Increased Bitcoin ETF Adoption Propels BTC Dominance To Highest Level Since 2021

April 15 2024 - 2:30PM

NEWSBTC

Bitcoin’s dominance within the cryptocurrency market has reached a

three-year high, signaling strong demand for US spot Bitcoin ETF

holding the largest digital asset and a challenging period for

smaller tokens. Bitcoin accounted for nearly 55% of the $2.4

trillion digital asset market at the end of last week, a level not

seen since April 2021. On Saturday, in particular, BTC’s dominance

jumped to 57% as it briefly touched the $67,000 mark. The

next largest tokens by market share include Ethereum (ETH),

Tether’s USDT stablecoin, Binance exchange’s native token Binance

Coin (BNB), and Solana (SOL). BTC’s Rise Fueled By Successful US

Bitcoin ETF Launches According to Bloomberg, the recent success of

the recently approved US spot Bitcoin ETFs from prominent issuers

such as BlackRock and Fidelity Investments has played a significant

role in Bitcoin’s rise. These ETFs have garnered

approximately $56 billion in assets, making their debut one of the

most successful in fund category history. Related Reading: XRP

Poised For Takeoff: Analysts Predict Huge Gains After Bitcoin

Halving The inflows into these ETFs drove BTC to its current

all-time high (ATH) of $73,798 in mid-March, a clear resistance

level for the largest cryptocurrency on the market, as evidenced by

its inability to consolidate above the $70,000 level following this

achievement. Although BTC is down about 6% since then,

smaller digital assets such as Avalanche (AVAX), Polkadot (DOT),

and Chainlink (LINK) have seen more significant declines of nearly

30% over the past month. This drop coincided with reduced

expectations for looser US monetary policy settings, often fueling

speculative gains. Hong Kong-Listed ETFs Boosts Bitcoin And

Ethereum Institutional investors’ allocations to the US Bitcoin ETF

have greatly influenced Bitcoin’s performance relative to the rest

of the market. Benjamin Celermajer, director of digital-asset

investment at Magnet Capital, noted that strong institutional

demand is a key driver. On Monday, Bitcoin and Ethereum, the

second-largest cryptocurrency, saw notable price jumps following

indications that asset managers are preparing to launch Hong

Kong-listed ETFs on both tokens. Bitcoin rose 4.3% to $66,575,

while ETH jumped 6.2% to $3,260. These rallies had a positive

impact on the broader crypto market, lifting other notable tokens

such as Polygon (MATIC), Cardano (ADA), the dog-themed meme coin

Dogecoin (DOGE), and Solana, which is now the top 5 cryptocurrency

market winner, up over 8% on Monday. Related Reading: Shiba Inu

Insider Reveals Top 5 Shibarium Investment Rules Interestingly, the

Bloomberg Galaxy Crypto Index, which measures the performance of

the largest digital assets traded in US dollars, has more than

tripled since the beginning of last year, marking a significant

rebound from the bear market experienced in 2022. Lastly, investors

and traders eagerly anticipate the upcoming Bitcoin Halving, an

event that will cut the new supply of the token in half, expected

around April 20th. Previous Halving events have acted as a

tailwind for prices, although there are growing doubts about

whether history will repeat itself given BTC’s recent all-time high

achievement. BTC has successfully maintained its position

above the $66,000 threshold and has consolidated in this range.

However, it is important to note that losses have accumulated over

longer time frames. Over the past fourteen and thirty days of

trading, the cryptocurrency has experienced significant declines of

over 21% and 24% respectively. Featured image from Shutterstock,

chart from TradingView.com

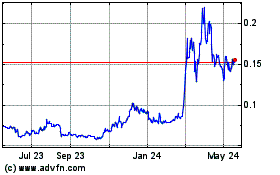

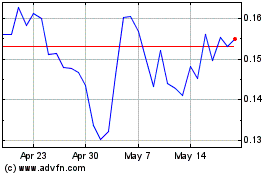

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Jul 2023 to Jul 2024