Lockheed Martin Lifts Full-Year Guidance -- Update

April 26 2016 - 2:24PM

Dow Jones News

By Doug Cameron and Lisa Beilfuss

Lockheed Martin lifted its earnings forecast for the year as the

company, continuing to reshape its business, benefited from sales

of its F-35 jet fighter and its recently acquired Sikorsky

helicopter unit.

The Maryland company, the world's largest military contractor by

revenue, earlier this year announced plans to carve out its big

government information-technology unit, a move to focus on more

profitable work building military jets, helicopters and

missiles.

Last month, Lockheed launched a voluntary layoff program in its

aeronautics business, aiming to cut about 1,000 U.S. jobs, or about

0.8% of its total workforce.

Meanwhile, Lockheed has been working to fix glitches in its F-35

program, which is due to enter service with the U.S. Air Force by

year-end. The company reported a 21% increase in aeronautics sales,

to $3.80 billion, an increase it attributed to sales associated

with the F-35 program in addition to increased deliveries of C-130

cargo planes. At the same time, revenue in its mission systems

segment surged 52% thanks to helicopter maker Sikorsky Corp., a

business Lockheed bought last year for $9 billion.

The jumps in aeronautics and mission-systems sales helped offset

sales declines in the company's information-systems and

space-systems segments.

Lockheed generates around 20% of its sales from exports and aims

to boost the absolute total and share to around 25% over the next

several years. Export prospects will be closely monitored as other

large U.S. defense companies report their earnings this week.

Contractors including L-3 Communications Holdings Inc. and

Oshkosh Corp. cautioned earlier this year that some prospective

Middle East deals were taking longer to complete as countries

scrutinized budgets falling into deficit because of low oil

prices.

Chief Financial Officer Bruce Tanner said Lockheed expected to

end the year with a backlog of $90 billion to $95 billion, down

from almost $100 billion after the planned sale of its government

IT unit to Leidos Inc.

Big orders expected this year include another sale of its F-35

combat jets to the U.S. and international customers. While a number

of smaller opportunities are available next year, the Pentagon

isn't expected to decide on two large contracts for missile defense

and a new long-range missile until 2018, said Mr. Tanner.

Overall, for the first quarter, the company reported a profit of

$794 million, or $2.58 a share, down from $878 million, or $2.74 a

share, a year earlier. The company said charges stemming from job

cuts reduced earnings by 21 cents a share.

Revenue climbed 16% to $11.70 billion. Analysts had projected

$2.59 in adjusted earnings per share on $11.34 billion in revenue,

according to Thomson Reuters.

For the full year, Lockheed expects to report $11.50 to $11.80 a

share, up from earlier guidance of $11.45 to $11.75 a share. The

company sees sales of $49.6 billion to $51.1 billion, slightly

higher than its earlier prediction of $49.5 billion to $51

billion.

Shares of Lockheed Martin rose 2.3% to $231.42 in afternoon

trading.

Write to Doug Cameron at doug.cameron@wsj.com and Lisa Beilfuss

at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

April 26, 2016 14:09 ET (18:09 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

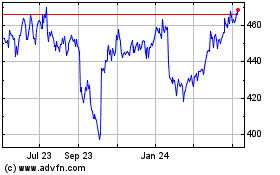

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

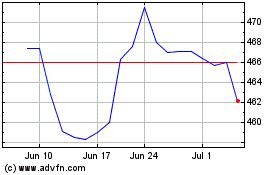

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Apr 2023 to Apr 2024