Lufax Holding Ltd (“Lufax” or the “Company”) (NYSE: LU), a

leading technology-empowered personal financial services platform

in China, today announced its unaudited financial results for the

first quarter ended March 31, 2022.

First Quarter 2022 Financial Highlights

- Total income increased by 13.5% to RMB17,316 million (US$2,732

million) in the first quarter of 2022 from RMB15,251 million in the

same period of 2021.

- Net profit increased by 6.5% to RMB5,290 million (US$834

million) in the first quarter of 2022 from RMB4,969 million in the

same period of 2021.

(In millions except percentages,

unaudited)

Three Months Ended March

31,

2021

2022

YoY

RMB

RMB

USD

Total income

15,251

17,316

2,732

13.5%

Total expenses

(8,530)

(10,163)

(1,603)

19.1%

Total expenses excluding credit and asset

impairment losses

(7,477)

(7,339)

(1,158)

(1.8%)

Credit and asset impairment losses

(1,053)

(2,824)

(445)

168.2%

Net profit1

4,969

5,290

834

6.5%

First Quarter 2022 Operational Highlights

Retail credit facilitation

business:

- Outstanding balance of loans facilitated increased by 16.1% to

RMB676.3 billion as of March 31, 2022 from RMB582.6 billion as of

March 31, 2021.

- Cumulative number of borrowers increased by 17.9% to

approximately 17.8 million as of March 31, 2022 from approximately

15.1 million as of March 31, 2021.

- New loans facilitated decreased by 4.7% to RMB164.3 billion in

the first quarter of 2022 from RMB172.4 billion in the same period

of 2021.

- During the first quarter of 2022, excluding the consumer

finance subsidiary, 83.5% of new loans facilitated were disbursed

to small business owners, up from 75.7% in the same period of

2021.

- During the first quarter of 2022, excluding the consumer

finance subsidiary, the Company bore risk on 20.4% of its new loans

facilitated, up from 12.5% in the same period of 2021.

- As of March 31, 2022, including the consumer finance

subsidiary, the Company bore risk on 19.4% of its outstanding

balance, up from 8.7% as of March 31, 2021.

- For the first quarter of 2022, the Company’s retail credit

facilitation revenue take rate2 based on loan balance was 9.7%, as

compared to 10.0% for the first quarter of 2021.

- C-M3 flow rate3 for the total loans the Company had facilitated

was 0.6% in the first quarter of 2022, as compared to 0.5% in the

fourth quarter of 2021. Flow rates for the general unsecured loans

and secured loans the Company had facilitated were 0.7% and 0.2%,

respectively, in the first quarter of 2022, as compared to 0.6% and

0.2%, respectively, in the fourth quarter of 2021.

- Days past due (“DPD”) 30+ delinquency rate4 for the total loans

the Company had facilitated was 2.6% as of March 31, 2022, as

compared to 2.2% as of December 31, 2021. DPD 30+ delinquency rate

for general unsecured loans was 3.0% as of March 31, 2022, as

compared to 2.6% as of December 31, 2021. DPD 30+ delinquency rate

for secured loans was 1.0% as of March 31, 2022, as compared to

0.8% as of December 31, 2021.

- DPD 90+ delinquency rate5 for the total loans facilitated was

1.4% as of March 31, 2022, as compared to 1.2% as of December 31,

2021. DPD 90+ delinquency rate for general unsecured loans was 1.6%

as of March 31, 2022, as compared to 1.5% as of December 31, 2021.

DPD 90+ delinquency rate for secured loans was 0.5% as of March 31,

2022, as compared to 0.4% as of December 31, 2021.

Wealth management business:

- Total number of registered users grew to 52.0 million as of

March 31, 2022 from 46.5 million as of March 31, 2021.

- Total number of active investors grew to 15.2 million as of

March 31, 2022 from 14.8 million as of March 31, 2021.

- Total client assets grew by 2.7% to RMB432.6 billion as of

March 31, 2022 from RMB421.1 billion as of March 31, 2021.

- Client assets in the Company’s current products increased by

3.7% to RMB432.6 billion as of March 31, 2022 from RMB417.1 billion

as of March 31, 2021.

- As of March 31, 2022, no client assets remained in legacy

products. Legacy products had accounted for 0.9% of total client

assets as of March 31, 2021.

- The 12-month investor retention rate was 94.4% as of March 31,

2022, as compared to 96.6% as of March 31, 2021.

- Contribution to total client assets from customers with

investments of more than RMB300,000 on the Company’s platform

increased to 81.3% as of March 31, 2022 from 76.3% as of March 31,

2021.

- During the first quarter of 2022, the annualized take rate6 for

current products and services on the Company’s wealth management

platform was 53.9 bps, down from 64.0 bps during the fourth quarter

of 2021.

Mr. Ji Guangheng, Chairman of Lufax, commented, “We overcame

external challenges and delivered another quarter of solid

financial and operational performance by leveraging our core

competitive advantages in regulatory compliance, market potential,

business models, and capital reserves. As part of our plan to

reward shareholders, we also paid out our inaugural dividend during

April. More importantly, we are actively implementing a series of

operational initiatives to preempt any potential capital market

dislocations. Looking ahead, we will remain fully in sync with

China’s national policy directives, offer inclusive financing

services, and continue to demonstrate our resolve, resiliency, and

commitment to support small- and micro-businesses and the real

economy at large.”

Mr. Gregory Gibb, Co-Chief Executive Officer of Lufax,

commented, “Our first quarter results exceeded our own guidance

both on the top and bottom lines, as we further augmented our

competitive strengths on the back of our stable operations. While

there remains uncertainty ahead given the ongoing pandemic, we have

implemented a number of proactive measures, including targeting

higher-quality customers, providing more customized products, and

improving our risk management efficiency, to enhance our business.

We are confident that our strong balance sheet, abundant cash

reserves, and well-funded credit insurance and funding partners

have equipped us with significant strength and flexibility to

weather the COVID resurgence and related economic slowdown.”

Mr. James Zheng, Chief Financial Officer of Lufax, commented,

“During the first quarter, our total income increased by 13.5% year

over year to RMB17.3 billion and our net profit grew by 6.5% to

RMB5.3 billion, mostly driven by our stable unit economics, deeper

market penetration, and sophisticated risk-sharing business model.

As of March 31, 2022, we had approximately RMB52.1 billion in

liquid assets7 maturing in 90 days or less. While we have great

confidence in our own ability to thrive in a challenging external

environment, we are also cognizant of the severe downward pressure

that the simultaneous rolling lockdowns across multiple cities have

put on the entire economy and the financial services industry.

Because it is next to impossible to predict the duration and

severity of the COVID-induced economic slowdown, we have adopted a

more conservative outlook towards our own growth prospects and

revised our guidance accordingly.”

First Quarter 2022 Financial Results

TOTAL INCOME

Total income increased by 13.5% to RMB17,316 million (US$2,732

million) in the first quarter of 2022 from RMB15,251 million in the

same period of 2021. The Company’s revenue mix changed with the

evolution of its business model, as it gradually bore more credit

risk and increased funding from consolidated trust plans that

provided lower funding costs.

Three Months Ended March

31,

(In millions except percentages,

unaudited)

2021

2022

YoY

RMB

% of income

RMB

% of income

Technology platform-based income

10,290

67.5%

9,292

53.7%

(9.7%)

Retail credit facilitation service

fees

9,665

63.4%

8,700

50.2%

(10.0%)

Wealth management transaction and service

fees

625

4.1%

592

3.4%

(5.3%)

Net interest income

2,911

19.1%

4,984

28.8%

71.2%

Guarantee income

551

3.6%

1,902

11.0%

245.2%

Other income

1,039

6.8%

704

4.1%

(32.2%)

Investment income

490

3.2%

435

2.5%

(11.2%)

Share of net profits of investments

accounted for using the equity method

(30)

(0.2%)

(0)

(0)

(100.0%)

Total income

15,251

100%

17,316

100%

13.5%

- Technology platform-based income decreased by 9.7% to

RMB9,292 million (US$1,466 million) in the first quarter of 2022

from RMB10,290 million in the same period of 2021 due to a decrease

in retail credit facilitation service fees, and wealth management

transaction and service fees.

- Retail credit facilitation service fees decreased by 10.0% to

RMB8,700 million (US$1,372 million) in the first quarter of 2022

from RMB9,665 million in the same period of 2021, mainly due to

changes in the Company’s business model that resulted in more

income being recognized in net interest income and guarantee

income, and to a lesser extent, a lower take rate as a result of

being more selective in borrowers.

- Wealth management transaction and service fees decreased by

5.3% to RMB592 million (US$93 million) in the first quarter of 2022

from RMB625 million in the same period of 2021. The decrease was

mainly driven by the run-off of legacy products, partially offset

by the increase in fees generated from the Company’s current

products and services.

- Net interest income increased by 71.2% to RMB4,984

million (US$786 million) in the first quarter of 2022 from RMB2,911

million in the same period of 2021, mainly as a result of 1) the

Company’s increased usage of trust funding channels that were

consolidated by the Company (as of March 31, 2022, the Company’s

on-balance sheet loans accounted for 34.5% of its total loan

balance under management, as compared to 24.7% as of March 31,

2021), and 2) increase in the consumer finance loans.

- Guarantee income increased by 245% to RMB1,902 million

(US$300 million) in the first quarter of 2022 from RMB551 million

in the same period of 2021, primarily due to the increase in the

loans for which the Company bore credit risk.

- Other income decreased to RMB704 million (US$111

million) in the first quarter of 2022 from RMB1,039 million in the

same period of 2021, mainly due to the change of service scope and

fee structure that the Company provided and charged to its

financial institution partners.

- Investment income decreased by 11.2% to RMB435 million

(US$69 million) in the first quarter of 2022 from RMB490 million in

the same period of 2021, mainly due to the decrease of investment

asset.

TOTAL EXPENSES

Total expenses increased by 19.1% to RMB10,163 million (US$1,603

million) in the first quarter of 2022 from RMB8,530 million in the

same period of 2021. This increase was mainly driven by credit

impairment losses, since credit impairment losses increased by 168%

to RMB2,824 million (US$445 million) in the first quarter of 2022

from RMB1,053 million in the same period of 2021. Total expenses

excluding credit impairment losses, finance costs and other

(gains)/losses increased by 2.7% to RMB7,247 million (US$1,143

million) in the first quarter of 2022 from RMB7,055 million in the

same period of 2021.

Three Months Ended March

31,

(In millions except percentages,

unaudited)

2021

2022

YoY

RMB

% of income

RMB

% of income

Sales and marketing expenses

4,233

27.8%

4,484

25.9%

5.9%

General and administrative expenses

854

5.6%

726

4.2%

(15.0%)

Operation and servicing expenses

1,521

10.0%

1,590

9.2%

4.5%

Technology and analytics expenses

447

2.9%

448

2.6%

0.2%

Credit impairment losses

1,053

6.9%

2,824

16.3%

168.2%

Finance costs

284

1.9%

211

1.2%

(25.7%)

Other (gains)/losses - net

138

0.9%

(118)

(0.7%)

(185.5%)

Total expenses

8,530

55.9%

10,163

58.7%

19.1%

- Sales and marketing expenses increased by 5.9% to

RMB4,484 million (US$707 million) in the first quarter of 2022 from

RMB4,233 million in the same period of 2021.

- Borrower acquisition expenses decreased by 7.3% to RMB2,435

million (US$384 million) in the first quarter of 2022 from RMB2,627

million in the same period of 2021. The decrease was mainly due to

increased sales productivity and continual optimization of

commissions, partly offset by the increased investment in direct

sales channel.

- Investor acquisition and retention expenses decreased by 11.1%

to RMB104 million (US$16 million) in the first quarter of 2022 from

RMB117 million in the same period of 2021, mostly due to the

improvement in the Company’s investor acquisition efficiency.

- General sales and marketing expenses increased by 30.5% to

RMB1,945 million (US$307 million) in the first quarter of 2022 from

RMB1,490 million in the same period of 2021. This increase was

primarily due to the increase in sales cost related to platform

services8 and the increase in the staff costs for sales and

marketing personnel.

- General and administrative expenses decreased by 15.0%

to RMB726 million (US$115 million) in the first quarter of 2022

from RMB854 million in the same period of 2021 as a result of the

Company’s expense control measures.

- Operation and servicing expenses increased by 4.5% to

RMB1,590 million (US$251 million) in the first quarter of 2022 from

RMB1,521 million in the same period of 2021, primarily due to the

increase of trust plan management expenses, which resulted from the

increase in consolidated trust plans.

- Technology and analytics expenses increased by 0.2% to

RMB448 million (US$71 million) in the first quarter of 2022 from

RMB447 million in the same period of 2021, mainly due to the

Company’s ongoing investments in technology research and

development.

- Credit impairment losses increased by 168.2% to RMB2,824

million (US$445 million) in the first quarter of 2022 from RMB1,053

million in the same period of 2021, mainly driven by 1) the

increase of provision and indemnity loss driven by increased risk

exposure, and 2) the change in credit performance due to impact of

the COVID-19 outbreak.

- Finance costs decreased by 25.7% to RMB211 million

(US$33 million) in the first quarter of 2022 from RMB284 million in

the same period of 2021, mainly due to the increase in interest

income resulting from the increase in deposits.

- Other gains were RMB118 million (US$19 million) in the

first quarter of 2022 compared to other losses of RMB138 million in

the same period of 2021, mainly due to the foreign exchange gain in

the first quarter of 2022.

NET PROFIT

Net profit increased by 6.5% to RMB5,290 million (US$834

million) in the first quarter of 2022 from RMB4,969 million in the

same period of 2021, driven by the aforementioned factors, If

non-cash foreign exchange gains and losses were excluded from the

calculation of net profit, then the year on year increase in net

profit would have been 2.1% instead.

EARNINGS PER ADS

Basic and diluted earnings per American Depositary Share (“ADS”)

were RMB2.31 (US$0.36) and RMB2.14 (US$0.34), respectively, in the

first quarter of 2022.

BALANCE SHEET

The Company had RMB40,556 million (US$6,398 million) in cash at

bank as of March 31, 2022, as compared to RMB34,743 million as of

December 31, 2021.

Recent Developments

US$1 Billion Share Repurchase Program

During 2021, the Company’s board of directors authorized share

repurchase programs under which the Company could repurchase up to

an aggregate of US$1 billion of its ADSs during the specific

period. As of March 31, 2022, the Company had repurchased

approximately 110 million ADSs for approximately US$877 million

under these share repurchase programs.

US$500 Million Share Repurchase Program

On March 7, 2022, the Company’s board of directors authorized an

additional share repurchase program, under which the Company may

repurchase up to an aggregate of US$500 million worth of its ADSs

over the following twelve months.

Early retirement of CFO

Mr. James Zheng, the Company’s CFO, will be taking early

retirement from the end of this June after many years career with

the Company. Over his years of service James has contributed a

great deal to the success of Lufax. The Company would like to thank

James for his service. The company has started the search for a new

CFO. During the interim period, Mr. David Choy, Chief Financial

Officer of Puhui, will assume the finance function of the

company.

Business Outlook

During the first quarter of 2022, the overall economics in China

was impacted by the regional lockdowns. Under the current zero

COVID policy, the Company believes that rolling lockdowns,

simultaneously affecting multiple cities, will likely remain rooted

in the landscape throughout most of 2022, thus exerting severe

negative influences on the entire economy and the credit business.

As such, the Company would like to provide its revised guidance to

account for the near-term macro headwinds.

For the first half of 2022, the Company expects its new loans

facilitated to decrease between 7% to 10% year over year to the

range of RMB294 billion to RMB301 billion, client assets to grow by

1% to 3% year over year to the range of RMB425 billion to RMB434

billion, total income to grow by 8% to 10% year over year to the

range of RMB32.5 billion to RMB33.1 billion, and net profit to

decrease between 11% to 13% year over year to the range of RMB8.5

billion to RMB8.6 billion. If non-cash foreign exchange losses were

excluded from the calculation of net profit, then the Company's

expectation would be for a decrease in net profit for the first

half of 2022 of between 3% and 4%.

These forecasts reflect the Company’s current and preliminary

views on the market and operational conditions, which are subject

to change.

Conference Call Information

The Company’s management will hold an earnings conference call

at 9:00 P.M. U.S. Eastern Time on Wednesday, May 25, 2022 (9:00

A.M. Beijing Time on Thursday, May 26, 2022) to discuss the

financial results. For participants who wish to join the call,

please complete online registration using the link provided below

in advance of the conference call. Upon registering, each

participant will receive a set of participant dial-in numbers, the

Direct Event passcode, and a unique access PIN, which can be used

to join the conference call.

Registration Link: https://ige.netroadshow.com/registration/q4inc/11007/lufax-holding-ltd-first-quarter-2022-earnings-conference-call/

A replay of the conference call will be accessible through June

1, 2022 (dial-in numbers: +1 (866) 813-9403 or +1 (226) 828-7578;

replay access code: 992269). A live and archived webcast of the

conference call will also be available at the Company’s investor

relations website at https://ir.lufaxholding.com.

About Lufax

Lufax Holding Ltd is a leading technology-empowered personal

financial services platform in China. Lufax Holding Ltd primarily

utilizes its customer-centric product offerings and offline

to-online channels to provide retail credit facilitation services

to small business owners and salaried workers in China as well as

tailor-made wealth management solutions to China’s rapidly growing

middle class. The Company has implemented a unique, capital-light,

hub-and spoke business model combining purpose-built technology

applications, extensive data, and financial services expertise to

effectively facilitate the right products to the right

customers.

Exchange Rate Information

This announcement contains translations of certain RMB amounts

into U.S. dollars at a specified rate solely for the convenience of

the reader. Unless otherwise noted, all translations from RMB to

U.S. dollars are made at a rate of RMB6.3393 to US$1.00, the rate

in effect as of March 31, 2022, as certified for customs purposes

by the Federal Reserve Bank of New York.

Safe Harbor Statement

This announcement contains forward-looking statements. These

statements are made under the "safe harbor" provisions of the

United States Private Securities Litigation Reform Act of 1995.

These forward-looking statements can be identified by terminology

such as "will," "expects," "anticipates," "future," "intends,"

"plans," "believes," "estimates" and similar statements. Statements

that are not historical facts, including statements about Lufax’s

beliefs and expectations, are forward-looking statements. Lufax has

based these forward-looking statements largely on its current

expectations and projections about future events and financial

trends, which involve known or unknown risks, uncertainties and

other factors, all of which are difficult to predict and many of

which are beyond the Company’s control. These forward-looking

statements include, but are not limited to, statements about

Lufax's goals and strategies; Lufax's future business development,

financial condition and results of operations; expected changes in

Lufax's income, expenses or expenditures; expected growth of the

retail credit facility and wealth management markets; Lufax's

expectations regarding demand for, and market acceptance of, its

services; Lufax's expectations regarding its relationship with

borrowers, platform investors, funding sources, product providers

and other business partners; general economic and business

conditions; and government policies and regulations relating to the

industry Lufax operates in. Forward-looking statements involve

inherent risks and uncertainties. Further information regarding

these and other risks is included in Lufax’s filings with the U.S.

Securities and Exchange Commission. All information provided in

this press release is as of the date of this press release, and

Lufax does not undertake any obligation to update any

forward-looking statement, except as required under applicable

law.

LUFAX HOLDING LTD

UNAUDITED INTERIM CONDENSED

CONSOLIDATED INCOME STATEMENTS

(All amounts in thousands,

except share data, or otherwise noted)

Three Months Ended March

31,

2021

2022

RMB

RMB

USD

Technology platform-based income

10,290,119

9,292,015

1,465,779

Retail credit facilitation service

fees

9,665,145

8,699,844

1,372,367

Wealth management transaction and service

fees

624,974

592,171

93,413

Net interest income

2,910,924

4,983,561

786,137

Guarantee income

551,375

1,902,334

300,086

Other income

1,038,556

703,575

110,986

Investment income

489,706

434,988

68,618

Share of net profits of investments

accounted for using the equity method

(29,883

)

(377

)

(59

)

Total income

15,250,797

17,316,096

2,731,547

Sales and marketing expenses

(4,233,269

)

(4,483,896

)

(707,317

)

General and administrative expenses

(853,705

)

(725,541

)

(114,451

)

Operation and servicing expenses

(1,521,187

)

(1,589,827

)

(250,789

)

Technology and analytics expenses

(446,593

)

(447,883

)

(70,652

)

Credit impairment losses

(1,053,250

)

(2,823,516

)

(445,399

)

Asset impairment losses

-

-

-

Finance costs

(284,092

)

(210,792

)

(33,252

)

Other gains/(losses) - net

(137,966

)

118,027

18,618

Total expenses

(8,530,062

)

(10,163,428

)

(1,603,241

)

Profit before income tax

expenses

6,720,735

7,152,668

1,128,306

Income tax expenses

(1,752,106

)

(1,862,787

)

(293,847

)

Net profit for the period

4,968,629

5,289,881

834,458

Net profit/(loss) attributable

to:

Owners of the Group

4,995,358

5,278,942

832,733

Non-controlling interests

(26,729

)

10,939

1,726

Net profit for the period

4,968,629

5,289,881

834,458

Earnings per share

-Basic earnings per share

4.18

4.62

0.73

-Diluted earnings per share

3.91

4.28

0.68

-Basic earnings per ADS

2.09

2.31

0.36

-Diluted earnings per ADS

1.96

2.14

0.34

LUFAX HOLDING LTD

UNAUDITED INTERIM CONDENSED

CONSOLIDATED BALANCE SHEETS

(All amounts in thousands,

except share data, or otherwise noted)

As of December 31,

As of March 31,

2021

2022

RMB

RMB

USD

Assets

Cash at bank

34,743,188

40,556,230

6,397,588

Restricted cash

30,453,539

32,830,158

5,178,830

Financial assets at fair value through

profit or loss

31,023,211

22,411,763

3,535,369

Financial assets at amortized cost

3,784,613

4,135,985

652,436

Financial assets purchased under reverse

repurchase agreements

5,527,177

7,581,474

1,195,948

Accounts and other receivables and

contract assets

22,344,773

20,538,961

3,239,941

Loans to customers

214,972,110

232,924,575

36,742,949

Deferred tax assets

4,873,370

4,045,011

638,085

Property and equipment

380,081

357,891

56,456

Investments accounted for using the equity

method

459,496

459,120

72,424

Intangible assets

899,406

897,482

141,574

Right-of-use assets

804,990

746,276

117,722

Goodwill

8,918,108

8,918,108

1,406,797

Other assets

1,249,424

1,580,305

249,287

Total assets

360,433,486

377,983,339

59,625,406

Liabilities

Payable to platform users

2,747,891

2,374,849

374,623

Borrowings

25,927,417

31,663,352

4,994,771

Current income tax liabilities

8,222,684

7,378,003

1,163,851

Accounts and other payables and contract

liabilities

8,814,255

7,415,382

1,169,748

Payable to investors of consolidated

structured entities

195,446,140

203,756,412

32,141,784

Financial guarantee liabilities

2,697,109

3,340,716

526,985

Deferred tax liabilities

833,694

963,292

151,956

Lease liabilities

794,544

742,462

117,121

Convertible promissory note payable

10,669,498

10,808,448

1,704,991

Optionally convertible promissory

notes

7,405,103

7,493,776

1,182,114

Other liabilities

2,315,948

2,181,685

344,152

Total liabilities

265,874,283

278,118,377

43,872,096

Equity

Share capital

75

75

12

Share premium

33,365,786

33,409,962

5,270,292

Treasury shares

(5,560,104)

(5,642,769)

(890,125)

Other reserves

9,304,995

9,344,200

1,474,011

Retained earnings

55,942,943

61,221,885

9,657,515

Total equity attributable to owners of

the Company

93,053,695

98,333,353

15,511,705

Non-controlling interests

1,505,508

1,531,609

241,605

Total equity

94,559,203

99,864,962

15,753,311

Total liabilities and equity

360,433,486

377,983,339

59,625,406

LUFAX HOLDING LTD

UNAUDITED INTERIM CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(All amounts in thousands,

except share data, or otherwise noted)

Three Months Ended March

31,

2021

2022

RMB

RMB

USD

Net cash generated from/(used in)

operating activities

1,784,388

(1,702,222)

(268,519)

Net cash generated from/(used in)

investing activities

(3,840,244)

6,895,061

1,087,669

Net cash generated from/(used in)

financing activities

1,922,448

(725,147)

(114,389)

Effects of exchange rate changes on cash

and cash

equivalents

23,707

(22,177)

(3,498)

Net increase/(decrease) in cash and cash

equivalents

(109,701)

4,445,515

701,263

Cash and cash equivalents at the beginning

of the

period

23,785,651

26,496,310

4,179,690

Cash and cash equivalents at the end of

the period

23,675,950

30,941,825

4,880,953

1 For the first quarter of 2022 and the same period of 2021, no

Non-IFRS adjustment was made.

2 The take rate of retail credit facilitation business is

calculated by dividing the aggregated amount of retail credit

facilitation service fee, net interest income, guarantee income and

the penalty fees and account management fees by the average

outstanding balance of loans facilitated for each period.

3 Flow rate estimates the percentage of current loans that will

become non-performing at the end of three months, and is defined as

the product of (i) the loan balance that is overdue from 1 to 29

days as a percentage of the total current loan balance of the

previous month, (ii) the loan balance that is overdue from 30 to 59

days as a percentage of the loan balance that was overdue from 1 to

29 days in the previous month, and (iii) the loan balance that is

overdue from 60 to 89 days as a percentage of the loan balance that

was overdue from 30 days to 59 days in the previous month. Loans

from legacy products and consumer finance subsidiary are excluded

from the flow rate calculation.

4 DPD 30+ delinquency rate refers to the outstanding balance of

loans for which any payment is 30 to 179 calendar days past due

divided by the outstanding balance of loans. Loans from legacy

products and consumer finance subsidiary are excluded from the

calculation.

5 DPD 90+ delinquency rate refers to the outstanding balance of

loans for which any payment is 90 to 179 calendar days past due

divided by the outstanding balance of loans. Loans from legacy

products and consumer finance subsidiary are excluded from the

calculation.

6 The take rate for the wealth management business is calculated

by dividing total wealth management transaction and service fees

for current products by average client assets in the Company’s

current products. Part of the wealth management transaction and

service fees do not generate client assets.

7 The liquid assets consist of cash at bank, financial assets at

amortized cost, financial assets purchased under reverse repurchase

agreements and financial assets at fair value through profit or

loss with a maturity of 90 days or less as of March 31, 2022.

8 Platform services are provided by the Company’s platform, and

this income is primarily based on transaction volume.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220525005386/en/

Investor Relations Contact Lufax Holding Ltd Email:

Investor_Relations@lu.com ICR, LLC Robin Yang Tel: +1 (646)

308-0546 Email: lufax.ir@icrinc.com

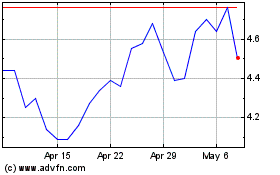

Lufax (NYSE:LU)

Historical Stock Chart

From Jun 2024 to Jul 2024

Lufax (NYSE:LU)

Historical Stock Chart

From Jul 2023 to Jul 2024