By Sarah Nassauer, Suzanne Kapner and Khadeeja Safdar

Retailers dangled hefty discounts in their stores -- after

offering earlier deals on their websites -- as they waged a

high-stakes battle with Amazon.com Inc. and other rivals to capture

as much spending as they could during the Black Friday shopping

spree.

Shoppers arrived in the predawn hours Friday, following millions

of Americans who left family Thanksgiving gatherings Thursday to

visit malls and shopping centers. They scooped up flat-screen

televisions, toys and other gifts that retailers have been

promoting for days, but often had their smartphones in hand to

check prices.

Target Corp. CEO Brian Cornell said Thursday evening that he was

"very encouraged by the initial response," particularly to toys and

Apple Inc. products. He noted that hoverboards sold out early

online and highlighted the success of a $10 giant teddy bear.

"So far, the most encouraging trend we are seeing is that while

door-busters continue to be important," Mr. Cornell said, "once

guests are there, they are shopping multiple categories."

For brick-and-mortar retailers, the challenge is to draw more

shoppers into their stores on a chaotic day often marred by long

lines and crowded parking lots. Last year, more people shopped

online than in stores during the Thanksgiving weekend, according to

the National Retail Federation.

By 4:45 a.m. on Friday, Michael and Jessica Ansbro were close to

finished with their holiday shopping for the year. The Berne, N.Y.,

couple woke at 1 a.m. to hit department stores and GameStop, where

they stood in a short queue for the store's predawn opening.

The couple have been planning their holiday shopping since

September, putting toys for their sons, ages 4 and 7, on layaway at

Toys "R" Us. The couple are Amazon Prime members but have preferred

to hit the stores for Black Friday deals for the past decade.

"You actually know what you're getting," said Mr. Ansbro, 33, a

construction worker. "I like the sales, and I like to ask

questions," said Ms. Ansbro, 34.

Online shopping was on pace to reach $2 billion on Thanksgiving

Day, up 16% from a year ago, according to Adobe Systems Inc., which

tracked visits to e-commerce sites. But the revenue gains were

muted by hefty price cuts, especially on electronics, Adobe said.

Tablets, for example, were being discounted 25% on average

Thursday, compared with 12% a year earlier.

Sally Skupien, 49 years old, was one of about 50 people waiting

outside the Home Depot in Spring, Texas, at 5:30 a.m. Friday. Ms.

Skupien had come to buy an artificial Christmas tree and a table

saw for her husband, each of which were heavily discounted. But she

wasn't certain she would be the first to reach the tree she wanted,

so she also had gone online and added it to her cart.

"I'm too old to go in there and fight people for it," she

said.

A number of shoppers in the Houston suburb also said they went

to bricks-and-mortar stores because they weren't confident they

would be able to actually purchase door-buster items online, even

though they were offered.

"I try online every year, but it just hasn't worked, you can't

access everything online," said Betty Rasmus, 63, who arrived at

Best Buy at 4:45 a.m. and was the first in line, aiming to buy a

55-inch Sharp television for $250, about half price, as well as two

laptops.

Across the industry, retailers released advertisements of their

biggest deals three days sooner this year on average than last,

according to Market Track LLC, which analyzed emails, social media

and retail websites.

Consumer spending has been healthy this year, boosted by high

employment and rising wages. While there remain pockets of

weakness, especially among teen-apparel retailers and department

stores, many chains -- including Home Depot Inc., TJX Cos. and Best

Buy Co. -- reported healthy sales gains in the latest quarter. The

Commerce Department said U.S. retail sales through October logged

the strongest two-month stretch in the past two years.

In an effort to hold off advances from online rivals such as

Amazon, traditional retailers have been moving discounts earlier in

the month, linking their stores and websites more closely and

finding ways to capitalize on the rise in mobile shopping.

"Bricks-and-mortar stores are pulling out all the stops," said

Pete Madden, a director in the retail practice at consulting firm

AlixPartners. "They are making it clear they won't be beat on

price, service or products."

This year, shoppers are expected to spend $27 billion on the

Friday after Thanksgiving, according to consulting firm Customer

Growth Partners, making it the second-biggest U.S. shopping day of

the year -- behind Super Saturday, which falls the weekend before

Christmas.

By 5:30 a.m. Friday the crowds had thinned at the sprawling

Gateway Center in Brooklyn, with employees appearing to outnumber

shoppers at several stores.

Dante Pierre-Louis, 18, and his younger brother pried their

father out of bed at 4 a.m. to take them shopping. Mr.

Pierre-Louis, home from college for the holiday, said he mostly

shops online but wanted to hit stores to spend time with his

family.

He jumped up-and-down in excitement upon finding a deeply

discounted faux-fur throw blanket at Target, and also got some

hoodies for 25% off. "When it's crazy, it's exciting to see

everyone running around," he said. "But now you have a better

chance of actually getting what you need."

"I don't miss the crazy," said Christine Aguirre, a 37-year-old

office manager, as she pushed a cart filled with two televisions

and other goods. She woke at 4 a.m., a 20-year tradition even

though most stores she shops at now open on Thanksgiving and not

early Friday. "It's better now, it used to be so packed."

Black Friday is no longer a one-day event; promotions are

increasingly spread throughout November, as traditional retailers

try to match more nimble online rivals.

Toys "R" Us Inc. made its Black Friday deals available to online

shoppers on Wednesday night, before stores opened at 5 p.m. on

Thanksgiving.

Kohl's Corp. for the first time made "door-buster" deals

normally reserved for in-store shoppers such as a $250 Samsung TV

and a $130 Fitbit wristband available online, starting at midnight

Thursday, before stores opened at 6 p.m. that day.

Amazon started its deals on Nov. 1. The web giant is offering

new discounts every day, sometimes as often as every five minutes,

through Dec. 22. In preparation for the holidays, Amazon expanded

its product offerings by 30%, the equivalent of 3.6 million new

products, according to 360pi, a retail pricing- and

assortment-tracking firm.

The risk is that early spending will pull dollars from later in

the season. That pattern has occurred over past Thanksgiving

weekends, as more stores opened on Thursday and siphoned sales from

Friday. As a result, more retailers and malls stayed closed on

Thanksgiving this year.

The National Retail Federation forecasts total holiday shopping

will rise 3.6% to $655.8 billion from a year ago, with 137.4

million people shopping in stores and online during Thanksgiving

weekend alone.

In what some analysts have dubbed the "Trump Bump," they are

hopeful that President-elect Donald Trump will stimulate the

economy and lower taxes, which means "a large segment of the

population that was previously reluctant to spend," Citi analyst

Paul Lejuez wrote in a research note, "now feels better."

This year, 23% of Americans plan to shop in stores on Black

Friday, according to a survey conducted by Bankrate.com, a

financial-services company.

At a Wal-Mart Stores Inc. location in Washington, D.C., on

Thursday evening, Jose Francisco was hoping to buy some electronics

that he said were a few dollars cheaper than at Best Buy. "I

planned ahead," said the 30-year-old who lives in Germantown, Md.,

as he scrolled his smartphone for online prices.

However, Amazon will still get a large chunk of his holiday

budget, he said, based on lower prices for videogames for his

nephew. "I have another list for that," he said.

--Sharon Terlep, Bradley Olson and Sara Germano contributed to

this article.

Write to Sarah Nassauer at sarah.nassauer@wsj.com, Suzanne

Kapner at Suzanne.Kapner@wsj.com and Khadeeja Safdar at

khadeeja.safdar@wsj.com

(END) Dow Jones Newswires

November 25, 2016 10:39 ET (15:39 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

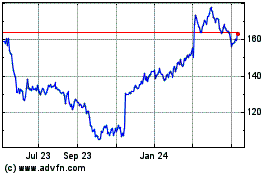

Target (NYSE:TGT)

Historical Stock Chart

From Aug 2024 to Sep 2024

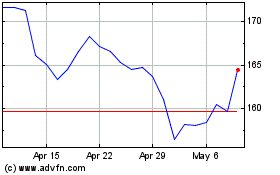

Target (NYSE:TGT)

Historical Stock Chart

From Sep 2023 to Sep 2024