Gazprom to Sell First Euro Debt Since Last Year -- Update

October 08 2015 - 3:07PM

Dow Jones News

By Christopher Whittall

Russian energy giant OAO Gazprom became the latest

emerging-market borrower to sell debt to international investors on

Thursday, taking advantage of growing expectation that the U.S.

Federal Reserve will delay raising interest rates.

Gazprom will pay an interest rate of 4.625% on a EUR1 billion

($1.12 billion), three-year bond, according to a deal notice

released today. Gazprom didn't respond to requests for comment.

The latest offering follows several bond deals from

emerging-market governments and companies this week as investors

backed the idea that the U.S. Federal Reserve might push back

raising interest rates following a weaker-than-expected jobs report

released Friday.

Turkcell Iletisim Hizmetleri AS, Turkey's biggest mobile-phone

operator, sold a 10-year, $500 million bond on Wednesday at an

interest rate of 5.75%. Ghana issued a 15-year, $1 billion bond at

an interest rate of 10.75% Wednesday. And Poland sold a six-year,

EUR1.75 billion bond at an interest rate of 0.875% on

Wednesday.

"These trades have really been driven by the benign interest

rate outlook in the U.S. after Friday's weak payroll numbers.

That's stimulated risk appetite, which has benefited

emerging-market borrowers, " said Stefan Weiler, a managing

director at J.P. Morgan Chase & Co.

Many economists believe emerging-market countries are vulnerable

to a rise in U.S. interest rates and a stronger dollar. Low

interest rates in the U.S. over the past several years encouraged

some investors to buy higher-yielding emerging-market assets.

Emerging-market debt has rallied since Friday's jobs report. The

extra yield investors demand to hold dollar-denominated

emerging-market sovereign debt narrowed to 4.10 percentage points

Wednesday, according to the J.P. Morgan Emerging-Market Bond Index

, from 4.37 percentage points last Friday.

Russian borrowers took advantage of the rally to return to

international bond markets after a lengthy absence.

Mining firm Norilsk Nickel broke a nine-month, dollar-bond

freeze for Russian companies when it issued a $1 billion bond on

Tuesday at an interest rate of 6.625%.

The average yield on Russian corporate and quasi-sovereign

corporate debt denominated in U.S. dollars rose to more than 13%

last December following a sharp fall in the price of oil, an

escalation of the conflict in Ukraine and the imposition of U.S.

and European sanctions against various Russian firms and

individuals. The average yield is now 6.3%, according to Barclays,

following a perceived easing of tensions in Ukraine. Yields rise as

prices fall.

International investors have again become comfortable with

holding Russian corporate bonds, which have performed strongly this

year, said Patrick Zweifel, chief economist at Pictet Asset

Management.

"As long as things haven't deteriorated in terms of sanctions,

we've reached a sort of a 'new normal' that investors are pretty

happy with," he said, adding that the interest payments investors

demand are high enough to compensate for the political risk

associated with holding this debt.

"Investors' perception of Russian risk has evolved over time,"

said Eric Cherpion, a managing director at Societe Generale, which

was one of several banks managing the recent Norilsk Nickel

deal.

"We got very strong investor feedback when we were on the road

with Norilsk; they considered the situation in Russia has

stabilized," he added.

Write to Christopher Whittall at

christopher.whittall@wsj.com

(END) Dow Jones Newswires

October 08, 2015 14:52 ET (18:52 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

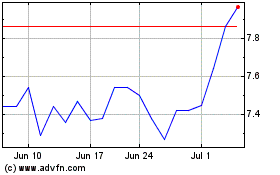

Turkcell lletism Hizmetl... (NYSE:TKC)

Historical Stock Chart

From Aug 2024 to Sep 2024

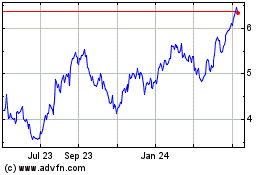

Turkcell lletism Hizmetl... (NYSE:TKC)

Historical Stock Chart

From Sep 2023 to Sep 2024