false

0001707910

0001707910

2023-11-28

2023-11-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): November 28, 2023

| REBORN COFFEE, INC. |

| (Exact

name of registrant as specified in its charter) |

| Delaware |

|

001-41479 |

|

47-4752305 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 580 N. Berry Street, Brea, CA |

|

92821 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(714)

784-6369

(Registrant’s

telephone number)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Securities Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, $0.0001 par value per share |

|

REBN |

|

The

Nasdaq Stock Market LLC (Nasdaq Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement

As

previously reported, on June 1, 2023, Reborn Global Holdings, Inc., a California corporation and subsidiary of Reborn Coffee, Inc., a

Delaware corporation (the “Company”) entered into a debt agreement (the “Loan Note”) with DRE, Inc, a Illinois

corporation (“DRE”). DRE is owned and controlled by Dennis Egidi who is Vice Chairman of the Company’s Board of Directors

(the “Board”).

On

November 28, 2023, the Company entered into an exchange agreement (the “Exchange Agreement”) with DRE. Pursuant to the Exchange

Agreement, HNRA agreed to exchange, in consideration of surrender and termination of the Loan Note , with an outstanding balance (including

interest accrued thereon) of $1,000,000, for 1,666,667 shares of common stock, par value $0.0001 per share, of the Company (“Common

Stock”) at a price per share equal to $0.60 per share (the “Exchange Shares”). Pursuant to the Exchange Agreement,

the Company also granted to DRE piggyback registration rights with regard to the Exchange Shares.

The

foregoing summary of the Exchange Agreement is qualified in its entirety by reference to the text of the Exchange Agreement, which is

filed hereto as Exhibit 10.1, and is incorporated herein by reference.

Item 3.02

Unregistered Sales of Equity Securities

The

information disclosed under Item 1.01 of this Report is incorporated into this Item 3.02 to the extent required herein. The Company issued

the Exchange Shares in reliance upon the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended

(the “Securities Act”), Rule 506(b) of Regulation D promulgated thereunder, and/or Section 3(a)(9) of the Securities Act.

Item

9.01. Financial Statements and Exhibits

(d)

Exhibits

The

following exhibits are being filed herewith:

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

November 29, 2023

| |

REBORN

COFFEE, INC. |

| |

|

|

| |

By: |

/s/

Jay Kim |

| |

Name:

|

Jay

Kim |

| |

Title: |

Chief

Executive Officer |

Exhibit

10.1

EXCHANGE

AGREEMENT

THIS

EXCHANGE AGREEMENT (the “Agreement”), dated as of November 28, 2023, is entered into by and between Reborn Coffee, Inc.,

a Delaware corporation (the “Company”) and DRE, Inc., an Illinois corporation (the “Holder”). As used herein,

the term “Parties” shall be used to refer to the Company and Holder jointly.

RECITALS:

A. Holder is in possession of line of credit note dated June 1, 2023, attached hereto as Exhibit

A (the “Note”).

B. The

Parties desire to exchange One Million Dollars ($1,000,000) out of the combined amount of the principal and accumulated interest due

under the Note for 1,666,667 shares of common stock of the Company, par value $0.0001 per share, at a price per share equal to $0.60

per share (the “Exchange Shares”).

NOW

THEREFORE THE PARTIES AGREE AS FOLLOWS:

1.00

Exchange of Note. The Parties agree that, upon the execution of this Agreement, the Holder shall surrender Note for

termination, and in consideration of the surrender and termination of the Note, the Company shall issue to the Holder, and the Holder

shall acquire from the Company, the Exchange Shares.

2.00 Piggyback

Registration Rights.

2.01 Piggyback

Registration Rights. The Company will notify the Holder in writing at least thirty (30) days prior to filing any registration statement

under the Securities Act of 1933, as amended (the “Securities Act”) for purposes of effecting a public offering of securities

of the Company (including, but not limited to, registration statements relating to secondary offerings of securities of the Company,

but excluding registration statements relating to any demand or Form S-3 registration or to any employee benefit plan or a corporate

reorganization) and will afford the Holder an opportunity to include in such registration statement all or any part of the Exchange Shares

then held by the Holder. The Holder, if they desire to include in any such registration statement all or any part of the Exchange Shares

held by the Holder will, within twenty (20) days after receipt of the above-described notice from the Company, so notify the Company

in writing, and in such notice will inform the Company of the number of Exchange Shares such Holder wishes to include in such registration

statement. If the Holder decides not to include all of its Exchange Shares in any registration statement thereafter filed by the Company,

such Holder will nevertheless continue to have the right to include any Exchange Shares in any subsequent registration statement or registration

statements as may be filed by the Company with respect to offerings of its securities, all upon the terms and conditions set forth herein.

2.02 Underwriting.

If a registration statement under which the Company gives notice under Section 2.01 is for an underwritten offering, then the

Company will so advise the Holder. In such event, the right of any of the Holder’s Exchange Shares to be included in a registration

pursuant to Section 2.01 will be conditioned the such Holder’s participation in such underwriting and the inclusion of the Holder’s

Exchange Shares in the underwriting to the extent provided herein. The Holder, if proposing to distribute their Exchange Shares through

such underwriting, will enter into an underwriting agreement in customary form with the managing underwriter or underwriter(s) selected

for such underwriting. Notwithstanding any other provision of this Agreement, if the managing underwriter(s) determine(s) in good faith

that marketing factors require a limitation of the number of shares to be underwritten, then the managing underwriter(s) may exclude

shares (including Exchange Shares) from the registration and the underwriting, and the number of shares that may be included in the registration

and the underwriting will be allocated, first, to the Company, and second, to the Holder, if requesting inclusion of their Exchange Shares

in such registration statement. If the Holder disapproves of the terms of any such underwriting, the Holder may elect to withdraw therefrom

by written notice to the Company and the underwriter, delivered at least ten (10) business days prior to the effective date of the

registration statement. Any Exchange Shares excluded or withdrawn from such underwriting will be excluded and withdrawn from the registration.

2.03

Furnish Information. It will be a condition precedent to the obligations of the Company to take any action pursuant

to Section this Section 2.00 hereof that the Holder will furnish to the Company such information regarding themselves, the Exchange

Shares held by them and the intended method of disposition of such securities as will be required to timely effect the registration of

their Exchange Shares.

2.04 Delay

of Registration. The Holder will have no right to obtain or seek an injunction restraining or otherwise delaying

any such registration as the result of any controversy that might arise with respect to the interpretation or implementation of this

Section 2.00.

3.00 Representations

of the Company. The Company hereby represents and warrants to the Holder that:

3.01 Organization

and Corporate Power. The Company is a corporation, which is duly organized, validly existing and in good standing under the laws

of Delaware and is qualified to do business in every jurisdiction in which its ownership of property or conduct of business requires

it to qualify. The Company has all requisite power and authority and all material licenses, permits and authorizations necessary to own

and operate its properties and to carry on its business as now conducted and presently proposed to be conducted, and all requisite power

and authority to carry out the transactions contemplated by this Agreement.

3.02 No

Conflicts. The execution, delivery and performance of this Agreement and the consummation by the Company of the transactions contemplated

hereby do not violate, conflict with or constitute a default under (i) the Certificate of Incorporation or Bylaws of the Company, (ii)

any agreement, indenture or instrument to which the Company is a party, or (iii) any law, statute, rule or regulation to which the Company

is subject, or any agreement, order, judgment or decree to which the Company is subject.

3.03 Title

to Exchange Shares. Upon issuance in accordance with

the terms hereof, the Holder will have or receive good title to the Exchange Shares, free and clear of all liens, claims and encumbrances

of any kind, other than (a) transfer restrictions hereunder and other agreements to which the Exchange Shares may be subject which have

been notified to the Holder in writing, (b) transfer restrictions under federal and state securities laws, and (c) liens, claims or encumbrances

imposed due to the actions of the Holder.

3.04 No

Adverse Actions. There are no actions, suits, investigations

or proceedings pending, threatened against or affecting the Company which: (i) seek to restrain, enjoin, prevent the consummation of or

otherwise affect the transactions contemplated by this Agreement or (ii) question the validity or legality of any transactions contemplated

by this Agreement or seeks to recover damages or to obtain other relief in connection with such transactions.

4.00 Representations

of the Holder. As a material inducement to the Company to enter into this Agreement, the Holder hereby represents and warrants to

the Company and agrees with the Company as follows:

4.01 No

Government Recommendation or Approval. The Holder understands that no federal or state agency has passed upon or made any recommendation

or endorsement of the offering of the Exchange Shares.

4.02 No Conflicts.

The execution, delivery and performance of this Agreement and the consummation by Holder of the transactions contemplated hereby do not

violate, conflict with or constitute a default under (i) the formation and governing documents of Holder, if applicable, (ii) any agreement,

indenture or instrument to which Holder is a party or (iii) any law, statute, rule or regulation to which Holder is subject, or any agreement,

order, judgment or decree to which Holder is subject.

4.03 Organization

and Authority. The Holder possesses all requisite power and authority necessary to carry out the transactions contemplated by this

Agreement. Upon execution and delivery by Holder, this Agreement is a legal, valid and binding agreement Holder, enforceable against Holder

in accordance with its terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, fraudulent conveyance

or similar laws affecting the enforcement of creditors’ rights generally and subject to general principles of equity (regardless

of whether enforcement is sought in a proceeding at law or in equity).

4.04 Experience,

Financial Capability and Suitability. Holder is: (i) sophisticated in financial matters and is able to evaluate the risks and benefits

of the investment in the Exchange Shares and (ii) able to bear the economic risk of its investment in the Exchange Shares for an indefinite

period of time because the Exchange Shares have not been registered under the Securities Act and therefore cannot be sold unless subsequently

registered under the Securities Act or an exemption from such registration is available. Holder is capable of evaluating the merits and

risks of its investment in the Company and has the capacity to protect its own interests. Holder must bear the economic risk of this investment

until the Exchange Shares are sold pursuant to: (i) an effective registration statement under the Securities Act or (ii) an exemption

from registration available with respect to such sale. Holder is able to bear the economic risks of an investment in the Exchange Shares

and to afford a complete loss of such Holder’s investment in the Exchange Shares.

4.05 Accredited

Investor. Holder represents that it is an “accredited investor” as such term is defined in Rule 501(a) of Regulation D

under the Securities Act and acknowledges the sale contemplated hereby is being made in reliance on a private placement exemption to “accredited

investors” within the meaning of Section 501(a) of Regulation D under the Securities Act or similar exemptions under state law.

4.06 Investment

Purposes. Holder is acquiring the Exchange Shares solely for investment purposes, for Holder’s own account and not for the account

or benefit of any other person, and not with a view towards the distribution or dissemination thereof. Holder did not decide to enter

into this Agreement as a result of any general solicitation or general advertising within the meaning of Rule 502 under the Securities

Act.

4.07 Restrictions

on Transfer. Holder understands the Exchange Shares are being offered and issued in a transaction not involving a public offering

within the meaning of the Securities Act (including, without limitation, Section 4(a)(2) and/or Regulation 506(b)). Holder understands

the Exchange Shares will be “restricted securities” within the meaning of Rule 144(a)(3) under the Securities Act, and Holder

understands that the certificates or book-entries representing the Exchange Shares will contain a legend in respect of such restrictions.

If in the future Holder decides to offer, resell, pledge or otherwise transfer the Exchange Shares, such Exchange Shares may be offered,

resold, pledged or otherwise transferred only pursuant to: (i) registration under the Securities Act, or (ii) an available exemption

from registration. Holder agrees that if any transfer of its Exchange Shares or any interest therein is proposed to be made, as a condition

precedent to any such transfer, Holder may be required to deliver to the Company an opinion of counsel satisfactory to the Company. Absent

registration or an exemption, Holder agrees not to resell the Exchange Shares.

4.08 No

Governmental Consents. No governmental, administrative or other third party consents or approvals are required, necessary or appropriate

on the part of Holder in connection with the transactions contemplated by this Agreement.

4.09 No

Bad Actor. Holder hereby represents that none of the “Bad Actor” disqualifying events described in Rule 506(d)(1)(i) to

(viii) under the Securities Act (a “Disqualification Event”) is applicable to Holder or any of its Rule 506(d) Related Parties

(as defined below), except, if applicable, for a Disqualification Event as to which Rule 506(d)(2)(ii) or (iii) or (d)(3) is applicable.

Holder hereby agrees that it shall notify the Company promptly in writing in the event a Disqualification Event becomes applicable to

Holder or any of its Rule 506(d) Related Parties, except, if applicable, for a Disqualification Event as to which Rule 506(d)(2)(ii) or

(iii) or (d)(3) is applicable. For purposes of this paragraph, “Rule 506(d) Related Party” shall mean a person or entity that

is a beneficial owner of the Holder’s securities for purposes of Rule 506(d) of the Act.

4.10 Anti-Terrorism.

Holder is not an individual, corporation, partnership, joint venture, association, joint stock company, trust, trustee, estate, company,

unincorporated organization, real estate investment trust, government or any agency or political subdivision thereof, or any other form

of entity (“Person”) with whom a United States citizen, entity organized under the laws of the United States or its territories

or entity having its principal place of business within the United States or any of its territories (collectively, a “U.S. Person”),

is prohibited from transacting business of the type contemplated by this Agreement, whether such prohibition arises under United States

law, regulation, executive orders and lists published by the Office of Foreign Assets Control, Department of the Treasury (“OFAC”)

(including those executive orders and lists published by OFAC with respect to Persons that have been designated by executive order or

by the sanction regulations of OFAC as Persons with whom U.S. Persons may not transact business or must limit their interactions to types

approved by OFAC, such Persons, “Specially Designated Nationals and Blocked Persons”) or otherwise. Neither Holder nor any

Person who owns an interest in Holder is a Person with whom a U.S. Person, including a United States financial institution as defined

in 31 U.S.C. 5312, as periodically amended, is prohibited from transacting business of the type contemplated by this Agreement, whether

such prohibition arises under United States law, regulation, executive orders and lists published by OFAC (including those executive orders

and lists published by OFAC with respect to Specially Designated Nationals and Blocked Persons) or otherwise.

4.11 Accredited

Investor Verification. Upon request by the Company, Holder shall deliver to the Company a letter from its legal counsel verifying

its status as an accredited investor as such term is defined in Rule 501(a) of Regulation D under the Securities Act, and such letter

to be made in a form acceptable to the Company and its counsel.

4.12 Sophistication. The

Holder warrants and represents that it is sophisticated and experienced in acquiring the securities of small public companies that has

allowed it to evaluate the risks and uncertainties involved in acquiring said securities and thereby make an informed investment decision.

5.00 Restrictions

on Transfer.

5.01 Securities

Law Restrictions. Holder agrees not to sell, transfer, pledge, hypothecate or otherwise dispose of all or any part of the Exchange

Shares unless, prior thereto (a) such Holder received prior written consent of the Company, (b) a registration statement on the appropriate

form under the Securities Act and applicable state securities laws with respect to the Exchange Shares proposed to be transferred shall

then be effective or (c) the Company has received an opinion from counsel reasonably satisfactory to the Company, that such registration

is not required because such transaction is exempt from registration under the Securities Act and the rules promulgated by the Securities

and Exchange Commission thereunder and with all applicable state securities laws.

5.02 Restrictive

Legends. Any certificates representing the Securities shall have endorsed thereon legends substantially as follows:

“THE SECURITIES REPRESENTED HEREBY HAVE NOT

BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR ANY STATE SECURITIES LAWS AND NEITHER THE SECURITIES NOR ANY INTEREST

THEREIN MAY BE OFFERED, SOLD, TRANSFERRED, PLEDGED OR OTHERWISE DISPOSED OF EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER

SUCH ACT OR SUCH LAWS OR AN EXEMPTION FROM REGISTRATION UNDER SUCH ACT AND SUCH LAWS WHICH, IN THE OPINION OF COUNSEL, IS AVAILABLE.”

6.00 Miscellaneous.

6.01 Counterparts.

This Agreement may be executed in two or more counterparts and by facsimile signature, delivery of PDF images of executed signature

pages by email or otherwise, and each of such counterparts shall be deemed an original and all of such counterparts together shall constitute

one and the same agreement.

6.02 Effect

of Invalidity. If any provision of this Agreement is prohibited by law or otherwise determined to be invalid or unenforceable by a

court of competent jurisdiction, the provision that would otherwise be prohibited, invalid or unenforceable shall be deemed amended to

apply to the broadest extent that it would be valid and enforceable, and the invalidity or unenforceability of such provision shall not

affect the validity of the remaining provisions of this Agreement so long as this Agreement as so modified continues to express, without

material change, the original intentions of the Parties as to the subject matter hereof and the prohibited nature, invalidity or unenforceability

of the provision(s) in question does not substantially impair the respective expectations or reciprocal obligations of the Parties or

the practical realization of the benefits that would otherwise be conferred upon the Parties. The Parties will endeavor in good faith

negotiations to replace the prohibited, invalid or unenforceable provision(s) with a valid provision(s), the effect of which comes as

close as possible to that of the prohibited, invalid or unenforceable provision(s).

6.03 Matter

of Further Assurances & Cooperation. The Holder and the Company hereby agree and the Company further agrees that it shall provide

further assurances that it will, in the future, execute and deliver any and all further agreements, certificates, instruments and documents

and do and perform or cause to be done and performed, all acts and things as may be necessary or appropriate to carry out the intent and

accomplish the purposes of this Agreement without unreasonable delay and in no event later than one (1) business after it receives any

reasonable written request from the Holder.

6.04 Successors.

The provisions of this Agreement shall be deemed to obligate, extend to and inure to the benefit of the successors, assigns, transferees,

grantees, and indemnitees of each of the Parties to this Agreement; provided, that neither this Agreement nor any of the rights,

interests, or obligations hereunder may be assigned by either Party without the prior written consent of the other Party.

6.05 Integration.

This Agreement, after full execution, acknowledgment and delivery, memorializes and constitutes the entire agreement and understanding

between the parties and supersedes and replaces all prior negotiations and agreements of the Parties, whether written or unwritten with

the exception of the Company's profit-sharing plan and any agreements related thereto.

6.06 Severance.

If any provision of this Agreement is held to be illegal or invalid by a court of competent jurisdiction, such provision shall be deemed

to be severed and deleted; and neither such provision, nor its severance and deletion, shall affect the validity of the remaining provisions.

6.07

Governing Law. This Agreement shall be governed by and construed in accordance with the internal laws of the State of Delaware, without

giving effect to any of the conflicts of law principles which would result in the application of the substantive law of another jurisdiction.

This Agreement shall not be interpreted or construed with any presumption against the party causing this Agreement to be drafted.

6.08 Consent

to Jurisdiction. Each of the Company and the Holder (i) hereby irrevocably submits to the exclusive jurisdiction of the State of New

York for the purposes of any suit, action or proceeding arising out of or relating to this Agreement and (ii) hereby waives, and agrees

not to assert in any such suit, action or proceeding, any claim that it is not personally subject to the jurisdiction of such court, that

the suit, action or proceeding is brought in an inconvenient forum or that the venue of the suit, action or proceeding is improper.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, this Agreement is executed

as of the date first set forth above.

| FOR THE COMPANY: |

|

| |

|

|

| REBORN COFFEE, INC. |

|

| |

|

|

| By: |

/s/ Jay Kim |

|

| Name: |

Jay Kim |

|

| Title: |

CEO |

|

| |

|

|

| FOR THE HOLDER: |

|

| |

|

|

| DRE, INC. |

|

| |

|

|

| By: |

/s/ Dennis R. Egidi |

|

| Name: |

Dennis R. Egidi |

|

| Title: |

President |

|

Signature Page to Exchange Agreement

EXHIBIT A

Note

Exhibit A to Exchange Agreement

Exhibit A to Exchange Agreement

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

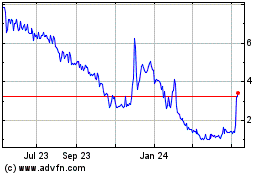

Reborn Coffee (NASDAQ:REBN)

Historical Stock Chart

From Oct 2024 to Oct 2024

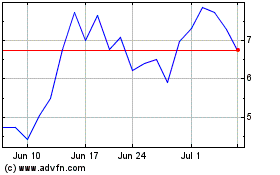

Reborn Coffee (NASDAQ:REBN)

Historical Stock Chart

From Oct 2023 to Oct 2024