- First Quarter Revenue of $1.05 billion, up 4%

reported and 7% organic year-over-year

- First Quarter GAAP Loss from Operations of $44 million, an

84% improvement year-over-year

- First Quarter Non-GAAP Income from Operations of $160

million; raised full year guidance to $585 to $635 million

Twilio (NYSE: TWLO), the customer engagement platform that

drives real-time, personalized experiences for today’s leading

brands, reported financial results for its first quarter ended

March 31, 2024.

“We are operating with greater financial discipline, operational

rigor, and focus on innovation than ever before,” said Khozema

Shipchandler, CEO of Twilio. “Our solid first quarter results build

on the momentum that we’ve delivered over the last several

quarters, demonstrating continued progress on profitability and

significant free cash flow. Moving forward, we’ll continue to drive

further leverage, while also making focused investments that we

expect will re-accelerate growth over time.”

First Quarter 2024 Financial Highlights

- Total revenue of $1.05 billion for the first quarter of 2024,

up 4% year-over-year. Communications revenue of $972.0 million for

the first quarter of 2024, up 4% year-over-year. Segment revenue of

$75.0 million for the first quarter of 2024, up 2%

year-over-year.

- Total organic revenue growth of 7% year-over-year for the first

quarter of 2024. Communications organic revenue growth of 7%

year-over-year for the first quarter of 2024.

- GAAP loss from operations of $43.5 million for the first

quarter of 2024, compared with GAAP loss from operations of $264.1

million for the first quarter of 2023.

- Non-GAAP income from operations of $159.6 million for the first

quarter of 2024, compared with non-GAAP income from operations of

$103.8 million for the first quarter of 2023.

- GAAP net loss per share attributable to common stockholders,

basic and diluted, of $0.31 based on 181.0 million weighted average

shares outstanding in the first quarter of 2024, compared with GAAP

net loss per share attributable to common stockholders, basic and

diluted, of $1.84 based on 186.4 million weighted average shares

outstanding in the first quarter of 2023.

- Non-GAAP net income per share attributable to common

stockholders, diluted, of $0.80 based on 183.4 million non-GAAP

weighted average shares outstanding in the first quarter of 2024,

compared with non-GAAP net income per share attributable to common

stockholders, diluted, of $0.47 based on 188.7 million non-GAAP

weighted average shares outstanding in the first quarter of

2023.

- Net cash provided by operating activities of $190.1 million and

free cash flow of $177.3 million for the first quarter of 2024. Net

cash used in operating activities of $97.9 million and free cash

flow of $(114.5) million for the first quarter of 2023.

Key Metrics

- More than 313,000 Active Customer Accounts as of March 31,

2024, compared to more than 300,000 Active Customer Accounts as of

March 31, 2023.

- Dollar-Based Net Expansion Rate of 102% for the first quarter

of 2024 compared to Dollar-Based Net Expansion Rate of 106% for the

first quarter of 2023.

- 5,582 employees as of March 31, 2024.

Dollars in millions, except per share

amounts

Q1 2024

Results

Revenue

$1,047

Y/Y Revenue Growth

4%

Y/Y Organic Revenue Growth

7%

Amount

Margin

GAAP loss from operations

$(44)

(4.2)%

Non-GAAP income from operations

$160

15.2%

Cash provided by operating activities

$190

18%

Free cash flow

$177

17%

GAAP net loss attributable to common

stockholders

$(55)

Non-GAAP net income attributable to common

stockholders

$146

Net loss per share attributable to common

stockholders, basic and diluted

$(0.31)

Non-GAAP net income per share attributable

to common stockholders, diluted

$0.80

Share Repurchase Program

In February 2023, Twilio’s Board of Directors authorized a share

repurchase program pursuant to which Twilio may repurchase up to

$1.0 billion of its outstanding Class A common stock. Subsequently,

in March 2024, Twilio’s Board of Directors authorized an additional

$2.0 billion of share repurchases. To date, Twilio has completed

approximately $1.5 billion of aggregate repurchases and is

targeting to complete the remaining $1.5 billion of repurchases

before the end of 2024.

Outlook

Twilio is initiating guidance for the second quarter ending June

30, 2024 and raising its non-GAAP income from operations range for

fiscal year 2024. Twilio also expects its full year 2024 free cash

flow to be in line with its full year 2024 non-GAAP income from

operations. Lastly, Twilio is reaffirming the full year 2024

organic revenue growth guidance of 5% - 10%, as originally provided

on March 5, 2024.

Dollars in millions, except per share

amounts

Q2 2024

Guidance

Revenue

$1,050 - $1,060

Y/Y Revenue Growth

1% - 2%

Y/Y Organic Revenue Growth

4% - 5%

Non-GAAP income from operations

$135 - $145

Non-GAAP diluted earnings per share

(1)

$0.64 - $0.68

Non-GAAP weighted average diluted shares

outstanding

171

Dollars in millions

2024 Full Year

Guidance

Organic Revenue Growth

5% - 10%

Non-GAAP income from operations

$585 - $635

(1) Non-GAAP diluted earnings per share

guidance assumes no impact from volatility of foreign exchange

rates.

Conference Call Information

Twilio is hosting a Q&A conference call today, May 7, 2024,

to discuss its first quarter 2024 financial results. The conference

call will begin at 2:00 p.m. (PT) / 5:00 p.m. (ET), and investors

and analysts should register for the webcast in advance by visiting

https://edge.media-server.com/mmc/p/8d9eqc2g/. The live webcast of

the conference call, as well as a replay and transcript, and

Twilio’s supplemental earnings presentation, will be available on

the investor relations website at https://investors.twilio.com.

Twilio uses its investor relations website and its X (formerly

Twitter) feed (@twilio), as a means of disclosing material

non-public information and for complying with its disclosure

obligations under Regulation FD.

About Twilio Inc.

Today’s leading companies trust Twilio’s Customer Engagement

Platform (CEP) to build direct, personalized relationships with

their customers everywhere in the world. Twilio enables companies

to use communications and data to add intelligence and security to

every step of the customer journey, from sales to marketing to

growth, customer service and many more engagement use cases in a

flexible, programmatic way. Across 180 countries and territories,

millions of developers and hundreds of thousands of businesses use

Twilio to create magical experiences for their customers. For more

information about Twilio (NYSE: TWLO) visit www.twilio.com.

Forward-Looking Statements

This press release and the accompanying conference call contain

forward-looking statements within the meaning of the federal

securities laws, which statements involve substantial risks and

uncertainties. Forward-looking statements generally relate to

future events or our future financial or operating performance. In

some cases, you can identify forward-looking statements because

they contain words such as “may,” “can,” “will,” “would,” “should,”

“expects,” “plans,” “anticipates,” “could,” “intends,” “target,”

“projects,” “contemplates,” “believes,” “estimates,” “predicts,”

“forecasts,” “potential” or “continue” or the negative of these

words or other similar terms or expressions that concern our

expectations, strategy, plans or intentions. Forward-looking

statements contained in this press release and the accompanying

conference call include, but are not limited to, statements about:

our future financial performance, including our expected financial

results and our guidance; our expectations regarding profitability,

including when we will become profitable on GAAP and non-GAAP

bases; our anticipated strategies and business plans; our

expectations regarding our relationships with ISVs, partners and

resellers, and our self-service and cross-sell efforts, and our

ability to expand into new markets and larger deal sizes; our

ability to execute on our announced plans and targets for Segment

following our operational review; our ability to create synergies

with our Communications and Segment products; the ongoing effects

of our recent workforce reductions and other cost-saving measures;

our expectations regarding compensation programs; our expectations

regarding levels of stock-based compensation; the reorganization of

our business and the shift in our segment reporting structure; our

expectations regarding our sales pipeline, the benefits to us of

recently signed deals, new product releases, increased investment

and go-to-market focus to capture market share, our revenue growth,

profit potential and anticipated cash flows, and our strategy for

streamlining the customer experience; our ability to develop

products related to generative artificial intelligence and machine

learning, including CustomerAI and its use cases; our ability to

deliver on our product roadmap and our focus on innovation; our

expectations regarding share repurchases; and our expectations

regarding the impact of macroeconomic and industry conditions, the

impact of such conditions on our customers, and our ability to

operate in such conditions. You should not rely upon

forward-looking statements as predictions of future events.

The outcome of the events described in these forward-looking

statements is subject to known and unknown risks, uncertainties,

and other factors that may cause our actual results, performance,

or achievements to differ materially from those described in the

forward-looking statements, including, among other things: our

ability to successfully implement our cost-saving initiatives and

to capture expected efficiencies; our ability to realize the

anticipated benefits of changes to our operating model and

organizational structure; the impact of macroeconomic uncertainties

and market volatility; our financial performance, including

expectations regarding our results of operations and the

assumptions underlying such expectations, and ability to achieve

and sustain profitability; our ability to attract and retain

customers; our ability to compete effectively in an intensely

competitive market; our ability to comply with modified or new

industry standards, laws and regulations applying to our business,

and increased costs associated with regulatory compliance; our

ability to manage changes in network service provider fees and

optimize our network service provider coverage and connectivity;

our ability to form and expand partnerships; and our ability to

successfully enter into new markets and manage our international

expansion.

The forward-looking statements contained in this press release

and the accompanying conference call are also subject to additional

risks, uncertainties, and factors, including those more fully

described in our most recent filings with the Securities and

Exchange Commission, including our Annual Report on Form 10-K and

subsequent Quarterly Reports on Form 10-Q. Should any of these

risks materialize, or should our assumptions prove to be incorrect,

actual financial results could differ materially from our

projections or those implied by these forward-looking statements.

Further information on potential risks that could affect actual

results will be included in the subsequent periodic and current

reports and other filings that we make with the Securities and

Exchange Commission from time to time. Moreover, we operate in a

very competitive and rapidly changing environment, and new risks

and uncertainties may emerge that could have an impact on the

forward-looking statements contained in this press release and the

accompanying conference call.

Forward-looking statements represent our management’s beliefs

and assumptions only as of the date such statements are made. We

undertake no obligation to update any forward-looking statements

made in this press release or the accompanying conference call to

reflect events or circumstances occurring after this press release

or accompanying conference call, as applicable, or to reflect new

information or the occurrence of unanticipated events, except as

required by law.

Non-GAAP Financial Measures

In addition to financial information presented in accordance

with U.S. generally accepted accounting principles (“GAAP”), this

press release and the accompanying conference call include certain

non-GAAP financial measures, including those listed below. We use

these non-GAAP financial measures to evaluate our ongoing

operations and for internal planning and forecasting purposes. We

believe that these non-GAAP financial measures may be helpful to

investors because they provide consistency and comparability with

past financial performance, facilitate period-to-period comparisons

of results of operations and assist in comparisons with other

companies, many of which use similar non-GAAP financial measures to

supplement their GAAP results. We believe organic revenue, organic

revenue growth, Communications organic revenue and Communications

organic revenue growth are useful in understanding the ongoing

results of our operations on a consolidated basis and at the

segment level. We believe free cash flow and free cash flow margin

provide useful supplemental information to help investors

understand underlying trends in our business and our liquidity.

These non-GAAP financial measures are presented for supplemental

informational purposes only, should not be considered substitutes

for financial information presented in accordance with GAAP, and

may be different from similarly-titled non-GAAP measures used by

other companies. A reconciliation of these measures to the most

directly comparable GAAP measures is included at the end of this

press release. We have not provided the forward-looking GAAP

equivalents for certain forward-looking non-GAAP measures presented

in this press release and the accompanying conference call, or a

GAAP reconciliation, as a result of the uncertainty regarding, and

the potential variability of, reconciling items such as stock-based

compensation expense. Accordingly, a reconciliation of these

non-GAAP guidance metrics to their corresponding GAAP equivalents

is not available without unreasonable effort. However, it is

important to note that material changes to reconciling items could

have a significant effect on future GAAP results.

Non-GAAP Gross Profit and Non-GAAP Gross Margin.

For the periods presented, we define non-GAAP gross profit and

non-GAAP gross margin as GAAP gross profit and GAAP gross margin,

respectively, adjusted to exclude stock-based compensation,

amortization of acquired intangibles and payroll taxes related to

stock-based compensation. Segment-level non-GAAP gross profit and

non-GAAP gross margin are calculated using the same methodology,

but using (and excluding, as applicable) only revenue and expenses

attributable to the applicable segment.

Non-GAAP Gross Profit Growth. For the periods presented,

we calculate non-GAAP gross profit growth by dividing (i) non-GAAP

gross profit for the period presented less non-GAAP gross profit in

the comparative period by (ii) non-GAAP gross profit in the

comparative period.

Non-GAAP Operating Expenses. For the periods presented,

we define non-GAAP operating expenses (including categories of

operating expenses) as GAAP operating expenses (and categories of

operating expenses) adjusted to exclude, as applicable, stock-based

compensation, amortization of acquired intangibles, loss on net

assets divested, acquisition and divestiture related expenses,

payroll taxes related to stock-based compensation, charitable

contributions, restructuring costs, and impairment of long-lived

assets.

Non-GAAP Income (Loss) from Operations and Non-GAAP

Operating Margin. For the periods presented, we define non-GAAP

income (loss) from operations and non-GAAP operating margin as GAAP

loss from operations and GAAP operating margin, respectively,

adjusted to exclude, as applicable, stock-based compensation,

amortization of acquired intangibles, loss on net assets divested,

acquisition and divestiture related expenses, payroll taxes related

to stock-based compensation, charitable contributions,

restructuring costs, and impairment of long-lived assets.

Segment-level non-GAAP income (loss) from operations and non-GAAP

operating margin are calculated using the same methodology, but

using (and excluding, as applicable) only revenue and expenses

attributable to the applicable segment.

Non-GAAP Net Income (Loss) Attributable to Common

Stockholders and Non-GAAP Net Income (Loss) Per Share

Attributable to Common Stockholders. For the periods presented,

we define non-GAAP net income (loss) attributable to common

stockholders and non-GAAP net income (loss) per share attributable

to common stockholders, diluted (which we refer to as “non-GAAP

diluted earnings per share”) as GAAP net loss attributable to

common stockholders and GAAP net loss per share attributable to

common stockholders, basic and diluted, respectively, adjusted to

exclude share-based compensation, amortization of acquired

intangibles, loss on net assets divested, acquisition and

divestiture related expenses, payroll taxes related to stock-based

compensation, amortization of debt discount and issuance costs,

income tax benefit related to acquisitions, charitable

contributions, share of losses from equity method investment,

restructuring costs, impairment of long-lived assets and gains on

or impairment of strategic investments.

Organic Revenue. For the periods presented, we define

organic revenue as GAAP revenue, excluding (i) revenue from each

acquired business and revenue from application-to-person (“A2P”)

10DLC fees imposed by major U.S. carriers on our core messaging

business, in each case until the beginning of the first full

quarter following the one-year anniversary of the closing date of

such acquisition or the initial date such fees were charged and

(ii) revenue from each divested business beginning in the quarter

of the closing date of such divestiture; provided that (a) if an

acquisition closes or such fees are initially charged on the first

day of a quarter, such revenue will be included in organic revenue

beginning on the one-year anniversary of the closing date of such

acquisition or the initial date such fees were charged, and (b) if

a divestiture closes on the last day of a quarter, such revenue

will be included in organic revenue for that quarter. A2P 10DLC

fees are fees imposed by U.S. mobile carriers for A2P SMS messages

delivered to its subscribers, and we pass these fees to our

messaging customers at cost.

Organic Revenue Growth. For the periods presented, we

calculate organic revenue growth by dividing (i) organic revenue

for the period presented less organic revenue in the comparative

period by (ii) organic revenue in the comparative period. If

revenue from certain acquisitions, divestitures or A2P 10DLC fees

is included or excluded in organic revenue in the period presented,

then revenue from the same acquisitions, divestitures and A2P 10DLC

fees is included or excluded in organic revenue in the comparative

period for purposes of the denominator in the organic revenue

growth calculation. As a result, the denominator used in this

calculation will not always equal the organic revenue reported for

the comparative period. Organic revenue growth excluding crypto and

Zipwhip software customers is calculated using the same

methodology, but excluding revenue attributable to customers that

operate in the cryptocurrency space and customers of our Zipwhip

software business in each respective period. Communications organic

revenue growth is calculated using the same methodology, but using

(and excluding, as applicable) only revenue attributable to the

Communications segment.

Free Cash Flow and Free Cash Flow Margin. For the periods

presented, we define free cash flow and free cash flow margin as

net cash provided by (used in) operating activities and operating

cash flow margin, respectively, excluding capitalized software

development costs and purchases of long-lived and intangible

assets.

Operating Metrics

We review a number of operational and financial metrics,

including Active Customer Accounts and Dollar-Based Net Expansion

Rate, to evaluate our business, measure our performance, identify

trends affecting our business, formulate business plans and make

strategic decisions. These metrics are not based on any

standardized industry methodology and are not necessarily

calculated in the same manner or comparable to similarly titled

measures presented by other companies. Similarly, these metrics may

differ from estimates published by third parties or from similarly

titled metrics of our competitors due to differences in

methodology. The numbers that we use to calculate Active Customer

Accounts and Dollar-Based Net Expansion Rate are based on internal

data. While these numbers are based on what we believe to be

reasonable judgments and estimates for the applicable period of

measurement, there are inherent challenges in measuring usage. We

regularly review and may adjust our processes for calculating our

internal metrics to improve their accuracy. If investors or

analysts do not perceive our metrics to be accurate representations

of our business, or if we discover material inaccuracies in our

metrics, our reputation, business, results of operations, and

financial condition would be harmed.

Active Customer Accounts. We define an Active Customer

Account at the end of any period as an individual account, as

identified by a unique account identifier, for which we have

recognized at least $5 of revenue in the last month of the period.

A single organization may constitute multiple unique Active

Customer Accounts if it has multiple account identifiers, each of

which is treated as a separate Active Customer Account. Active

Customer Accounts excludes customer accounts from Zipwhip, Inc.

(“Zipwhip”). Communications Active Customer Accounts and Segment

Active Customer Accounts are calculated using the same methodology,

but using only revenue recognized from accounts in the respective

segment. The number of consolidated and Communications Active

Customer Accounts is rounded down to the nearest thousand. The

number of Segment Active Customer Accounts is rounded down to the

nearest hundred.

Our business and customer relationships have grown since we

began reporting the number of Active Customer Accounts using the

above definition, which is anchored to a minimum $5 monthly revenue

figure. We have a large number of Active Customer Accounts with

relatively low individual spend that in the aggregate do not drive

a significant portion of our revenue. Due to this dynamic, we

believe that the number of Active Customer Accounts, as currently

defined, is less informative now as an indicator of the growth of

our business and future revenue trends than it has been in prior

periods.

Dollar-Based Net Expansion Rate. Our Dollar-Based Net

Expansion Rate compares the total revenue from all Active Customer

Accounts and customer accounts from Zipwhip in a quarter to the

same quarter in the prior year. To calculate the Dollar-Based Net

Expansion Rate, we first identify the cohort of Active Customer

Accounts and customer accounts from Zipwhip that were Active

Customer Accounts or customer accounts from Zipwhip in the same

quarter of the prior year. The Dollar-Based Net Expansion Rate is

the quotient obtained by dividing the revenue generated from that

cohort in a quarter, by the revenue generated from that same cohort

in the corresponding quarter in the prior year. When we calculate

Dollar-Based Net Expansion Rate for periods longer than one

quarter, we use the average of the applicable quarterly

Dollar-Based Net Expansion Rates for each of the quarters in such

periods. Revenue from acquisitions does not impact the Dollar-Based

Net Expansion Rate calculation until the quarter following the

one-year anniversary of the applicable acquisition, unless the

acquisition closing date is the first day of a quarter. As a

result, for the quarter ended March 31, 2024, our Dollar-Based Net

Expansion Rate excludes the contributions from any acquisitions

made after January 1, 2023. Revenue from divestitures does not

impact the Dollar-Based Net Expansion Rate calculation beginning in

the quarter the divestiture closed, unless the divestiture closing

date is the last day of a quarter. As a result, for the quarter

ended March 31, 2024, our Dollar-Based Net Expansion Rate excludes

the contributions from any divestitures made after March 31, 2023.

Communications Dollar-Based Net Expansion Rate and Segment

Dollar-Based Net Expansion Rate are calculated using the same

methodology, but using only revenue attributable to the respective

segment and Active Customer Accounts and customer accounts from

Zipwhip for that respective segment. Dollar-Based Net Expansion

Rate excluding crypto and Zipwhip software customers is calculated

using the same methodology described above, but excluding revenue

attributable to customers that operate in the cryptocurrency space

and customers of our Zipwhip software business in each respective

period. Revenue from customer accounts from Zipwhip, which we

acquired on July 14, 2021, has been included in our Dollar-Based

Net Expansion Rate beginning in the quarter ended December 31,

2022.

We believe that measuring Dollar-Based Net Expansion Rate, on an

aggregate basis and at the segment level, provides an important

indication of the performance of our efforts to increase revenue

from existing customers. Our ability to drive growth and generate

incremental revenue depends, in part, on our ability to maintain

and grow our relationships with existing Active Customer Accounts

and to increase their use of the platform. An important way in

which we have historically tracked performance in this area is by

measuring the Dollar-Based Net Expansion Rate for Active Customer

Accounts. Our Dollar-Based Net Expansion Rate increases when such

Active Customer Accounts increase their usage of a product, extend

their usage of a product to new applications or adopt a new

product. Our Dollar-Based Net Expansion Rate decreases when such

Active Customer Accounts cease or reduce their usage of a product

or when we lower usage prices on a product. As our customers grow

their businesses and extend the use of our platform, they sometimes

create multiple customer accounts with us for operational or other

reasons. As such, when we identify a significant customer

organization (defined as a single customer organization generating

more than 1% of revenue in a quarterly reporting period) that has

created a new Active Customer Account, this new Active Customer

Account is tied to, and revenue from this new Active Customer

Account is included with, the original Active Customer Account for

the purposes of calculating this metric.

Source: Twilio Inc.

TWILIO INC.

Condensed

Consolidated Statements of Operations

(In thousands, except share and per

share amounts)

(Unaudited)

Three Months Ended

March 31,

2024

2023

Revenue

$

1,047,050

$

1,006,564

Cost of revenue

503,009

515,874

Gross profit

544,041

490,690

Operating expenses:

Research and development

251,615

238,595

Sales and marketing

214,018

259,885

General and administrative

111,966

112,568

Restructuring costs

9,946

121,942

Impairment of long-lived assets

—

21,784

Total operating expenses

587,545

754,774

Loss from operations

(43,504

)

(264,084

)

Other expenses, net:

Share of losses from equity method

investment

(29,575

)

(30,419

)

Impairment of strategic investments

—

(46,154

)

Other income, net

27,918

8,985

Total other expenses, net

(1,657

)

(67,588

)

Loss before provision for income taxes

(45,161

)

(331,672

)

Provision for income taxes

(10,188

)

(10,467

)

Net loss attributable to common

stockholders

$

(55,349

)

$

(342,139

)

Net loss per share attributable to common

stockholders, basic and diluted

$

(0.31

)

$

(1.84

)

Weighted-average shares used in computing

net loss per share attributable to common stockholders, basic and

diluted

181,017,726

186,403,349

TWILIO INC.

Condensed

Consolidated Balance Sheets

(In thousands)

(Unaudited)

As of March 31,

As of December 31,

2024

2023

ASSETS

Current assets:

Cash and cash equivalents

$

672,595

$

655,931

Short-term marketable securities

3,154,005

3,356,064

Accounts receivable, net

540,932

562,773

Prepaid expenses and other current

assets

310,063

329,204

Total current assets

4,677,595

4,903,972

Property and equipment, net

201,273

209,639

Operating right-of-use assets

68,887

73,959

Equity method investment

568,145

593,582

Intangible assets, net

321,501

350,490

Goodwill

5,243,266

5,243,266

Other long-term assets

208,622

234,799

Total assets

$

11,289,289

$

11,609,707

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

82,194

$

119,615

Accrued expenses and other current

liabilities

442,133

424,311

Deferred revenue and customer deposits

142,372

144,499

Operating lease liability, current

47,904

49,872

Total current liabilities

714,603

738,297

Operating lease liability, noncurrent

110,267

120,770

Finance lease liability, noncurrent

6,960

9,191

Long-term debt, net

989,356

988,953

Other long-term liabilities

20,373

19,944

Total liabilities

1,841,559

1,877,155

Commitments and contingencies

Stockholders’ equity:

Preferred stock

—

—

Common stock

177

182

Additional paid-in capital

14,960,837

14,797,723

Accumulated other comprehensive (loss)

income

(4,941

)

619

Accumulated deficit

(5,508,343

)

(5,065,972

)

Total stockholders’ equity

9,447,730

9,732,552

Total liabilities and stockholders’

equity

$

11,289,289

$

11,609,707

TWILIO INC.

Condensed

Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

Three Months Ended

March 31,

2024

2023

CASH FLOWS FROM OPERATING ACTIVITIES:

Net loss

$

(55,349

)

$

(342,139

)

Adjustments to reconcile net loss to net

cash provided by (used in) operating activities:

Depreciation and amortization

53,318

71,393

Non-cash reduction to the right-of-use

asset

5,076

8,574

Net amortization of investment premium and

discount

(6,029

)

3,515

Impairment of long-lived assets

—

21,784

Stock-based compensation including

restructuring

158,606

170,799

Amortization of deferred commissions

18,829

17,865

Provision for doubtful accounts

6,204

7,220

Share of losses from equity method

investment

29,575

30,419

Impairment of strategic investments

—

46,154

Other adjustments

4,996

9,746

Changes in operating assets and

liabilities:

Accounts receivable

15,637

(35,215

)

Prepaid expenses and other current

assets

16,901

(51,438

)

Other long-term assets

6,859

(21,481

)

Accounts payable

(37,762

)

66

Accrued expenses and other current

liabilities

(12,447

)

(19,130

)

Deferred revenue and customer deposits

(2,127

)

(2,611

)

Operating lease liabilities

(12,470

)

(13,651

)

Other long-term liabilities

306

264

Net cash provided by (used in) operating

activities

190,123

(97,866

)

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchases of marketable securities and

other investments

(435,590

)

(136,119

)

Proceeds from sales and maturities of

marketable securities

638,185

355,195

Capitalized software development costs

(11,154

)

(9,860

)

Purchases of long-lived and intangible

assets

(1,671

)

(6,751

)

Net cash provided by investing

activities

189,770

202,465

CASH FLOWS FROM FINANCING ACTIVITIES:

Principal payments on debt and finance

leases

(4,832

)

(7,353

)

Value of equity awards withheld for tax

liabilities

(1,918

)

(2,456

)

Repurchases of shares of Class A common

stock and related costs

(356,900

)

(114,993

)

Proceeds from exercises of stock

options

421

3,264

Net cash used in financing activities

(363,229

)

(121,538

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

—

39

NET INCREASE (DECREASE) IN CASH, CASH

EQUIVALENTS AND RESTRICTED CASH

16,664

(16,900

)

CASH, CASH EQUIVALENTS AND RESTRICTED

CASH—Beginning of period

655,931

656,078

CASH, CASH EQUIVALENTS AND RESTRICTED CASH

—End of period

$

672,595

$

639,178

TWILIO INC.

Reconciliation of

GAAP Financial Measures to Non-GAAP Financial

Measures

(In thousands, except shares, per share

amounts and percentages)

(Unaudited)

Three Months Ended March

31,

2024

2023

GAAP gross profit

$

544,041

$

490,690

GAAP gross margin

52.0

%

48.7

%

Non-GAAP adjustments:

Stock-based compensation

5,891

5,290

Amortization of acquired intangibles

15,682

29,961

Payroll taxes related to stock-based

compensation

345

195

Non-GAAP gross profit

$

565,959

$

526,136

Non-GAAP gross margin

54.1

%

52.3

%

GAAP research and development

$

251,615

$

238,595

Non-GAAP adjustments:

Stock-based compensation

(81,349

)

(78,093

)

Amortization of acquired intangibles

(1,120

)

(420

)

Acquisition and divestiture related

expenses

—

(447

)

Payroll taxes related to stock-based

compensation

(3,937

)

(2,870

)

Non-GAAP research and development

$

165,209

$

156,765

Non-GAAP research and development as % of

revenue

15.8

%

15.6

%

GAAP sales and marketing

$

214,018

$

259,885

Non-GAAP adjustments:

Stock-based compensation

(34,655

)

(48,129

)

Amortization of acquired intangibles

(12,137

)

(20,393

)

Acquisition and divestiture related

expenses

—

(1,058

)

Payroll taxes related to stock-based

compensation

(1,646

)

(1,478

)

Non-GAAP sales and marketing

$

165,580

$

188,827

Non-GAAP sales and marketing as % of

revenue

15.8

%

18.8

%

GAAP general and administrative

$

111,966

$

112,568

Non-GAAP adjustments:

Stock-based compensation

(34,263

)

(28,954

)

Acquisition and divestiture related

expenses

—

(730

)

Loss on net assets held for sale

—

(3,824

)

Payroll taxes related to stock-based

compensation

(848

)

(704

)

Charitable contributions

(1,295

)

(1,599

)

Non-GAAP general and administrative

$

75,560

$

76,757

Non-GAAP general and administrative as %

of revenue

7.2

%

7.6

%

TWILIO INC.

Reconciliation of

GAAP Financial Measures to Non-GAAP Financial

Measures

(In thousands, except shares, per share

amounts and percentages)

(Unaudited)

Three Months Ended March

31,

2024

2023

GAAP loss from operations

$

(43,504

)

$

(264,084

)

GAAP operating margin

(4.2

)%

(26.2

)%

Non-GAAP adjustments:

Stock-based compensation

156,158

160,466

Amortization of acquired intangibles

28,939

50,774

Acquisition and divestiture related

expenses

—

2,235

Loss on net assets held for sale

—

3,824

Payroll taxes related to stock-based

compensation

6,776

5,247

Charitable contributions

1,295

1,599

Restructuring costs

9,946

121,942

Impairment of long-lived assets

—

21,784

Non-GAAP income from operations

$

159,610

$

103,787

Non-GAAP operating margin

15.2

%

10.3

%

GAAP net loss attributable to common

stockholders

$

(55,349

)

$

(342,139

)

GAAP net loss attributable to common

stockholders as % of revenue

(5.3

)%

(34.0

)%

Non-GAAP adjustments:

Stock-based compensation

156,158

160,466

Amortization of acquired intangibles

28,939

50,774

Acquisition and divestiture related

expenses

—

2,235

Loss on net assets held for sale

—

3,824

Payroll taxes related to stock-based

compensation

6,776

5,247

Accretion of debt discount and issuance

costs

403

387

Income tax benefit related to

acquisitions

—

(384

)

Provision of income tax effects related to

non-GAAP adjustments

(31,086

)

(14,044

)

Charitable contributions

1,295

1,599

Share of losses of equity method

investment

29,575

30,419

Restructuring costs

9,946

121,942

Impairment of long-lived assets

—

21,784

(Gains) losses on impairment of strategic

investments

(322

)

46,154

Non-GAAP net income attributable to common

stockholders

$

146,335

$

88,264

Non-GAAP net income attributable to common

stockholders as % of revenue

14.0

%

8.8

%

TWILIO INC.

Reconciliation of

GAAP Financial Measures to Non-GAAP Financial

Measures

(In thousands, except shares, per share

amounts and percentages)

(Unaudited)

Three Months Ended March

31,

2024

2023

GAAP net loss per share attributable to

common stockholders, basic and diluted*

$

(0.31

)

$

(1.84

)

Non-GAAP adjustments:

Stock-based compensation

0.85

0.85

Amortization of acquired intangibles

0.16

0.27

Acquisition and divestiture related

expenses

—

0.01

Loss on net assets held for sale

—

0.02

Payroll taxes related to stock-based

compensation

0.04

0.03

Accretion of debt discount and issuance

costs

—

—

Income tax benefit related to

acquisitions

—

—

Provision of income tax effects related to

non-GAAP adjustments

(0.17

)

(0.07

)

Charitable contributions

0.01

0.01

Share of losses of equity method

investment

0.16

0.16

Restructuring costs

0.05

0.65

Impairment of long-lived assets

—

0.12

(Gains) losses on impairment of strategic

investments

—

0.24

Other dilutive

0.01

0.02

Non-GAAP net income per share attributable

to common stockholders, diluted

$

0.80

$

0.47

GAAP weighted-average shares used to

compute net loss per share attributable to common stockholders,

basic

181,017,726

186,403,349

Weighted Average Diluted Shares

Outstanding

2,336,311

2,284,442

Non-GAAP weighted-average shares used

to compute non-GAAP net income per share attributable to common

stockholders, diluted

183,354,037

188,687,791

* Some columns may not add due to

rounding

TWILIO INC.

Reconciliation to

Non-GAAP Financial Measures

(In thousands, except

percentages)

(Unaudited)

Three Months Ended

March 31,

2024

GAAP Revenue

$

1,047,050

Organic Revenue

$

1,047,050

GAAP Revenue Y/Y Growth

4

%

Organic Revenue Y/Y Growth1

7

%

1 Organic revenue for the three months

ended March 31, 2023, when used as the denominator for Organic

Revenue Growth for the three months ended March 31, 2024, excludes

$28.0 million of divestiture revenue. Revenue for the three months

ended March 31, 2023 was $1.01 billion.

Three Months Ended

March 31,

2024

GAAP Communications Revenue

$

972,005

Communications Organic Revenue

$

972,005

GAAP Communications Revenue Y/Y Growth

4

%

Communications Organic Revenue Y/Y

Growth1

7

%

1 Communications organic revenue for the

three months ended March 31, 2023, when used as the denominator for

Communications Organic Revenue Growth for the three months ended

March 31, 2024, excludes $28.0 million of divestiture revenue.

Communications revenue for the three months ended March 31, 2023,

was $932.9 million.

Three Months Ended

March 31,

2024

2023

Free cash flow

Net cash provided by (used in) operating

activities

$

190,123

$

(97,866

)

Operating cash flow margin

18

%

(10

)%

Non-GAAP adjustments:

Capitalized software development costs

(11,154

)

(9,860

)

Purchases of long-lived and intangible

assets

(1,671

)

(6,751

)

Free cash flow

$

177,298

$

(114,477

)

Free cash flow margin

17

%

(11

)%

TWILIO INC.

Operating Results

by Segment

(In thousands)

(Unaudited)

Three Months Ended

March 31,

2024

Revenue:

Communications

$

972,005

Segment

75,045

Total

$

1,047,050

Non-GAAP income (loss) from

operations:

Communications

$

249,010

Segment

(20,994

)

Corporate costs

(68,406

)

Total

$

159,610

Reconciliation of non-GAAP income from

operations to loss from operations:

Total non-GAAP income from operations

$

159,610

Stock-based compensation

(156,158

)

Amortization of acquired intangibles

(28,939

)

Payroll taxes related to stock-based

compensation

(6,776

)

Charitable contributions

(1,295

)

Restructuring costs

(9,946

)

Loss from operations

(43,504

)

Other expenses, net

(1,657

)

Loss before provision for income taxes

$

(45,161

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240507858870/en/

Investor Contact: Bryan Vaniman ir@Twilio.com

or

Media Contact: Caitlin Epstein press@Twilio.com

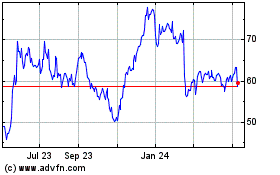

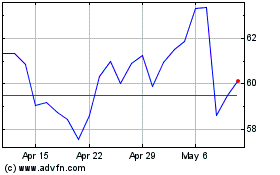

Twilio (NYSE:TWLO)

Historical Stock Chart

From Oct 2024 to Oct 2024

Twilio (NYSE:TWLO)

Historical Stock Chart

From Oct 2023 to Oct 2024