Waiting For The Bitcoin Bull Run To Resume? Here’s The Indicator To Watch For

April 13 2024 - 7:00AM

NEWSBTC

The bullish momentum of the Bitcoin price has dwindled over the

past few weeks, putting the progression of the crypto bull cycle

into question. On Friday, April 12, the crypto market witnessed a

flash crash, causing the premier cryptocurrency’s value to drop

from $70,000 to below $67,000. This latest downturn underscores the

struggle of the Bitcoin price to return to its recent all-time high

of $73,737, which was forged in mid-March. On-chain analytics

platform Santiment has identified a particular Bitcoin metric that

may signal the resumption of the bull run. Bitcoin Bull Run May

Resume If This Metric Falls In a recent post on X, blockchain

intelligence firm Santiment provided an exciting insight into the

current cycle and the price performance of Bitcoin. The firm

pinpointed the Mean Dollar Invested Age metric as one of the

indicators to watch as the market leader moves sideways. Related

Reading: Cardano (ADA) Prints ‘Undeniable Bull Run’ Signal: Crypto

Analyst According to Santiment, the Mean Dollar Invested Age metric

tracks the average age of investment in an asset that has sat in

the same wallet. When this indicator is rising, it means that

investments are getting more stagnant and old coins are being held

in the same wallets. Conversely, a decreasing Mean Dollar Invested

Age metric implies that investments are flowing back into regular

circulation. This “falling line” also suggests an increase in

network activity. A chart showing Bitcoin's Mean Dollar

Invested Age | Source: Santiment/X From a historical perspective,

Bitcoin exhibited a falling Mean Dollar Invested Age line during

the previous bull cycles. According to Santiment, this has been the

case for the premier cryptocurrency in the current bull run, which

kicked off in late October 2023. The on-chain analytics

platform, however, noted that Bitcoin’s Mean Dollar Invested Age

line has been moving sideways over the past couple of weeks. This

phenomenon is even more shocking, considering that the

highly-anticipated halving event is about a week away. The Bitcoin

halving will see the miners’ reward slashed in half (from 6.25 BTC

to 3.125 BTC). It is a bullish event that has contributed to the

optimistic outlook – borne by most investors – for the premier

cryptocurrency in 2024. From Santiment’s latest report, investors

might want to keep their eyes peeled for the Bitcoin Mean Dollar

Invested Age metric. And the bull run is likely to continue if the

BTC’s Mean Dollar Invested Age line resumes its fall, which would

imply that major stakeholders (like whales) are back to moving

coins into regular circulation. BTC Price At A Glance As of this

writing, Bitcoin is trading around $66,548, reflecting a notable 6%

price decline in the past 24 hours. Related Reading: Traders

Forecast Massive Rally For Altcoins, But Why Is Sentiment “Down”?

Bitcoin price falls below $67,000 on the daily timeframe | Source:

BTCUSDT chart on TradingView Featured image from iStock, chart from

TradingView

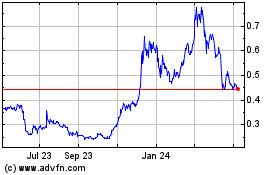

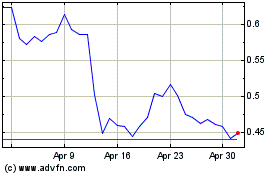

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Jul 2023 to Jul 2024