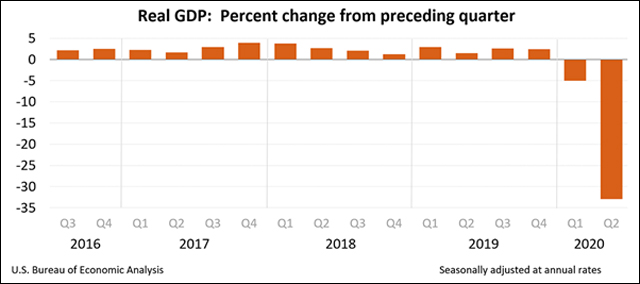

This week we have learned that the first economy registered the worst contraction, whatsoever. Real gross domestic product decreased at an annual rate of 32.9 percent in the second quarter of 2020. This was the result of so-called quarantine measures issued in March and April. Without any doubt, the situation could have been even worse if the government had not interfered with pandemic assistance payments

“The full economic effects of the COVID-19 pandemic cannot be quantified in the GDP estimate for the second quarter of 2020 because the impacts are generally embedded in source data and cannot be separately identified. “

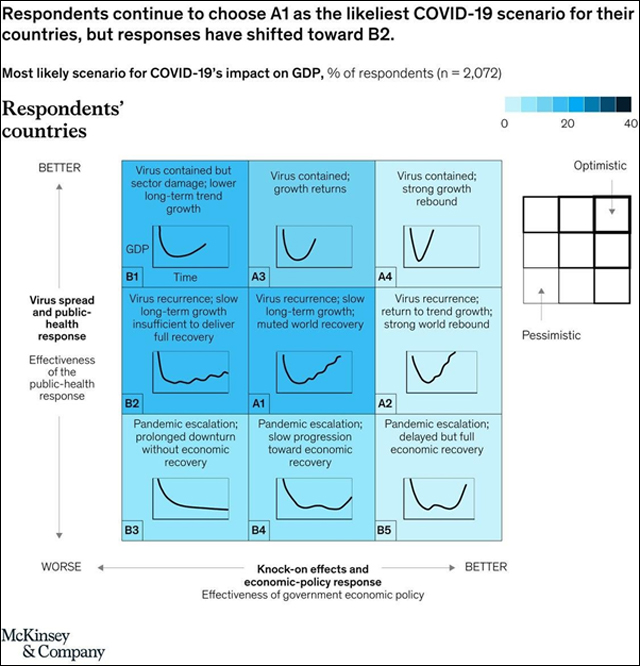

As the uncertainty grows, gold prices, together with Bitcoin, went up to the moon. It means that the increase of COVID-19 cases around the world weighs on investor confidence. Even though, for the first time in 2020, respondents are more likely to expect their companies’ profits to increase than decrease in the months ahead. Overall, it is expected that the return to pre-crisis levels of GDP, income, and corporate earnings will take time.

In terms of unemployment, initial claims increased for the second week in a row. In the week ending July 25, the advance figure for seasonally adjusted initial claims was 1,434,000, an increase of 12,000 from the previous week’s revised level. Taken together, 30.2 million Americans were receiving unemployment benefits.

For now, the Federal Reserve will keep the rate of QE at the current levels. Additionally, it would keep seven of its emergency pandemic lending facilities open to applications for an additional three months. It is worth noting that the decision will not expand the amount of liquidity that will be provided under the facilities, however, nor will it extend the length of the loans provided.

Even before the approval of an additional stimulus package, Fitch Ratings revised the outlook on the United States’ triple-A rating to negative from stable on Friday, citing eroding credit strength, including a growing deficit to finance stimulus to combat the fallout from the coronavirus pandemic. The future of U.S. fiscal policy will depend also on the November elections and the resulting makeup of Congress.

Despite the certain negativity, Wall Street once again closed higher, with the S&P 500 and Dow Jones Industrial Average registering a Big Tech bonanza. Apple, Amazon, Facebook, and Google-Alphabet all beat expectations.

It may be hard to believe but the second-quarter earnings season wasn’t as bad as expected. Almost 80% of S&P 500 companies beat expectations. There are still some fears that the reopening may be slowing, and the second half will not see the V-shaped recovery.

Chart of the week

Macroeconomic Data & Events

Politicians in the US still cannot agree on a new fiscal package. In this context, the United States House of Representatives canceled its traditional August recess until the coronavirus aid bill is passed. Meanwhile, three crucial relief programs are close to ending – unemployment benefits, eviction protection, and small business relief.

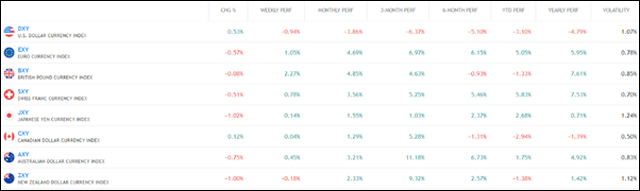

Besides that, markets will focus on the Reserve Bank of Australia and the Bank of England rate announcements. In the US nonfarm payrolls will give a clue to the health of the economy. It is forecasted that the unemployment rate should fall to 10,3%, from 11,1%. Meanwhile, a total of 218 areas had jobless rates of less than 10.0 percent and 6 areas had rates of at least 20.0 percent.

August 3: Global Manufacturing PMIs, US manufacturing ISM, and the Chinese Caixin manufacturing PMI.

August 4: The Reserve Bank of Australia’s announcement of their interest rate decision

August 5: The US non-manufacturing ISM, service PMIs for China, the UK, and Europe and Swedish Q2 GDP flash.

August 6: Bank of England rate meeting

August 7: US Employment Report and industrial production data in Norway, Denmark, and Germany.

Hot Features

Hot Features