assets and not treated as an expense in the period acquired. Depreciation of capitalized equipment used to perform research and development

is classified as research and development expense in the year computed.

The

Company incurred $219,728 and $241,301 in research and development costs for the six months ended June 30, 2023 and 2022, respectively,

all of which were recorded in the Company’s operating expenses noted on the statements of operations for the periods then ended.

Advertising

and Marketing Costs

Advertising

and marketing costs are expensed as incurred except for the cost of tradeshows which are deferred until the tradeshow occurs. During

the six months ended June 30, 2023 and 2022, the Company incurred nominal advertising and marketing costs.

Contingencies

In

the ordinary course of business, the Company is involved in legal proceedings involving contractual and employment relationships, product

liability claims, patent rights, and a variety of other matters. The Company records contingent liabilities resulting from asserted and

unasserted claims against it, when it is probable that a liability has been incurred and the amount of the loss is reasonably estimable.

The Company discloses contingent liabilities when there is a reasonable possibility that the ultimate loss will exceed the recorded liability.

Estimated probable losses require analysis of multiple factors, in some cases including judgments about the potential actions of third-party

claimants and courts. Therefore, actual losses in any future period are inherently uncertain. The Company has entered into various agreements

that require them to pay certain fees to consultants and/or employees that have been fully accrued for as of June 30, 2023 and December

31, 2022.

Income

Taxes

To

address accounting for uncertainty in tax positions, the Company clarifies the accounting for income taxes by prescribing a minimum recognition

threshold that a tax position is required to meet before being recognized in the financial statements. The Company also provides guidance

on de-recognition, measurement, classification, interest, and penalties, accounting in interim periods, disclosure and transition.

The

Company files income tax returns in the U.S. federal jurisdiction. The Company did not have any tax expense for the six months ended

June 30, 2023 and 2022. The Company did not have any deferred tax liability or asset on its balance sheets on June 30, 2023 and December

31, 2022.

Interest

costs and penalties related to income taxes, if any, will be classified as interest expense and general and administrative costs, respectively,

in the Company’s financial statements. For the six months ended June 30, 2023 and 2022, the Company did not recognize any interest

or penalty expense related to income taxes. The Company believes that it is not reasonably possible for the amounts of unrecognized tax

benefits to significantly increase or decrease within the next twelve months.

Stock-Based

Compensation

The

Company recognizes compensation costs under FASB ASC Topic 718, Compensation – Stock Compensation and ASU 2018-07. Companies are

required to measure the compensation costs of share-based compensation arrangements based on the grant-date fair value and recognize

the costs in the financial statements over the period during which employees are required to provide services. Share based compensation

arrangements include stock options, restricted share plans, performance-based awards, share appreciation rights and employee share purchase

plans. As such, compensation cost is measured on the date of grant at their fair value. Such compensation amounts, if any, are amortized

over the respective vesting periods of the option grant.

Recent

Accounting Pronouncements

The

Company does not discuss recent pronouncements that are not anticipated to have an impact on or are unrelated to its financial condition,

results of operations, cash flows or disclosures.

NOTE

2: RELATED PARTY TRANSACTIONS

Preferred

and Common Shares Issued to Officers and Directors

In

March 2022, the Chief Executive Officer exercised 75,000 warrants in a cashless exercise into 22,266 shares of common stock, and was

issued 76,250 shares of common stock valued at $4,880 for services rendered.

NOTE

3: STOCKHOLDERS’ EQUITY

Common

Stock

The

Company has 950,000,000 shares of common stock authorized, with a par value of $0.001, and as of June 30, 2023 and December 31, 2022,

the Company has 370,541,528 and 362,541,528 shares issued and outstanding, respectively.

Preferred

Stock

As

of June 30, 2023 and December 31, 2022, the Company has 20,000,000 shares of Preferred stock authorized with a par value of $0.001. The

Company’s Board of Directors is authorized to provide for the issuance of shares of preferred stock in one or more series, fix

or alter the designations, preferences, rights, qualifications, limitations or restrictions of the shares of each series, including the

dividend rights, dividend rates, conversion rights, voting rights, term of redemption including sinking fund provisions, redemption price

or prices, liquidation preferences and the number of shares constituting any series or designations of such series without further vote

or action by the shareholders. The issuance of preferred stock may have the effect of delaying, deferring or preventing a change in control

of management without further action by the shareholders and may adversely affect the voting and other rights of the holders of common

stock. The issuance of preferred stock with voting and conversion rights may adversely affect the voting power of the holders of common

stock, including the loss of voting control to others.

On

October 8, 2018 the Company created out of the shares of Preferred Stock, par value $0.001 per share, of the Company, as authorized in

Article IV of the Company’s Certificate of Incorporation, a series of Preferred Stock of the Company, to be named “Series

B Convertible Preferred Stock,” consisting of Five Million (5,000,000) shares.

On

March 27, 2019 the Company created out of the shares of Preferred Stock, par value $0.001 per share, of the Company, as authorized in

Article IV of the Company’s Certificate of Incorporation, a series of Preferred Stock of the Company, to be named “Series

C Convertible Preferred Stock,” consisting of Five Million (5,000,000) shares.

Series

A Convertible Preferred Stock (“Series A Convertible Preferred”)

In

June 2015, the Series A Certificate of Designation was filed with the Delaware Secretary of State to designate 2.5 million shares of

our preferred stock as Series A Convertible Preferred. Effective March 31, 2016, the Company amended the Certificate of Designations,

Preferences and Rights of Series A Convertible Preferred of the Registrant, increasing the maximum number of shares of Series A Convertible

Preferred from 2,500,000 shares to 5,000,000 shares. The following summarizes the current rights and preferences of the Series A Convertible

Preferred:

Liquidation

Preference. The Series A Convertible Preferred has a liquidation preference of $5.00 per share.

Dividends.

Shares of Series A Convertible Preferred do not have any separate dividend rights.

Conversion.

Subject to certain limitations set forth in the Series A Certificate of Designation, each share of Series A Convertible Preferred is

convertible, at the option of the holder, into that number of shares of common stock (the “Series A Conversion Shares”)

equal to the liquidation preference thereof, divided by Conversion Price (as such term is defined in the Series A Certificate of Designation),

currently $4.00.

In

the event the Company completes an equity or equity-based public offering, registered with the SEC, resulting in gross proceeds to the

Company totaling at least $5.0 million, all issued and outstanding shares of Series A Convertible Preferred at that time will automatically

convert into Series A Conversion Shares.

Redemption.

Subject to certain conditions set forth in the Series A Certificate of Designation, in the event of a Change of Control (defined in the

Series A Certificate of Designation as the time at which as a third party not affiliated with the Company or any holders of the Series

A Convertible Preferred shall have acquired, in one or a series of related transactions, equity securities of the Company representing

more than fifty percent 50% of the outstanding voting securities of the Company), the Company, at its option, will have the right to

redeem all or a portion of the outstanding Series A Convertible Preferred in cash at a price per share of Series A Convertible Preferred