London open: Stocks fall as US-China trade tensions escalate

London stocks fell early on Monday as trade concerns continued to weigh on investors’ minds, with US President Trump set to slap tariffs on a further $200bn on Chinese imports.

At 0830 BST, the FTSE 100 was down 0.4% to 7,277.95, while the pound was up 0.1% against the dollar at 1.3079 and flat versus the euro at 1.1245.

According to the Wall Street Journal, Trump has instructed aides to press ahead with tariffs of 10% as early as Monday, while Beijing is considering declining the US administration’s offer of negotiations later this month.

Analyst Jasper Lawler at London Capital Group said: “The decision to start to apply tariffs, which are rumoured to be 10%, rather than the initially higher level of 25%, is expected despite Treasury Secretary Steve Mnuchin’s attempts to restart talks with the Chinese to try to resolve trade difference between the two powers; once again highlighting the hap hazard approach of the White House in its America First protectionist policies.

“Trade concerns have been simmering for months and it is growing increasingly clear that neither side is prepared to back down, which is fanning fears that the world’s two biggest economies are heading towards a trade war. For now, developed markets are taking heart from the scant signs the trade spat is able to shake the global economy.”

There was some more pleasing data for UK home owners as figures released by Rightmove earlier showed that house prices bounced back in September.

Prices rose 0.7% on the month following a 2.3% decline in August amid signs of a recovery in London and a pickup in sales of the capital’s most expensive properties. On the year, prices were up 1.2% compared to a 1.1% increase the month before.

In Greater London, house prices were up 1.2% on the month, but down 0.5% on the year. Rightmove said there were signs of renewed buyer activity in the upper price sectors in London, with a 6% increase in the number of sales agreed for properties of £750,000 and over compared to the same month last year.

Miles Shipside, Rightmove director and housing market analyst, said: “Buyer affordability has been increasingly stretched by seven years of national average property price rises outstripping buyers’ average wage inflation. However in London, after asking prices rose by over 50% between 2011 and their peak in 2016, there have been two years of subsequent price falls in parts of the capital. Now, there are signs that these price reductions in parts of London have led to an upturn in buyer activity as sentiment improves.”

Lawler said: “This is some welcome good news for the housebuilders, after the UK housing market has been struggling thanks to slower economic growth, Brexit fears and weaker confidence, all of which have been more acutely felt in the capital.”

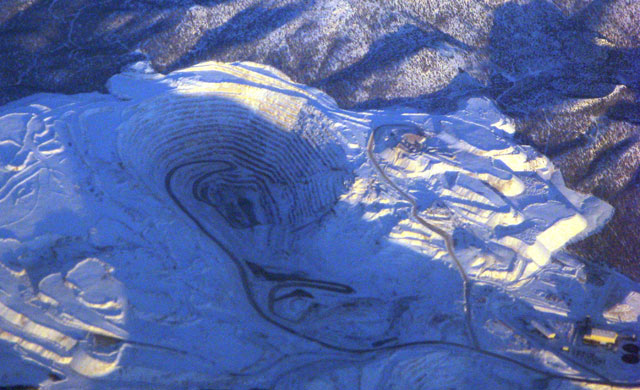

Miners retreated as copper and iron ore prices fell, with Glencore, Antofagasta, Anglo American and BHP Billiton all weaker.

ITV was lower after reports emerged over the weekend that it has entered the bidding for the leading independent production house Endemol Shine, the £3bn maker of programmes including Big Brother, The Fall, MasterChef and Peaky Blinders.

Prudential was in the red after saying that M&G Prudential will take on around £3.5bn of subordinated debt when it is spun off, subject to approval from its new board.

On the upside, Dairy Crest rallied after it said strong sales from its largest cheese and butter brands will mean first half revenues will churn higher than last year. The FTSE 250 group expects half-year profit will be “slightly ahead” of last year but expectations for the full year remain thus-far unchanged.

Sirius Minerals racked up strong gains as it secured a supply deal to sell up to 2.5m tonnes per year of POLY4 – its flagship fertiliser product – to Brazilian fertiliser distribution company The Cibra Group.

IP Group ticked higher as it appointed Sir Douglas Flint as non-executive chairman and director of the company. Flint, who succeeds Mike Humphrey, will become chairman elect with immediate effect and will assume the role of chairman from 1 November.

St. Modwen Properties was on the front foot after announcing the appointment of Danuta Gray as chair designate and non-executive director with effect from 1 October.

On the broker note front, Compass was started at ‘outperform’ by Bernstein, while Tullow Oil was upgraded to ‘hold’ at HSBC.

Hays and Sophos were cut to ‘hold’ at HSBC and Deutsche Bank, respectively, while Caretech was initiated at ‘buy’ at Liberum.

Hot Features

Hot Features