SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of November, 2023

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Management Remuneration

Policy

Area responsible for issuing

Executive Vice

Presidency of Governance, Risk and Compliance / Strategic Governance Area

Target Audience

Managers and members

of Statutory Committees of Eletrobras and its companies.

Resolution 194/2023,

of 11/24/2023, of the Board of Directors of Eletrobras.

Eletrobras policies can

be found at: https://eletrobras.com/pt/Paginas/Estatuto-Politicas-e-Manuais.aspx

Copyright and confidentiality

The contents of

this document may not be reproduced without proper authorization. All rights belong to Eletrobras.

Maximum revision

period: 5 years.

|

MANAGEMENT REMUNERATION POLICY |

|

| |

|

|

Table of Contents

| |

3 |

| 1 Objetctive |

4 |

| 2 Principles |

4 |

| 3 Guidelines |

4 |

| 4 Responsibilities |

9 |

| 5 General Provision |

9 |

| 6 Appendix |

10 |

|

MANAGEMENT REMUNERATION POLICY |

|

| |

|

|

This policy is

part of the set of initiatives designed to provide the continuous maturation of Eletrobras' corporate governance system, marked by its

capitalization and privatization process carried out in 2022, and is based on the principles of transparency and accountability, which

prescribe the importance of disclosing the guidelines and main rules applicable to the remuneration of managers, as well as the mechanisms

that ensure alignment between the long-term interests of the company, shareholders, managers and other stakeholders, in line with sustainable

practices that foster the company's continuity and the generation of long-term value.

| MANAGEMENT REMUNERATION POLICY | |

| | | |

1

Objective

1.1 Establish principles

and guidelines to determine the remuneration of the managers of Eletrobras ("Company"), its companies and members of statutory

advisory committees to the Board of Directors of Eletrobras ("Advisory Committees" or "Committees").

1.2 Establish general

guidelines for the participation of managers in stock-based remuneration plans and establish rules for the retention of management remuneration,

resulting from improper payment and/or loss/damage caused to Eletrobras and its companies.

1.3 To provide,

by means of Appendix I to this policy, the specific guidelines and rules for recovery of incentive remuneration that has been erroneously

granted, having been designed to comply with and be interpreted as consistent with Section 10D of the Securities Exchange Act of 1934,

as amended (the "Exchange Act"), Rule 10D-1 promulgated under the Exchange Act ("Rule 10D-1") and Section 303A.14

of the New York Stock Exchange Listed Company Manual.

2

Principles

2.1 Transparent

and clear stance regarding the company's remuneration practices, in line with the principles of ethics, integrity, transparency and accountability.

2.2 Alignment of

management's interests with those of the company, shareholders and other stakeholders, having as main drivers the company's values, purpose

and vision for the future, with a view to generating value and sustainable results in the long term.

2.3 Transparency

and compliance in the annual variable remuneration of executives ("short-term incentives" or "ICP") with compliance

with ESG ("environmental, social and governance") and other goals that are not linked to direct financial metrics.

2.4 Encouraging

a meritocratic and high-performance corporate culture, focusing on good management, mitigating business risks and identifying, attracting,

and retaining talent in the reference markets, through a remuneration model based on best market practices.

3 Guidelines

3.1 General

3.1.1 The company's

remuneration structure is designed with the aim of attracting, retaining and recognizing highly qualified, high-performance professionals

who are aligned with Eletrobras' values, purpose and vision for the future, aligning the managers' behavior and practices with the company's

strategic guidelines and objectives, stimulating Eletrobras' competitive power, prioritizing the generation of long-term sustainable value

and fostering the alignment of the strategic interests of the company, its managers, its shareholders and other stakeholders.

3.1.2 Eletrobras'

remuneration strategy must consider the best remuneration practices in relation to reference markets and companies of equivalent size

and complexity, also taking into account the main challenges and the company's strategic plan.

3.1.3 The Eletrobras

General Meeting ("General Meeting") shall establish the overall amount of remuneration of its managers and members of the statutory

advisory committees, in addition to the individual amount of remuneration of the members of the Fiscal Council, subject to applicable

law.

3.1.4 The Board of

Directors of Eletrobras shall define, with the support of the People Committee, the variable remuneration programs (short and long term

incentives) and set the individual amount of the fixed monthly remuneration due to its members, the members of its statutory advisory

committees and the members of the Executive Board, taking into account the responsibilities, the time dedicated to the functions, the

competence, the professional reputation and the value of its services in the market, observing the global remuneration limit and any

action plans approved by the General Meeting.

| MANAGEMENT REMUNERATION POLICY | |

| | | |

3.1.5 The proposal

for global remuneration must be prepared by the Vice Presidency of People, Management and Culture under the coordination and guidelines

of the People Committee, after hearing the President of the company, for consideration by the Board of Directors of Eletrobras ("Board

of Directors") and subsequent submission to the General Meeting.

3.1.5.1 The People

Committee may count on the support of independent external consultants to support the modeling of the remuneration structure and the formulation

of the global remuneration proposal to be submitted to the General Meeting.

3.1.6 The People Committee,

with the support of the Vice Presidency of People, Management and Culture, will supervise the periodic reassessment of the executive remuneration

structure through research on market practices and trends, and may rely on the support of specialized consultancies, aiming at the continuous

adherence of Eletrobras to the best market practices and the maintenance of its competitive power.

3.1.7 The People Committee

must also supervise, with the support of the Vice Presidency of People, Management and Culture, and the preparation of variable remuneration

programs for managers and the preparation of contracts to be signed with the company's executives.

3.1.8 The managers

and external members of the statutory advisory committees are indirect beneficiaries of the Directors and Officers liability insurance

(D&O), compulsorily included in the policy, the cost of which will be fully borne by the company, pursuant to the Articles of Incorporation.

3.1.9 The company

may enter into indemnity agreements with its managers and external members of the statutory advisory committees, pursuant to the Articles

of Incorporation, in accordance with the Indemnity Policy.

3.2 Board

of Directors of Eletrobras (CA)

3.2.1 The annual

fixed remuneration of the members of the Board of Directors must be composed of 12 monthly installments and will not be linked to the

number of meetings held or the frequency of their participation.

3.2.1.1 The members

of the Board of Directors shall all receive the same level of remuneration. However, the Board of Directors may assign a different remuneration

to the member who is Chairman of the Board of Directors.

| 3.2.2 | The payment of short-term incentives to the members of the Board of Directors is prohibited. |

3.2.3 The members

of the Board of Directors may be entitled, as beneficiaries, to long-term incentives based on stock-based remuneration plans, provided

that the following minimum requirements are met:

| a) | approval of the stock-based remuneration plan and the portion of the associated global remuneration by

the General Meeting; |

| b) | definition of the same long-term incentive level for all members of the Board of Directors, the Board

of Directors being entitled to define a differentiated level for the member who is elected to the position of Chairman of the Board of

Directors; |

| c) | non-binding to specific performance targets; |

| d) | compliance with the full term of office; |

| e) | time shift between the end of the term of office and the effective delivery of the shares and/or fixing

of the period of prohibition to the negotiation ("lock-up") of the shares delivered to the member of the Board of Directors; |

| f) | provision for the cases in which beneficiaries will lose their rights relating to the plan. |

| MANAGEMENT REMUNERATION POLICY | |

| | | |

3.2.4 The setting

of remuneration levels must be in line with market practices, with flexibility to vary as necessary, in order to adequately remunerate

the services of the members of the Board of Directors according to their dedication, the volume of demand, the complexity of the challenges

and according to the spectrum of responsibility attributed to the members of said collegiate body.

3.2.5 The benefits

granted to the members of the Board of Directors are those defined at the Shareholders' General Meeting.

3.2.5.1 The company

shall bear directly, or through reimbursement, all food, transportation and accommodation expenses incurred by a member of the Board of

Directors and necessary for the performance of their duties.

3.2.5.2 The company

will pay, directly or through reimbursement, expenses with training and events of interest to the company, incurred by a member of the

Board of Directors, provided that they are pertinent to the performance of their duties and in compliance with the applicable internal

rules.

3.3 Statutory

advisory committees

3.3.1 The members

of the statutory advisory committees shall be entitled to monthly fees for participation in each committee, with the remunerated participation

of the members of the Board of Directors being limited to two committees.

3.3.2 The remunerated

participation in a second committee shall represent half of the amount attributed to the remuneration of that board member.

3.3.3 The Chairman

of the Board of Directors will only be entitled to remuneration for eventual participation in committees, if his/her remuneration as Chairman

of the Board of Directors is identical to that of the other members of this collegiate board.

3.3.4 The members

of the committees shall not receive differentiated remuneration as a result of their role in coordinating the collegiate body, and it

is forbidden for a member of the Board of Directors to coordinate more than one committee.

3.3.5 The Board

of Directors is entitled to set differentiated remuneration for external members of committees, taking into account the demands of the

company, the degree of responsibility of the position, the time dedicated to the functions, the competence and level of expertise, the

reputation and professional experience and the value of its services in the market.

3.3.6

Committee coordinators should preferably be members of the Board of Directors.

3.3.7 Members of

statutory advisory committees are not entitled to benefits or any type of variable remuneration.

3.3.8 The company

shall bear directly, or by way of reimbursement, the expenses incurred by members of the Committees for food, travel and accommodation

necessary for the performance of their duties.

3.3.9 Participation

in the statutory advisory committees of anyone who is not a Board Member or an independent external member is prohibited.

3.4 Statutory

Executive Board of Eletrobras

3.4.1 The Statutory Executive

Board ("Board" or "Statutory Board") is composed of the Company's President ("President") and up to 15 Vice

President Officers (“Vice Presidents"), all with a statutory relationship with the company (“executives" or "statutory

officers").

3.4.2 Executive

remuneration seeks to reflect the results obtained by the company, as well as individual and collective performance, at levels competitive

with those of the market, and is made up of four elements:

| MANAGEMENT REMUNERATION POLICY | |

| | | |

| a) | fixed remuneration ("fees" or "base salary"); |

| b) | short-term variable remuneration (“short-term incentive”, “bonus” or “ICP”); |

| c) | long-term variable remuneration (“long-term incentive” or “ILP”); and |

3.4.3 The executive

remuneration strategy must be designed to ensure that the ILP is the most important element in the composition of the executive's total

remuneration, followed by the ICP.

3.4.4 In the event

of temporary impediment, leave or vacation of a member of the Executive Board, the substitute who may be appointed from among the other

members of the Executive Board, in accordance with the applicable internal rules, will not be entitled to any supplementation of their

fees.

3.4.5 Fixed remuneration

3.4.5.1 Executive

fees are based on the company's strategic positioning against the market median obtained through salary surveys carried out by specialized

companies, subject to annual adjustments depending on market levels, individual performance and other factors such as executive potential,

specific skills, experience in the function and retention risks.

3.4.5.2 Executive

fees shall be defined annually and shall be paid in 12 monthly installments.

3.4.5.3 The President

and the other Vice President Officers shall be entitled, annually, to 30 days of paid leave, with the prior authorization of the Executive

Board, which may be accumulated up to a maximum of two periods, being prohibited its conversion into cash and indemnity.

3.4.6 Short-Term

Variable Remuneration (“Short-Term Incentive” or “ICP”)

3.4.6.1 The members

of the Executive Board will be entitled to remuneration based on ICP programs, paid through bonuses, which are based on goals for achieving

the company's results, with specific indicators deployed in its Strategic Plan.

3.4.6.2 Each position

of the Executive Board is assigned a multiple that will represent the maximum amount that said executive may perceive as ICP annually,

which may be increased by a predetermined percentage if the triggers for exceeding their goals are met.

3.4.6.3 The payment

of the ICP installment, linked to financial metrics, must occur after the approval of the accounts of the respective fiscal year by the

Annual General Meeting ("AGM").

3.4.6.4 In cases

where, due to their date of appointment, the executive contributes only partially to the results of the fiscal year, an amount proportional

to the actual length of service in the respective fiscal year must be paid when paying the other elected officials, provided that they

took office before the last four months of the year.

3.4.7 Long-Term Variable Remuneration

(“Long-Term Incentive” or “ILP”)

3.4.7.1 The ILP

component of executive remuneration shall be based on Share Plan(s) and Program(s).

3.4.7.2 Together

with this policy, the stock-based remuneration plans approved at the 184th Extraordinary General Meeting held on 12/22/2022 must be observed,

namely: (i) Stock Option-Based Remuneration Plan ("Option Plan" or "Stock Option Plan") and (ii) Restricted Stock-Based

Remuneration Plan ("Restricted Stock Plan").

3.4.7.3 The Restricted

Stock Plan consists of the granting of rights to transfer shares of the company, respecting the rules of terms and other conditions previously

approved by the shareholders at the General Meeting.

| MANAGEMENT REMUNERATION POLICY | |

| | | |

3.4.7.3.1 If the

executive voluntarily or involuntarily resigns from the company, he/she will lose, as from the date of resignation, the right to receive

the Restricted Stock of the remaining time frames and, as a consequence, the company will be unable to transfer ownership of the corresponding

Restricted Stock to him/her.

3.4.7.4 The Option

Plan consists of the granting of rights to purchase shares of the company, respecting the rules of prices, terms and other conditions

previously approved by the shareholders at the General Meeting and covered in the program approved by the Board of Directors.

3.4.7.4.1 If the

executive voluntarily or involuntarily leaves the company before completing the grace period between the grant date and the date from

which the options will be mature and, therefore, able to be exercised ("Maturity Term"), he/she will lose his/her rights to

the Option Plan.

3.4.7.5 In addition

to the plans mentioned in item 3.4.7.2, the Board of Directors may, whenever deemed necessary, propose to the General Meeting new models

of stock-based remuneration plans.

3.4.8 Benefits

3.4.8.1 The executives

will be entitled to direct and indirect benefits, under the terms established by the Board of Directors and subject to the general guidelines

established by the General Meeting, in order to contribute to their quality of life and to attract and retain talent.

3.4.8.2 The executives

will have the benefits of supplementary pension, life insurance and health care, under the terms and conditions established by the Board

of Directors.

3.5 General

Compensatory Rules (“malus rule”)

3.5.1 The Board

of Directors, with the support of the People Committee and the Legal Affairs Support Committee, may resolve on the application of a malus

rule against executives, with the reduction and/or extinction of remuneration credits that may be due by the company to executives,

in the case of events and/or facts with impacts on the market value and/or reputation and/or equity of the company, in order to compensate,

partially or totally, losses and/or damages against the company.

3.5.2 In the event

of any determination of executive liability, the Board of Directors may decide, as a precautionary measure, to suspend the payment of

ICP and ILP to the respective executives, until the calculation process is completed.

3.5.3 Failure by

the executive or former executive to comply with the established confidentiality rules and/or the non-competition and non-solicitation

rules will subject the executive / former executive to penalties and the loss of all their benefits and/or remuneration installments that

may be due by the company.

3.5.4 The company's

executives and former executives are also subject to the general indemnity rules and the specific conditions for recovery of remuneration

incentive granted erroneously ("clawback") according to Appendix I of this policy.

3.5.5 All executives

of Eletrobras and its subsidiaries, including those already elected and/or sworn in at the time of approval of this policy, must sign

a specific term of adherence to this policy, according to Appendix II of this policy.

4 Responsibilities

4.1 People

Committee

4.1.1 Advise the

Board of Directors on matters related to remuneration, following the main practices, trends, market conditions, the competitive environment

and the relativity of remuneration.

| MANAGEMENT REMUNERATION POLICY | |

| | | |

4.1.2 Propose to

the Board of Directors periodic reviews of the modeling of the remuneration of Eletrobras' managers and general guidelines for the remuneration

of subsidiaries, with the support of the Vice Presidency of People, Management and Culture.

4.1.3 Propose periodic

reviews of this policy to the Board of Directors, taking into account the best remuneration practices in the global reference markets

and the alignment of the interests of the managers with those of the company, shareholders and other stakeholders.

4.1.4 Support the

Board of Directors in structuring global and individual remuneration proposals and stock-based remuneration plans and/or programs.

4.1.5 Support the

Board of Directors in the definition and determination of executive goals and in the management of ICP and ILP programs.

4.2 Board of Directors

4.2.1 Implement,

supervise and periodically review this policy, evaluating the alignment of the content with market practices, in order to identify significant

discrepancies with respect to similar companies.

4.2.2 Formulate

the proposal for the global annual remuneration of the managers, committees and members of the audit committee, to be submitted for approval

by the Shareholders' General Meeting.

4.2.3 Approve short

and long-term incentive programs and set the individual amount of monthly remuneration due to its members, members of its statutory advisory

committees and members of the Executive Board, taking into account responsibilities, time dedicated to functions, competence, professional

reputation and the value of its services in the market, subject to the overall remuneration limit and any action plans approved by the

General Meeting.

4.3

Vice Presidency of People, Management and Culture

4.3.1 Support the

People Committee (CPES) in the design of the programs and individual remuneration levels of the Executive Board, based on the current

remuneration guidelines, and be able to count on the support of specialized external consultancies, according to guidelines established

by the CPES.

4.3.2 Take into

account, in the design of its proposals, the company's results in the previous year, individual performance, market remuneration surveys

and other aspects such as retention risks, skills and knowledge, experience and potential of each executive.

4.3.3 To assess

with the company's President the strategic alignment of the design of the proposals for the remuneration of the members of the Executive

Board.

5 General

Provisions

5.1 None of the

provisions contained in this policy shall be construed as creating rights for the company's executives, or as granting the right to remain

as a manager or committee member, or as interfering in any way with the company's right to terminate the relationship with any person

at any time, under the conditions provided by law, in the articles of incorporation and in the employment contract.

5.2 This policy

may be revised by resolution of the Board of Directors, especially in the event of a material change in the laws or regulations applicable

to the company.

5.3 Omitted cases

will be decided by the Board of Directors, with the support of the People Committee.

| MANAGEMENT REMUNERATION POLICY | |

| | | |

5.4 The Executive

Board of Eletrobras will define the remuneration structure of the managers of the companies controlled by Eletrobras, subject to the general

strategic guidelines established by the Board of Directors with the support of the People Committee.

5.5 In the exceptional

event that a member of the Board of Directors accumulates a position on the Executive Board, the remuneration will be due only due to

the performance as an executive, without prejudice to the legal prohibition contained in art. 138, §3, of Law No. 6.404/76, and the

Chairman of the Board of Directors is also prohibited from accumulating a position on the Executive Board.

5.6 If the Fiscal

Council is installed, its members must receive a fixed monthly fee, on bases defined by the General Meeting, totaling 12 installments

in the year, respecting the legal minimum limit.

5.6.1 The

members of the Fiscal Council are not entitled to benefits and variable portion.

5.6.2 The members

of the Fiscal Council, as provided for in its Internal Regulations, will be reimbursed, by the company, for the expenses with food, transportation

and accommodation necessary for the performance of their duties.

5.6.3 In case of

vacancy, resignation, impediment or unjustified absence to two consecutive meetings or three interspersed meetings, of 12 meetings, the

member of the fiscal council must be replaced, until the end of the term of office, by the respective alternate, being responsible for

the respective remuneration.

5.7 The provisions

of this policy apply, as applicable, to the executives of Eletrobras' subsidiaries.

5.8 The relevant

legislation and the company's specific legal provisions and agreements must be observed.

5.9 Situations

not provided for in this policy must be analyzed by the Vice Presidencies involved, being justified by a technical note. The conclusions

must be ratified by Eletrobras' Board of Directors, subject to the provisions of current legislation and Eletrobras' Articles of Incorporation.

5.10 In order to meet

the specificities of each process, this policy can be broken down into other specific normative documents, always in line with the principles

and guidelines established herein.

5.11 The normative

documents and provisions contrary to this policy are revoked, in particular the Regulation on the Remuneration of Members of the Executive

Board, Boards of Directors and Fiscal Councils and Statutory Committees of Eletrobras Companies (REG-23), edition 1.0, approved by Resolution

RES-373/2021, of 05/31/2021, of the Executive Board of Eletrobras and by Resolution DEL-125/2021, of 06/17/2021, of the Board of Directors

of Eletrobras.

6

Appendices

Appendix I –

Recovery Relating to Incentive Remuneration Received Erroneously.

Appendix II –

Term of Adhesion to the Management Remuneration Policy and its Appendix I – Recovery Relating to Incentive Remuneration Received

Erroneously.

| MANAGEMENT REMUNERATION POLICY | |

| | | |

Appendix

– I

RECOVERY RELATING

TO INCENTIVE REMUNERATION RECEIVED ERRONEOUSLY.

1 Introduction

1.1 This Recovery

Appendix provides for the recovery of incentive remuneration that was wrongly granted and was designed to comply with and will be construed

as consistent with Section 10D of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), Rule 10D-1 promulgated

under the Exchange Act ("Rule 10D-1"), and Section 303A.14 of the New York Stock Exchange Listed Company Manual.

1.2 This Appendix

is applicable to all current and former managing directors. An executive officer is the President of the Company, chief financial officer,

chief accounting officer, any Vice President of the company responsible for a business unit, division, or primary function (such as sales,

management, or finance), any other officer exercising a policymaking function, or any person exercising similar policymaking functions

for the company. The executive officers of the company's subsidiaries are also considered executive officers of the company.

2 Definitions

The terms used

in this Appendix have the following meanings.

2.1 "Code"

– Internal Revenue Code of the United States of 1986, and its updates.

2.2 "Company"

– Centrais Elétricas Brasileiras S/A – Eletrobras.

2.3 "Board

of Directors" – Board of Directors of the company.

2.4 "Date

on which the company is required to prepare an accounting correction" – the earliest date between (a) the date on which

the Board of Directors or the Audit and Risk Committee concludes, or reasonably should have concluded, that the company is required to

prepare an accounting correction, or (b) the date on which a court, regulator or other legally authorized body requires the company to

prepare an accounting correction; in either case, regardless of whether or when any corrected financial statements are filed with the

SEC.

2.5 "Executive

Officer" – any executive officer of the company, as defined in Rule 10D-1 and the NYSE Listing Standards, as they

may be amended from time to time.

2.6 "Covered

Officer" – any member of the Executive Board of the company who holds or has held office as a member of the Executive

Board.

2.7 "Recovery

Manager" – person, committee or other body designated by the Board of Directors to administer this Recovery Appendix.

If the Board of Directors decides to assign the role of Recovery Manager to a committee, its composition must be exclusive of independent

members. If the Board of Directors decides to assign the role of Recovery Manager to only one person, this person must be an independent

member.

2.8 "Financial

Disclosure Measure" – any measure that is determined and presented in accordance with the accounting principles

used in the preparation of the company's financial statements, and any measure that is derived in whole or in part from such measure.

The stock price and TSR are also financial disclosure measures. The measure in question does not need to be reported in the company's

financial statements or included in a filing with the SEC to be considered a financial disclosure measure.

2.9 "NYSE"

– New York Stock Exchange.

2.10 “Listing

Standards” – listing standards promulgated by the NYSE.

2.11 "Applicable

Period"– period consisting of three fiscal years completed immediately before the date on which the company is required

to prepare an accounting correction, as well as any transition period (which results from a change in the company's fiscal year) within

or immediately after these three fiscal years completed (except in cases where a transition period comprising a period of at least nine

months counts as a full fiscal year).

| MANAGEMENT REMUNERATION POLICY | |

| | | |

2.12 “Received”

or “Receipt” – with respect to any incentive-based remuneration, the actual or assumed receipt of, and incentive-based

remuneration shall be treated as received in, the fiscal period of the corporation during which the measure of financial disclosure specified

in the grant of the incentive-based remuneration is achieved, even if the payment or grant of the incentive-based remuneration to the

executive officer occurs after the expiration of that period.

2.13 "Incentive-Based

Remuneration" – any remuneration granted, obtained or acquired based, in whole or in part, on the achievement of

a financial disclosure measure.

2.14 “Erroneously

Awarded Remuneration” – difference, if any, between the incentive-based remuneration that was received by a covered

executive and the amount of incentive-based remuneration that would have been received if remuneration had been determined based on the

amounts restated (determined without taking into account any taxes paid or withheld in relation to incentive-based remuneration).

2.15 "Accounting

Correction" – rectification of the company's financial statements arising from a material failure by the company

to comply with any financial disclosure requirement under securities legislation, including any accounting correction necessary to correct

a material error in the previously issued financial statements, or which would result in a material misstatement if the error were corrected

in the current period or left uncorrected in the current period.

2.16

"SEC" – United States Securities and Exchange Commission.

2.17 "Section

409A" – Section 409A of the Code and the Treasury Regulations promulgated under said section.

2.18 "TSR"

– total shareholder return.

3 Application

of Recovery

3.1 This appendix

applies to any incentive-based remuneration received by an officer on or after November 24, 2023.

3.2 This appendix

applies only to incentive-based remuneration that has been received while the company has a class of securities listed on the NYSE.

4 Recovery Trigger

4.1 The company

will promptly recover, in a reasonable manner, the amount of any erroneously granted remuneration that was received by any covered officer

during the applicable period, when the company is required to prepare an accounting correction. The obligation to recover does not depend

on whether or when the amended financial statements are presented. The recovery manager shall determine the timing and method for recovery.

5 Determination of Wrongly Granted

Remuneration

5.1 The recovery

manager shall determine, at their sole discretion, any amounts of wrongly granted remuneration.

5.2 If the erroneously

granted remuneration was based, in whole or in part, on obtaining a share price or TSR, and it is not possible to determine the amount

of the erroneously granted remuneration directly by mathematical recalculation based on the accounting correction, the recovery manager

must determine the amount of the erroneously granted remuneration based on a reasonable estimate of the effect of the accounting correction

on the share price or TSR upon which the incentive-based remuneration was received. The recovery manager may, at its discretion and at

the expense of the company, hire consultants and experts to support the definition of any decision-making provided for herein.

| MANAGEMENT REMUNERATION POLICY | |

| | | |

5.3 The recovery

manager will document the determination of any reasonable estimates used to determine the wrongly awarded remuneration and provide such

documentation to the NYSE.

6 Notices to the Executive Officer

6.1 The recovery manager

shall:

6.1.1 Determine,

in its sole discretion, the amount of any wrongly awarded remuneration that has been received by each current and former executive officer.

6.1.2 Promptly

notify each of the current and former executive officers of the amount of any wrongly awarded remuneration; and

6.1.3 Demand reimbursement,

return and/or loss of such erroneously granted remuneration, as applicable.

7 Recovery method

7.1 The recovery manager

shall have discretion to determine the appropriate means for recovery of wrongly awarded remuneration based on the specific facts and

circumstances.

7.2 The recovery manager

may, at its sole discretion:

7.2.1

Seek repayment in whole or in part of any cash awards or stock-based remuneration;

7.2.2 Cancel previous

awards in cash or stock-based remuneration, whether vested or unvested, paid or unpaid;

7.2.3 Cancel or

set off against any planned future cash awards or stock-based remuneration;

7.2.4 Forfeit the

deferred indemnity, subject to compliance with Section 409A; or

7.2.5 Use any other

method authorized by applicable law or contract.

8 Exceptions to recovery

8.1 Wrongly granted

remuneration need not be recovered if the recovery manager determines that recovery would be impractical and one or more of the following

limited conditions apply:

8.1.1 The expenses

incurred in using a third party to assist in enforcing the terms of this Appendix would exceed the amount to be recovered. Before concluding

that it would be unfeasible to recover any amount of wrongly awarded remuneration based on such expenses, the recovery manager shall make

a reasonable attempt to recover such wrongly awarded remuneration by documenting the attempt and providing such documentation to the NYSE.

8.1.2 Recovery

would violate Brazilian law, provided that such law was adopted before November 28th, 2022. Before concluding that it would be unfeasible

to recover any amount of wrongly awarded remuneration based on a violation of Brazilian law, the recovery manager shall comply with the

applicable opinion and disclosure requirements of Rule 10D-1 and Listing Standards; or

8.1.3 Recovery

would likely cause a qualified plan under Code Section 401(a) not to comply with the requirements of Code Section 401(a)(13) or Code Section

411(a) and the regulations promulgated thereby.

9

Prohibition on indemnification

9.1 Regardless

of the terms of any indemnity policy or insurance policy or any contractual agreement with any covered officer, to the contrary, the

company may not indemnify any covered officers for losses of any erroneously granted remuneration, including any payment or reimbursement

of third party insurance costs acquired by any covered officers to fund possible recovery obligations under this Recovery Appendix.

| MANAGEMENT REMUNERATION POLICY | |

| | | |

10 SEC Disclosure

10.1 The company

will file all disclosures related to this Recovery Appendix required by any applicable SEC rules.

11 Administration of the Recovery

Appendix

11.1 This Recovery

Appendix will be administered by the recovery manager, and any determinations made by the recovery manager will be final and binding on

all affected individuals.

11.2 The recovery

manager is authorized to interpret this Recovery Appendix and to make all determinations necessary, appropriate or advisable for the administration

of this Recovery Appendix and for the company's compliance with the Listing Standards, Section 10D, Rule 10D-1 and any other applicable

law, regulation, rule or interpretation promulgated or issued in connection with the Recovery Appendix.

11.3 Except to

the extent prohibited by applicable law or the Listing Standards, the recovery manager, where it is a collegiate body, may delegate all

or part of its responsibility and power to any one or more of its members. The Recovery Manager may further delegate all or part of its

responsibility and power to any person or persons it selects. Any such assignment or delegation may be revoked by the recovery manager

at any time. Without prejudice to the generality of the foregoing, the recovery manager may delegate to one or more officers of the company

the authority to act on its behalf with respect to any matter, right, obligation or election which is the responsibility of or assigned

to it in this Recovery Policy, and which may be delegated by operation of law and in accordance with the Listing Standards.

12 Amendment and Repeal

12.1 The Board

of Directors may amend this Recovery Appendix from time to time at its discretion and shall amend this Recovery Appendix as it deems necessary.

Notwithstanding anything to the contrary, no amendment or repeal of this Recovery Appendix shall be effective if such amendment or repeal

(after considering any actions taken by the company concurrently with such amendment or repeal) would cause the company to violate any

securities laws or the Listing Standards.

13 Other recovery rights

13.1 This Recovery Appendix

shall be binding upon and enforceable against all executive officers and, to the extent required by applicable law or direction of the

SEC or the NYSE, their beneficiaries, heirs, executors, administrators or other legal representatives. The recovery manager intends that

this Recovery Appendix be enforced to the maximum extent required by applicable law. Any employment agreement, equity award agreement,

remuneration plan or any other agreement or arrangement with an executive officer shall include, as a condition to the granting of any

benefit provided for therein, an undertaking by the executive officer to comply with the terms of this Recovery Appendix. Any right of

recovery under this Recovery Appendix is in addition to, and does not replace, any other remedies or rights of recovery that may be available

to the company under applicable law, regulation or rule or pursuant to the terms of any company policy or any provision in any employment

agreement, equity award agreement, remuneration plan, contract or other agreement.

| MANAGEMENT REMUNERATION POLICY | |

| | | |

Appendix

– II

Term of Adhesion to the Management

Remuneration Policy and its Appendix I – Recovery Relating to Incentive Remuneration Received Erroneously.

[Name], [Identity],

[CPF], domiciled at [address, neighborhood, zip code, city], [position], manifest, unrestricted and irrevocably, adherence to the Management

Remuneration Policy and its Appendix I – Recovery Relating to Incentive Remuneration Received Erroneously, "Recovery Appendix",

declaring to know and agree with its terms, as well as signing the commitment to comply with the provisions therein.

signature

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: November 28, 2023

| CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS |

| |

|

|

| By: |

/S/ Eduardo Haiama

|

|

| |

Eduardo Haiama

Vice-President of Finance and Investor Relations |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

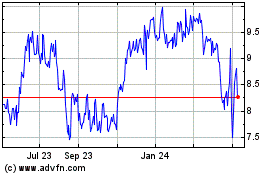

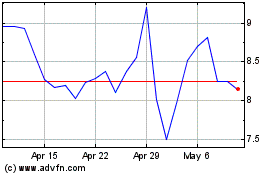

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

From Sep 2024 to Oct 2024

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

From Oct 2023 to Oct 2024