TIDMSFT

RNS Number : 7188T

Sinosoft Technology plc

01 October 2010

SINOSOFT TECHNOLOGY PLC

("Sinosoft" or "the Company")

Proposed cancellation of admission to AIM and tender offer to buy-back shares

Following Sinosoft's notification on 14 September 2010 of its intention to

cancel its admission to AIM, the Company announces that it is today posting a

circular to shareholders ("Circular") regarding a tender offer ("Tender Offer")

for Ordinary Shares, the cancellation of admission of the Company's Ordinary

Shares to trading on AIM (the "De-listing") and other related matters, including

a capital reduction ("Capital Reduction"). The proposed Tender Offer applies to

a maximum of approximately 30.1 per cent. of the Company's current issued share

capital representing 51,180,000 Ordinary Shares and the price at which the

Tender will be undertaken is 8 pence per Ordinary Share. A Shareholder General

Meeting is called for 9 November 2010 to consider the Proposals which are

contained in the Circular. A copy of the Circular will shortly be available

from the Company's website at www.sinosoft-technology.com.

The Company has received irrevocable commitments from Shareholders representing

69.1% of the current issued share capital to vote in favour of the Proposals at

the General Meeting.

If approved by the Shareholders, the De-listing is expected to take effect on 3

December 2010.

In order to effect the Tender Offer, the Company will need to apply to the Court

for the approval of the reduction of its share capital by way of cancellation of

its share premium account. Accordingly completion of the Tender Offer is

conditional, amongst other things, upon the approval of the Court.

Shareholders should note that if, for any reason the Capital Reduction does not

take place by 1 December 2010, the Board intends to continue with the

De-listing.

Capitalised terms in this announcement follow the same definitions as in the

Circular unless otherwise specified.

The key points of the Circular are summarised as follows:

Introduction

Having carefully considered, together with its advisers, its current position

the Company now proposes to:

· purchase Ordinary Shares by way of the Tender Offer;

· apply to the Court for the reduction of its share capital by way of

cancellation of its share premium account; and

· cancel the admission of its Ordinary Shares to trading on AIM.

De-listing

Having carefully considered the wider position of the Company following the

losses arising from a number of foreign exchange contracts in respect of which

the Company's internal stop loss limits were not complied with, the Board

concluded that the best option would be for the Company to de-list and continue

its growth strategy away from the public market, at least in the near term. In

particular the De-listing will allow the Company to grow without the pressure a

quoted company may face to deliver short term performance over long term

positioning and growth.

A de-listing will also save the Company costs associated with being quoted and,

importantly, will allow executive management based in China more time to focus

on driving the business forward. Ultimately, the Board believes that greater

Shareholder value will be derived by operating the Company's business off-market

for the immediate future.

Those shareholders who want to continue to own shares in the Company after the

cancellation of admission to AIM may do so, although they should understand that

the shares will no longer be traded on a market and they may not be able to

dispose of their shareholding in the Company easily or at all.

De-listing is subject to shareholder approval by special resolution. The

Company has received irrevocable undertakings from shareholders holding

114,402,189 Ordinary Shares, representing 69.1 per cent of the current issued

ordinary share capital to vote in favour of the De-listing at the General

Meeting.

Tender Offer

The Board recognises that not all Shareholders will be able or willing to

continue to own shares in the Company following the De-listing. Although it is

under no formal obligation to do so, the Board is therefore arranging for the

Company to provide the Tender Offer Shareholders with the opportunity to sell

Ordinary Shares in the Company at the Tender Offer Record Date by means of the

Tender Form accompanying the Circular (in the case of Tender Offer Shares held

in certificated form) or by TTE Instruction (in respect of Tender Offer Shares

held in uncertificated form).

Under the Tender Offer a maximum of 51,180,000 Ordinary Shares may be purchased,

representing approximately 30.9 per cent. of the issued ordinary share capital

at a price of 8 pence per Ordinary Share, for a maximum aggregate cash

consideration of GBP4.09 million.

The price to be paid for each Ordinary Share subject to the Tender Offer shall

be 8 pence which represents a premium of 56.0 per cent. to the closing mid-price

of an Ordinary Share on 13 September 2010, the last trading day prior to release

of the announcement that the Board was intending to make the Tender Offer and a

premium of 8.5 per cent. to the closing mid-price on 8 July 2010, the day

immediately preceding the trading update announced on 9 July 2010 detailing

certain foreign exchange losses.

The Company has received irrevocable undertakings from Xin Yingmei, a Director,

and other persons currently indirectly holding 114,402,189 Ordinary Shares in

aggregate at the date of this document, representing approximately 69.1 per

cent. of the current issued ordinary share capital of the Company that they will

not participate in the Tender Offer in respect of those Ordinary Shares.

The Tender Offer is conditional upon Shareholder approval by special resolution

and the Capital Reduction outlined below being confirmed by the Court.The

Company has received irrevocable undertakings from Shareholders holding

114,402,189 Ordinary Shares, representing approximately 69.1 per cent. of the

current issued ordinary share capital of the Company, to vote in favour of the

Resolution authorising the Company to purchase its Ordinary Shares at the

General Meeting.

Effects of the Proposals

The principal effect of the Proposals and the De-Listing in particular is that

Shareholders will no longer be able to buy and sell shares in the Company

through a public stock market; that is liquidity in the Company's shares will be

very limited. Upon the De-listing becoming effective, Ordinary Shares shall

cease to be available in uncertificated form and shall be withdrawn from CREST.

Holders of Ordinary Shares in uncertificated form will then hold those shares in

certificated form, for which they will be sent share certificates within 7 days

of the CREST facility being withdrawn.

It is anticipated that Mark Greaves and Teo Kean Eek will resign as Directors

following completion of the Proposals.

Capital Reduction

As at 30 June 2010, the Company had an aggregate negative balance on its

retained earnings account and other reserves accounts of US$1,322,207

("Balance") and a share premium account of US$11,283,551.

If the Tender Offer is accepted by all Shareholders other than those who have

given irrevocable undertakings not to accept it, the Company would require

distributable reserves of about US$6,817,903 (equivalent to the aggregate of the

total purchase price under the Tender Offer and associated costs of about

GBP4,315,675 applying an exchange rate of GBP1:US$1.5798, applicable at the

close of business on 29 September 2010, the latest practicable date prior to the

date of the Circular) to fund the buy back of Ordinary Shares. The negative

amount of distributable reserves of the Company, represented by the Balance, at

30 June 2010, was accordingly US$8,140,110 short of the aggregate amount of

distributable reserves that may be required. Since that date, the aggregate

negative balance on the retained earnings account and the other reserves

accounts has increased and is expected to increase further by the time the

Capital Reduction becomes effective. In order to create sufficient

distributable reserves ("the Reserve") to enable the Tender Offer to be

undertaken, the Board has resolved to seek Shareholders' authority to cancel the

Company's share premium account (the "Capital Reduction").

The share premium account is an undistributable reserve and, accordingly, the

purposes for which the Company can use its share premium account are extremely

restricted. In particular, it cannot be used for the purpose of making

distributions to shareholders or to fund a buy back of the Company's shares.

However, with the consent of the Court, the Company may reduce or cancel its

share premium account and, subject to satisfying the Court that no creditor is

prejudiced thereby, move the sum which results upon such a reduction or

cancellation to its distributable reserves where its application is not so

restricted.

Accordingly, in order to create sufficient distributable reserves to enable the

Tender Offer to be undertaken, the Board has resolved to seek Shareholders'

authority to cancel the Company's share premium account.

The Capital Reduction would reduce the Company's share premium account to nil.

However, the Capital Reduction would leave the Company's net assets unchanged

and the underlying book value of the Company would be unaffected.

The Capital Reduction requires shareholder approval by special resolution. The

Company has received irrevocable undertakings in relation to 114,402,189

Ordinary Shares, representing approximately 69.1 per cent. of the current issued

ordinary share capital of the Company, to vote in favour of the Resolution to

effect the Capital Reduction at the General Meeting.

Articles of Association

Although the Company is not considered to be subject to the City Code on

Takeovers and Mergers, article 50 of the Articles provides for Shareholders of

the Company to be made subject to provisions equivalent to those contained in

the City Code at the discretion of the Board. The Board does not consider that

it would be appropriate to retain these provisions in the Articles in view of

the proposed De-listing, and a Resolution will be proposed at the General

Meeting which would, if passed, provide for article 50 of the Articles to be

deleted, subject to the De-listing being approved.

In addition, the Board considers that it would be inappropriate in view of the

De-listing for the restrictions on borrowings contained in article 102 of the

Articles to be maintained. The Resolution also provides for article 102 to be

deleted and those restrictions removed, subject to the De-listing being

approved.

The current Articles can be found at the "Investor Relations" page on the

Company's website at www.sinosoft-technology.com and a copy will be available

for inspection 15 minutes before and during the General Meeting at the place of

the meeting and at the offices of Edwin Coe LLP, 2 Stone Buildings, Lincoln's

Inn, London WC2A 3TH during normal business hours (Saturdays and Sundays

excepted) until the time of the meeting.

Shareholder approval is required for the alteration of the articles of

association. The Company has received irrevocable undertakings in relation to

114,402,189 Ordinary Shares in aggregate, representing approximately 69.1 per

cent. of the current issued ordinary share capital of the Company, to vote in

favour of the special resolution providing for the alteration of the articles of

association.

Significant shareholders

The Company is aware of the following persons who directly or indirectly have an

interest representing 3 per cent. or more of the existing issued share capital

of the Company (being the threshold at or above which, in accordance with the

Disclosure and Transparency Rules, an interest must be disclosed to the

Company):

+---------------------------------------+--------------+-------------+

| Name | Current | Percentage |

| | shareholding | of current |

| | | issued |

| | | share |

| | | capital |

+---------------------------------------+--------------+-------------+

| Long Capital International Limited1 | 85,500,542 | 51.64% |

+---------------------------------------+--------------+-------------+

| Telewise Group Limited2 | 14,450,824 | 8.73% |

+---------------------------------------+--------------+-------------+

| Mr Guy Thomas | 8,237,602 | 4.97% |

+---------------------------------------+--------------+-------------+

| Team United Investments Limited3 | 6,021,176 | 3.64% |

+---------------------------------------+--------------+-------------+

| Joint Allied Enterprises Limited4 | 6,021,176 | 3.64% |

+---------------------------------------+--------------+-------------+

| | | |

+---------------------------------------+--------------+-------------+

(1) Long Capital International Limited is a BVI incorporated company wholly

owned by Xin Yingmei.

(2) Telewise Group Limited is a BVI incorporated company wholly owned by Wang

Xiaogang, who is the husband of Xin Yingmei. Wang Xiaogang is also a statutory

director of both Nanjing Skytech Co., Ltd and Nanjing Skytech Software Co. Ltd,

subsidiaries of the Company.

(3) Team United Investments Limited is a BVI incorporated company wholly owned

by Liu Biao.

(4) Joint Allied Enterprises Limited is a BVI incorporated company wholly owned

by Zhang Hong, an executive director and a vice-president (research and

development) of Nanjing Skytech Co., Ltd.

The interests (all of which are beneficial unless otherwise stated) of the

Directors and persons connected with them and senior management in the existing

share capital of the Company as at the date of this document and immediately

following the Tender Offer are as set out below:

+------------+--------------+------------+--------------+------------+

| Name | Current | Percentage | Shareholding | Percentage |

| | shareholding | of current | following | of issued |

| | | issued | Tender Offer | share |

| | | share | | capital |

| | | capital | | following |

| | | | | Tender |

| | | | | Offer* |

+------------+--------------+------------+--------------+------------+

| Mark | 500,000 | 0.30% | Nil | Nil% |

| Greaves(1) | | | | |

+------------+--------------+------------+--------------+------------+

| Xin | 85,500,542 | 51.64% | 85,500,542 | 74.74% |

| Yingmei(2) | | | | |

+------------+--------------+------------+--------------+------------+

| | | | | |

+------------+--------------+------------+--------------+------------+

| | | | | |

+------------+--------------+------------+--------------+------------+

| | | | | |

+------------+--------------+------------+--------------+------------+

| | | | | |

+------------+--------------+------------+--------------+------------+

* assuming maximum possible take-up of the Tender Offer, excluding Ordinary

Shares in respect of which irrevocable undertakings not to accept the Tender

Offer have been given.

(1) Mark Greaves intends to tender his Ordinary Share to the Tender Offer.

(2) These Ordinary Shares are held by Long Capital International Limited, a BVI

incorporated company wholly owned by Xin Yingmei, as described in the table

immediately above this one.

Directors' Share Options

Each of Mark Greaves, Teo Kean Eek and Yu Yifa, who are Directors, have been

granted options to subscribe up to 1 million Ordinary Shares at subscription

prices of 8 pence per Ordinary Share in the case of each of Mark Greaves and Teo

Kean Eek and 5 pence per Ordinary Share in the case of Yu Yifa. In each case,

options to subscribe up to one third of those Ordinary Shares have vested and

are exercisable.

Each of the Optionholders has reached agreement with the Company that it would

be inappropriate for those Options to remain outstanding after the De-listing.

Each of the Optionholders has accordingly agreed to the Options being cancelled

upon the De-listing becoming effective. In the case of Mark Greaves and Teo

Kean Eek, they will receive no consideration for agreeing to such cancellation,

and in the case of Yu Yifa, he will receive GBP15,000 upon such cancellation

becoming effective. The Optionholders have in addition undertaken not to

exercise any of the Options until the De-listing becomes effective or the

Company announces that that it has not been approved by Shareholders.

Takeover Code

Although the Company is incorporated in England and Wales and the Ordinary

Shares are admitted to trading on AIM, as the Company's central place of

management is in China the Company is not considered to be resident in the UK

for the purposes of the City Code on Takeovers and Mergers (the "City Code")

which for the time being does not apply to the Company. Accordingly, the

Company is not subject to takeover regulation in the UK under the City Code

until such time as the position changes. Investors should be aware that the

protections afforded to shareholders by the City Code which are designed to

regulate the way in which takeovers and the purchase by a company of its own

shares are conducted will not be available.

Recommendation

The Directors, having consulted with the Company's nominated adviser, Westhouse

Securities Limited, consider that all the proposals to be considered at the

General Meeting are fair and reasonable and are in the best interests of the

Company and the Shareholders as a whole.

The Directors therefore unanimously recommend that Shareholders vote in favour

of the Resolutions as they have undertaken to do so in respect of their own

direct or indirect current beneficial holdings of 86,000,542 Ordinary Shares,

representing approximately 51.94 per cent. of the existing issued ordinary share

capital of the Company. This undertaking includes 500,000 Ordinary Shares which

are in addition to the undertakings to vote described above in this

announcement.

The Directors recommend that all Tender Offer Shareholders consult their duly

authorised independent advisers before they make a decision as to whether to

tender all, or none, of their Tender Offer Shares, in order to obtain advice

relevant to their particular circumstances.

The Tender Offer is conditional upon the Capital Reduction being approved by the

Court and taking effect by 5.00 p.m. on 31 January 2011. If for any reason the

Capital Reduction does not become effective by 5.00 p.m. on 31 January 2011,

irrespective of receipt by the Company of one or more Tender Forms or of one or

more TTE Instructions, the Tender Offer will not proceed. Shareholders should

note that if for any reason the Tender Offer does not take place, the De-listing

will still occur.

Circular

A copy of the Circular will be available shortly on the Company's website at

www.sinosoft-technology.com

DEFINITIONS

+---------------+--------+-------------+

| "Ordinary | | the |

| Shares" | | ordinary |

| | | shares |

| | | of |

| | | 0.148642p |

| | | nominal |

| | | value |

| | | each in |

| | | the |

| | | capital |

| | | of the |

| | | Company |

| | | |

+---------------+--------+-------------+

| "Proposals" | | the |

| | | Capital |

| | | Reduction, |

| | | Tender |

| | | Offer, |

| | | De-listing |

| | | and |

| | | proposed |

| | | amendment |

| | | of the |

| | | Articles |

| | | |

+---------------+--------+-------------+

| "Tender | | the |

| Offer" | | tender |

| | | offer |

| | | to the |

| | | holders |

| | | of |

| | | ordinary |

| | | shares |

| | | in the |

| | | capital |

| | | of the |

| | | Company |

| | | made by |

| | | the |

| | | Company |

| | | on the |

| | | terms |

| | | and |

| | | subject |

| | | to the |

| | | conditions |

| | | set out in |

| | | the |

| | | Circular |

| | | |

+---------------+--------+-------------+

| "Tender | | 5.00p.m. |

| Offer | | on 22 |

| Record | | October |

| Date" | | 2010 |

| | | |

+---------------+--------+-------------+

| 'Tender | | Ordinary |

| Offer | | Shares |

| Shares" | | to which |

| | | the |

| | | Tender |

| | | Offer |

| | | relates |

| | | being, |

| | | in |

| | | aggregate, |

| | | the total |

| | | number of |

| | | Ordinary |

| | | Shares in |

| | | issue as |

| | | at 5.00 |

| | | p.m. on |

| | | the Tender |

| | | Offer |

| | | Record |

| | | Date other |

| | | than those |

| | | Ordinary |

| | | Shares in |

| | | respect of |

| | | which |

| | | irrevocable |

| | | commitments |

| | | not to |

| | | participate |

| | | in the |

| | | Tender |

| | | Offer have |

| | | been given |

| | | |

+---------------+--------+-------------+

| "Tender | | holders |

| Offer | | of |

| Shareholders" | | Tender |

| | | Offer |

| | | Shares |

+---------------+--------+-------------+

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

+----------------------------------------+----------------------+

| | 2010 |

+----------------------------------------+----------------------+

| Tender Offer opens | 1 October |

+----------------------------------------+----------------------+

| Latest time for receipt of Tender | by 1.00p.m. on 22 |

| Forms for certificated shares | October |

+----------------------------------------+----------------------+

| Latest time for receipt of TTE | by 1.00p.m. on 22 |

| Instructions for uncertificated shares | October |

+----------------------------------------+----------------------+

| Record Date for the Tender Offer | 5.00p.m. on 22 |

| | October |

+----------------------------------------+----------------------+

| Announcement of results of the Tender | 25 October |

| Offer | |

+----------------------------------------+----------------------+

| Purchase Contract available for | from 25 October |

| inspection | until 9 November |

+----------------------------------------+----------------------+

| Latest time for receipt of Forms of | 7 November at 11.00 |

| Proxy | a.m. |

+----------------------------------------+----------------------+

| General Meeting | 9 November at 11.00 |

| | a.m. |

+----------------------------------------+----------------------+

| Announcements of results of General | 9 November |

| Meeting | |

+----------------------------------------+----------------------+

| Court hearing to confirm Capital | 1 December |

| Reduction and effective date for | |

| Capital Reduction* | |

+----------------------------------------+----------------------+

| Effective Date for Capital Reduction* | By 1 December |

+----------------------------------------+----------------------+

| Purchase of Tender Offer Shares under | 1 December |

| the Tender Offer** | |

+----------------------------------------+----------------------+

| CREST Account credited with Tender | 2 December |

| Offer proceeds** | |

+----------------------------------------+----------------------+

| Dispatch of cheques for Tender Offer | 2 December |

| proceeds** | |

+----------------------------------------+----------------------+

| Ordinary Shares delisted from AIM | By 3 December |

+----------------------------------------+----------------------+

| CREST facilities for Ordinary Shares | By 3 December |

| cancelled** | |

+----------------------------------------+----------------------+

* These dates are dependent on, inter alia, the date upon which the Court

confirms the Capital Reduction. The Court hearing may be subject to postponement

by the Court.

** The Capital Reduction is subject to the approval of the Court and will not

take place if Court approval is not obtained. If the Capital Reduction is not

approved by the Court, the Tender Offer will not be completed. If scaling down

of entitlements under the Tender Offer is required, as described under "Effect

of the Capital Reduction" in Part 1 of the Circular, these actions will be

delayed by about seven days.

If any of the above times and/or dates change, the revised times and/or dates

will be notified to Shareholders by announcement through a Regulatory

Information Service of the London Stock Exchange.

All references to times in this announcement are to London (UK) time unless

otherwise stated.

Commenting on the Proposals, Mark Greaves, Chairman of Sinosoft said: "The

uncertain economic climate has led the Company to produce mixed operating

results, with a clear negative impact on certain divisions, with other divisions

such as tax software having performed reasonably well. However, the financial

performance in the period was seriously impacted by the losses on unauthorised

foreign exchange transactions and the Board, following a detailed strategic

review, has taken the decision that shareholders' interests will best be served

by the Company seeking to cancel the admission to AIM and to provide those

shareholders who wish to sell their shares the opportunity to do so."

For further information please contact:

+--------------------+--------------------+--------------------------------+

| Sinosoft | Mr. Yifa Yu | +86 025 84815959 |

| Technology plc | | yuyifa@sinosoft-technology.com |

+--------------------+--------------------+--------------------------------+

| Westhouse | Tim Metcalfe / | 020 7601 6100 |

| Securities | Richard Baty | |

| | | |

+--------------------+--------------------+--------------------------------+

| Tavistock | Simon Compton | 020 7920 3150 |

| Communications | | |

+--------------------+--------------------+--------------------------------+

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCMBBBTMBAMBPM

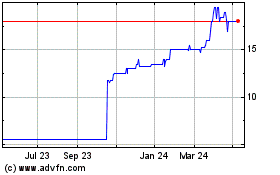

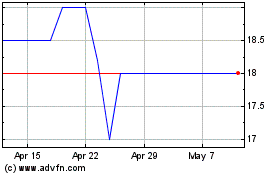

Software Circle (LSE:SFT)

Historical Stock Chart

From Apr 2024 to May 2024

Software Circle (LSE:SFT)

Historical Stock Chart

From May 2023 to May 2024