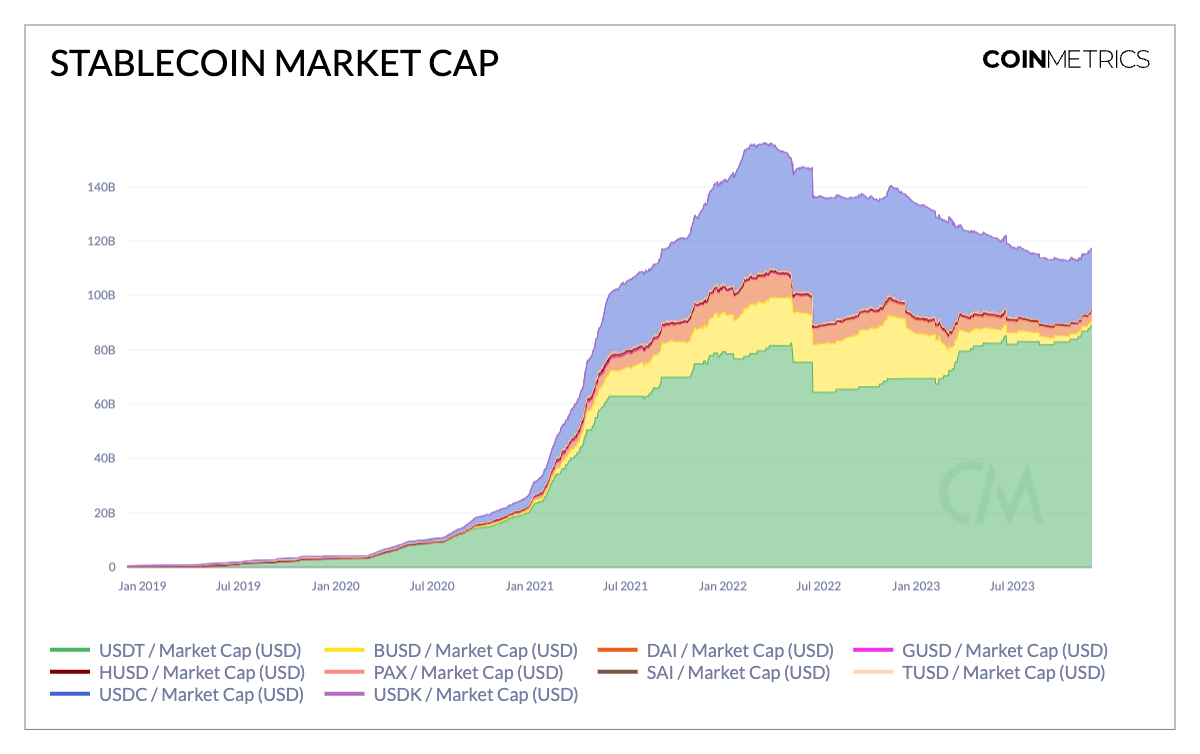

Stablecoins play a vital role in the ever-changing digital asset world, offering a stable store of value that brings steadiness during market fluctuations. They provide stability not only in developed markets but also in emerging economies facing high inflation and limited financial access. With their borderless and 24/7 availability, stablecoins facilitate smooth cross-border transactions and remittances, making them a crucial medium of exchange. Additionally, they serve as a bridge connecting decentralized finance (DeFi) and traditional financial systems, supporting trading and lending while acting as an indicator for blockchain activity. Despite facing challenges that led to a dip in the digital dollar market from $155 billion to $112 billion in 2022, recent increases in digital asset values hint at a potential comeback. This suggests a renewed interest in stablecoins, signaling a potential recovery in on-chain liquidity for both bear and bull markets.

Exploring Trends in Market Capitalization and Supply

The prevailing market capitalization within this asset class is predominantly steered by USDT and USDC, constituting the lion’s share of the overall supply. The recent surge is ascribed to the expansion of Tether (USDT) across the Ethereum ($41 billion) and Tron ($48 billion) networks, catapulting Tether’s market cap to an unprecedented $88 billion. Concurrently, Circle’s USDC maintains stability at $22.5 billion. Despite the prevalence of fiat-collateralized stablecoins, the ascent of stablecoins backed by cryptoassets (e.g., ETH) and off-chain assets (e.g., public securities) underscores the increasing diversity and adaptability within this dynamic asset class.

Illustrated in the chart below are the weekly fluctuations in stablecoin supply over the course of the year. Notable downturns in total stablecoin supply were observed after significant events such as the Luna collapse in June 2022 and the Silicon Valley Bank (SVB) crisis in March, reflecting a palpable decline in market confidence. However, starting from October 2023 onward, there has been a consistent upswing in the overall stablecoin supply, indicative of a positive trajectory. This ascending trend signals an enhancement in the on-chain liquidity landscape, suggesting a notable increase in available capital for deployment.

To trace the trajectory of the expanding stablecoin supply, a closer look at the portion held by smart contracts reveals intriguing insights. Take USDC, a widely-used asset in decentralized finance (DeFi) applications, for example. Experiencing a zenith in March 2022, the smart contract holdings of this entity surged to an impressive peak exceeding $20 billion. However, a substantial contraction followed, witnessing a precipitous drop from the March high of $14 billion to a diminished $7 billion by the close of December 2023. In contrast, Tether (ETH), predominantly housed within externally owned accounts (EOAs), unfolds a divergent narrative. Commencing the year with smart contract holdings at $4 billion, it has demonstrated growth, now eclipsing the $6 billion mark.

Adoption Trend

Shifting our focus from smart contract holdings, let’s explore broader trends in stablecoin adoption by examining the number of accounts with substantial holdings. While the count of addresses holding over $100k USDC has decreased to 13k and Ethereum-based USDT addresses remain relatively steady, a distinct pattern emerges for USDT on the Tron network. Tether on Tron shows consistent growth in adoption, boasting nearly 40k addresses with holdings over $100k. This surge can be attributed to lower transaction fees, making it more appealing in emerging economies across Latin America, Africa, and Asia. In regions facing high inflation and limited access to dollar-denominated services, the convenience and cost-effectiveness of stablecoins like USDT on Tron have become increasingly attractive.

Surging Participation of Stablecoins in Lending and Trading Sectors

Stablecoins play a vital role in decentralized finance (DeFi), acting as stable collateral in lending markets and allowing users to earn interest on their digital assets. The chart above illustrates utilization rates on Aave for major stablecoins, indicating the proportion of deposited funds being borrowed. This rate serves as a gauge for stablecoin demand and capital availability on platforms like Aave and Compound, offering insights into overall activity.

The relationship between pool utilization and interest rates is key: low utilization prompts lower interest rates to attract borrowers, while high utilization leads to increased rates to encourage debt repayments and new deposits. Except for a disruption in March 2023, utilization rates for USDT, USDC, and Dai have reached levels not seen since 2021, signaling a growing demand for stablecoin-collateralized loans and a rising interest in leveraging these assets for yield generation.

Emerging Dynamics in the Stablecoin Market

Examining the current state of stablecoins, we can zoom out to spot key trends shaping their landscape. One significant factor is the yields offered by both on-chain and off-chain sources. These yields not only influence capital flows but also guide potential avenues for capital attraction in diverse economic conditions.

A notable trend in the past two years has been the increase in US Treasury yields during the financial tightening cycle. The presence of a high yield on the ‘risk-free rate’ has created an opportunity cost for both stablecoin holders and issuers, prompting a shift of capital away from on-chain markets. To meet the demand for yield and address interest rate sensitivity, we’ve witnessed the emergence of tokenized treasuries and interest-bearing stablecoins.

Conclusion

In conclusion, the increasing supply of stablecoins signals a notable uptick in activity and engagement within the digital asset space. Notably, the dominance of Tether on Tron stands out in supply and adoption trends. Despite regulatory challenges in the U.S. and a complex political landscape, stablecoin liquidity has demonstrated remarkable resilience. This expansion highlights the versatile utility of stablecoins, from DeFi pools to exchanges and various yield-generating opportunities. Against the backdrop of a broader market rally, these trends not only emphasize growing usage but also affirm the central role that stablecoins play in the crypto economy.

Learn from market wizards: Books to take your trading to the next level.

Hot Features

Hot Features