Government Bond Yields Rise Amid European Pressures

October 26 2016 - 4:23PM

Dow Jones News

By Sam Goldfarb

A selloff in European government bonds spilled into the U.S.

Treasury market Wednesday, as new bond sales and the potential for

tighter central bank policies continued to weigh on haven debt.

In late-afternoon trading, the yield on the benchmark 10-year

U.S. Treasury note was 1.790%, compared with 1.758% Tuesday. Yields

on European government bonds registered larger increases, with

10-year German bund yield climbing to 0.088% from 0.022% and the

10-year Italian bond yield rising to 1.465% from 1.382%, according

to Tradeweb.

Yields rise when bond prices fall.

A heavy dose of corporate and government bond issuance in Europe

contributed to the overnight selloff, analysts said.

Investors are also growing more confident that the Federal

Reserve will raise interest rates in December but remain uncertain

about the future of the European Central Bank's bond-buying

program.

ECB President Mario Draghi defended that program Tuesday. But he

hasn't explicitly said it will be extended in its current form once

it expires in March. That means investors need to prepare for the

"tail risk" that the central bank tapers its bond purchases, said

Stanley Sun, interest-rates strategist at Nomura Securities

International in New York.

After rising sharply at the start of October, government bond

yields have stabilized in recent weeks. But the selloff may have a

"little bit more room to go just given the sentiment shift in the

overseas markets," Mr. Sun said.

Among the reasons why investors think central banks may scale

back their stimulus efforts is a growing chorus of voices urging

governments to do more to support their economies through

expansionary fiscal policies.

Large-scale fiscal stimulus doesn't seem imminent, but there are

signs that this argument is starting to get a more receptive

hearing in some European capitals.

In the U.S., meanwhile, several Fed officials over the past few

days have signaled that the central bank's tightening plan this

year remains on track.

Fresh economic data Wednesday showed a decline in the U.S. trade

deficit and an increase in retail and wholesale inventories last

month, a potentially positive sign for the third-quarter

gross-domestic product numbers that will be released Friday.

Fed-funds futures, which are used to place bets on central bank

policy, showed Wednesday that investors and traders see a 74%

likelihood of a rate increase in December, up from around 60% at

the start of the month, according to CME Group.

"People are coming to terms with the reality that there is near

unanimity among Fed officials that there is going to be a move in

December," said Anthony Karydakis, chief economic strategist at

Miller Tabak.

Despite the generally soft appetite for government debt, demand

was decent for $34 billion of five-year Treasury notes sold

Wednesday. The auction attracted $2.49 in bids for each dollar

offered, a higher ratio than three of the past four five-year note

auctions.

COUPON ISSUE Price CHANGE YIELD CHANGE

3/4% 2-year 99 31/32 dn 1/32 0.872% +1.6BPS

1% 3-year 100 5/32 dn 1/32 1.016% +1.3BPS

1 1/8% 5-year 99 14/32 dn 4/32 1.302% +2.6BPS

1 3/8% 7-year 98 21/32 dn 6/32 1.580% +2.9BPS

1 1/2% 10-year 97 13/32 dn 9/32 1.790% +3.2BPS

2 1/4% 30-year 94 1/32 dn 22/32 2.537% +3.4BPS

2-10-Yr Yield Spread: +91.8BPS Vs + 90.2BPS

Source: Tradeweb/WSJ Market Data Group

(END) Dow Jones Newswires

October 26, 2016 16:08 ET (20:08 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

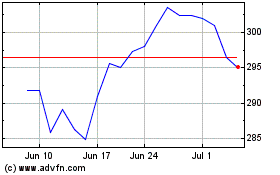

Boston Beer (NYSE:SAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

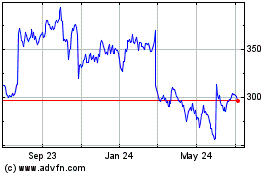

Boston Beer (NYSE:SAM)

Historical Stock Chart

From Apr 2023 to Apr 2024