By Suzanne Kapner and Joann S. Lublin

Macy's Inc. longtime leader Terry Lundgren will step down as

chief executive at a time when the company he built into the

biggest U.S. department store chain is facing an onslaught of

competition from upstarts and struggling to adapt to changing

consumer demands.

The retailer appointed one of Mr. Lundgren's top lieutenants,

President Jeff Gennette, to take over as CEO in 2017, a move the

company said was part of its succession plan. Mr. Gennette, 55

years old, will join the company's board immediately and gain

additional oversight of store operations.

Mr. Gennette began his career at the retailer in 1983 as an

executive trainee and has climbed the ranks over three decades,

much like his predecessor. Mr. Lundgren, who will turn 65 next

year, will remain chairman.

Macy's directors accelerated the timetable for Mr. Gennette's

ascent to give him the freedom to begin reshaping Macy's now,

according to a person familiar with the company. "He is going to

make the radical changes" before he officially takes the helm, this

person said, adding that Mr. Gennette "has a tough job" ahead of

him.

Shares of Macy's, which rose 1.7% to $33.38 on Thursday, have

lost roughly half of their value in the past 12 months. The decline

attracted activist investor Starboard Value LP, which last year

pressured the company to explore options for its vast real-estate

holdings.

In his 13 years as CEO, Mr. Lundgren repeatedly defied critics

who said the department-store model was dead. In 2005, he

orchestrated the merger of the two biggest chains, Federated

Department Stores Inc. and the May Department Stores Co., creating

a national player that generated $27 billion in revenue last

year.

Macy's was one of the brands owned by Federated and the whole

company was renamed Macy's in 2007 as Mr. Lundgren eliminated

regional brands like Burdines, Filene's and Marshall Field's.

Mr. Lundgren pioneered the idea of tailoring store merchandise

to local tastes, a strategy that competitors have copied. And he

presided over a massive renovation of the flagship New York store,

which enabled it to attract high-end brands like Louis Vuitton to

the Herald Square location.

"He steered Macy's through the most transformative and

disruptive period in recent history," said Arnold Aronson, a former

Saks Fifth Avenue CEO who is now a consultant.

But the forces reshaping retailing may have surpassed even Mr.

Lundgren's ability to outrun them. Macy's, like other traditional

department stores, is fending off fierce competition from online

rivals like Amazon.com Inc., fast-fashion retailers such as H&M

Hennes & Mauritz AB, and even its suppliers such as Coach Inc.

or Michael Kors Holdings Ltd., which have built their own store

networks.

In an interview, Mr. Lundgren said he planned to stick around as

chairman for as long as he can help with the transition. "I told

the board, I'm ready to go when you want me to go," he said. "But

having been CEO for 13 years puts me in a unique position to be

helpful."

Macy's results have been disappointing. In the first quarter, it

reported its worst quarterly sales since the recession, setting off

fresh fears about the health of the U.S. retail sector and raising

concerns as to whether the chain is losing market share.

Executives at the retailer have complained that consumer

spending has shifted from handbags and apparel to experiences and

electronics, areas where it has little exposure. To address the

changes, Mr. Lundgren has pushed into off-price retailing to try to

compete with the likes of TJX Cos.' brands TJ Maxx and Marshalls.

Last year, it also acquired beauty and skin-care chain Bluemercury

Inc., a move to try to reach customers beyond the mall.

Finding a lasting solution to the shifting shopping habits will

now fall on Mr. Gennette, a San Diego native and graduate of

Stanford University, who was anointed heir-apparent in March 2014

after being chief merchandising officer for five years.

Mr. Gennette said Thursday that Macy's plans to simplify its

pricing to better communicate the value it offers shoppers; do a

better job of curating its merchandise to contrast with the often

overwhelming choices found at online retailers; and create a

"friction-free" shopping experience in which customers can more

easily find their color or size, or get the help they need.

"We are used to winning and we will win again," Mr. Gennette

said in an interview.

Mr. Gennette is steeped in Macy's with a 33-year career. He

served as a store manager for FAO Schwarz, held merchandise

positions for its men's and children's businesses, and eventually

took executive responsibility for various regions.

Some Macy's directors initially had been unsure whether the

CEO-to-be could identify the sweeping steps needed to get back on

track, given his long Macy's tenure and similar background to Mr.

Lundgren, the person familiar with the matter said. But the full

board ultimately decided Mr. Gennette "has the courage" to make the

big shifts needed, this person said.

Mr. Gennette has filled holes in his management experience since

being elevated to president. He led analyst meetings, dealt

regularly with Macy's finance chief, attended board meetings, and

learned more about marketing, the person familiar with the

situation said.

The company said earlier this year it would close about 40

stores, cutting thousands of jobs. Macy's employed about 157,900

full-time and part-time workers as of Jan. 30. After deciding

against a spinoff of its properties, it has also hired advisers to

explore strategic options for its flagship stores and real-estate

portfolio.

Mr. Lundgren, who started his career in 1975 at a Bullock's

store in Los Angeles, became interested in fashion as a teenager

growing up in California. He honed his look, which consisted of

Sperry topsiders and Farah slacks. In 1972, he was Bachelor No. 2

on "The Dating Game." He won the date. As CEO, he was known for

wearing impeccable suits and never having a hair out of place. He

even designed the dress his wife wore to their 2005 wedding.

But people who know him say he is more than a merchant prince.

"Terry was one of the top CEOs in recent history," said Mr.

Aronson, the former Saks chief. "He will leave his stamp on the

retail industry for many years to come."

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com and Joann S.

Lublin at joann.lublin@wsj.com

(END) Dow Jones Newswires

June 23, 2016 17:51 ET (21:51 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

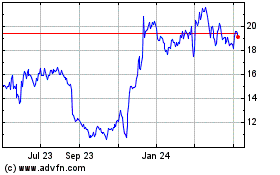

Macys (NYSE:M)

Historical Stock Chart

From Mar 2024 to Apr 2024

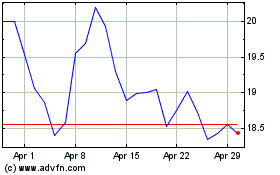

Macys (NYSE:M)

Historical Stock Chart

From Apr 2023 to Apr 2024