Bitcoin On Steroids: Key Technical Factors Fueling The Rally To $70,000

February 19 2024 - 5:00AM

NEWSBTC

The price of Bitcoin has been on a tear in recent weeks, surging

over 30% and breaching the $50,000 mark. At the time of writing,

Bitcoin was trading at $52,377, up 1.3% and 8.8% in the daily and

weekly timeframes, data from Coingecko shows. Related Reading:

Cardano Solid Stats: ADA Soars 14% On Rising TVL and Market Cap –

Details This bullish momentum has ignited fresh optimism among

investors, with many wondering if the world’s leading

cryptocurrency is poised for another assault on its all-time high

of $69,000. Analysts point to several key technical factors that

could propel Bitcoin towards new heights in the coming months. Here

are three of the most prominent: Halving Frenzy April 2024 marks

the next Bitcoin halving, a highly anticipated event that occurs

roughly every four years. During this event, the block reward for

miners, currently 6.25 BTC, is slashed in half, effectively

reducing the rate at which new Bitcoins enter circulation. This

engineered scarcity has historically triggered significant price

rallies, and analysts predict a similar outcome this time around.

Source: IntoTheBlock IntoTheBlock, a quantitative crypto analysis

firm, estimates a surge to a new all-time high just one month after

the halving. They reason that miners, better prepared for the

halving’s impact this time, will hold onto their rewards, limiting

selling pressure and potentially boosting the price. Additionally,

the halving reduces Bitcoin’s inflation rate from 1.7% to 0.85%,

further enhancing its store-of-value appeal. We give Bitcoin 85%

odds of hitting all-time high in the next 6 months. Curious what’s

behind this prediction? read our latest

newsletter👇https://t.co/acx2Fbi1Dw — IntoTheBlock (@intotheblock)

February 17, 2024 The CEO of Sound Planning Group and an investment

adviser representative, David Stryzewski, gave an explanation of

his belief that the price of bitcoin is about to experience a

significant upswing on the Schwab Network on Thursday. He clarified

that the triggers for the rising price momentum for bitcoin are the

impending halves of the cryptocurrency and the recently introduced

spot exchange-traded funds (ETFs) that the U.S. Securities and

Exchange Commission (SEC) approved last month. Macroeconomic

Tailwinds The Federal Reserve’s dovish monetary policy stance,

aimed at combating deflationary pressures, is another factor

buoying Bitcoin’s prospects. The anticipation of interest rate cuts

and increased liquidity injections into the financial system could

benefit Bitcoin alongside other risk assets. Bitcoin market cap

remains in the $1 trillion territory. Chart: TradingView.com ETF

Explosion The long-awaited approval of Bitcoin Exchange-Traded

Funds (ETFs) in late 2023 has opened the floodgates for

institutional investors to enter the crypto market. These

investment vehicles, which track the price of Bitcoin without

requiring direct ownership, have already attracted billions of

dollars in inflows. This surge in institutional participation is

expected to continue in Q2 2024, potentially pushing the price of

Bitcoin even higher. The Impact Of US Elections Furthermore,

the upcoming US presidential election in November 2024 could

provide an additional tailwind. If a Bitcoin-friendly candidate

emerges victorious, it could lead to policies that accelerate

cryptocurrency adoption and further legitimize Bitcoin as an asset

class. Related Reading: UNI Jumps Over 12% – Here’s Why Investors

Flock To This Token Not Without Risks The remarkable surge of

Bitcoin as it tries to go a notch higher to the vaunted $70,000

level can be attributed to a convergence of key technical factors,

propelling the cryptocurrency into uncharted territory. The

relentless growth of the hash rate, improved scalability solutions,

and ongoing developments in the blockchain ecosystem are

collectively fueling this rally. Featured image from Freepik, chart

from TradingView

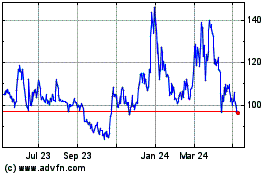

Quant (COIN:QNTUSD)

Historical Stock Chart

From Jun 2024 to Jul 2024

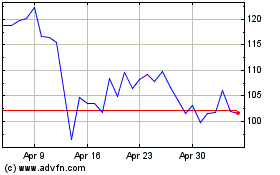

Quant (COIN:QNTUSD)

Historical Stock Chart

From Jul 2023 to Jul 2024