Current Report Filing (8-k)

November 12 2019 - 4:12PM

Edgar (US Regulatory)

false0001688852

0001688852

2019-11-06

2019-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 6, 2019

_______________________________________________________________________________

Safehold Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Maryland

|

|

001-38122

|

|

30-0971238

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File

Number)

|

|

(IRS Employer

Identification Number)

|

|

|

|

|

|

|

|

|

1114 Avenue of the Americas

|

|

|

39th Floor

|

|

|

New York

|

,

|

NY

|

10036

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (212) 930-9400

_______________________________________________________________________________

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

SAFE

|

|

NYSE

|

Item 1.01 Entry Into a Material Definitive Agreement

On November 6, 2019, Safehold Inc. (the "Company") entered into an amended and restated credit agreement (the “Restated Credit Agreement”), as the borrower, with Safehold Operating Partnership LP (the "Operating Partnership") and certain subsidiaries of the Company and the Operating Partnership from time to time party thereto, as guarantors, Bank of America, N.A., as administrative agent, Bank of America, N.A., JPMorgan Chase Bank, N.A. and Barclays Bank PLC, as L/C issuers, and the other lenders party thereto, BofA Securities, Inc., JPMorgan Chase Bank, N.A. and Barclays Bank PLC, as joint lead arrangers, and BofA Securities, Inc., as sole bookrunner. The Restated Credit Agreement amends and restates the original credit agreement entered into in June 2017 in connection with the Company's initial public offering. In general, the Restated Credit Agreement increases the aggregate borrowing capacity, extends the maturity and improves the pricing of the original credit agreement. The Restated Credit Agreement also relaxes certain of the covenants that were in the original credit agreement and reduces certain of the conditions of borrowing.

The Restated Credit Agreement provides for a secured revolving credit facility with aggregate borrowing capacity of up to $525.0 million, subject to borrowing base availability and certain other conditions. The Company may, subject to certain conditions, including obtaining additional commitments from lenders, request additional capacity of up to $1.0 billion. Availability of borrowings is based on a borrowing base of assets comprised of ground leases and other assets, subject to certain investment concentrations.

The Restated Credit Agreement has an initial maturity of November 6, 2022, which may be extended for an additional year no more than two times upon the payment of applicable fees and satisfaction of certain other conditions. Borrowings under the Credit Agreement will bear interest at a per annum rate of applicable LIBOR plus 1.30%. The applicable LIBOR will be the rate with a term equivalent to the interest period applicable to the relevant borrowing. The facility is freely prepayable at any time and is mandatorily prepayable by the Company if the borrowing base availability is at any time less than zero (in an amount equal to such deficiency in coverage).

The Operating Partnership and its general partner, and each of the Operating Partnership’s subsidiaries that owns a direct or indirect interest in a borrowing base asset will be guarantors under the Restated Credit Agreement until the Company receives an investment grade corporate credit rating from S&P Global Ratings or Moody's Investors Service, Inc.

The Restated Credit Agreement contains representations, warranties, covenants, terms and conditions customary for transactions of this type, including but not limited to:

|

|

|

|

•

|

a limitation on total consolidated leverage of not more than 70%, or 75% for no more than 180 days, of total consolidated assets;

|

|

|

|

|

•

|

a consolidated fixed charge coverage ratio of at least 1.40x;

|

|

|

|

|

•

|

a consolidated tangible net worth of at least $632,827,000 plus 75% of future issuances of net equity;

|

|

|

|

|

•

|

a consolidated secured leverage ratio of not more than 70%, or 75% for no more than 180 days, of total consolidated assets;

|

|

|

|

|

•

|

a secured recourse debt ratio of not more than 5.0% of total consolidated assets;

|

|

|

|

|

•

|

limitations on indebtedness, liens, fundamental changes, borrowing base asset dispositions, restricted payments, investments, negative pledges, lines of business and transactions with affiliates; and

|

|

|

|

|

•

|

default provisions, including defaults for non-payment, breach of representations and warranties, insolvency, non-performance of covenants, cross-defaults and guarantor defaults.

|

The Restated Credit Agreement permits the Company to pay dividends without restriction as to amount, so long as after giving effect to the dividend, the Company is in pro forma compliance with the financial covenants in the Restated Credit Agreement and no event of default has occurred and is continuing.

The foregoing summary of the Restated Credit Agreement is qualified in its entirety by reference to the Restated Credit Agreement, a copy of which is filed herewith as Exhibit 10.1 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

|

|

|

*

|

The Company has omitted certain schedules and exhibits pursuant to Item 601(b)(2) of Regulation S-K and shall furnish supplementally to the SEC copies of any of the omitted schedules and exhibits upon request by the SEC.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Safehold Inc.

|

|

|

|

|

|

|

Date:

|

November 12, 2019

|

By:

|

/s/ JAY SUGARMAN

|

|

|

|

|

Jay Sugarman

Chief Executive Officer

|

|

|

|

|

|

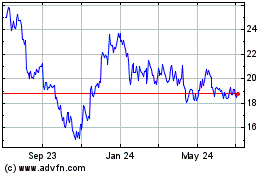

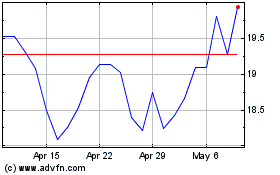

Safehold (NYSE:SAFE)

Historical Stock Chart

From Aug 2024 to Sep 2024

Safehold (NYSE:SAFE)

Historical Stock Chart

From Sep 2023 to Sep 2024