SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment

No. __)

Filed by the Registrant [ ]

Filed by a Party other than the Registrant

[x]

Check the appropriate box:

| [ ] |

Preliminary Proxy Statement |

| [ ] |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] |

Definitive Proxy Statement |

| [X] |

Definitive Additional Materials |

| [ ] |

Soliciting Material Under Rule 14a-12 |

MGM Resorts International

(Name of Registrant as Specified In Its Charter)

Land & Buildings Investment Management,

LLC

Land & Buildings Capital Growth Fund,

L.P.

Jonathan Litt

Matthew J. Hart

Richard Kincaid

Marc A. Weisman

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (check the appropriate

box):

| [X] |

No fee required. |

| |

|

| [ ] |

Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

| |

1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

|

|

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act |

| Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

|

|

| |

4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

|

|

| |

|

|

| |

5) |

Total fee paid: |

| |

|

|

| |

|

|

| |

|

|

| [ ] |

Fee paid previously with preliminary materials. |

| [ ] |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the |

| filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

1) |

Amount Previously Paid: |

| |

|

|

| |

|

|

| |

|

|

| |

2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

|

|

| |

|

|

| |

3) |

Filing Party: |

| |

|

|

| |

|

|

| |

|

|

| |

4) |

Date Filed: |

On April 30, 2015, Land & Buildings Investment Management,

LLC and its affiliates (collectively, "Land & Buildings") issued a press release announcing that Land & Buildings

had released a new investor presentation (the "Presentation") highlighting Land & Buildings' belief that there is

an urgent need for change at MGM Resorts International (the "Company"), available at its newly-launched website www.RestoreMGM.com

(the "Website"), and that Land & Buildings would be hosting a conference call to discuss the Presentation at 4:00

P.M. EST on Thursday, April 30, 2015. A copy of the press release is filed herewith as Exhibit 1.

Also on April 30, 2015, Land & Buildings posted various

soliciting materials to the Website. Copies of the materials posted to the Website are filed herewith as Exhibit 2. Other than

materials filed herewith, all materials posted to the Website that are required to be filed on Schedule 14A have been previously

filed with the Securities and Exchange Commission as soliciting material under Rule 14a-12 or definitive additional materials on

Schedule 14A.

EXHIBIT 1

Land and Buildings Issues New Investor Presentation

Highlighting Urgent Need for Change at MGM Resorts

| | - Land and Buildings Believes That MGM Suffers From a Broken Governance Culture For a Host

of Reasons Including a Lack of Holding Management Accountable for $4.5 Billion of Impairments Since 2009 – |

| | - Land and Buildings Has Outlined

Several Value Creation Suggestions to Close the Persistent Valuation Discount the Company Has Traded At Relative to

Operational Peers – |

| | - Land and Buildings’ Estimated

MGM Net Asset Value is $30-$33 Following Independent Review by Houlihan Lokey, Highlighting Significant Upside From Current

Stock Price – |

| | - Land and Buildings’ New

Presentation is Available at Newly-Launched Website www.RestoreMGM.com

– |

| | - Land and Buildings Will Host a

Conference Call at 4:00PM EST Today – |

| | - Vote for Land and Buildings’

Four Highly-Qualified Board Nominees on the GOLD Proxy Card Today – |

Stamford, CT— (April 30, 2015) – Today Land

and Buildings Investment Management, LLC (“Land and Buildings”) issued an investor presentation providing a detailed

analysis supporting what it views as the urgent need for change at MGM Resorts International (NYSE:MGM) (“MGM” or the

“Company”), and why shareholders should elect Matthew Hart, Richard Kincaid, Jonathan Litt and Marc Weisman to the

Company’s Board. The presentation is available at www.RestoreMGM.com and www.landandbuildings.com.

“When we initially brought our ideas to MGM, we genuinely

hoped to avoid a public campaign and work constructively with the Board. Unfortunately this was not a path they were willing to

take, and now that we find ourselves in a contested situation, we’re actually pleased to have this opportunity to put a spotlight

on the Company,” said Jonathan Litt, Founder/CIO of Land and Buildings. “The long-term performance of the Company relative

to its peers has been unacceptable, in our view, and as we have done our due diligence we have uncovered what we believe are serious

concerns about MGM’s current boardroom culture. In our view, MGM is in need of a wakeup call, which we believe can benefit

all shareholders.”

The presentation highlights why Land and Buildings believes

there is an urgent need for change, as the MGM Board has failed to address the issues that have plagued the Company’s performance

for years:

| · | Substantial stock underperformance: MGM’s total shareholder

return has lagged its peers by 433% since Jim Murren became CEO on December 1, 2008, and has lagged over the trailing 1-, 3- and

5-year periods1. |

| · | Overleveraged balance sheet: MGM’s balance sheet management

is déjà vu from the last economic cycle: free cash flow is going negative once again. |

| · | Lack of capital allocation discipline: The Company is embarking

on $5 billion of development today, with parallels to the last cycle when the $9 billion CityCenter development resulted in impairments

of over 50% of MGM’s investment. Since 2009, MGM has written down $4.5 billion, or over one-third of the equity market capitalization

of the Company, including $2 billion of write downs unrelated to CityCenter. |

| · | Sub-optimal operations: MGM’s EBITDA margins are

substantially below its operational peers2 and the company has been inconsistent in converting revenues into

EBITDA. |

| · | Lack of accountability: MGM has a history of very poor capital

allocation decisions in our view, has been a consistent underperformer and persistently trades at a depressed valuation –

and yet we see no evidence that the Board has held management accountable. |

| · | Poor compensation practices: The Company has a history of poor

compensation practices and its current bonus structure for executives is not fully aligned with shareholder interests. Proxy advisory

firm Glass Lewis gave MGM a “D” in pay-for-performance over the last three years and in 2014 noted that “shareholders

should be deeply concerned with the compensation committee’s sustained failure.”3 |

Land and Buildings has outlined several value creating recommendations

to unlock the intrinsic value at MGM:

| · | Evaluate a REIT: REITs have proven to be an effective corporate

structure to create sustained shareholder value in a variety of types of real estate and should be seriously evaluated, in our

view. |

| · | Divest non-core assets: MGM should sell non-core assets, such

as Circus Circus or MGM Grand Detroit, given the Company trades at a discount to net asset value, in order to reduce debt and focus

efforts on driving shareholder value at the marquee assets, such as Bellagio. |

| · | Deleverage balance sheet: MGM has, in our view, seemingly not

learned from its past mistakes and continues to have an overleveraged balance sheet, while embarking on an aggressive debt-financed

$5 billion development pipeline rather than paying down debt. |

| · | Margin Improvement: Expense reduction should be a priority and

the Board and Management need to take an honest inquiry of the Company’s operations given how EBITDA margin expansion can

dramatically improve MGM’s stock price. |

| · | Modernization of the CEO’s Incentive Compensation: Currently,

MGM’s CEO’s annual incentive compensation is largely determined by achieving EBITDA targets, which we believe could

create incentives for the management team to embark on ambitious developments at the expense of destroying shareholder value. |

We are also concerned about what we view as recent breaches

of appropriate corporate governance:

A recent Wall Street Journal article4 questions

the coincidence of Roland Hernandez being the only link between the MGM and Vail Resorts boards at the time that one of the Land

and Buildings nominees was

given

an ultimatum to withdraw as an MGM nominee or resign from the Vail board. While it is unclear what the exact circumstances were

concerning the involvement of Mr. Hernandez, who serves as the lead independent director of both MGM and Vail, when Richard Kincaid

was pressured to resign from the Vail Board, one thing appears clear to us: there are too many troubling questions surrounding

the actions of the Vail board, led by Mr. Hernandez as lead independent director.

Land and Buildings updates its analysis to a range of $30-$33

per share net asset value

In consultation with Houlihan Lokey, Land and Buildings has

updated its net asset value analysis for MGM to a range of $30-$33, from $33 per share previously, reflecting upside of 36% to

52% from the current share price5. The updated estimate reflects a reduced size of the proposed MGM China special

dividend, possible taxes on such dividend and other asset sales, more conservative EBITDA multiples and an assumed higher rent

coverage on the REIT.

Land and Buildings to hold conference call on MGM Resorts

Thursday April 30, 2015 at 4:00PM EST

Land and Buildings will hold a conference call on Thursday April

30, 2015 at 4:00PM EST to discuss why it believes there is an urgent need for change at MGM Resorts International. Information

for accessing the call is as follows:

PARTICIPANT ACCESS INFORMATION

Domestic: 800 761 5415

International: +1 212 231 2931

About Land and Buildings:

Land and Buildings is a registered investment manager specializing

in publicly traded real estate and real estate related securities. Land and Buildings seeks to deliver attractive risk adjusted

returns by opportunistically investing in securities of global real estate and real estate related companies, leveraging its investment

professionals' deep experience, research expertise and industry relationships.

Investor Contact:

Scott Winter / Jonathan Salzberger

Innisfree M&A Incorporated

212-750-5833

Media Contact:

Elliot Sloane / Dan Zacchei

Sloane & Company

212-486-9500

Esloane@sloanepr.com or

Dzacchei@sloanepr.com

LAND & BUILDINGS CAPITAL GROWTH FUND, L.P., LAND &

BUILDINGS INVESTMENT MANAGEMENT, LLC AND JONATHAN LITT (COLLECTIVELY, "LAND & BUILDINGS") AND MATTHEW J. HART, RICHARD

KINCAID AND MARC A. WEISMAN (TOGETHER WITH LAND & BUILDINGS, THE "PARTICIPANTS") FILED WITH THE SECURITIES AND EXCHANGE

COMMISSION (THE "SEC") ON APRIL 16, 2015 A DEFINITIVE PROXY STATEMENT AND ACCOMPANYING FORM OF PROXY CARD TO BE USED

IN CONNECTION WITH THE PARTICIPANTS' SOLICITATION OF PROXIES FROM THE

STOCKHOLDERS

OF MGM RESORTS INTERNATIONAL (THE "COMPANY") FOR USE AT THE COMPANY'S 2015 ANNUAL MEETING OF STOCKHOLDERS (THE "PROXY

SOLICITATION"). ALL STOCKHOLDERS OF THE COMPANY ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER DOCUMENTS RELATED

TO THE PROXY SOLICITATION BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING ADDITIONAL INFORMATION RELATED TO THE PARTICIPANTS.

THE DEFINITIVE PROXY STATEMENT AND AN ACCOMPANYING PROXY CARD HAVE BEEN FURNISHED TO SOME OR ALL OF THE COMPANY'S STOCKHOLDERS

AND ARE, ALONG WITH OTHER RELEVANT DOCUMENTS, AVAILABLE AT NO CHARGE ON THE SEC'S WEBSITE AT HTTP://WWW.SEC.GOV/.

IN ADDITION, INNISFREE M&A INCORPORATED, LAND & BUILDING'S PROXY SOLICITOR, WILL PROVIDE COPIES OF THE DEFINITIVE PROXY

STATEMENT AND ACCOMPANYING PROXY CARD WITHOUT CHARGE UPON REQUEST.

1

All references to MGM total shareholder returns are through March 16, 2015 unaffected closing price. Peer set for total shareholder

returns consists of both gaming and lodging companies. Gaming companies include publicly traded casino companies in the U.S. excluding

Caesars which was excluded for a number of reasons including filing for bankruptcy earlier in 2015. Lodging companies include

Hilton, Hyatt Hotels Corporation, Marriott, and Starwood Hotels & Resorts Worldwide, Inc., each of which has businesses that

focus on higher chain-scale and vacation destinations, which we believe is similar to MGM’s real estate assets.

2

Defined as Las Vegas Sands and Wynn Resorts.

3

As noted in Glass Lewis’ 2014 Proxy Paper report.

4

“Activist Investors Ramp Up, and Boardroom Rifts Ensue”, Wall

Street Journal, April 16, 2015.

5

MGM share price as of April 24, 2015.

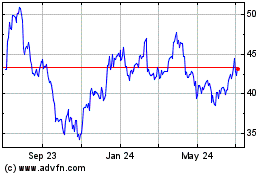

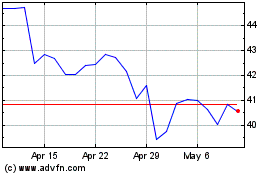

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Aug 2024 to Sep 2024

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Sep 2023 to Sep 2024