UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): August 4, 2015

VENTAS, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware |

|

1-10989 |

|

61-1055020 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

353 N. Clark Street, Suite 3300, Chicago, Illinois |

|

60654 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (877) 483-6827

Not Applicable

Former Name or Former Address, if Changed Since Last Report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.01. Completion of Acquisition or Disposition of Assets.

On August 4, 2015, Ventas, Inc. (“Ventas”) completed its acquisition of Ardent Medical Services, Inc. (“AHS”). Concurrent with the closing of the transaction, Ventas separated AHS’s hospital operations from its owned real estate and sold the hospital operations to a newly formed and capitalized operating company (“Ardent”). Ardent is majority owned by an entity controlled by Equity Group Investments (“EGI”), with Ventas purchasing a 9.9% interest and management of AHS retaining a significant ownership stake. Ventas has entered into a long-term triple-net lease with Ardent to operate the acquired properties with an initial base rent of $105 million. The value of Ventas’s investment in the AHS-owned real estate (inclusive of Ventas’s concurrent purchase of the real estate previously owned by a joint venture between AHS and a minority partner in one of AHS’s hospital service areas) plus Ventas’s purchased 9.9% interest in Ardent is approximately $1.4 billion.

A copy of the press release issued by Ventas, EGI and AHS on August 4, 2015 announcing the completion of the transactions is filed herewith as Exhibit 99.1 and is incorporated in this Item 2.01 by reference.

Item 9.01. Financial Statements and Exhibits.

(a) Financial Statements of Businesses Acquired.

Financial statements of the business acquired and any additional information specified by Rule 3-05 of Regulation S-X will be filed by amendment to this Current Report on Form 8-K no later than 71 days following the date that this Current Report is required to be filed.

(b) Pro Forma Financial Information.

Pro forma financial information will be filed by amendment to this Current Report on Form 8-K no later than 71 days following the date that this Current Report is required to be filed.

(c) Shell Company Transactions.

Not applicable.

(d) Exhibits:

|

Exhibit

Number |

|

Description |

|

99.1 |

|

Press release issued by Ventas, EGI and AHS on August 4, 2015. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

VENTAS, INC. |

|

|

|

|

|

|

|

|

|

Date: August 10, 2015 |

By: |

/s/ T. Richard Riney |

|

|

|

T. Richard Riney |

|

|

|

Executive Vice President, Chief Administrative Officer and General Counsel |

3

EXHIBIT INDEX

|

Exhibit

Number |

|

Description |

|

99.1 |

|

Press release issued by Ventas, EGI and AHS on August 4, 2015. |

4

Exhibit 99.1

VENTAS AND EQUITY GROUP INVESTMENTS ANNOUNCE

COMPLETION OF ARDENT TRANSACTIONS

Ventas Completes Acquisition of Ardent Health Services and Separates Hospital Operations from Owned Real Estate

Operating Company of Ardent Health Services to be Majority Owned by EGI-Controlled Entity

CHICAGO, IL and NASHVILLE, TN — AUGUST 4, 2015 — Ventas, Inc. (“Ventas”), Equity Group Investments (“EGI”), and Ardent Health Services (“AHS”) today announced the completion of their previously reported transactions. Ventas has completed its acquisition of AHS, and an EGI affiliate has completed its majority investment in a newly capitalized hospital operating company, which will continue to be branded “Ardent.” The transactions were announced on April 6, 2015 and July 7, 2015, respectively.

At closing, Ventas separated AHS’ owned real estate from its hospital operations, folding the real estate into the Ventas portfolio, and spinning off AHS’ hospital operations into a separate entity, Ardent. Concurrently, an EGI-controlled entity acquired a majority stake in the operations company, while Ventas retained a 9.9 percent interest and AHS management retained a significant ownership stake.

Ardent’s exceptional and experienced management team, under President and Chief Executive Officer David Vandewater, will continue to lead the operating company. He and his team were responsible for establishing AHS as a premier provider of healthcare services and as one of the top 10 investor-owned hospital companies in the U.S. Ardent will continue to provide high-quality healthcare services in three key service areas: Amarillo, Texas; Tulsa, Oklahoma; and Albuquerque, New Mexico. The portfolio includes 14 hospitals and three multi-specialty physician groups. Ardent, which currently generates approximately $2 billion in annual net revenues, will remain headquartered in Nashville with no expected changes to its current operations.

“We are pleased to have completed our acquisition of Ardent Health Services, a top 10 U.S. hospital operator with a strong financial and operating profile,” said Ventas Chairman and Chief Executive Officer Debra A. Cafaro. “We are also delighted that EGI will be the majority owner of the operating company. With Ardent’s experienced, well-respected management team and scalable platform, and EGI as our partner, we are confident we can build a formidable business in the U.S. hospital industry.”

Sam Zell, Chairman of EGI, said, “America’s large, highly fragmented health care sector is experiencing an unprecedented consolidation phase. The unique combination of Ventas, Ardent and EGI creates an exceptional platform to deliver best-in-class health care services to Ardent’s patients.”

David T. Vandewater, President and Chief Executive Officer of Ardent, said, “We look forward to continuing to serve our existing patients, physicians, employees and communities, and we are excited about the prospects of entering new markets with our new capital partners.”

Ventas’s acquisition of AHS is expected to be immediately accretive to Ventas’s normalized funds from operations per share on a leverage neutral basis.

About Ventas

Ventas, Inc., an S&P 500 company, is a leading real estate investment trust. Its diverse portfolio of more than 1,600 assets in the United States, Canada and the United Kingdom consists of seniors housing communities, medical office buildings, skilled nursing facilities, hospitals and other properties. Through its Lillibridge subsidiary, Ventas provides management, leasing, marketing, facility development and advisory services to highly rated hospitals and health systems throughout the United States. More information about Ventas and Lillibridge can be found at www.ventasreit.com and www.lillibridge.com.

About Equity Group Investments

Equity Group Investments, the private firm founded by Sam Zell over 45 years ago, specializes in opportunistic investments across the debt and equity markets. EGI has extensive experience in energy, industrial, manufacturing, logistics and transportation, business services, communications, health care and real estate.

About Ardent Health Services

Ardent Health Services invests in quality health care. In people, technology, facilities and communities, Ardent makes considerable investments, producing high-quality care and extraordinary results. Based in Nashville, Tenn., Ardent’s subsidiaries own and operate acute care health systems in three service areas — Amarillo, Texas; Tulsa, Okla. and Albuquerque, N.M. — that include 14 hospitals and three multi-specialty physician groups. For more information, go to www.ardenthealth.com.

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements regarding the benefits of the proposed transaction with AHS, including future financial and operating results, statements regarding plans, objectives, expectations relating to the proposed transaction and other statements that are not historical facts. All statements regarding Ventas, Inc. (the “Company”) or its tenants’, operators’, borrowers’ or managers’ expected future financial condition, results of operations, cash flows, funds from operations, dividends and dividend plans, financing opportunities and plans, capital markets transactions, business strategy, budgets, projected costs, operating metrics, capital expenditures, competitive positions, acquisitions, investment opportunities, dispositions, acquisition integration, growth opportunities, expected lease income, continued qualification as a real estate investment trust (“REIT”), plans and objectives of management for future operations and statements that include words such as “anticipate,” “if,” “believe,” “plan,” “estimate,” “expect,” “intend,” “may,” “could,” “should,” “will” and other similar expressions are forward-looking statements. These forward-looking statements are inherently uncertain, and actual results may differ from the Company’s expectations. The Company does not undertake a duty to update these forward-looking statements, which speak only as of the date on which they are made.

The Company’s actual future results and trends may differ materially from expectations depending on a variety of factors discussed in the Company’s filings with the Securities and Exchange Commission. These factors include without limitation: (a) the risk that the expected benefits of the AHS transaction, including financial results, may not be fully realized or

may take longer to realize than expected; (b) risks related to disruption of management’s attention from ongoing business operations due to the AHS transaction; (c) the effect of the announcement of the AHS transaction on the Company’s or Ardent’s relationships with their respective customers, tenants, lenders, operating results and businesses generally; (d) the ability and willingness of the Company’s tenants, operators, borrowers, managers and other third parties to satisfy their obligations under their respective contractual arrangements with the Company, including, in some cases, their obligations to indemnify, defend and hold harmless the Company from and against various claims, litigation and liabilities; (e) the ability of the Company’s tenants, operators, borrowers and managers to maintain the financial strength and liquidity necessary to satisfy their respective obligations and liabilities to third parties, including without limitation obligations under their existing credit facilities and other indebtedness; (f) the Company’s success in implementing its business strategy and the Company’s ability to identify, underwrite, finance, consummate and integrate diversifying acquisitions and investments, including investments in different asset types and outside the United States; (g) macroeconomic conditions such as a disruption of or lack of access to the capital markets, changes in the debt rating on U.S. government securities, default or delay in payment by the United States of its obligations, and changes in the federal or state budgets resulting in the reduction or nonpayment of Medicare or Medicaid reimbursement rates; (h) the nature and extent of future competition, including new construction in the markets in which the Company’s seniors housing communities and medical office buildings (“MOBs”) are located; (i) the extent of future or pending healthcare reform and regulation, including cost containment measures and changes in reimbursement policies, procedures and rates; (j) increases in the Company’s borrowing costs as a result of changes in interest rates and other factors; (k) the ability of the Company’s operators and managers, as applicable, to comply with laws, rules and regulations in the operation of the Company’s properties, to deliver high-quality services, to attract and retain qualified personnel and to attract residents and patients; (l) changes in general economic conditions or economic conditions in the markets in which the Company may, from time to time, compete, and the effect of those changes on the Company’s revenues, earnings and capital sources; (m) the Company’s ability to pay down, refinance, restructure or extend its indebtedness as it becomes due; (n) the Company’s ability and willingness to maintain its qualification as a REIT in light of economic, market, legal, tax and other considerations; (o) final determination of the Company’s taxable net income for the year ended December 31, 2014 and for the year ending December 31, 2015; (p) the ability and willingness of the Company’s tenants to renew their leases with the Company upon expiration of the leases, the Company’s ability to reposition its properties on the same or better terms in the event of nonrenewal or in the event the Company exercises its right to replace an existing tenant, and obligations, including indemnification obligations, the Company may incur in connection with the replacement of an existing tenant; (q) risks associated with the Company’s senior living operating portfolio, such as factors that can cause volatility in the Company’s operating income and earnings generated by those properties, including without limitation national and regional economic conditions, costs of food, materials, energy, labor and services, employee benefit costs, insurance costs and professional and general liability claims, and the timely delivery of accurate property-level financial results for those properties; (r) changes in exchange rates for any foreign currency in which the Company may, from time to time, conduct business; (s) year-over-year changes in the Consumer Price Index or the UK Retail Price Index and the effect of those changes on the rent escalators contained in the Company’s leases and the Company’s earnings; (t) the Company’s ability and the ability of its tenants, operators, borrowers and managers to obtain and maintain adequate property, liability and other insurance from reputable, financially stable providers; (u) the impact of increased operating costs and uninsured professional liability claims on the Company’s liquidity, financial condition and results of operations or that of the Company’s tenants, operators, borrowers and managers, and the ability of the Company and the Company’s tenants, operators, borrowers and managers to accurately estimate the magnitude of those claims; (v) risks associated with the Company’s MOB portfolio and operations, including the Company’s ability to successfully design, develop and manage MOBs, to accurately estimate its costs in fixed fee-for-service projects and to retain key personnel; (w) the ability of the hospitals on or near whose campuses the Company’s MOBs are located and their affiliated health systems to remain competitive and financially viable and to attract physicians and physician groups; (x) the Company’s ability to build, maintain and expand its relationships with existing and prospective hospital and health system clients; (y) risks associated with the Company’s investments in joint ventures and unconsolidated entities, including its lack of sole decision-making authority and its reliance on its joint venture partners’ financial condition; (z) the impact of market or issuer events on the liquidity or value of the Company’s investments in marketable securities; (aa) merger and acquisition activity in the seniors housing and healthcare industries resulting in a change of control of, or a competitor’s investment in, one or more of the Company’s tenants, operators, borrowers or managers or significant changes in the senior management of the Company’s tenants, operators, borrowers or managers; (ab) the impact of litigation or any financial, accounting, legal or regulatory issues that may affect the Company or its tenants, operators, borrowers or managers; (ac) changes in accounting principles, or their application or interpretation, and the Company’s ability to make estimates and the assumptions underlying the estimates, which could have an effect on the Company’s earnings; (ad) uncertainties as to the completion and timing of the Company’s proposed spin-off transaction; and (ae) the impact of the Company’s proposed spin-off transaction on the Company’s business. Many of these factors are beyond the control of the Company and its management.

Contact

Ventas, Inc.

Lori B. Wittman

(877) 4-VENTAS

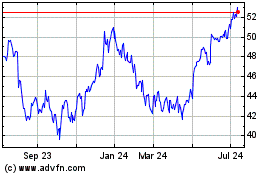

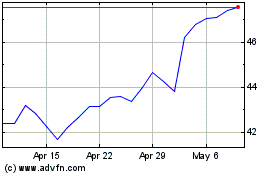

Ventas (NYSE:VTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ventas (NYSE:VTR)

Historical Stock Chart

From Apr 2023 to Apr 2024