SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For December 14, 2015

(Commission File No. 1-31317)

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

(Exact name of registrant as specified in its charter)

Basic Sanitation Company of the State of Sao Paulo - SABESP

(Translation of Registrant's name into English)

Rua Costa Carvalho, 300

São Paulo, S.P., 05429-900

Federative Republic of Brazil

(Address of Registrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1)__.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7)__.

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

Companhia de Saneamento Básico do Estado de São Paulo

Board of Directors |

COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO - SABESP

CORPORATE TAXPAYER’S ID (CNPJ): 43.776.517/0001-80

COMPANY REGISTRY (NIRE): 35.3000.1683-1

SUMMARY OF THE MINUTES OF THE 817TH

BOARD OF DIRECTORS’ MEETING

On December 09, 2015, at 2:00 p.m., the Chairman of the Board of Directors, Benedito Pinto Ferreira Braga Junior, pursuant to the caput and Paragraph 4 of Article 12 of the Bylaws called via-email an extraordinary meeting of the Board of Directors of Companhia de Saneamento Básico do Estado de São Paulo – SABESP, located at Rua Costa Carvalho, 300, São Paulo, which was attended by the appointed and undersigned members to resolve in an executive session on the sole item on the agenda “Approval of conditions applicable to the 20th issuance of debentures”, which was based on the Board of Resolution No. 0281/2015 of 12/08/2015, the Internal Communication FI 035/2015 of 12/07/2015, and power point presentation, documents filed in the online folder of this meeting. The matter was put to a vote, pursuant to Article 59, paragraph 1 of Law 6,404, of December 15, 1976, (“Brazilian Corporate Law”) in accordance with Article 13, paragraphs X and XIII of the Bylaws, and in addition to the general conditions of the 20th issuance of debentures approved at the 816th Board of Directors’ Meeting held on November 27, 2015, the conditions applicable to the 20th issuance of nonconvertible unsecured debentures, in a single series, for public distribution with restricted placement efforts, pursuant to CVM Instruction 476, of January 16, 2009, as amended (“Debentures” and “CVM Instruction 476”, respectively), were unanimously approved, as described below:

1) Issuer: Companhia de Saneamento Básico do Estado de São Paulo – SABESP.

2) Issue Amount: R$500,000,000.00 (five hundred million reais).

3) Series: Single.

4) Type: Unsecured.

5) Date of Issue: For all legal purposes and effects, the date of issue will be December 20, 2015 (“Date of Issue”).

6) Format and Convertibility: The Debentures will be registered, book-entry, nonconvertible into shares and without issuance of certificates.

7) Quantity: 50,000 (fifty thousand) Debentures.

8) Nominal Unit Value: R$10,000.00 (ten thousand reais) on the Date of Issue (“Nominal Unit Value”).

9) Placement and Distribution Procedure: The Debentures will be distributed through a public offering with restricted efforts, in accordance with CVM Rule 476, under firm guarantee of

placement, with the intermediation of financial institutions in the distribution system of securities (jointly, "Coordinators"). For this purpose, the Coordinators may identify a maximum of 75 (seventy five) qualified investors, pursuant to Article 9-A of CVM Instruction 539, of November 13, 2013, with the Debentures subscribed to or acquired by a maximum of 50 (fifty) qualified investors. In accordance with Article 6 of CVM Instruction 476, the public offering with restricted efforts of the Debentures is automatically exempted from registration at the Brazilian Securities and Exchange Commission (CVM).

Companhia de Saneamento Básico do Estado de São Paulo

Board of Directors |

10) Subscription Price and Payment: The Debentures will be subscribed and paid up, in the primary market, by the Nominal Unit Value, plus the Remuneration, calculated pro rata temporis from the date of first payment ("Date of Payment") until the date of their effective subscription and payment. The payment of the Debentures will be made in cash, in national currency, through the Securities Distribution System (“SDT”), managed and run by CETIP S.A. – Mercados Organizados (“CETIP”), as from the date of beginning of the distribution.

11) Monetary Restatement: The Nominal Unit Value will not be adjusted to any index.

12) Remuneration: The Debentures will be entitled to remuneration (“Remuneration”) corresponding to 100% (one hundred percent) of the accumulated variation of the daily Interbank Deposit Rate – DI, extra-group, expressed as a one-year percentage, based on 252 (two hundred and fifty two) business days, calculated and disclosed by CETIP on a daily basis in the bulletin available on its website (http://www.cetip.com.br), plus the spread or surcharges of 3.80% (three point eighty percent) per year, based on 252 (two hundred and fifty two) business days. The Remuneration will be calculated exponentially and cumulatively pro rata temporis, per business day, on the Nominal Unit Value, as of the Date of Payment or the date of the last payment of the Remuneration, whichever the case, and will be paid in biannual installments at the end of each Yield Period. In order to calculate the Debentures Remuneration, the "Yield Period" is defined as the length of time starting on the Date of Payment, including this day, in the case of the first Yield Period, or on the maturity date of the previous Remuneration, including this day, in the case of other Yield Periods, and ends on the next due date of Remuneration, excluding this day.

13) Term: Except in the events of optional acquisition, optional total early redemption and/or early maturity, whichever the case, as defined in the indenture of issue ("Indenture of Issue"), the Debentures will mature in 4 (four) years, as of the Date of Issue, that is December 20, 2019 (“Date of Maturity”).

14) Guarantee: None.

15) Amortization: Except in the events of optional acquisition, optional total early redemption, optional partial extraordinary amortization and/or early maturity, as defined in the Indenture of Issue, the amortization of the Debentures will take place in 2 (two) consecutive annual installments, with the first installment on 20 December 2018, in an amount of 50% (fifty percent) of the Nominal Unit Value or balance of Nominal Unit Value, as applicable, and the second, on the

Date of Maturity, in an amount corresponding to the remaining balance of the Nominal Unit Value.

Companhia de Saneamento Básico do Estado de São Paulo

Board of Directors |

16) Place of Payment: The payments related to the Debentures will be made by the Issuer on the respective maturity date in accordance with: (a) the procedures adopted by CETIP, for the Debentures held in electronic custody by CETIP; and/or (b) the procedures adopted by the settlement bank, for the Debentures that are not held in electronic custody by CETIP ("Place of Payment").

17) Extension of Terms: The periods for the payment of any obligations arising from the Debentures will be extended until the subsequent business day, if the due date coincides with a day that is not a business or banking day in the Place of Payment or in the City of São Paulo, State of São Paulo, without any increase in the amounts to be paid, except for cases in which the payments must be made through CETIP, in which case an extension is granted only when the due date falls on a national holiday, Saturday and/or Sunday.

18) Allocation of Funds: The proceeds from the issuance of Debentures will be allocated to cash recovery of the Issuer and refinance of financial commitments maturing in the first quarter of 2016.

19) Registration for Placement and Trade: The Debentures will be registered for (a) public distribution on the primary market through the SDT, managed and run by CETIP, with distribution settled by CETIP; and (b) trading on the secondary market through CETIP21 – Títulos e Valores Mobiliários, managed and run by CETIP, with trades settled financially and the Debentures held in custody electronically by CETIP.

20) Optional Acquisition: The Issuer may, at any time, acquire outstanding Debentures, pursuant to Article 55, paragraph 3 of the Brazilian Corporate Law. The Debentures acquired by the Issuer may be: (i) canceled, through a deliberate act of the Issuer; (ii) held in the Issuer’s treasury; or (iii) once again placed on the market, subject to the trading restrictions provided for in CVM Instruction 476. The Debentures acquired by the Issuer and held in treasury, once placed on the market again, will be entitled to the same remuneration as the other outstanding Debentures.

21) Optional Total Early Redemption: The optional early redemption of the Debentures may occur at any time at the Issuer's discretion, from the 18th (eighteenth) month from the Date of Issue, that is, June 20, 2017, including this day, in relation to the total number of outstanding Debentures (“Total Early Redemption"). The Total Early Redemption will take place upon payment of the Nominal Unit Value plus the Remuneration, calculated pro rata temporis as of the date of the last payment of Remuneration until the date of effective redemption, with no addition in the form of redemption premium, in accordance with the procedure adopted by CETIP for the Debentures under electronic custody at CETIP and other procedures described in the Indenture of Issue. The Total Early Redemption will take place upon publication of communication addressed to the Debenture holders, as well as preceded by written notification to the Trustee, no less than 10

(ten) days before the effective date of the Total Early Redemption. The Debentures redeemed in accordance with the Indenture of Issue shall be cancelled by the Issuer.

Companhia de Saneamento Básico do Estado de São Paulo

Board of Directors |

22) Optional Partial Extraordinary Amortization: The Optional Partial Extraordinary Amortization of the Debentures may occur at any time at the Issuer's discretion, from the 18th (eighteenth) month from the Date of Issue, that is, June 20, 2017, including this day ("Partial Extraordinary Amortization"). The Partial Extraordinary Amortization shall be proceeded by written notification to the Trustee, no less than ten (10) days before the payment of the Partial Extraordinary Amortization, and limited to 90% (ninety percent) of the Nominal Unit Value or the balance of the Nominal Unit Value, plus the Remuneration and other charges due and unpaid, up to the date of the Partial Extraordinary Amortization, with no additions in the form of premiums, subject to other proceedings to be described in the Indenture if Issue.

23) Default Charges: Without prejudice to the Remuneration, if there is any delay in the payment of any amount due to holders of the Debentures, the late payments will be subject to non-compensatory fine of 2% (two percent) of the amount due and overdue charges shall be calculated from the date of default to the date of effective payment, at a rate of 1% (one percent) per month on the overdue amount, independently of a notice, notification or legal or any other intervention, in addition to expenses incurred by holders of the Debentures in collecting their credits.

24) Potential Early Redemption Events: The Debentures will have early redemption declared in case of the events envisaged in the Indenture of Issue, as negotiated with the Coordinators.

25) Renegotiation: The Debentures will not be renegotiated.

The Board of Directors also authorized the members of the Company's Board of Executive Officers, with due regard for all legal and statutory terms, to execute any and all acts related to the 20th Issue of Simple, Unsecured, Nonconvertible Debentures in a single series, ratifying all acts related to the 20th Issue that have already been conducted by the Board of Executive Officers.

(...)

These minutes, after being approved, were signed by the attending members of the Board of Directors: Benedito Pinto Ferreira Braga Junior, Alberto Goldman, Cláudia Polto da Cunha, Francisco Vidal Luna, Jerônimo Antunes, Jerson Kelman, Luis Eduardo de Assis, Reinaldo Guerreiro, Sidnei Franco da Rocha and Walter Tesch.

This is a free English translation of the excerpt of the original minutes drawn up in the Book of Minutes of the Board of Directors.

São Paulo, December 09, 2015.

|

Benedito Pinto Ferreira Braga Junior |

Marialve S. Martins |

|

Chairman of the

Board of Directors |

Secretary of the

Board of Directors |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in the city São Paulo, Brazil.

Date: December 14, 2015

|

Companhia de Saneamento Básico do Estado de São Paulo - SABESP |

|

|

|

| By: |

/s/ Rui de Britto Álvares Affonso

|

|

| |

Name: Rui de Britto Álvares Affonso

Title: Chief Financial Officer and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

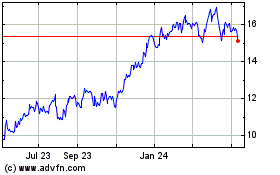

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

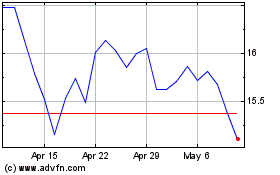

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Apr 2023 to Apr 2024