UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 14, 2015

THE MOSAIC COMPANY

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 001-32327 | | 20-1026454 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

3033 Campus Drive Suite E490 Plymouth, Minnesota | | 55441 |

|

|

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (800) 918-8270

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

On May 14, 2015, the Board of Directors (the “Board”) of The Mosaic Company (the “Company”) approved a new share repurchase program of $1.5 billion (the “New Repurchase Program”), allowing the Company to repurchase Class A or common shares, through open market purchases, accelerated share repurchase arrangements, privately negotiated transactions or otherwise. The Board also approved the termination of the remaining amount authorized under the Company’s previous share repurchase program announced in February 2014. The New Repurchase Program has no set expiration date.

|

| |

Item 7.01. | Regulation FD Disclosure. |

The following information is being “furnished” in accordance with General Instruction B.2. of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing:

Press release, dated May 14, 2015, of The Mosaic Company, announcing, among other things, the New Repurchase Program described above, furnished herewith as Exhibit 99.1.

|

| |

Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

Reference is made to the Exhibit Index hereto with respect to the exhibit furnished herewith. The exhibit listed in the Exhibit Index hereto is being “furnished” in accordance with General Instruction B.2. of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | |

| | | | | | |

| | | | THE MOSAIC COMPANY |

| | | |

Date: May 14, 2015 | | | | By: | | /s/ Mark J. Isaacson |

| | | | Name: | | Mark J. Isaacson |

| | | | Title: | | Vice President, General Counsel |

| | | | | | and Corporate Secretary |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

99.1 | | Press release issued by The Mosaic Company on May 14, 2015 |

|

| |

| The Mosaic Company 3033 Campus Drive, Suite E490 Plymouth, MN 55441 www.mosaicco.com |

FOR IMMEDIATE RELEASE

|

| |

Media Ben Pratt The Mosaic Company 763-577-6102 benjamin.pratt@mosaicco.com | Investors Laura Gagnon The Mosaic Company 763-577-8213 investor@mosaicco.com |

MOSAIC ANNOUNCES

NEW $1.5 BILLION SHARE REPURCHASE AUTHORIZATION

To Include $500 Million Accelerated Share Repurchase

DECLARES INCREASED QUARTERLY DIVIDEND OF $0.275 PER SHARE

PLYMOUTH, MN, May 14, 2014 - The Mosaic Company (NYSE: MOS) announced today that its Board of Directors approved a new share repurchase authorization in the amount of $1.5 billion, allowing Mosaic to repurchase Class A or common shares, through open market purchases, accelerated share repurchase arrangements, privately negotiated transactions or otherwise. The new authorization has no set expiration date, but it is expected to be completed over the next two to three year period depending on market conditions. The remaining amount under the Company’s current authorization has been cancelled.

As part of the new authorization, Mosaic intends to execute an accelerated share repurchase (ASR) agreement in the near term for $500 million. The ASR agreement is expected to be completed by the end of September, 2015.

“This new authorization, combined with our increased dividend, underscores confidence in our investments and Mosaic’s ability to grow cash flow across business cycles," said President and Chief Executive Officer Jim Prokopanko. "Effectively allocating our capital to generate attractive long-term returns and returning excess capital to shareholders are top priorities."

“We’re happy to announce a $1.5 billion authorization which fits with our long articulated capital management philosophy. As we have said, Mosaic will continue with a balanced approach to capital by investing in our assets, growing our business when compelling opportunities arise, increasing our dividend as our business grows, and returning excess cash to shareholders,” said Rich Mack, Executive Vice President and Chief Financial Officer. “Mosaic’s prudent capital allocation will be an integral part of creating long-term, sustainable value for our shareholders, and our future cash flow generation looks promising.”

Additionally, the Board of Directors declared a quarterly dividend of $0.275 per share on the Company’s common stock, which is an increase from the previous quarterly dividend of $0.25. The dividend will be paid on June 18, 2015, to stockholders of record as of the close of business on June 4, 2015.

The declaration and payment of any future dividends is subject to approval by Mosaic’s Board of Directors. There can be no assurance that the Company’s Board of Directors will declare future dividends.

About The Mosaic Company

The Mosaic Company is one of the world's leading producers and marketers of concentrated phosphate and potash crop nutrients. Mosaic is a single source provider of phosphate and potash fertilizers and feed ingredients for the global agriculture industry. More information on the Company is available at www.mosaicco.com.

###

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about the Wa’ad Al Shamal Phosphate Company (also known as the Ma’aden joint venture), the acquisition and assumption of certain related liabilities of the Florida phosphate assets of CF Industries, Inc. (“CF”) and Mosaic’s ammonia supply agreements with CF; repurchases of stock; other proposed or pending future transactions or strategic plans and other statements about future financial and operating results. Such statements are based upon the current beliefs and expectations of The Mosaic Company’s management and are subject to significant risks and uncertainties. These risks and uncertainties include but are not limited to risks and uncertainties arising from the ability of the Ma’aden joint venture to obtain additional planned funding in acceptable amounts and upon acceptable terms, the timely development and commencement of operations of production facilities in the Kingdom of Saudi Arabia, the future success of current plans for the Ma’aden joint venture and any future changes in those plans; difficulties with realization of the benefits of the transactions with CF, including the risk that the cost or capital savings from the transactions may not be fully realized or may take longer to realize than expected, or the price of natural gas or ammonia changes to a level at which the natural gas based pricing under one of the long term ammonia supply agreements with CF becomes disadvantageous to Mosaic; customer defaults; the effects of Mosaic’s decisions to exit business operations or locations; the predictability and volatility of, and customer expectations about, agriculture, fertilizer, raw material, energy and transportation markets that are subject to competitive and other pressures and economic and credit market conditions; the level of inventories in the distribution channels for crop nutrients; changes in foreign currency and exchange rates; international trade risks and other risks associated with Mosaic’s international operations and those of joint ventures in which Mosaic participates, including the risk that protests against natural resource companies in Peru extend to or impact the Miski Mayo mine; changes in government policy; changes in environmental and other governmental regulation, including greenhouse gas regulation, implementation of numeric water quality standards for the discharge of nutrients into Florida waterways or efforts to reduce the flow of excess nutrients into the Mississippi River basin, the Gulf of Mexico or elsewhere; further developments in judicial or administrative proceedings, or complaints that Mosaic’s operations are adversely impacting nearby farms, business operations or properties; difficulties or delays in receiving, increased costs of or challenges to necessary governmental permits or approvals or increased financial assurance requirements; resolution of global tax audit activity; the effectiveness of Mosaic’s processes for managing its strategic priorities; adverse weather conditions affecting operations in Central Florida, the Mississippi River basin, the Gulf Coast of the United States or Canada, and including potential hurricanes, excess heat, cold, snow, rainfall or drought; actual costs of various items differing from management’s current estimates, including, among others, asset retirement, environmental remediation, reclamation or other environmental regulation, Canadian resources taxes and royalties, the liabilities Mosaic assumed in the Florida phosphate assets acquisition, or the costs of the Ma’aden joint venture, its existing or future funding and Mosaic’s commitments in support of such funding; reduction of Mosaic’s available cash and liquidity, and increased leverage, due to its use of cash and/or available debt capacity to fund share repurchases, financial assurance requirements and strategic investments; brine inflows at Mosaic’s Esterhazy, Saskatchewan, potash mine or other potash shaft mines; other accidents and disruptions involving Mosaic’s operations, including potential mine fires, floods, explosions, seismic events or releases of hazardous or volatile chemicals; and risks associated with cyber security, including reputational loss, as well as other risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may differ from those set forth in the forward-looking statements.

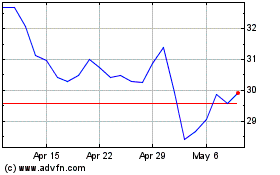

Mosaic (NYSE:MOS)

Historical Stock Chart

From Aug 2024 to Sep 2024

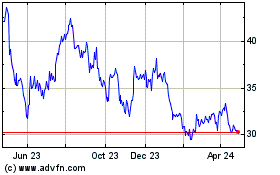

Mosaic (NYSE:MOS)

Historical Stock Chart

From Sep 2023 to Sep 2024