Six Banks Repay $626 Million In TARP Funds

December 29 2010 - 4:31PM

Dow Jones News

The U.S. Treasury Department announced six financial firms

repaid funds they received in the government's Wall Street bailout,

delivering $626 million to taxpayers.

Through the Troubled Asset Relef Program, created in 2008,

Treasury provided capital to banks and other financial companies

sent reeling by the financial crisis.

As the economy recovers, companies that took TARP money have

been making repayments and delivering accrued dividends.

Treasury disbursed $389 billion in TARP money. On Wednesday it

said repayments along with investment income, including dividends

and interest, total $270 billion.

The $626 million figure includes repayments and dividends. On

Wednesday, Treasury said East West Bancorp of Pasadena, Calif.

repurchased $306.5 million in TARP investments and paid $1.9

million in dividends.

Webster Financial Corp. of Waterbury, Conn. repurchased $200

million in TARP investments and paid $1.2 million in dividends.

1st Source Corproation of South Bend, Ind. repurchased $111

million and paid $678,333 million in dividends.

Surrey Bancorp of Mount Airy, N.C., repurchased a total of $2.1

million in preferred shares and paid $13,322 in dividends.

Nationwide Bankshares of West Point, Neb. repurchased a total of

$2.1 million in preferred shares and paid $20,509 in dividends.

Haviland Bancshares, Inc. of Haviland, Kan., repurchased

$446,000 and paid $2828 in dividends.

-By Ryan Tracy, Dow Jones Newswires; 202-862-9245; ryan.tracy@dowjones.com

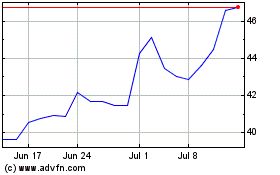

Webster Financial (NYSE:WBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

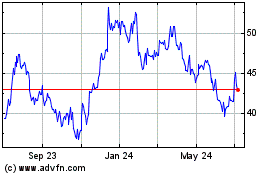

Webster Financial (NYSE:WBS)

Historical Stock Chart

From Apr 2023 to Apr 2024