SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Under Section 13 or

15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 23, 2015

ResMed Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware

|

|

001-15317

|

|

98-0152841

|

|

|

|

| (State or Other Jurisdiction of

Incorporation) |

|

(Commission File

Number) |

|

(I.R.S. Employer

Identification No.) |

9001 Spectrum Center Blvd.

San Diego, California 92123

(Address of

Principal Executive Offices)

(858) 836-5000

(Registrant’s telephone

number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Disclosure of Results of Operations and Financial Condition.

On April 23, 2015 we issued the press release attached as Exhibit 99.1. It is incorporated into this report by reference. The press

release describes the results of our operations for the quarter ended March 31, 2015.

Item 8.01. Other Events.

On April 23, 2015, we announced that our board of directors declared a cash dividend of US $0.28 per share of outstanding common

stock. The dividend will be payable on June 18, 2015, with a record date of May 21, 2015. We will pay the dividend in US currency to holders of our common stock trading on the New York Stock Exchange (NYSE). We will pay the

dividend to holders of CHESS Depositary Instruments (CDIs) trading on the Australian Securities Exchange (ASX) at an equivalent amount in Australian currency, based on the exchange rate on May 21, 2015, and reflecting the 10:1 ratio between

CDIs and NYSE shares. The ex-dividend date will be May 19, 2015 for CDI holders and common stock holders. ResMed has received a waiver from the ASX’s settlement operating rules, which will allow us to defer processing conversions between

its common stock and CDI registers from May 19, 2015 through May 21, 2015, inclusive.

Item 9.01. Financial Statements and Exhibits.

|

|

|

| Exhibits: |

|

Description of Document |

| 99.1 |

|

Press Release dated April 23, 2015 regarding results of operations |

2

SIGNATURES

We have authorized the person whose signature appears below to sign this report on our behalf, in accordance with the Securities Exchange Act of 1934.

|

|

|

|

|

|

|

| Date: April 23, 2015 |

|

|

|

RESMED INC. |

|

|

|

|

(registrant) |

|

|

|

|

|

|

|

By: /s/ Brett Sandercock |

|

|

|

|

Name: Brett Sandercock |

|

|

|

|

Its: Chief Financial Officer |

3

EXHIBIT INDEX

|

|

|

| Exhibits: |

|

Description of Document |

| 99.1 |

|

Press Release dated April 23, 2015 regarding results of operations |

Exhibit 99.1

ResMed Inc. Announces Results for the Third Quarter of Fiscal Year 2015

Revenue increased 6% to $422 million; up 13% on a constant currency basis

GAAP diluted earnings per share of $0.64, or non-GAAP earnings per share of $0.65

Operating cash flow of $90.9 million

Company repurchased 300,000 shares in the third quarter

San Diego, April 23, 2015 – ResMed Inc. (NYSE: RMD) today announced results for its quarter ended March 31, 2015. Revenue for the quarter was

$422.5 million, a 6 percent increase compared to the quarter ended March 31, 2014 (a 13 percent increase on a constant currency basis). Net income was $91.0 million, an increase of 1 percent compared to the quarter ended March 31, 2014.

Diluted earnings per share for the quarter were $0.64, an increase of 2 percent compared to the quarter ended March 31, 2014. Non-GAAP diluted earnings per share for the quarter were $0.65, a 2 percent increase compared to the quarter ended

March 31, 2014.

“We are pleased to report excellent progress with our new product launches, as we continued to see double-digit revenue growth,”

said Mick Farrell, ResMed’s chief executive officer. “Strong demand for our new flow generator launches in the U.S. and continued growth in our Asia Pacific and Europe regions drove our results in the quarter.

“We saw strong customer adoption of our range of new flow generators: the Astral, AirSense™ 10 and the recently launched AirCurve™ 10 series of

cloud-connected bilevel devices. This quarter, we continued to build our informatics capabilities with the acquisition of Jaysec, a provider of cloud-based software solutions for the home medical equipment industry, as well as the integration of our

AirView patient management system with leading informatics partners.” Farrell concluded, “We are executing on our long-term strategy: growing our core sleep disordered breathing market and investing in future opportunities in chronic

obstructive pulmonary disease as well as cardio-respiratory conditions. Our innovative products and solutions improve patient outcomes, lower healthcare costs, and reduce the impact of chronic disease.”

Analysis of third quarter results

In the third quarter of fiscal year

2015, revenue in the Americas was $250.9 million, a 16 percent increase over the prior year’s quarter. Revenue in combined Europe and Asia Pacific was $171.6 million, a 6 percent decrease compared to the quarter ended March 31, 2014 (a 9

percent increase on a constant currency basis).

Gross margin in the third quarter was 59.5 percent, lower than the prior year, mainly due to declines in average

selling prices, an unfavorable product and geographic mix, and an unfavorable impact from foreign exchange rate movements.

Selling, general and administrative expenses were $116.3 million for the quarter, a 1 percent increase (a 10 percent

increase on a constant currency basis) over the quarter ended March 31, 2014. SG&A expenses improved to 27.5 percent of revenue in the quarter, compared to 28.9 percent in the quarter ended March 31, 2014.

Research and development expenses were $27.0 million for the quarter, or 6.4 percent of revenue. R&D expenses decreased by 8 percent (a 4 percent increase on a

constant currency basis) compared to the quarter ended March 31, 2014.

Operating profit for the quarter was $105.9 million and cash flow from operations was

$90.9 million.

Amortization of acquired intangible assets was $2.2 million ($1.6 million, net of tax) during the quarter. Stock-based compensation costs incurred

during the quarter of $11.7 million ($8.2 million, net of tax) consisted of expenses associated with employee equity grants, and the company’s employee stock purchase plan.

Share repurchase program

During the quarter, the

company repurchased 300,000 shares at a cost of $20.3 million, as part of its ongoing capital management program.

Dividend program

The ResMed board of directors today declared a quarterly dividend of $0.28 per share. The dividend will have a record date of May 21, 2015, payable on June 18,

2015. The dividend will be paid in U.S. currency to holders of ResMed’s common stock trading on the New York Stock Exchange. Holders of Chess Depositary Instruments trading on the Australian Securities Exchange will receive an equivalent amount

in Australian currency, based on the exchange rate on the record date, and reflecting the 10:1 ratio between CDIs and NYSE shares. The ex-dividend date will be May 19, 2015 for common stock holders and for CDI holders. ResMed has received a

waiver from the ASX’s settlement operating rules, which will allow ResMed to defer processing conversions between its common stock and CDI registers from May 19, 2015 through May 21, 2015, inclusive.

Webcast details

ResMed will discuss its financial and business

results and its business outlook on its webcast at 1:30 p.m. U.S. Pacific Standard Time today. The live webcast of the call can be accessed on ResMed’s website at www.resmed.com. Please allow extra time before the call to visit the

website and download the streaming media player (Windows Media Player), required to listen to the internet broadcast. The online archive of the broadcast will be available after the live call on ResMed’s website. In addition, a telephone replay

of the conference call will be available approximately two hours after the call by dialing 630-652-3042 (U.S.) and +1 630-652-3042 (international) and entering a passcode of 39335543. The telephone replay will be available until May 7, 2015.

About ResMed

The global team at ResMed (NYSE:RMD) is united in

their commitment to changing lives with every breath. With more than 4,000 employees and a presence in over 100 countries, the company has been pioneering new and innovative devices and treatments for sleep-disordered breathing, chronic obstructive

pulmonary disease, and other chronic diseases for more than 25 years. ResMed’s world-leading products and innovative solutions improve the quality of life for millions of patients worldwide, reduce the impact of chronic disease, and save

healthcare costs. For more information about ResMed and its businesses, visit www.resmed.com or follow @resmed on Twitter.

Safe harbor statement

Statements contained in this release that are not historical facts are “forward-looking” statements as contemplated by the Private Securities Litigation Reform

Act of 1995. These forward-looking statements -- including statements regarding ResMed’s projections of future revenue or earnings, expenses, new product development, new product launches and new markets for its products -- are subject to risks

and uncertainties, which could cause actual results to materially differ from those projected or implied in the forward-looking statements. Additional risks and uncertainties are discussed in ResMed’s periodic reports on file with the U.S.

Securities & Exchange Commission. ResMed does not undertake to update its forward-looking statements.

Investors:

Agnes Lee

Senior Director, Investor Relations

(858) 836-5971

investorrelations@resmed.com

News Media:

Alison Graves

Director, Global Corporate Communications

(858) 836-6789

news@resmed.com

- More -

RESMED INC AND SUBSIDIARIES

Condensed Consolidated Statements of Income (Unaudited)

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

March 31, |

|

|

Nine Months Ended

March 31, |

|

| |

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

| |

|

|

|

|

| Net revenue |

|

|

$422,497 |

|

|

|

$397,758 |

|

|

|

$1,225,848 |

|

|

|

$1,139,762 |

|

| Cost of sales

|

|

|

171,066 |

|

|

|

145,970 |

|

|

|

473,882 |

|

|

|

411,234 |

|

| |

|

|

|

|

| Gross profit

|

|

|

251,431 |

|

|

|

251,788 |

|

|

|

751,966 |

|

|

|

728,528 |

|

| |

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and administrative |

|

|

116,336 |

|

|

|

115,101 |

|

|

|

349,377 |

|

|

|

328,172 |

|

| Research and development |

|

|

27,024 |

|

|

|

29,530 |

|

|

|

86,342 |

|

|

|

86,430 |

|

| Amortization of

acquired intangible assets |

|

|

2,203 |

|

|

|

2,459 |

|

|

|

6,558 |

|

|

|

7,325 |

|

| |

|

|

|

|

| Total operating

expenses |

|

|

145,563 |

|

|

|

147,090 |

|

|

|

442,277 |

|

|

|

421,927 |

|

| |

|

|

|

|

| Income from

operations |

|

|

105,868 |

|

|

|

104,698 |

|

|

|

309,689 |

|

|

|

306,601 |

|

| |

|

|

|

|

| Other income (expenses), net: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income (expense), net |

|

|

4,761 |

|

|

|

6,015 |

|

|

|

15,765 |

|

|

|

19,182 |

|

| Other, net

|

|

|

3,729 |

|

|

|

2,199 |

|

|

|

6,346 |

|

|

|

(1,340) |

|

| |

|

|

|

|

| Total other income

(expenses), net |

|

|

8,490 |

|

|

|

8,214 |

|

|

|

22,111 |

|

|

|

17,842 |

|

| |

|

|

|

|

| Income before income taxes |

|

|

114,358 |

|

|

|

112,912 |

|

|

|

331,800 |

|

|

|

324,443 |

|

| Income taxes

|

|

|

23,375 |

|

|

|

22,943 |

|

|

|

66,376 |

|

|

|

66,908 |

|

| |

|

|

|

|

| Net income

|

|

|

$90,983 |

|

|

|

$89,969 |

|

|

|

$265,424 |

|

|

|

$257,535 |

|

| |

|

|

|

|

| Basic earnings per share |

|

|

$0.65 |

|

|

|

$0.64 |

|

|

|

$1.89 |

|

|

|

$1.82 |

|

| Diluted earnings per share |

|

|

$0.64 |

|

|

|

$0.63 |

|

|

|

$1.86 |

|

|

|

$1.78 |

|

| |

|

|

|

|

| Basic shares outstanding |

|

|

140,792 |

|

|

|

140,959 |

|

|

|

140,341 |

|

|

|

141,774 |

|

| Diluted shares

outstanding |

|

|

142,813 |

|

|

|

143,375 |

|

|

|

142,614 |

|

|

|

144,758 |

|

- More -

RESMED INC AND SUBSIDIARIES

Condensed Consolidated Balance Sheets (Unaudited - In thousands)

|

|

|

|

|

|

|

|

|

| |

|

March 31, |

|

|

June 30, |

|

| |

|

2015

|

|

|

2014

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

$866,325 |

|

|

|

$905,730 |

|

| Accounts receivable, net |

|

|

345,485 |

|

|

|

359,593 |

|

| Inventories |

|

|

225,191 |

|

|

|

165,418 |

|

| Prepayments, deferred

income taxes and other current assets |

|

|

115,769 |

|

|

|

125,468 |

|

| |

|

|

| Total current

assets |

|

|

1,552,770 |

|

|

|

1,556,209 |

|

| Property, plant and equipment, net |

|

|

384,160 |

|

|

|

434,277 |

|

| Goodwill and other intangible assets, net |

|

|

302,339 |

|

|

|

334,510 |

|

| Deferred income taxes

and other non-current assets |

|

|

38,760 |

|

|

|

35,966 |

|

| |

|

|

| Total non-current

assets |

|

|

725,259 |

|

|

|

804,753 |

|

| |

|

|

| Total assets

|

|

|

$2,278,029 |

|

|

|

$2,360,962 |

|

| LIABILITIES AND STOCKHOLDERS’

EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

|

$70,900 |

|

|

|

$85,405 |

|

| Accrued expenses |

|

|

131,770 |

|

|

|

130,656 |

|

| Deferred revenue |

|

|

37,295 |

|

|

|

42,370 |

|

| Income taxes payable |

|

|

15,800 |

|

|

|

10,392 |

|

| Deferred income taxes |

|

|

639 |

|

|

|

717 |

|

| Current portion of

long-term debt |

|

|

0 |

|

|

|

18 |

|

| |

|

|

| Total current

liabilities |

|

|

256,404 |

|

|

|

269,558 |

|

| Non-current liabilities: |

|

|

|

|

|

|

|

|

| Deferred income taxes |

|

|

8,831 |

|

|

|

10,716 |

|

| Deferred revenue |

|

|

14,184 |

|

|

|

16,352 |

|

| Income taxes payable |

|

|

1,754 |

|

|

|

5,318 |

|

| Non-current portion of

long-term debt |

|

|

460,581 |

|

|

|

300,770 |

|

| |

|

|

| Total non-current

liabilities |

|

|

485,350 |

|

|

|

333,156 |

|

| |

|

|

| Total liabilities

|

|

|

741,754 |

|

|

|

602,714 |

|

| Stockholders’ Equity: |

|

|

|

|

|

|

|

|

| Common stock |

|

|

563 |

|

|

|

561 |

|

| Additional paid-in capital |

|

|

1,195,880 |

|

|

|

1,117,644 |

|

| Retained earnings |

|

|

1,927,958 |

|

|

|

1,780,396 |

|

| Treasury stock |

|

|

(1,388,623) |

|

|

|

(1,291,910) |

|

| Accumulated other

comprehensive income |

|

|

(199,503) |

|

|

|

151,557 |

|

| |

|

|

| Total

stockholders’ equity |

|

|

$1,536,275 |

|

|

|

$1,758,248 |

|

| |

|

|

| Total liabilities and

stockholders’ equity |

|

|

$2,278,029 |

|

|

|

$2,360,962 |

|

- More –

RESMED INC AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows (Unaudited - In thousands)

|

|

|

|

|

|

|

|

|

| |

|

Nine Months

Ended

March 31, |

|

|

Nine Months

Ended

March 31, |

|

| |

|

2015

|

|

|

2014

|

|

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

| Net income |

|

|

$265,424 |

|

|

|

$257,535 |

|

| Adjustment to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

55,310 |

|

|

|

53,631 |

|

| Gain on disposal of business |

|

|

(709) |

|

|

|

- |

|

| Stock-based compensation costs |

|

|

34,802 |

|

|

|

32,679 |

|

| Foreign currency revaluation |

|

|

(1,252) |

|

|

|

(3,305) |

|

| Excess tax benefit from stock-based compensation arrangements |

|

|

(20,738) |

|

|

|

(11,388) |

|

| Changes in operating assets and liabilities, net of effect of acquisitions: |

|

|

|

|

|

|

|

|

| Accounts receivable, net |

|

|

(14,814) |

|

|

|

(12,873) |

|

| Inventories, net |

|

|

(80,793) |

|

|

|

(15,735) |

|

| Prepaid expenses, net deferred income taxes and other current assets |

|

|

(3,487) |

|

|

|

(4,020) |

|

| Accounts payable,

accrued expenses and other liabilities |

|

|

49,736 |

|

|

|

(20,839) |

|

| |

|

|

| Net cash provided by operating activities |

|

|

283,479 |

|

|

|

275,685 |

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

| Purchases of property, plant and equipment |

|

|

(50,266) |

|

|

|

(54,210) |

|

| Patent registration costs |

|

|

(7,109) |

|

|

|

(5,691) |

|

| Business acquisitions, net of cash acquired |

|

|

(26,956) |

|

|

|

(3,172) |

|

| Investments in cost-method investments |

|

|

(10,500) |

|

|

|

(5,275) |

|

| Proceeds from sale of business |

|

|

468 |

|

|

|

- |

|

| Purchases of foreign currency options |

|

|

- |

|

|

|

(1,337) |

|

| Payments on maturity of foreign currency

contracts |

|

|

(25,232) |

|

|

|

(2,466) |

|

| |

|

|

| Net cash used in

investing activities |

|

|

(119,595) |

|

|

|

(72,151) |

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| Proceeds from issuance of common stock, net |

|

|

23,176 |

|

|

|

15,624 |

|

| Excess tax benefit from stock-based compensation arrangements |

|

|

20,738 |

|

|

|

11,388 |

|

| Purchases of treasury stock |

|

|

(103,295) |

|

|

|

(169,398) |

|

| Payment of business combination contingent consideration |

|

|

(458) |

|

|

|

(1,117) |

|

| Proceeds from borrowings, net of borrowing costs |

|

|

160,000 |

|

|

|

507,838 |

|

| Repayment of borrowings |

|

|

(1,527) |

|

|

|

(415,029) |

|

| Dividends paid |

|

|

(117,862) |

|

|

|

(106,387) |

|

| |

|

|

| Net cash (used in) / provided by financing

activities |

|

|

(19,228) |

|

|

|

(157,081) |

|

| |

|

|

| Effect of exchange rate changes on cash |

|

|

(184,061) |

|

|

|

16,062 |

|

| |

|

|

| Net increase / (decrease) in cash and cash equivalents |

|

|

(39,405) |

|

|

|

62,515 |

|

| Cash and cash equivalents at beginning of period |

|

|

905,730 |

|

|

|

876,048 |

|

| |

|

|

| Cash and cash equivalents at end of

period |

|

|

866,325 |

|

|

|

938,563 |

|

- More –

Reconciliation of Non-GAAP Financial Measures (Unaudited)

(In US$ thousands, except share and per share data)

The measure,

“non-GAAP operating income” is reconciled with GAAP income from operations below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

Mar 31, |

|

|

Nine Months Ended

Mar 31, |

|

| |

|

|

2015 |

|

|

|

2014 |

|

|

|

2015 |

|

|

|

2014 |

|

| |

|

|

|

|

| GAAP income from operations |

|

|

105,868 |

|

|

|

104,698 |

|

|

|

309,689 |

|

|

|

306,601 |

|

| |

|

|

|

|

| Amortization of

acquired intangible assets (A) |

|

|

2,203 |

|

|

|

2,459 |

|

|

|

6,558 |

|

|

|

7,325 |

|

| |

|

|

|

|

| Non-GAAP operating income (excluding the impact of amortization of acquired intangible assets) |

|

|

108,071 |

|

|

|

107,157 |

|

|

|

316,247 |

|

|

|

313,926 |

|

The measure, “non-GAAP net income” and “non-GAAP diluted earnings per share” are reconciled with GAAP net income and

GAAP diluted earnings per share in the table below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

Mar 31, |

|

|

Nine Months Ended

Mar 31, |

|

| |

|

|

2015 |

|

|

|

2014 |

|

|

|

2015 |

|

|

|

2014 |

|

| |

|

|

|

|

| GAAP net income |

|

|

90,983 |

|

|

|

89,969 |

|

|

|

265,424 |

|

|

|

257,535 |

|

| |

|

|

|

|

| Amortization of

acquired intangible assets, net of tax (A) |

|

|

1,643 |

|

|

|

1,868 |

|

|

|

4,951 |

|

|

|

5,563 |

|

| Non-GAAP net income (excluding the impact of amortization of

acquired intangible assets) |

|

|

92,626 |

|

|

|

91,837 |

|

|

|

270,375 |

|

|

|

263,098 |

|

| |

|

|

|

|

| Diluted shares

outstanding |

|

|

142,813 |

|

|

|

143,375 |

|

|

|

142,614 |

|

|

|

144,758 |

|

| |

|

|

|

|

| GAAP diluted earnings

per share |

|

|

$0.64 |

|

|

|

$0.63 |

|

|

|

$1.86 |

|

|

|

$1.78 |

|

| |

|

|

|

|

| Non-GAAP diluted earnings per share (excluding the impact of

amortization of acquired intangible assets) |

|

|

$0.65 |

|

|

|

$0.64 |

|

|

|

$1.90 |

|

|

|

$1.82 |

|

| (A) |

Management excludes amortization of acquired intangible assets from its evaluation of ongoing operations and believes investors benefit from excluding these charges to facilitate a more meaningful evaluation of current

operating performance. |

ResMed believes that presenting diluted earnings per share, excluding the impact of the amortization of

acquired intangible assets is an additional measure of performance that investors can use to compare operating results between reporting periods.

Management uses non-GAAP information internally in planning, forecasting, and evaluating the results of operations in the current period and in

comparing it to past periods. Management believes this information provides investors better insight in evaluating the Company’s performance from core operations and provides consistency in financial reporting. Our use of non-GAAP measures is

intended to supplement, and not to replace, our presentation of net income and other GAAP measures. Like all non-GAAP measures, non-GAAP earnings are subject to inherent limitations because they do not include all the expenses that must be included

under GAAP.

- End -

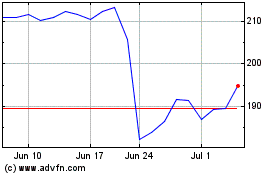

ResMed (NYSE:RMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

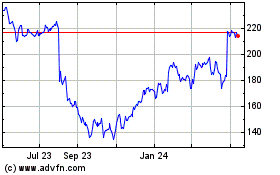

ResMed (NYSE:RMD)

Historical Stock Chart

From Apr 2023 to Apr 2024