US Sen. Hagan 'Very Concerned' About Mortgage Rules

February 02 2011 - 6:27PM

Dow Jones News

Rules being developed by U.S. banking regulators could make it

more difficult for consumers to get home loans, a new member of the

Senate Banking Committee warned Wednesday.

Sen. Kay Hagan, (D., N.C.) said in an interview Wednesday that

she is "very concerned" that regulators will be too stringent in

defining which loans are deemed less risky and therefore exempt

from requirements imposed by the Dodd-Frank financial overhaul

passed last summer.

The financial overhaul law mandated that banks retain 5% of the

risk of a loan if it is packaged into a security and sold to

investors. The idea was that, with more "skin in the game," banks

will be more cautious because they will stand to lose if a borrower

defaults.

Hagan, along with Sens. Mary Landrieu (D., La.) and Johnny

Isakson (R., Ga.), co-sponsored an amendment to the financial

overhaul providing an exemption for safe mortgages, which gave

regulators the task of defining which mortgages are safe.

In recent weeks, there has been concern in the banking industry

that regulators will be strict in their definition, perhaps only

allow loans with a 20% down payment to receive the exemption. Most

of the lending industry favors a broader definition.

Hagan said she sympathizes with those concerns. "I certainly

didn't want to narrow the availability (of credit), which I think

there's a lot of concern about," she said. "If you do that, then I

think you'll ultimately have a smaller number of entities that are

able to provide those mortgages."

If the definition mandates a high down payment requirement, it

could also harm the mortgage insurance industry, which allows

borrowers to take out loans with lower down payments by collecting

insurance premiums from borrowers.

Hagan's state is home to Genworth Financial Inc.'s (GNW)

mortgage insurance division, as well as Old Republic International

Corp.'s (ORI) Republic Mortgage Insurance Co. and American

International Group Inc.'s (AIG) United Guaranty, another mortgage

insurer.

Of mortgage insurers, Hagan said: "That's definitely an industry

that needs to continue staying in business."

-By Alan Zibel, Dow Jones Newswires; 202-862-9263;

alan.zibel@dowjones.com

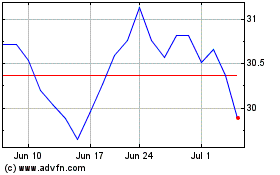

Old Republic (NYSE:ORI)

Historical Stock Chart

From Aug 2024 to Sep 2024

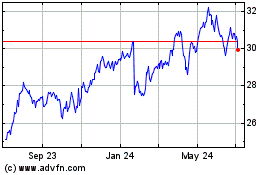

Old Republic (NYSE:ORI)

Historical Stock Chart

From Sep 2023 to Sep 2024