As iPhone 7 Hits Stores, Apple Devotees Click 'Buy'

September 16 2016 - 4:30AM

Dow Jones News

A slightly unusual scene unfolded Friday at some Apple Inc.

stores around the world, where the normal lines of camped-out

shoppers eager to buy the latest iPhone were replaced in certain

locations by smaller throngs who had preordered the largely

sold-out phone.

The big question, whose answer could take time to become clear,

is whether these fans' launch-day zeal will ultimately stem

declining sales of the company's flagship smartphone.

Analysts and investors have long looked at opening-weekend sales

as a gauge of enthusiasm for the smartphone.

At an Apple store in downtown Sydney where sales began Friday,

16-year-old high-school student Marcus Barsoum was at the front of

the line. He said his sister held his spot over the previous days

so he could go to school and take exams. He was looking forward to

the iPhone 7's water resistance and improved camera features.

"I'm a die-hard Apple fan," he said, shortly before getting a

new phone in matte black. "Basically, I love Apple. I love the

iPhone. I love the experience."

At the Beijing Apple store in Sanlitun, most of the people who

had arrived early Friday morning had preordered a phone online.

Wang Tianxiang, 23, said the Apple China preorder site was

overloaded during the day earlier this week, but he managed to get

his order in by refreshing the website repeatedly at 2 a.m. He

decided to switch to an iPhone for the first time from his

Chinese-designed Oneplus smartphone.

"iPhones are more reliable and the interface is better," he

said.

In Japan, more than 200 people lined up on Friday morning in

front of Apple stores in Ginza and Omotesando, two of Tokyo's

ritziest shopping districts. Japan's three major mobile phone

carriers—NTT DoCoMo Inc., KDDI Corp. and SoftBank Group Corp.'s

local unit—said they were seeing the highest number of orders since

they started selling iPhones.

Initial excitement doesn't necessarily translate into bigger

sales, however. Initial iPhone 6s and 6s Plus orders exceeded those

from the prior year, though sales declined in the past two

quarters. Apple doesn't specify sales by model.

For the first time, Apple this year isn't planning to report

first-weekend sales, calling the numbers irrelevant since it knows

the iPhone 7 will sell out. Apple already signaled that it wouldn't

be able to meet demand when customers start walking through the

doors Friday. It said the iPhone 7 in shiny "jet black"—its newest

finish—and the larger iPhone 7 Plus in all colors, sold out during

preorders.

Adding to the prelaunch hype, T-Mobile US Inc. and Sprint Corp.

earlier this week suggested strong consumer interest, though

without providing specific numbers.

"Nobody does product launches better than Apple—we know the

phones will sell out. They always sell out," said Rob Handfield, a

professor of supply-chain management at North Carolina State

University. "What we don't know is whether or not the hype and

demand will last."

Even though Apple is a consumer-product veteran run by a

logistics expert, it perennially comes up short in meeting initial

iPhone demand. Knowing how much supply to produce for highly

coveted new products, like an iPhone with a new color, is tough,

said John Haber, chief executive at the consulting firm Spend

Management Experts and a former UPS executive who spent a decade

working in corporate strategy and finance.

Still, Apple has been selling the iPhone for nearly 10 years.

And creating buzz with the appearance of customers hungry to get

their hands on an item in short supply is a tactic straight from

marketing textbooks.

"They're happy not meeting demand this weekend," Mr. Haber said.

"This is a common tactic for companies that want to turn selling a

new product into what are essentially events—Apple devices, Air

Jordans, Harry Potter books, it's all the same tactic to generate

interest."

Such temporary shortfalls generally don't hurt total sales of a

new device, as Apple's supply in the past has caught up with demand

by the time it really counts, in time for the winter holiday

rush.

Apple declined to comment on its supply chain and launch

strategy.

Megumi Fujikawa contributed to this article.

Write to Nathan Olivarez-Giles at Nathan.Olivarez-giles@wsj.com,

Eva Dou at eva.dou@wsj.com and Mike Cherney at

mike.cherney@wsj.com

(END) Dow Jones Newswires

September 16, 2016 04:15 ET (08:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

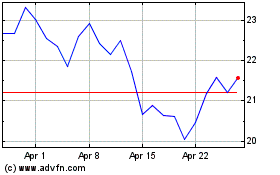

SentinelOne (NYSE:S)

Historical Stock Chart

From Mar 2024 to Apr 2024

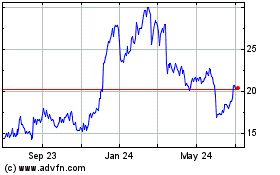

SentinelOne (NYSE:S)

Historical Stock Chart

From Apr 2023 to Apr 2024