0000715072false00007150722023-10-242023-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

April 23, 2024

Date of report (Date of earliest event reported)

RENASANT CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Mississippi | 001-13253 | 64-0676974 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

209 Troy Street, Tupelo, Mississippi 38804-4827

(Address of principal executive offices)(Zip Code)

Registrant’s telephone number, including area code: (662) 680-1001

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $5.00 par value per share | RNST | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On April 23, 2024, Renasant Corporation (“Renasant”) issued a press release announcing earnings for the first quarter of 2024. The press release is furnished as Exhibit 99.1 to this Form 8-K.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On April 23, 2024, the Board of Directors of (the “Company”) and Renasant Bank (the “Bank”) approved the next step of the Company’s and Bank’s management succession plan by designating Kevin D. Chapman to become Chief Executive Officer of the Company and the Bank, effective May 2025. Following Mr. Chapman’s promotion to Chief Executive Officer, C. Mitchell Waycaster will continue in his role as Executive Vice Chairman of the Company and the Bank. Until that time, Mr. Waycaster and Mr. Chapman will retain their current titles and duties as Chief Executive Officer and President and Chief Operating Officer, respectively, of both entities.

Mr. Waycaster’s and Mr. Chapman’s respective compensation and other benefit arrangements and the terms of their employment agreements were not changed in connection with the above-described designation. These compensation and other benefit arrangements and employment agreement terms, as well as the background, experience and related person disclosures for Mr. Waycaster and Mr. Chapman are described in the Company‘s definitive proxy statement for its 2024 Annual Meeting of Shareholders, filed with the Securities and Exchange Commission on March 13, 2024.

Item 7.01. Regulation FD Disclosure

On April 23, 2024, the Company also made available presentation materials (the “Presentation”) prepared for use with its earnings conference call on April 24, 2024. The Presentation is attached hereto and incorporated herein as Exhibit 99.2.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 7.01, including Exhibit 99.2, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, and shall not be deemed incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference in such filing.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS:

This press release may contain, or incorporate by reference, statements about Renasant Corporation that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “projects,” “anticipates,” “intends,” “estimates,” “plans,” “potential,” “focus,” “possible,” “may increase,” “may fluctuate,” “will likely result,” and similar expressions, or future or conditional verbs such as “will,” “should,” “would” and “could,” are generally forward-looking in nature and not historical facts. Forward-looking statements include information about the Company’s future financial performance, business strategy, projected plans and objectives and are based on the current beliefs and expectations of management. The Company’s management believes these forward-looking statements are reasonable, but they are all inherently subject to significant business, economic and competitive risks and uncertainties, many of which are beyond the Company’s control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ from those indicated or implied in the forward-looking statements, and such differences may be material. Prospective investors are cautioned that any forward-looking statements are not guarantees of future performance and involve risks and uncertainties and, accordingly, investors should not place undue reliance on these forward-looking statements, which speak only as of the date they are made.

Important factors currently known to management that could cause our actual results to differ materially from those in forward-looking statements include the following: (i) the Company’s ability to efficiently integrate acquisitions into its operations, retain the customers of these businesses, grow the acquired operations and realize the cost savings expected from an acquisition to the extent and in the timeframe anticipated by management; (ii) the effect of economic conditions and interest rates on a national, regional or international basis; (iii) timing and success of the implementation of changes in operations to achieve enhanced earnings or effect cost savings; (iv) competitive pressures in the consumer finance, commercial finance, insurance, financial services, asset management, retail banking, factoring and mortgage lending and auto lending industries; (v) the financial resources of, and products available from, competitors; (vi) changes in laws and regulations as well as changes in accounting standards; (vii) changes in policy by regulatory agencies; (viii) changes in the securities and foreign exchange markets; (ix) the Company’s potential growth, including its entrance or expansion into new markets, and the need for sufficient capital to support that growth; (x) changes in the quality or composition of the Company’s loan or investment portfolios, including adverse developments in borrower industries or the repayment ability of individual borrowers or issuers of investment securities, or the impact of interest rates on the value of our investment securities portfolio; (xi) an insufficient allowance for credit losses as a result of inaccurate assumptions; (xii) changes in the sources and costs of the capital we use to make loans and otherwise fund our operations, due to deposit outflows, changes in the mix of deposits and the cost and availability of borrowings; (xiii) general economic, market or business conditions, including the impact of inflation; (xiv) changes in demand for loan products and financial services; (xv) concentration of deposit and credit exposure; (xvi) changes or the lack of changes in interest rates, yield curves and interest rate spread relationships; (xvii) increased cybersecurity risk, including potential network breaches, business disruptions or financial losses; (xviii) civil unrest, natural disasters, epidemics and other catastrophic events in the Company’s geographic area; (xix) the impact, extent and timing of technological changes; and (xx) other circumstances, many of which are beyond management’s control.

Management believes that the assumptions underlying Company's forward-looking statements are reasonable, but any of the assumptions could prove to be inaccurate. Investors are urged to carefully consider the risks described in the Company’s filings with the Securities and Exchange Commission (the “SEC”) from time to time, including its most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, which are available at www.renasant.com and the SEC’s website at www.sec.gov.

The Company undertakes no obligation, and specifically disclaims any obligation, to update or revise forward-looking statements, whether as a result of new information or to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, except as required by federal securities laws.

Item 9.01. Financial Statements and Exhibits.

(d) The following exhibits are furnished herewith:

Exhibit No. Description

104 The cover page of Renasant Corporation's Form 8-K is formatted in Inline XBRL.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | RENASANT CORPORATION |

Date: April 23, 2024 | | By: | /s/ C. Mitchell Waycaster |

| | | C. Mitchell Waycaster |

| | | Chief Executive Officer |

| | | |

| | | | | | | | | | | |

| Contacts: | For Media: | | For Financials: |

| John S. Oxford | | James C. Mabry IV |

| Senior Vice President | | Executive Vice President |

| Chief Marketing Officer | | Chief Financial Officer |

| (662) 680-1219 | | (662) 680-1281 |

| | | |

RENASANT CORPORATION ANNOUNCES

EARNINGS FOR THE FIRST QUARTER OF 2024

TUPELO, MISSISSIPPI (April 23, 2024) - Renasant Corporation (NYSE: RNST) (the “Company”) today announced earnings results for the first quarter of 2024.

| | | | | | | | | | | | | | |

| (Dollars in thousands, except earnings per share) | Three Months Ended | | |

| Mar 31, 2024 | Dec 31, 2023 | Mar 31, 2023 | | | |

| Net income and earnings per share: | | | | | | |

| Net income | $39,409 | $28,124 | $46,078 | | | |

| After-tax loss on sale of securities | — | | (15,711) | | — | | | | |

| Basic EPS | 0.70 | 0.50 | 0.82 | | | |

| Diluted EPS | 0.70 | 0.50 | 0.82 | | | |

Adjusted diluted EPS (Non-GAAP)(1) | 0.65 | 0.76 | 0.82 | | | |

| Impact to diluted EPS from after-tax loss on sale of securities (including impairments) | — | | 0.28 | — | | | | |

“The quarter's results reflect solid performance across the company, including good loan and deposit growth.” remarked C. Mitchell Waycaster, Chief Executive Officer of the Company. “We continue to build balance sheet strength and believe this will keep Renasant well positioned for additional growth.”

Quarterly Highlights

Earnings

•Net income for the first quarter of 2024 was $39.4 million; diluted EPS was $0.70 and adjusted diluted EPS (non-GAAP)(1) was $0.65

•Net interest income (fully tax equivalent) for the first quarter of 2024 was $125.9 million, down $2.7 million on a linked quarter basis

•For the first quarter of 2024, net interest margin was 3.30%, down 3 basis points on a linked quarter basis

•Cost of total deposits was 2.35% for the first quarter of 2024, up 18 basis points on a linked quarter basis

•Noninterest income increased $21.0 million on a linked quarter basis. In the fourth quarter of 2023, the Company recognized impairment charges of $19.4 million as a result of its determination to sell a portion of its available-for-sale securities; there was no such impairment in the first quarter of 2024. Noninterest income for the fourth quarter of 2023 also included the receipt of $2.3 million related to Renasant's participation in a recovery agreement, with minimal recoveries in the first quarter of 2024

•Mortgage banking income increased $4.8 million on a linked quarter basis. The mortgage division generated $0.4 billion in interest rate lock volume in the first quarter of 2024, an increase of $0.1 billion on a linked quarter basis. Gain on sale margin was 1.78% for the first quarter of 2024, up 64 basis points on a linked quarter basis. In addition, during the first quarter of 2024, the Company sold a portion of its mortgage servicing rights (“MSR”), recognizing a gain of $3.5 million

•Noninterest expense increased $1.0 million on a linked quarter basis. The Company contributed $1.1 million to certain charitable organizations which were recorded in the line item "advertising and public relations" expense. These contributions qualify as tax credits and will reduce income tax expense dollar for dollar in 2024. In the first quarter of 2024, the Company recorded expense of $0.7 million related to the FDIC special assessment, as compared to the $2.7 million recorded in the fourth quarter of 2023

Balance Sheet

•Loans increased $149.3 million on a linked quarter basis, representing 4.9% annualized net loan growth

•Securities decreased $181.1 million on a linked quarter basis primarily driven by the sale of a portion of the Company's available-for-sale securities for proceeds of $177.2 million. A portion of the proceeds was used to purchase higher yielding securities, while the remainder, along with other cash flows from the securities portfolio, was used to fund loan growth.

•Deposits at March 31, 2024 increased $160.4 million on a linked quarter basis. Brokered deposits decreased $119.2 million on a linked quarter basis to $342.3 million at March 31, 2024. Noninterest bearing deposits decreased $67.5 million on a linked quarter basis and represented 24.7% of total deposits at March 31, 2024

Capital and Liquidity

•Book value per share and tangible book value per share (non-GAAP)(1) increased 0.8% and 1.7%, respectively, on a linked quarter basis

•The Company has a $100 million stock repurchase program that is in effect through October 2024; there was no buyback activity during the first quarter of 2024

Credit Quality

•The Company recorded a provision for credit losses of $2.4 million for the first quarter of 2024

•The ratio of allowance for credit losses on loans to total loans was constant at 1.61% at March 31, 2024 compared to December 31, 2023

•The coverage ratio, or the allowance for credit losses on loans to nonperforming loans, was 270.87% at March 31, 2024, compared to 286.26% at December 31, 2023

•Net loan charge-offs for the first quarter of 2024 were $0.2 million, or 0.01% of average loans on an annualized basis

•Nonperforming loans to total loans increased to 0.59% at March 31, 2024 compared to 0.56% at December 31, 2023, and criticized loans (which include classified and special mention loans) to total loans increased to 2.76% at March 31, 2024, compared to 2.16% at December 31, 2023

(1) This is a non-GAAP financial measure. A reconciliation of all non-GAAP financial measures disclosed in this release from GAAP to non-GAAP is included in the tables at the end of this release. The information below under the heading “Non-GAAP Financial Measures” explains why the Company believes the non-GAAP financial measures in this release provide useful information and describes the other purposes for which the Company uses non-GAAP financial measures.

Income Statement

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands, except per share data) | Three Months Ended | | |

| Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | | | |

| Interest income | | | | | | | | |

| Loans held for investment | $ | 192,390 | | $ | 188,535 | | $ | 181,129 | | $ | 173,198 | | $ | 161,787 | | | | |

| Loans held for sale | 2,308 | | 3,329 | | 3,751 | | 2,990 | | 1,737 | | | | |

| Securities | 10,700 | | 10,728 | | 10,669 | | 14,000 | | 15,091 | | | | |

| Other | 7,781 | | 7,839 | | 10,128 | | 6,978 | | 5,430 | | | | |

| Total interest income | 213,179 | | 210,431 | | 205,677 | | 197,166 | | 184,045 | | | | |

| Interest expense | | | | | | | | |

| Deposits | 82,613 | | 77,168 | | 70,906 | | 51,391 | | 32,866 | | | | |

| Borrowings | 7,276 | | 7,310 | | 7,388 | | 15,559 | | 15,404 | | | | |

| Total interest expense | 89,889 | | 84,478 | | 78,294 | | 66,950 | | 48,270 | | | | |

| Net interest income | 123,290 | | 125,953 | | 127,383 | | 130,216 | | 135,775 | | | | |

| Provision for credit losses | | | | | | | | |

| Provision for loan losses | 2,638 | | 2,518 | | 5,315 | | 3,000 | | 7,960 | | | | |

| | | | | | | | |

| Recovery of unfunded commitments | (200) | | — | | (700) | | (1,000) | | (1,500) | | | | |

| Total provision for credit losses | 2,438 | | 2,518 | | 4,615 | | 2,000 | | 6,460 | | | | |

| Net interest income after provision for credit losses | 120,852 | | 123,435 | | 122,768 | | 128,216 | | 129,315 | | | | |

| Noninterest income | 41,381 | | 20,356 | | 38,200 | | 17,226 | | 37,293 | | | | |

| Noninterest expense | 112,912 | | 111,880 | | 108,369 | | 110,165 | | 109,208 | | | | |

| Income before income taxes | 49,321 | | 31,911 | | 52,599 | | 35,277 | | 57,400 | | | | |

| Income taxes | 9,912 | | 3,787 | | 10,766 | | 6,634 | | 11,322 | | | | |

| Net income | $ | 39,409 | | $ | 28,124 | | $ | 41,833 | | $ | 28,643 | | $ | 46,078 | | | | |

| | | | | | | | |

Adjusted net income (non-GAAP)(1) | $ | 36,572 | | $ | 42,887 | | $ | 41,833 | | $ | 46,728 | | $ | 46,078 | | | | |

Adjusted pre-provision net revenue (“PPNR”) (non-GAAP)(1) | $ | 48,231 | | $ | 52,614 | | $ | 57,214 | | $ | 59,715 | | $ | 63,860 | | | | |

| | | | | | | | |

| Basic earnings per share | $ | 0.70 | | $ | 0.50 | | $ | 0.75 | | $ | 0.51 | | $ | 0.82 | | | | |

| Diluted earnings per share | 0.70 | | 0.50 | | 0.74 | | 0.51 | | 0.82 | | | | |

Adjusted diluted earnings per share (non-GAAP)(1) | 0.65 | | 0.76 | | 0.74 | | 0.83 | | 0.82 | | | | |

| Average basic shares outstanding | 56,208,348 | | 56,141,628 | | 56,138,618 | | 56,107,881 | | 56,008,741 | | | | |

| Average diluted shares outstanding | 56,531,078 | | 56,611,217 | | 56,523,887 | | 56,395,653 | | 56,270,219 | | | | |

| Cash dividends per common share | $ | 0.22 | | $ | 0.22 | | $ | 0.22 | | $ | 0.22 | | $ | 0.22 | | | | |

(1) This is a non-GAAP financial measure. A reconciliation of all non-GAAP financial measures disclosed in this release from GAAP to non-GAAP is included in the tables at the end of this release. The information below under the heading “Non-GAAP Financial Measures” explains why the Company believes the non-GAAP financial measures in this release provide useful information and describes the other purposes for which the Company uses non-GAAP financial measures.

Performance Ratios

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | | | |

| Return on average assets | 0.92 | % | 0.65 | % | 0.96 | % | 0.66 | % | 1.09 | % | | | |

Adjusted return on average assets (non-GAAP)(1) | 0.86 | | 0.99 | | 0.96 | | 1.08 | | 1.09 | | | | |

Return on average tangible assets (non-GAAP)(1) | 1.00 | | 0.71 | | 1.05 | | 0.73 | | 1.19 | | | | |

Adjusted return on average tangible assets (non-GAAP)(1) | 0.93 | | 1.08 | | 1.05 | | 1.18 | | 1.19 | | | | |

| Return on average equity | 6.85 | | 4.93 | | 7.44 | | 5.18 | | 8.55 | | | | |

Adjusted return on average equity (non-GAAP)(1) | 6.36 | | 7.53 | | 7.44 | | 8.45 | | 8.55 | | | | |

Return on average tangible equity (non-GAAP)(1) | 12.45 | | 9.26 | | 13.95 | | 9.91 | | 16.29 | | | | |

Adjusted return on average tangible equity (non-GAAP)(1) | 11.58 | | 13.94 | | 13.95 | | 15.94 | | 16.29 | | | | |

| Efficiency ratio (fully taxable equivalent) | 67.52 | | 75.11 | | 64.38 | | 73.29 | | 62.11 | | | | |

Adjusted efficiency ratio (non-GAAP)(1) | 68.23 | | 66.18 | | 63.60 | | 62.98 | | 61.30 | | | | |

| Dividend payout ratio | 31.43 | | 44.00 | | 29.33 | | 43.14 | | 26.83 | | | | |

Capital and Balance Sheet Ratios

| | | | | | | | | | | | | | | | | |

| As of |

| Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 |

| Shares outstanding | 56,304,860 | | 56,142,207 | | 56,140,713 | | 56,132,478 | | 56,073,658 | |

| Market value per share | $ | 31.32 | | $ | 33.68 | | $ | 26.19 | | $ | 26.13 | | $ | 30.58 | |

| Book value per share | 41.25 | | 40.92 | | 39.78 | | 39.35 | | 39.01 | |

Tangible book value per share (non-GAAP)(1) | 23.32 | | 22.92 | | 21.76 | | 21.30 | | 20.92 | |

| Shareholders’ equity to assets | 13.39 | % | 13.23 | % | 13.00 | % | 12.82 | % | 12.52 | % |

Tangible common equity ratio (non-GAAP)(1) | 8.04 | | 7.87 | | 7.55 | | 7.37 | | 7.13 | |

| Leverage ratio | 9.75 | | 9.62 | | 9.48 | | 9.22 | | 9.18 | |

| Common equity tier 1 capital ratio | 10.59 | | 10.52 | | 10.46 | | 10.30 | | 10.19 | |

| Tier 1 risk-based capital ratio | 11.37 | | 11.30 | | 11.25 | | 11.09 | | 10.98 | |

| Total risk-based capital ratio | 15.00 | | 14.93 | | 14.91 | | 14.76 | | 14.68 | |

(1) This is a non-GAAP financial measure. A reconciliation of all non-GAAP financial measures disclosed in this release from GAAP to non-GAAP is included in the tables at the end of this release. The information below under the heading “Non-GAAP Financial Measures” explains why the Company believes the non-GAAP financial measures in this release provide useful information and describes the other purposes for which the Company uses non-GAAP financial measures.

Noninterest Income and Noninterest Expense | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | Three Months Ended | | |

| Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | | | |

| Noninterest income | | | | | | | | |

| Service charges on deposit accounts | $ | 10,506 | | $ | 10,603 | | $ | 9,743 | | $ | 9,733 | | $ | 9,120 | | | | |

| Fees and commissions | 3,949 | | 4,130 | | 4,108 | | 4,987 | | 4,676 | | | | |

| Insurance commissions | 2,716 | | 2,583 | | 3,264 | | 2,809 | | 2,446 | | | | |

| Wealth management revenue | 5,669 | | 5,668 | | 5,986 | | 5,338 | | 5,140 | | | | |

| Mortgage banking income | 11,370 | | 6,592 | | 7,533 | | 9,771 | | 8,517 | | | | |

| | | | | | | | |

| Net losses on sales of securities (including impairments) | — | | (19,352) | | — | | (22,438) | | — | | | | |

| Gain on extinguishment of debt | 56 | | 620 | | — | | — | | — | | | | |

| BOLI income | 2,691 | | 2,589 | | 2,469 | | 2,402 | | 3,003 | | | | |

| Other | 4,424 | | 6,923 | | 5,097 | | 4,624 | | 4,391 | | | | |

| Total noninterest income | $ | 41,381 | | $ | 20,356 | | $ | 38,200 | | $ | 17,226 | | $ | 37,293 | | | | |

| Noninterest expense | | | | | | | | |

| Salaries and employee benefits | $ | 71,470 | | $ | 71,841 | | $ | 69,458 | | $ | 70,637 | | $ | 69,832 | | | | |

| Data processing | 3,807 | | 3,971 | | 3,907 | | 3,684 | | 3,633 | | | | |

| Net occupancy and equipment | 11,389 | | 11,653 | | 11,548 | | 11,865 | | 11,405 | | | | |

| Other real estate owned | 107 | | 306 | | (120) | | 51 | | 30 | | | | |

| Professional fees | 3,348 | | 2,854 | | 3,338 | | 4,012 | | 3,467 | | | | |

| Advertising and public relations | 4,886 | | 3,084 | | 3,474 | | 3,482 | | 4,686 | | | | |

| Intangible amortization | 1,212 | | 1,274 | | 1,311 | | 1,369 | | 1,426 | | | | |

| Communications | 2,024 | | 2,026 | | 2,006 | | 2,226 | | 1,980 | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Other | 14,669 | | 14,871 | | 13,447 | | 12,839 | | 12,749 | | | | |

| Total noninterest expense | $ | 112,912 | | $ | 111,880 | | $ | 108,369 | | $ | 110,165 | | $ | 109,208 | | | | |

Mortgage Banking Income

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | Three Months Ended | | |

| Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | | | |

| Gain on sales of loans, net | $ | 4,535 | | $ | 1,860 | | $ | 3,297 | | $ | 4,646 | | $ | 4,770 | | | | |

| Fees, net | 1,854 | | 2,010 | | 2,376 | | 2,859 | | 1,806 | | | | |

| Mortgage servicing income, net | 4,981 | | 2,722 | | 1,860 | | 2,266 | | 1,941 | | | | |

| | | | | | | | |

| Total mortgage banking income | $ | 11,370 | | $ | 6,592 | | $ | 7,533 | | $ | 9,771 | | $ | 8,517 | | | | |

Balance Sheet

| | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | As of |

| Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 |

| Assets | | | | | |

| Cash and cash equivalents | $ | 844,400 | | $ | 801,351 | | $ | 741,156 | | $ | 946,899 | | $ | 847,697 | |

| Securities held to maturity, at amortized cost | 1,199,111 | | 1,221,464 | | 1,245,595 | | 1,273,044 | | 1,300,240 | |

| Securities available for sale, at fair value | 764,486 | | 923,279 | | 909,108 | | 950,930 | | 1,507,907 | |

| Loans held for sale, at fair value | 191,440 | | 179,756 | | 241,613 | | 249,615 | | 159,318 | |

| Loans held for investment | 12,500,525 | | 12,351,230 | | 12,168,023 | | 11,930,516 | | 11,766,425 | |

| Allowance for credit losses on loans | (201,052) | | (198,578) | | (197,773) | | (194,391) | | (195,292) | |

| Loans, net | 12,299,473 | | 12,152,652 | | 11,970,250 | | 11,736,125 | | 11,571,133 | |

| Premises and equipment, net | 282,193 | | 283,195 | | 284,368 | | 285,952 | | 287,006 | |

| Other real estate owned | 9,142 | | 9,622 | | 9,258 | | 5,120 | | 4,818 | |

| Goodwill and other intangibles | 1,009,248 | | 1,010,460 | | 1,011,735 | | 1,013,046 | | 1,014,415 | |

| | | | | |

| | | | | |

| Bank-owned life insurance | 385,186 | | 382,584 | | 379,945 | | 377,649 | | 375,572 | |

| Mortgage servicing rights | 71,596 | | 91,688 | | 90,241 | | 87,432 | | 85,039 | |

| Other assets | 289,466 | | 304,484 | | 298,352 | | 298,530 | | 320,938 | |

| Total assets | $ | 17,345,741 | | $ | 17,360,535 | | $ | 17,181,621 | | $ | 17,224,342 | | $ | 17,474,083 | |

| | | | | |

Liabilities and Shareholders’ Equity | | | | | |

| Liabilities | | | | | |

| Deposits: | | | | | |

| Noninterest-bearing | $ | 3,516,164 | | $ | 3,583,675 | | $ | 3,734,197 | | $ | 3,878,953 | | $ | 4,244,877 | |

| Interest-bearing | 10,720,999 | | 10,493,110 | | 10,422,913 | | 10,216,408 | | 9,667,142 | |

| Total deposits | 14,237,163 | | 14,076,785 | | 14,157,110 | | 14,095,361 | | 13,912,019 | |

| Short-term borrowings | 108,121 | | 307,577 | | 107,662 | | 257,305 | | 732,057 | |

| Long-term debt | 428,047 | | 429,400 | | 427,399 | | 429,630 | | 431,111 | |

| Other liabilities | 250,060 | | 249,390 | | 256,127 | | 233,418 | | 211,596 | |

| Total liabilities | 15,023,391 | | 15,063,152 | | 14,948,298 | | 15,015,714 | | 15,286,783 | |

| | | | | |

Shareholders’ equity: | | | | | |

| | | | | |

| Common stock | 296,483 | | 296,483 | | 296,483 | | 296,483 | | 296,483 | |

| Treasury stock | (99,683) | | (105,249) | | (105,300) | | (105,589) | | (107,559) | |

| Additional paid-in capital | 1,303,613 | | 1,308,281 | | 1,304,891 | | 1,301,883 | | 1,299,458 | |

| Retained earnings | 978,880 | | 952,124 | | 936,573 | | 907,312 | | 891,242 | |

| Accumulated other comprehensive loss | (156,943) | | (154,256) | | (199,324) | | (191,461) | | (192,324) | |

Total shareholders’ equity | 2,322,350 | | 2,297,383 | | 2,233,323 | | 2,208,628 | | 2,187,300 | |

Total liabilities and shareholders’ equity | $ | 17,345,741 | | $ | 17,360,535 | | $ | 17,181,621 | | $ | 17,224,342 | | $ | 17,474,083 | |

Net Interest Income and Net Interest Margin

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | Three Months Ended |

| March 31, 2024 | December 31, 2023 | March 31, 2023 |

| Average

Balance | Interest

Income/

Expense | Yield/

Rate | Average

Balance | Interest

Income/

Expense | Yield/

Rate | Average

Balance | Interest

Income/

Expense | Yield/

Rate |

| Interest-earning assets: | | | | | | | | | |

| Loans held for investment | $ | 12,407,976 | | $ | 194,640 | | 6.30 | % | $ | 12,249,429 | | $ | 190,857 | | 6.18 | % | $ | 11,688,534 | | $ | 163,970 | | 5.68 | % |

| Loans held for sale | 155,382 | | 2,308 | | 5.94 | % | 199,510 | | 3,329 | | 6.68 | % | 103,410 | | 1,737 | | 6.72 | % |

| Taxable securities | 1,891,817 | | 9,505 | | 2.01 | % | 2,050,175 | | 9,490 | | 1.85 | % | 2,635,130 | | 13,317 | | 2.02 | % |

Tax-exempt securities(1) | 270,279 | | 1,505 | | 2.23 | % | 282,698 | | 1,558 | | 2.20 | % | 397,014 | | 2,345 | | 2.36 | % |

| Total securities | 2,162,096 | | 11,010 | | 2.04 | % | 2,332,873 | | 11,048 | | 1.89 | % | 3,032,144 | | 15,662 | | 2.07 | % |

| Interest-bearing balances with banks | 570,336 | | 7,781 | | 5.49 | % | 552,301 | | 7,839 | | 5.63 | % | 464,229 | | 5,430 | | 4.74 | % |

| Total interest-earning assets | 15,295,790 | | 215,739 | | 5.66 | % | 15,334,113 | | 213,073 | | 5.52 | % | 15,288,317 | | 186,799 | | 4.94 | % |

| Cash and due from banks | 188,503 | | | | 180,609 | | | | 197,782 | | | |

| Intangible assets | 1,009,825 | | | | 1,011,130 | | | | 1,011,557 | | | |

| Other assets | 708,895 | | | | 669,988 | | | | 660,242 | | | |

| Total assets | $ | 17,203,013 | | | | $ | 17,195,840 | | | | $ | 17,157,898 | | | |

| Interest-bearing liabilities: | | | | | | | | | |

Interest-bearing demand(2) | $ | 6,955,989 | | $ | 52,500 | | 3.03 | % | $ | 6,721,053 | | $ | 47,783 | | 2.82 | % | $ | 6,066,770 | | $ | 20,298 | | 1.36 | % |

| Savings deposits | 860,397 | | 730 | | 0.34 | % | 888,692 | | 765 | | 0.34 | % | 1,052,802 | | 826 | | 0.32 | % |

| Brokered deposits | 445,608 | | 5,987 | | 5.39 | % | 632,704 | | 8,594 | | 5.39 | % | 395,745 | | 4,418 | | 4.53 | % |

| Time deposits | 2,319,420 | | 23,396 | | 4.06 | % | 2,185,737 | | 20,026 | | 3.63 | % | 1,564,855 | | 7,324 | | 1.90 | % |

| Total interest-bearing deposits | 10,581,414 | | 82,613 | | 3.13 | % | 10,428,186 | | 77,168 | | 2.94 | % | 9,080,172 | | 32,866 | | 1.47 | % |

| Borrowed funds | 544,564 | | 7,276 | | 5.35 | % | 543,344 | | 7,310 | | 5.37 | % | 1,281,552 | | 15,404 | | 4.86 | % |

| Total interest-bearing liabilities | 11,125,978 | | 89,889 | | 3.24 | % | 10,971,530 | | 84,478 | | 3.06 | % | 10,361,724 | | 48,270 | | 1.89 | % |

| Noninterest-bearing deposits | 3,518,612 | | | | 3,703,050 | | | | 4,386,998 | | | |

| Other liabilities | 244,142 | | | | 260,235 | | | | 222,382 | | | |

| Shareholders’ equity | 2,314,281 | | | | 2,261,025 | | | | 2,186,794 | | | |

| Total liabilities and shareholders’ equity | $ | 17,203,013 | | | | $ | 17,195,840 | | | | $ | 17,157,898 | | | |

| Net interest income/ net interest margin | | $ | 125,850 | | 3.30 | % | | $ | 128,595 | | 3.33 | % | | $ | 138,529 | | 3.66 | % |

| Cost of funding | | | 2.46 | % | | | 2.28 | % | | | 1.33 | % |

| Cost of total deposits | | | 2.35 | % | | | 2.17 | % | | | 0.99 | % |

(1) U.S. Government and some U.S. Government Agency securities are tax-exempt in the states in which the Company operates.

(2) Interest-bearing demand deposits include interest-bearing transactional accounts and money market deposits.

Supplemental Margin Information

| | | | | | | | | | | | | | |

| (Dollars in thousands) | Three Months Ended | | |

| Mar 31, 2024 | Dec 31, 2023 | Mar 31, 2023 | | | |

| Earning asset mix: | | | | | | |

Loans held for investment | 81.12 | % | 79.88 | % | 76.45 | % | | | |

| Loans held for sale | 1.02 | | 1.30 | | 0.68 | | | | |

| Securities | 14.14 | | 15.21 | | 19.83 | | | | |

| Interest-bearing balances with banks | 3.72 | | 3.61 | | 3.04 | | | | |

| Total | 100.00 | % | 100.00 | % | 100.00 | % | | | |

| | | | | | |

| Funding sources mix: | | | | | | |

| Noninterest-bearing demand | 24.03 | % | 25.23 | % | 29.74 | % | | | |

| Interest-bearing demand | 47.50 | | 45.80 | | 41.13 | | | | |

| Savings | 5.88 | | 6.06 | | 7.14 | | | | |

| Brokered deposits | 3.04 | | 4.31 | | 2.68 | | | | |

| Time deposits | 15.84 | | 14.89 | | 10.61 | | | | |

| Borrowed funds | 3.71 | | 3.71 | | 8.70 | | | | |

| Total | 100.00 | % | 100.00 | % | 100.00 | % | | | |

| | | | | | |

| Net interest income collected on problem loans | $ | 123 | | $ | 283 | | $ | 392 | | | | |

| Total accretion on purchased loans | 800 | | 1,117 | | 885 | | | | |

| Total impact on net interest income | $ | 923 | | $ | 1,400 | | $ | 1,277 | | | | |

| Impact on net interest margin | 0.02 | % | 0.04 | % | 0.03 | % | | | |

| Impact on loan yield | 0.03 | | 0.05 | | 0.04 | | | | |

Loan Portfolio

| | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | As of |

| Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 |

| Loan Portfolio: | | | | | |

| Commercial, financial, agricultural | $ | 1,869,408 | | $ | 1,871,821 | | $ | 1,819,891 | | $ | 1,729,070 | | $ | 1,740,778 | |

| Lease financing | 107,474 | | 116,020 | | 120,724 | | 122,370 | | 121,146 | |

| Real estate - construction | 1,243,535 | | 1,333,397 | | 1,407,364 | | 1,369,019 | | 1,424,352 | |

| Real estate - 1-4 family mortgages | 3,429,286 | | 3,439,919 | | 3,398,876 | | 3,348,654 | | 3,278,980 | |

| Real estate - commercial mortgages | 5,753,230 | | 5,486,550 | | 5,313,166 | | 5,252,479 | | 5,085,813 | |

| Installment loans to individuals | 97,592 | | 103,523 | | 108,002 | | 108,924 | | 115,356 | |

| Total loans | $ | 12,500,525 | | $ | 12,351,230 | | $ | 12,168,023 | | $ | 11,930,516 | | $ | 11,766,425 | |

Credit Quality and Allowance for Credit Losses on Loans

| | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | As of |

| Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 |

| Nonperforming Assets: | | | | | |

| Nonaccruing loans | $ | 73,774 | | $ | 68,816 | | $ | 69,541 | | $ | 55,439 | | $ | 56,626 | |

| Loans 90 days or more past due | 451 | | 554 | | 532 | | 36,321 | | 18,664 | |

| Total nonperforming loans | 74,225 | | 69,370 | | 70,073 | | 91,760 | | 75,290 | |

| Other real estate owned | 9,142 | | 9,622 | | 9,258 | | 5,120 | | 4,818 | |

| Total nonperforming assets | $ | 83,367 | | $ | 78,992 | | $ | 79,331 | | $ | 96,880 | | $ | 80,108 | |

| | | | | |

| Criticized Loans | | | | | |

| Classified loans | $ | 206,502 | | $ | 166,893 | | $ | 186,052 | | $ | 219,674 | | $ | 222,701 | |

| Special Mention loans | 138,366 | | 99,699 | | 89,858 | | 56,616 | | 64,832 | |

Criticized loans(1) | $ | 344,868 | | $ | 266,592 | | $ | 275,910 | | $ | 276,290 | | $ | 287,533 | |

| | | | | |

| Allowance for credit losses on loans | $ | 201,052 | | $ | 198,578 | | $ | 197,773 | | $ | 194,391 | | $ | 195,292 | |

| Net loan charge-offs | $ | 164 | | $ | 1,713 | | $ | 1,933 | | $ | 3,901 | | $ | 4,732 | |

| Annualized net loan charge-offs / average loans | 0.01 | % | 0.06 | % | 0.06 | % | 0.13 | % | 0.16 | % |

| Nonperforming loans / total loans | 0.59 | | 0.56 | | 0.58 | | 0.77 | | 0.64 | |

| Nonperforming assets / total assets | 0.48 | | 0.46 | | 0.46 | | 0.56 | | 0.46 | |

| Allowance for credit losses on loans / total loans | 1.61 | | 1.61 | | 1.63 | | 1.63 | | 1.66 | |

| Allowance for credit losses on loans / nonperforming loans | 270.87 | | 286.26 | | 282.24 | | 211.85 | | 259.39 | |

| Criticized loans / total loans | 2.76 | | 2.16 | | 2.27 | | 2.32 | | 2.44 | |

(1) Criticized loans include loans in risk rating classifications of classified and special mention.

CONFERENCE CALL INFORMATION:

A live audio webcast of a conference call with analysts will be available beginning at 10:00 AM Eastern Time (9:00 AM Central Time) on Wednesday, April 24, 2024.

The webcast is accessible through Renasant’s investor relations website at www.renasant.com or https://event.choruscall.com/mediaframe/webcast.html?webcastid=YbP0Ll7b. To access the conference via telephone, dial 1-877-513-1143 in the United States and request the Renasant Corporation 2024 First Quarter Earnings Webcast and Conference Call. International participants should dial 1-412-902-4145 to access the conference call.

The webcast will be archived on www.renasant.com after the call and will remain accessible for one year. A replay can be accessed via telephone by dialing 1-877-344-7529 in the United States and entering conference number 6704083 or by dialing 1-412-317-0088 internationally and entering the same conference number. Telephone replay access is available until May 8, 2024.

ABOUT RENASANT CORPORATION:

Renasant Corporation is the parent of Renasant Bank, a 120-year-old financial services institution. Renasant has assets of approximately $17.3 billion and operates 193 banking, lending, mortgage, wealth management and insurance offices throughout the Southeast as well as offering factoring and asset-based lending on a nationwide basis.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS:

This press release may contain, or incorporate by reference, statements about Renasant Corporation that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “projects,” “anticipates,” “intends,” “estimates,” “plans,” “potential,” “focus,” “possible,” “may increase,” “may fluctuate,” “will likely result,” and similar expressions, or future or conditional verbs such as “will,” “should,” “would” and “could,” are generally forward-looking in nature and not historical facts. Forward-looking statements include information about the Company’s future financial performance, business strategy, projected plans and objectives and are based on the current beliefs and expectations of management. The Company’s management believes these forward-looking statements are reasonable, but they are all inherently subject to significant business, economic and competitive risks and uncertainties, many of which are beyond the Company’s control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ from those indicated or implied in the forward-looking statements, and such differences may be material. Prospective investors are cautioned that any forward-looking statements are not guarantees of future performance and involve risks and uncertainties and, accordingly, investors should not place undue reliance on these forward-looking statements, which speak only as of the date they are made.

Important factors currently known to management that could cause our actual results to differ materially from those in forward-looking statements include the following: (i) the Company’s ability to efficiently integrate acquisitions into its operations, retain the customers of these businesses, grow the acquired operations and realize the cost savings expected from an acquisition to the extent and in the timeframe anticipated by management; (ii) the effect of economic conditions and interest rates on a national, regional or international basis; (iii) timing and success of the implementation of changes in operations to achieve enhanced earnings or effect cost savings; (iv) competitive pressures in the consumer finance, commercial finance, insurance, financial services, asset management, retail banking, factoring and mortgage lending and auto lending industries; (v) the financial resources of, and products available from, competitors; (vi) changes in laws and regulations as well as changes in accounting standards; (vii) changes in policy by regulatory agencies; (viii) changes in the securities and foreign exchange markets; (ix) the Company’s potential growth, including its entrance or expansion into new markets, and the need for sufficient capital to support that growth; (x) changes in the quality or composition of the Company’s loan or investment portfolios, including adverse developments in borrower industries or in the repayment ability of individual borrowers or issuers of investment securities, or the impact of interest rates on the value of our investment securities portfolio; (xi) an insufficient allowance for credit losses as a result of inaccurate assumptions; (xii) changes in the sources and costs of the capital we use to make loans and otherwise fund our operations, due to deposit outflows, changes in the mix of deposits and the cost and availability of borrowings; (xiii) general economic, market or business conditions, including the impact of inflation; (xiv) changes in demand for loan products and financial services; (xv) concentration of deposit and credit exposure; (xvi) changes or the lack of changes in interest rates, yield curves and interest rate spread relationships; (xvii) increased cybersecurity risk, including potential network breaches, business disruptions or financial losses; (xviii) civil unrest, natural disasters, epidemics and other

catastrophic events in the Company’s geographic area; (xix) the impact, extent and timing of technological changes; and (xx) other circumstances, many of which are beyond management’s control.

Management believes that the assumptions underlying the Company’s forward-looking statements are reasonable, but any of the assumptions could prove to be inaccurate. Investors are urged to carefully consider the risks described in the Company’s filings with the Securities and Exchange Commission (the “SEC”) from time to time, including its most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, which are available at www.renasant.com and the SEC’s website at www.sec.gov.

The Company undertakes no obligation, and specifically disclaims any obligation, to update or revise forward-looking statements, whether as a result of new information or to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, except as required by federal securities laws.

NON-GAAP FINANCIAL MEASURES:

In addition to results presented in accordance with generally accepted accounting principles in the United States of America (“GAAP”), this press release and the presentation slides furnished to the SEC on the same Form 8-K as this release contain non-GAAP financial measures, namely, (i) adjusted loan yield, (ii) adjusted net interest income and margin, (iii) pre-provision net revenue (including on an as-adjusted basis), (iv) adjusted net income, (v) adjusted diluted earnings per share, (vi) tangible book value per share, (vii) the tangible common equity ratio, (viii) certain performance ratios (namely, the ratio of pre-provision net revenue to average assets, the adjusted return on average assets and on average equity, and the return on average tangible assets and on average tangible common equity (including each of the foregoing on an as-adjusted basis)), and (ix) the adjusted efficiency ratio.

These non-GAAP financial measures adjust GAAP financial measures to exclude intangible assets, including related amortization, and/or certain gains or charges (such as, for the first quarter of 2024, the gain on extinguishment of debt and the gain on the sale of mortgage servicing rights), with respect to which the Company is unable to accurately predict when these charges will be incurred or, when incurred, the amount thereof. Management uses these non-GAAP financial measures when evaluating capital utilization and adequacy. In addition, the Company believes that these non-GAAP financial measures facilitate the making of period-to-period comparisons and are meaningful indicators of its operating performance, particularly because these measures are widely used by industry analysts for companies with merger and acquisition activities. Also, because intangible assets such as goodwill and the core deposit intangible can vary extensively from company to company and, as to intangible assets, are excluded from the calculation of a financial institution’s regulatory capital, the Company believes that the presentation of this non-GAAP financial information allows readers to more easily compare the Company’s results to information provided in other regulatory reports and the results of other companies. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the tables below under the caption “Non-GAAP Reconciliations”.

None of the non-GAAP financial information that the Company has included in this release or the accompanying presentation slides are intended to be considered in isolation or as a substitute for any measure prepared in accordance with GAAP. Investors should note that, because there are no standardized definitions for the calculations as well as the results, the Company’s calculations may not be comparable to similarly titled measures presented by other companies. Also, there may be limits in the usefulness of these measures to investors. As a result, the Company encourages readers to consider its consolidated financial statements in their entirety and not to rely on any single financial measure.

Non-GAAP Reconciliations

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands, except per share data) | Three Months Ended | | |

| Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | | | |

Adjusted Pre-Provision Net Revenue (“PPNR”) | | | | | | |

| Net income (GAAP) | $ | 39,409 | | $ | 28,124 | | $ | 41,833 | | $ | 28,643 | | $ | 46,078 | | | | |

| Income taxes | 9,912 | | 3,787 | | 10,766 | | 6,634 | | 11,322 | | | | |

| Provision for credit losses (including unfunded commitments) | 2,438 | | 2,518 | | 4,615 | | 2,000 | | 6,460 | | | | |

| Pre-provision net revenue (non-GAAP) | $ | 51,759 | | $ | 34,429 | | $ | 57,214 | | $ | 37,277 | | $ | 63,860 | | | | |

| | | | | | | | |

| | | | | | | | |

| Gain on extinguishment of debt | (56) | | (620) | | — | | — | | — | | | | |

| | | | | | | | |

| Gain on sales of MSR | (3,472) | | (547) | | — | | — | | — | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Losses on sales of securities (including impairments) | — | | 19,352 | | — | | 22,438 | | — | | | | |

| | | | | | | | |

| Adjusted pre-provision net revenue (non-GAAP) | $ | 48,231 | | $ | 52,614 | | $ | 57,214 | | $ | 59,715 | | $ | 63,860 | | | | |

| | | | | | | | |

| Adjusted Net Income and Adjusted Tangible Net Income | | | | | | |

| Net income (GAAP) | $ | 39,409 | | $ | 28,124 | | $ | 41,833 | | $ | 28,643 | | $ | 46,078 | | | | |

| Amortization of intangibles | 1,212 | | 1,274 | | 1,311 | | 1,369 | | 1,426 | | | | |

Tax effect of adjustments noted above(1) | (237) | | (240) | | (269) | | (266) | | (299) | | | | |

| Tangible net income (non-GAAP) | $ | 40,384 | | $ | 29,158 | | $ | 42,875 | | $ | 29,746 | | $ | 47,205 | | | | |

| | | | | | | | |

| Net income (GAAP) | $ | 39,409 | | $ | 28,124 | | $ | 41,833 | | $ | 28,643 | | $ | 46,078 | | | | |

| | | | | | | | |

| | | | | | | | |

| Gain on extinguishment of debt | (56) | | (620) | | — | | — | | — | | | | |

| | | | | | | | |

| Gain on sales of MSR | (3,472) | | (547) | | — | | — | | — | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Losses on sales of securities (including impairments) | — | | 19,352 | | — | | 22,438 | | — | | | | |

| | | | | | | | |

Tax effect of adjustments noted above(1) | 691 | | (3,422) | | — | | (4,353) | | — | | | | |

| Adjusted net income (non-GAAP) | $ | 36,572 | | $ | 42,887 | | $ | 41,833 | | $ | 46,728 | | $ | 46,078 | | | | |

| Amortization of intangibles | 1,212 | | 1,274 | | 1,311 | | 1,369 | | 1,426 | | | | |

Tax effect of adjustments noted above(1) | (237) | | (240) | | (269) | | (266) | | (299) | | | | |

| Adjusted tangible net income (non-GAAP) | $ | 37,547 | | $ | 43,921 | | $ | 42,875 | | $ | 47,831 | | $ | 47,205 | | | | |

Tangible Assets and Tangible Shareholders’ Equity | | | | | | |

Average shareholders’ equity (GAAP) | $ | 2,314,281 | | $ | 2,261,025 | | $ | 2,231,605 | | $ | 2,217,708 | | $ | 2,186,794 | | | | |

| Average intangible assets | 1,009,825 | 1,011,130 | 1,012,460 | 1,013,811 | 1,011,557 | | | |

Average tangible shareholders’ equity (non-GAAP) | $ | 1,304,456 | | $ | 1,249,895 | | $ | 1,219,145 | | $ | 1,203,897 | | $ | 1,175,237 | | | | |

| | | | | | | | |

| Average assets (GAAP) | $ | 17,203,013 | | $ | 17,195,840 | | $ | 17,235,413 | | $ | 17,337,924 | | $ | 17,157,898 | | | | |

| Average intangible assets | 1,009,825 | 1,011,130 | 1,012,460 | 1,013,811 | 1,011,557 | | | |

| Average tangible assets (non-GAAP) | $ | 16,193,188 | | $ | 16,184,710 | | $ | 16,222,953 | | $ | 16,324,113 | | $ | 16,146,341 | | | | |

| | | | | | | | |

Shareholders’ equity (GAAP) | $ | 2,322,350 | | $ | 2,297,383 | | $ | 2,233,323 | | $ | 2,208,628 | | $ | 2,187,300 | | | | |

| Intangible assets | 1,009,248 | 1,010,460 | 1,011,735 | 1,013,046 | 1,014,415 | | | |

Tangible shareholders’ equity (non-GAAP) | $ | 1,313,102 | | $ | 1,286,923 | | $ | 1,221,588 | | $ | 1,195,582 | | $ | 1,172,885 | | | | |

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands, except per share data) | Three Months Ended | | |

| Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | | | |

| | | | | | | | |

| Total assets (GAAP) | $ | 17,345,741 | | $ | 17,360,535 | | $ | 17,181,621 | | $ | 17,224,342 | | $ | 17,474,083 | | | | |

| Intangible assets | 1,009,248 | 1,010,460 | 1,011,735 | 1,013,046 | 1,014,415 | | | |

| Total tangible assets (non-GAAP) | $ | 16,336,493 | | $ | 16,350,075 | | $ | 16,169,886 | | $ | 16,211,296 | | $ | 16,459,668 | | | | |

| | | | | | | | |

| Adjusted Performance Ratios | | | | | | | | |

| Return on average assets (GAAP) | 0.92 | % | 0.65 | % | 0.96 | % | 0.66 | % | 1.09 | % | | | |

| Adjusted return on average assets (non-GAAP) | 0.86 | | 0.99 | | 0.96 | | 1.08 | | 1.09 | | | | |

| Return on average tangible assets (non-GAAP) | 1.00 | | 0.71 | | 1.05 | | 0.73 | | 1.19 | | | | |

| Pre-provision net revenue to average assets (non-GAAP) | 1.21 | | 0.79 | | 1.32 | | 0.86 | | 1.51 | | | | |

| Adjusted pre-provision net revenue to average assets (non-GAAP) | 1.13 | | 1.21 | | 1.32 | | 1.38 | | 1.51 | | | | |

| Adjusted return on average tangible assets (non-GAAP) | 0.93 | | 1.08 | | 1.05 | | 1.18 | | 1.19 | | | | |

| Return on average equity (GAAP) | 6.85 | | 4.93 | | 7.44 | | 5.18 | | 8.55 | | | | |

| Adjusted return on average equity (non-GAAP) | 6.36 | | 7.53 | | 7.44 | | 8.45 | | 8.55 | | | | |

| Return on average tangible equity (non-GAAP) | 12.45 | | 9.26 | | 13.95 | | 9.91 | | 16.29 | | | | |

| Adjusted return on average tangible equity (non-GAAP) | 11.58 | | 13.94 | | 13.95 | | 15.94 | | 16.29 | | | | |

| | | | | | | | |

| Adjusted Diluted Earnings Per Share | | | | | | |

| Average diluted shares outstanding | 56,531,078 | 56,611,217 | 56,523,887 | 56,395,653 | 56,270,219 | | | |

| | | | | | | | |

| Diluted earnings per share (GAAP) | $ | 0.70 | | $ | 0.50 | | $ | 0.74 | | $ | 0.51 | | $ | 0.82 | | | | |

| Adjusted diluted earnings per share (non-GAAP) | $ | 0.65 | | $ | 0.76 | | $ | 0.74 | | $ | 0.83 | | $ | 0.82 | | | | |

| | | | | | | | |

| Tangible Book Value Per Share | | | | | | | | |

| Shares outstanding | 56,304,860 | 56,142,207 | 56,140,713 | 56,132,478 | 56,073,658 | | | |

| | | | | | | | |

| Book value per share (GAAP) | $ | 41.25 | | $ | 40.92 | | $ | 39.78 | | $ | 39.35 | | $ | 39.01 | | | | |

| Tangible book value per share (non-GAAP) | $ | 23.32 | | $ | 22.92 | | $ | 21.76 | | $ | 21.30 | | $ | 20.92 | | | | |

| | | | | | | | |

| Tangible Common Equity Ratio | | | | | | | | |

| Shareholders’ equity to assets (GAAP) | 13.39 | % | 13.23 | % | 13.00 | % | 12.82 | % | 12.52 | % | | | |

| Tangible common equity ratio (non-GAAP) | 8.04 | % | 7.87 | % | 7.55 | % | 7.37 | % | 7.13 | % | | | |

| Adjusted Efficiency Ratio | | | | | | | | |

| Net interest income (FTE) (GAAP) | $ | 125,850 | | $ | 128,595 | | $ | 130,131 | | $ | 133,085 | | $ | 138,529 | | | | |

| | | | | | | | |

| Total noninterest income (GAAP) | $ | 41,381 | | $ | 20,356 | | $ | 38,200 | | $ | 17,226 | | $ | 37,293 | | | | |

| | | | | | | | |

| Gain on sales of MSR | 3,472 | | 547 | | — | | — | | — | | | | |

| | | | | | | | |

| Gain on extinguishment of debt | 56 | | 620 | | — | | — | | — | | | | |

| Losses on sales of securities (including impairments) | — | | (19,352) | | — | | (22,438) | | — | | | | |

| Total adjusted noninterest income (non-GAAP) | $ | 37,853 | | $ | 38,541 | | $ | 38,200 | | $ | 39,664 | | $ | 37,293 | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands, except per share data) | Three Months Ended | | |

| Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | | | |

| Noninterest expense (GAAP) | $ | 112,912 | | $ | 111,880 | | $ | 108,369 | | $ | 110,165 | | $ | 109,208 | | | | |

| Amortization of intangibles | 1,212 | | 1,274 | | 1,311 | | 1,369 | | 1,426 | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Total adjusted noninterest expense (non-GAAP) | $ | 111,700 | | $ | 110,606 | | $ | 107,058 | | $ | 108,796 | | $ | 107,782 | | | | |

| | | | | | | | |

| Efficiency ratio (GAAP) | 67.52 | % | 75.11 | % | 64.38 | % | 73.29 | % | 62.11 | % | | | |

| Adjusted efficiency ratio (non-GAAP) | 68.23 | % | 66.18 | % | 63.60 | % | 62.98 | % | 61.30 | % | | | |

| | | | | | | | |

| Adjusted Net Interest Income and Adjusted Net Interest Margin | | | | | | |

| Net interest income (FTE) (GAAP) | $ | 125,850 | | $ | 128,595 | | $ | 130,131 | | $ | 133,085 | | $ | 138,529 | | | | |

| Net interest income collected on problem loans | 123 | | 283 | | (820) | | 364 | | 392 | | | | |

| Accretion recognized on purchased loans | 800 | | 1,117 | | 1,290 | | 874 | | 885 | | | | |

| Adjustments to net interest income | $ | 923 | | $ | 1,400 | | $ | 470 | | $ | 1,238 | | $ | 1,277 | | | | |

| Adjusted net interest income (FTE) (non-GAAP) | $ | 124,927 | | $ | 127,195 | | $ | 129,661 | | $ | 131,847 | | $ | 137,252 | | | | |

| | | | | | | | |

| Net interest margin (GAAP) | 3.30 | % | 3.33 | % | 3.36 | % | 3.45 | % | 3.66 | % | | | |

| Adjusted net interest margin (non-GAAP) | 3.28 | % | 3.29 | % | 3.35 | % | 3.43 | % | 3.63 | % | | | |

| | | | | | | | |

| Adjusted Loan Yield | | | | | | | | |

| Loan interest income (FTE) (GAAP) | $ | 194,640 | | $ | 190,857 | | $ | 183,521 | | $ | 175,549 | | $ | 163,970 | | | | |

| Net interest income collected on problem loans | 123 | | 283 | | (820) | | 364 | | 392 | | | | |

| Accretion recognized on purchased loans | 800 | | 1,117 | | 1,290 | | 874 | | 885 | | | | |

| Adjusted loan interest income (FTE) (non-GAAP) | $ | 193,717 | | $ | 189,457 | | $ | 183,051 | | $ | 174,311 | | $ | 162,693 | | | | |

| | | | | | | | |

| Loan yield (GAAP) | 6.30 | % | 6.18 | % | 6.06 | % | 5.93 | % | 5.68 | % | | | |

| Adjusted loan yield (non-GAAP) | 6.27 | % | 6.14 | % | 6.04 | % | 5.89 | % | 5.64 | % | | | |

(1) Tax effect is calculated based on the respective periods’ year-to-date effective tax rate excluding the impact of discrete items.

###

First Quarter 2024 Earnings Call

This presentation may contain various statements about Renasant Corporation (“Renasant,” “we,” “our,” or “us”) that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “projects,” “anticipates,” “intends,” “estimates,” “plans,” “potential,” “focus,” “possible,” “may increase,” “may fluctuate,” “will likely result,” and similar expressions, or future or conditional verbs such as “will,” “should,” “would” and “could,” are generally forward-looking in nature and not historical facts. Forward-looking statements include information about our future financial performance, business strategy, projected plans and objectives and are based on the current beliefs and expectations of management. We believe these forward-looking statements are reasonable, but they are all inherently subject to significant business, economic and competitive risks and uncertainties, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions about future business strategies and decisions that are subject to change. Actual results may differ from those indicated or implied in the forward-looking statements; such differences may be material. Prospective investors are cautioned that any forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date they are made. Important factors currently known to management that could cause our actual results to differ materially from those in forward-looking statements include the following: (i) Renasant’s ability to efficiently integrate acquisitions into its operations, retain the customers of these businesses, grow the acquired operations and realize the cost savings expected from an acquisition to the extent and in the timeframe anticipated by management; (ii) the effect of economic conditions and interest rates on a national, regional or international basis; (iii) timing and success of the implementation of changes in operations to achieve enhanced earnings or effect cost savings; (iv) competitive pressures in the consumer finance, commercial finance, insurance, financial services, asset management, retail banking, factoring and mortgage lending and auto lending industries; (v) the financial resources of, and products available from, competitors; (vi) changes in laws and regulations as well as changes in accounting standards; (vii) changes in policy by regulatory agencies; (viii) changes in the securities and foreign exchange markets; (ix) Renasant’s potential growth, including its entrance or expansion into new markets, and the need for sufficient capital to support that growth; (x) changes in the quality or composition of our loan or investment portfolios, including adverse developments in borrower industries or the repayment ability of individual borrowers or issuers of investment securities, or the impact of interest rates on the value of our investment securities portfolio; (xi) an insufficient allowance for credit losses as a result of inaccurate assumptions; (xii) changes in the sources and costs of the capital we use to make loans and otherwise fund our operations, due to deposit outflows, changes in the mix of deposits and the cost and availability of borrowings; (xiii) general economic, market or business conditions, including the impact of inflation; (xiv) changes in demand for loan products and financial services; (xv) concentration of deposit and credit exposure; (xvi) changes or the lack of changes in interest rates, yield curves and interest rate spread relationships; (xvii) increased cybersecurity risk, including potential network breaches, business disruptions or financial losses; (xviii) civil unrest, natural disasters, epidemics and other catastrophic events in our geographic area; (xix) the impact, extent and timing of technological changes; and (xx) other circumstances, many of which are beyond management’s control. Management believes that the assumptions underlying our forward-looking statements are reasonable, but any of the assumptions could prove to be inaccurate. Investors are urged to carefully consider the risks described in Renasant’s filings with the Securities and Exchange Commission (“SEC”) from time to time, including its most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, which are available at www.renasant.com and the SEC’s website at www.sec.gov. We undertake no obligation, and specifically disclaim any obligation, to update or revise our forward-looking statements, whether as a result of new information or to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, except as required by federal securities laws. 2 Forward-Looking Statements

3 Overview Snapshot Note: As of March 31, 2024 Assets: $17.3 billion Loans: 12.5 Deposits: 14.2 Equity: 2.3 Footprint Loans and Deposits by State MS 18% AL 29% FL 8% Other 1% GA 29% TN 15% Loans MS 38% AL 14% FL 3% GA 32% TN 13% Deposits *Republic Business Credit operates on a nationwide basis. Locations in California, Illinois and Texas are not shown.

4 First Quarter Highlights • Net income of $39.4 million with diluted EPS of $0.70 and adjusted diluted EPS (non-GAAP)(1) of $0.65. The Company sold a portion of its mortgage servicing rights (“MSRs”) for a gain of $3.5 million, which increased diluted EPS by $0.05 • Net interest margin decreased 3 basis points to 3.30% on a linked quarter basis • Loans increased $149.3 million, or 4.9% annualized • Deposits increased $160.4 million; core deposits, which excludes brokered deposits, increased $279.6 million • Cost of total deposits increased 18 basis points to 2.35%; noninterest-bearing deposits represented 24.7% of total deposits • The ratio of allowance for credit losses on loans to total loans remained at 1.61% • Nonperforming loans represented 0.59% of total loans, an increase of 3 basis points on a linked quarter basis; annualized net loan charge-offs were 0.01% of average loans (1) Adjusted diluted EPS is a non-GAAP financial measure. A reconciliation of GAAP to non-GAAP financial measures is included in the earnings release furnished to the SEC on the same Form 8-K as this presentation under the heading “Non-GAAP Reconciliations”.

5 Balance Sheet $17,474 $17,224 $17,182 $17,361 $17,346 $17,000 $17,050 $17,100 $17,150 $17,200 $17,250 $17,300 $17,350 $17,400 $17,450 $17,500 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Assets $11,766 $11,931 $12,168 $12,351 $12,501 $11,200 $11,400 $11,600 $11,800 $12,000 $12,200 $12,400 $12,600 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Loans $13,912 $14,095 $14,157 $14,077 $14,237 $13,700 $13,800 $13,900 $14,000 $14,100 $14,200 $14,300 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Deposits $2,187 $2,209 $2,233 $2,297 $2,322 $2,100 $2,150 $2,200 $2,250 $2,300 $2,350 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Equity Note: Dollars in millions Note: In millions

6 Core Deposit Funding 25% 50% 6% 17% 2% Noninterest-bearing Interest-bearing* Savings Time Brokered • Average deposit account is $31 thousand; commercial and consumer deposit accounts, excluding time deposit accounts, averaged approximately $78 thousand and $13 thousand, respectively • Top 20 depositors, excluding public funds, comprise 4.6% of total deposits Diversification Note: As of March 31, 2024 *Includes money market Consumer 48% Commercial 36% Brokered 2% Public Funds 14% CommercialCustomer Construction 16% Professional Services 9% Real Estate 13% Financial 14% Manufacturing 7% Trade 11% Health Care 5% Other Services 16% Other 9% Granularity

7 Strong Liquidity Position 85% 85% 86% 88% 88% $1 $1 $1 $1 $1 $1 $1 $1 $1 $1 $1 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Loans to Deposits 20.9% 18.4% 16.9% 17.0% 16.2% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Cash and Securities to Total Assets Average Interest Earning Asset Mix (1Q 2024) 81% 1% 14% 4% Loans Held for Investment Loans Held for Sale Securities Interest Bearing Balances with Banks

8 Capital • $100 million stock repurchase program is in effect through October 2024; there was no buyback activity in the first quarter of 2024 • Consistent dividend payment history, including through the 2008 financial crisis • Unrealized losses on the HTM portfolio would have a negative impact of 47 basis points on the TCE ratio at March 31, 2024; unrealized losses on both HTM and AFS would have a negative impact of 149 basis points on CET1 and the Company would remain above well- capitalized thresholds at March 31, 2024 Highlights * Tangible Common Equity and Tangible Book Value are non-GAAP financial measures. A reconciliation of GAAP to non-GAAP financial measures is included in the earnings release furnished to the SEC on the same Form 8-K as this presentation under the heading “Non-GAAP Reconciliations”. 10.19% 10.30% 10.46% 10.52% 10.59% 14.68% 14.76% 14.91% 14.93% 15.00% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 CET1 / TRBC Common equity tier 1 capital ratio Total risk-based capital ratio $39.01 $39.35 $39.78 $40.92 $41.25 $20.92 $21.30 $21.76 $22.92 $23.32 $5 $10 $15 $20 $25 $30 $35 $40 $45 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Book Value / TBV Book Value Tangible Book Value (non-GAAP)* 12.52% 12.82% 13.00% 13.23% 13.39% 7.13% 7.37% 7.55% 7.87% 8.04% $0 $0 $0 $0 $0 $0 $0 $0 $0 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Equity to Assets / Tangible Common Equity Ratio Shareholders' equity to assets Tangible common equity ratio (non-GAAP)*

9 Asset Quality 2.44% 2.32% 2.27% 2.16% 2.76% 2.00% 2.50% 3.00% 3.50% 4.00% 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Criticized Loans/Total Loans 0.43% 0.10% 0.11% 0.44% 0.48% 0.0% 0.5% 1.0% 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Loans 30-89 Days Past Due/ Total Loans 0.16% 0.13% 0.06% 0.06% 0.01% 0.0% 0.5% 1.0% 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Net Charge-offs / Average Loans 1.66% 1.63% 1.63% 1.61% 1.61% 0.0% 1.0% 2.0% 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Allowance/Total Loans 259% 212% 282% 286% 271% 0% 200% 400% 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Allowance/Nonperforming Loans 0.46% 0.56% 0.46% 0.46% 0.48% 0.0% 0.5% 1.0% 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 NPAs/Total Assets

10 Profitability Note: Dollars in millions except per share amounts. *Adjusted Diluted EPS, Adjusted Net Income, Adjusted Net Interest Income (FTE), PPNR and Adjusted PPNR are non-GAAP financial measures. A reconciliation of GAAP to non-GAAP financial measures is included in the earnings release furnished to the SEC on the same Form 8-K as this presentation under the heading “Non-GAAP Reconciliations”. $.82 $.51 $.74 $.50 $.70 $.82 $.83 $.74 $.76 $.65 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Diluted EPS / Adjusted Diluted EPS (non-GAAP)* Diluted EPS (GAAP) Adjusted Diluted EPS (non-GAAP)* $46.1 $28.6 $41.8 $28.1 $39.4 $46.1 $46.7 $41.8 $42.9 $36.6 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Net Income / Adjusted Net Income (non-GAAP)* Net Income Adjusted Net Income (non-GAAP)* $138.5 $133.1 $130.1 $128.6 $125.9 $137.3 $131.8 $129.7 $127.2 $124.9 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Net Interest Income (FTE) / Adjusted Net Interest Income (FTE) (non-GAAP)* Net interest income (FTE) Adjusted net interest income (FTE) (non-GAAP)* $63.9 $37.3 $57.2 $34.4 $51.8 $63.9 $59.7 $57.2 $52.6 $48.2 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 PPNR (non-GAAP)* / Adjusted PPNR (non-GAAP)* PPNR (non-GAAP)* Adjusted PPNR (non-GAAP)*

11 Profitability Ratios *Adjusted ROAA, Adjusted ROATCE, PPNR/Average Assets, Adjusted PPNR/Average Assets and Adjusted Efficiency Ratio are non-GAAP financial measures. A reconciliation of GAAP to non-GAAP financial measures is included in the earnings release furnished to the SEC on the same Form 8-K as this presentation under the heading “Non-GAAP Reconciliations”. 8.55% 5.18% 7.44% 4.93% 6.85% 16.29% 15.94% 13.95% 13.94% 11.58% 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 ROAE / Adjusted ROATCE ROAE (GAAP) ROATCE (Adjusted) (non-GAAP)* 1.09% 0.66% 0.96% 0.65% 0.92% 1.09% 1.08% 0.96% 0.99% 0.86% 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 ROAA / Adjusted ROAA ROAA (GAAP) ROAA (Adjusted) (non-GAAP)* 62% 73% 64% 75% 68% 61% 63% 64% 66% 68% 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Efficiency Ratio / Adjusted Efficiency Ratio Efficiency Ratio (GAAP) Adjusted Efficiency Ratio (non-GAAP)* 1.51% 0.86% 1.32% 0.79% 1.21% 1.51% 1.38% 1.32% 1.21% 1.13% 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 PPNR / Adjusted PPNR Ratios PPNR/Average Assets (non-GAAP)* Adjusted PPNR/Average Assets (non-GAAP)*

12 Net Interest Margin (FTE), Loan Yield and Cost of Deposits 3.66% 3.45% 3.36% 3.33% 3.30% 3.63% 3.43% 3.35% 3.29% 3.28% 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Net Interest Margin (FTE) / Adjusted Net Interest Margin (FTE)(non-GAAP)* Net Interest Margin Adjusted Net Interest Margin (FTE)(non-GAAP)* 5.68% 5.93% 6.06% 6.18% 6.30% 5.64% 5.89% 6.04% 6.14% 6.27% 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Loan Yield / Adjusted Loan Yield (non-GAAP)* Loan yield Adjusted Loan Yield (non-GAAP)* *Adjusted Net Interest Margin (FTE) and Adjusted Loan Yield are non-GAAP financial measures. A reconciliation of GAAP to non-GAAP financial measures is included in the earnings release furnished to the SEC on the same Form 8-K as this presentation under the heading “Non-GAAP Reconciliations”. 0.99% 1.50% 1.98% 2.17% 2.35%1.47% 2.13% 2.70% 2.94% 3.13% 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Cost of Deposits Total cost of deposits Cost of total interest-bearing deposits

13 Noninterest Income / Total Revenue Service Charges 25% Fees and Commissions 10% Insurance 7% Wealth Management 14% Mortgage Banking 27% Other 17% Noninterest Income Mix - 1Q 2024 • Noninterest income increased $21.0 million on a linked quarter basis. In the fourth quarter of 2023, the Company recognized impairment charges of $19.4 million as a result of its determination to sell a portion of its available-for-sale securities; there was no such impairment in the first quarter of 2024. Noninterest income for the fourth quarter of 2023 also included the receipt of $2.3 million related to Renasant's participation in a recovery agreement, with minimal recoveries in the first quarter of 2024. During the first quarter of 2024, the Company sold a portion of its MSRs for a gain of $3.5 million. A gain of $547 thousand relating to a previous sale of MSRs was recognized in the fourth quarter of 2023. $37.3 $17.2 $38.2 $20.4 $41.4 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Noninterest Income 85% 4% 8% 3% YTD Total Revenue(1) Community Banking Wealth Management Mortgage Insurance Note: Dollars in millions (1) Total revenue is calculated as net interest income plus noninterest income.

14 Noninterest Expense Salaries and employee benefits 63% Data processing 4% Net occupancy and equipment 10% Advertising and public relations 4% Other 19% Mix - 1Q 2024($ in thousands) 4Q23 1Q24 Change Salaries and employee benefits 71,841$ 71,470$ (371)$ Data processing 3,971 3,807 (164) Net occupancy and equipment 11,653 11,389 (264) Advertising and public relations 3,084 4,886 1,802 Other 21,331 21,360 29 Total 111,880$ 112,912$ 1,032$ • Noninterest expense increased $1.0 million on a linked quarter basis. The Company contributed $1.1 million to certain charitable organizations (recorded in advertising and public relations expense), which qualify as tax credits and will reduce income tax expense dollar for dollar in 2024. In the first quarter of 2024, the Company recorded expense of $0.7 million related to the FDIC special assessment, as compared to the $2.7 million recorded in the fourth quarter of 2023 $109.2 $110.2 $108.4 $111.9 $112.9 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 ($ in millions)

Appendix

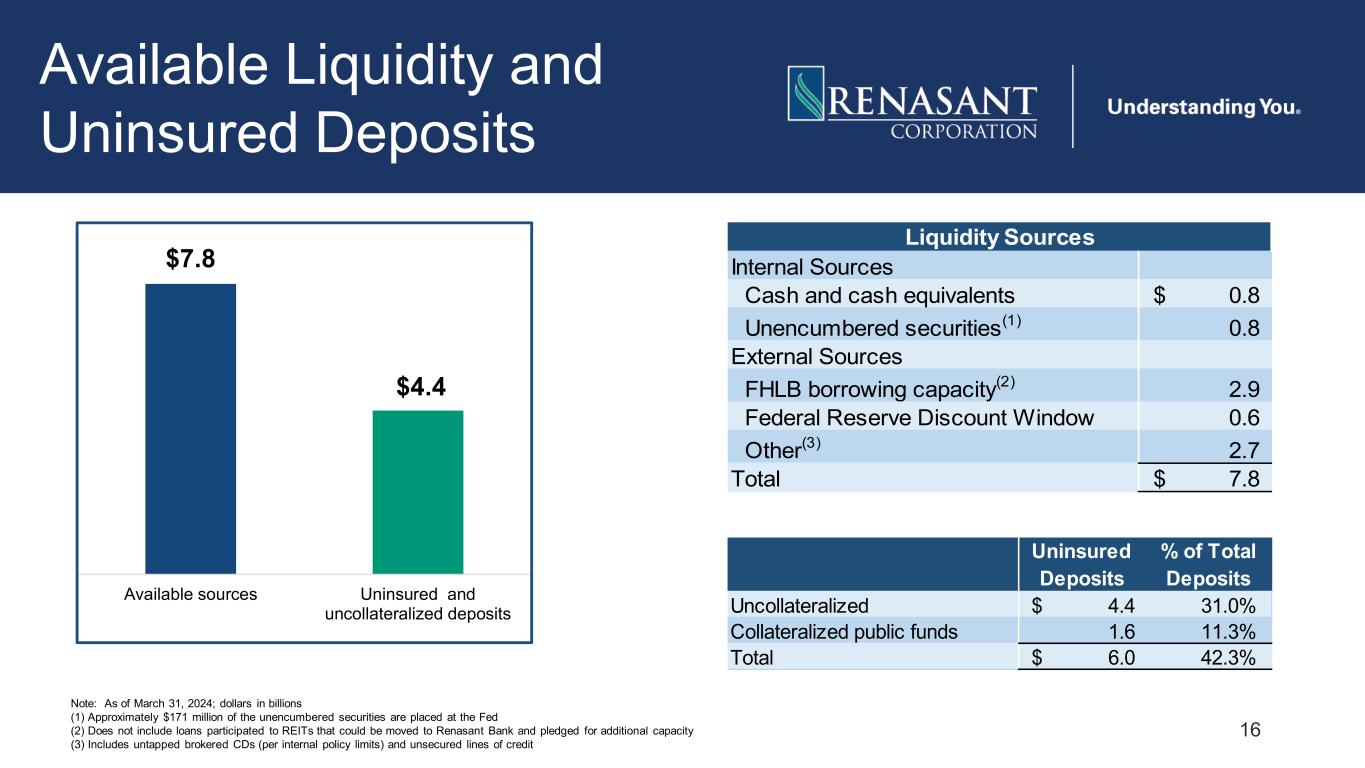

16 Available Liquidity and Uninsured Deposits Note: As of March 31, 2024; dollars in billions (1) Approximately $171 million of the unencumbered securities are placed at the Fed (2) Does not include loans participated to REITs that could be moved to Renasant Bank and pledged for additional capacity (3) Includes untapped brokered CDs (per internal policy limits) and unsecured lines of credit $7.8 $4.4 Available sources Uninsured and uncollateralized deposits Uninsured Deposits % of Total Deposits Uncollateralized 4.4$ 31.0% Collateralized public funds 1.6 11.3% Total 6.0$ 42.3% Internal Sources Cash and cash equivalents 0.8$ Unencumbered securities(1) 0.8 External Sources FHLB borrowing capacity(2) 2.9 Federal Reserve Discount Window 0.6 Other(3) 2.7 Total 7.8$ Liquidity Sources

17 Securities Composition (at Amortized Cost) Agency MBS 29% Agency CMO 38% Agency CMBS 10% Municipal 15% SBA 5% Other 3% • Represents 11.3% of total assets • Duration of 4.9 years • 61% of portfolio HTM o 10% of HTM are CRA investments o 24% of HTM are Municipals • Unrealized losses in AOCI on securities totaled $220.8 million ($165.7 million, net of tax); unrealized losses in AOCI on HTM securities totaled $75.2 million ($56.1 million, net of tax) Highlights $2.1 Billion Note: As of March 31, 2024

18 Non-Owner Occupied CRE – Term* and Office Non-Owner Occupied CRE – Term* 17% 9% 10% 21% 8% 9% 17% 9% Warehouse/Industrial Hotels Self Storage Multi-family Medical Office Office (non-medical) Retail Senior Housing • 31.8% of total loans • Non-performing loans of 0.24% • 30-89 days past due of 0.08% Note: As of March 31, 2024. LTV is calculated using the most recent appraisal available. *Excludes construction • Average loan size of $2.0 million • Weighted average LTV of 55.7% Office (non-medical) • $340 million portfolio, 2.7% of total loans • 0.24% past due or nonaccrual • Average loan size of $1.0 million • Weighted average LTV of 57.0% • 87% of portfolio < 75% LTV

19 Construction Note: As of March 31, 2024; LTV is calculated using the most recent appraisal available. 22% 5% 37% 6% 6% 10% 11% 3% 1-4 Family Commercial Owner-Occupied Multi-family Office Retail Self Storage Warehouse / Industrial Hotels Composition Highlights • 9.9% of total loans • 0.02% past due or nonaccrual • Average loan size of $1.9 million • Weighted average LTV of 60.2%

20 ACL / Loss Absorption ($ in thousands) ACL ACL as a % of Loans ACL ACL as a % of Loans Commercial, Financial, Agricultural 43,980$ 2.35 45,922$ 2.46 Lease Financing Receivables 2,515 2.17 2,554 2.38 Real Estate - 1-4 Family Mortgage 47,270 1.37 47,532 1.39 Real Estate - Commercial Mortgage 77,048 1.40 78,783 1.37 Real Estate - Construction 18,612 1.40 17,317 1.39 Installment loans to individuals 9,153 8.84 8,944 9.16 Allowance for Credit Losses on Loans 198,578 1.61 201,052 1.61 Allowance for Credit Losses on Deferred Interest 1,245 1,245 Reserve for Unfunded Commitments 16,918 16,718 Total Reserves 216,741 219,015 Purchase Accounting Discounts 8,593 7,635 Total Loss Absorption Capacity 225,334$ 226,650$ 3/31/202412/31/2023

21 Mortgage Banking MixMortgage Banking Income Gain on sale margin* *Gain on sale margin excludes pipeline fair value adjustments and buyback reserve activity included in “Gain on sales of loans, net” in the table above ($ in thousands) 1Q23 4Q23 1Q24 Gain on sales of loans, net 4,770$ 1,860$ 4,535$ Fees, net 1,806 2,010 1,854 Mortgage servicing income, net 1,941 2,722 4,981 Mortgage banking income, net 8,517$ 6,592$ 11,370$ 1.15% 1.66% 1.55% 1.14% 1.78% 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 $0.6 $0.6 $0.5 $0.3 $0.4 $- $0 $0 $0 $0 $1 $1 $1 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Locked Volume (in billions) (in %) 1Q23 4Q23 1Q24 Wholesale 36 52 51 Retail 64 48 49 Purchase 86 87 88 Refinance 14 13 12

| | | | | | | | | | | |

| Contacts: | For Media: | | For Financials: |

| John S. Oxford | | James C. Mabry IV |

| Senior Vice President | | Executive Vice President |

| Chief Marketing Officer | | Chief Financial Officer |

| (662) 680-1219 | | (662) 680-1281 |

| joxford@renasant.com | | jim.mabry@renasant.com |

Renasant Announces Leadership Transition

TUPELO, MISSISSIPPI (April 23, 2024) - The Board of Directors of Renasant Corporation (the “Company”) implemented the next step of the Company’s management succession plan, designating Kevin D. Chapman to become Chief Executive Officer of the Company and Renasant Bank (the “Bank”) effective May 2025. Chapman will retain his current title and duties of President of both the Company and Bank. Over the next year, current Renasant CEO, C. Mitchell Waycaster will work with Chapman on the leadership transition; in May 2025, while stepping down from the CEO position, Waycaster will continue in his role as Executive Vice Chairman of the Company and the Bank.