By Suzanne Kapner and Sara Germano

Retailers and big brands are increasingly getting pulled into

partisan fights involving President Donald Trump, as a deeply

divided nation seeks to punish those that don't agree with their

political views.

The debates, which kicked off the day after the November

election with a fight over sneaker maker New Balance Athletics

Inc.'s support of Mr. Trump's trade policy, have been sustained by

social media and Facebook groups in the ensuing weeks.

One anti-Trump group called Grab Your Wallet lists dozens of

stores that shoppers should boycott, including Macy's Inc. and L.L.

Bean Inc. Some Trump supporters are encouraging people to #buytrump

or #buyivanka on Twitter or calling on them to boycott Starbucks

Corp. for pledging to hire 10,000 refugees.

"These social media platforms impact the way people vote, and

they can affect a brand's bottom line," said Richard Torrenzano,

chief executive of a crisis communications consulting firm that

bears his name. "Individuals have an enormous ability to affect a

company's reputation, and that reputation impacts sales."

While some data show some brands seeing an increase or decrease

in sales, reasons for the changes aren't always clear.

The president himself has jumped into the latest scrum, raising

questions among some ethics experts. On Wednesday, Mr. Trump

complained on TwitterSHY that Nordstrom Inc. had dropped his

daughter Ivanka Trump's fashion line. Nordstrom said it was a

business decision, not a political one. The label's sales had

declined over the past year, especially in the second half of 2016,

the department-store chain said.

On Thursday, senior counselor Kellyanne Conway, urged Americans

to "go buy Ivanka's stuff" in a televised interview from the White

House, a possible violation of ethics rules. White House press

secretary Sean Spicer said Ms. Conway had been "counseled"

following the interview but didn't elaborate.

The top Republican and Democrat on the House Oversight Committee

said Thursday that Ms. Conway's remarks "raised extremely serious

concerns." Republican Jason Chaffetz of Utah and Democrat Elijah

Cummings of Maryland asked the Office of Government Ethics to

recommendSHY appropriate disciplinary measures "if warranted."

This week the controversy engulfed Under Armour Inc. after the

sportswear maker's billionaire founder and Chief ExecutiveSHY Kevin

Plank voiced support for Mr. Trump, calling him "a real asset."

That sparked a backlash from some consumers and a rebuke of Mr.

Plank's comments by two of the brand's stars, NBA player Steph

Curry and professionalSHY ballerina Misty Copeland.

Since the advent of social media, brands have grappled with how

to handle consumer backlashes that can spread rapidly, but the

current political environment has raised the stakes. "The election

has created an 'us' versus 'them' mentality," said Susan Cantor,

the chief executive of branding firm Red Peak.

It is difficult to measure the economic impact of the various

protest campaigns.

An analysis of holiday sales found little difference between

merchants that were targeted by Grab Your Wallet and all other

merchants tracked by research firm Slice Intelligence, which

gathers email receipts from 4.4 million U.S. consumers.

The online sales of merchants targeted by Grab Your Wallet

increased 18.4% during the 2016 holiday sales season, compared with

18.8% growth for all other merchants, according to Slice.

Ivanka Trump's brand, however, appears to have taken a hit

online. E-commerce sales for the brand fell 26% in January,

compared with January 2015, according to Slice. The brand's online

sales fell 63% at Nordstrom during the last three months of 2016,

compared with the same period a year ago.

A spokeswoman for Ivanka Trump's brand didn't respond to a

request for comment.

With the electorate evenly divided, an attack or endorsement

from Mr. Trump is a double-edged sword. Traffic to Nordstrom's

website spiked 28% on Wednesday, according to data from Connexity,

an e-commerce marketing firm. There were about 908,000 visits to

the site, compared with 709,000 the previous Wednesday.

"Trump's tweet will not have any effect except to make me shop

there more," said John Gangstad, an attorney who lives in Austin,

Texas, regarding Nordstrom.

In January, Mr. Trump told his 24 million Twitter followers to

buy merchandise from L.L. Bean Inc. to combat calls by his

opponents to boycott the brand. In the week that followed, traffic

to the L.L. Bean website jumped from a number of warm-weather

states that usually provide the least visits to the retailer

online, according to Connexity. They include Texas, Florida,

Mississippi and Arizona, which backed Mr. Trump in the presidential

election.

In the same week, traffic to the retailer's website declined in

all but one of the seven states that generate the most online

visits to the company, according to Connexity. The seven states,

which include all of cold-weather New England, plus New York, had

backed Democrat Hillary Clinton in the presidential election.

Melissa Dodd, an assistant professor in advertising and public

relations at the University of Central Florida, has found that

older people are more likely to boycott a company when its views

don't align with their own. By contrast, millennials are more

likely to shop at a company that has views similar to theirs.

Jack Gladstone Holroyde, a 30-year-old physical therapist in the

U.K, said he was unhappy Under Armour had suddenly become

associated with political views he doesn't support. "My UA running

shoes, that I usually wear to work, stayed under my bed this

morning," he said.

Under Armour, for its part, moved to address the backlash to Mr.

Plank's comments, saying the company advocates for fair trade, tax

reform, and "an inclusive immigration policy that welcomes the best

and the brightest."

--Dante Chinni, Rebecca Ballhaus and Sarah Nassauer contributed

to this article.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com and Sara

Germano at sara.germano@wsj.com

(END) Dow Jones Newswires

February 09, 2017 19:24 ET (00:24 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

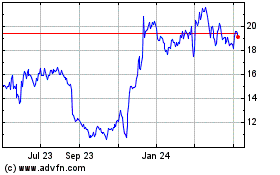

Macys (NYSE:M)

Historical Stock Chart

From Aug 2024 to Sep 2024

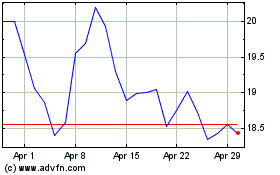

Macys (NYSE:M)

Historical Stock Chart

From Sep 2023 to Sep 2024