KeyCorp Reports 18% Profit Increase -- 2nd Update

October 15 2015 - 4:25PM

Dow Jones News

By Lisa Beilfuss And Rachel Louise Ensign

Regional lender KeyCorp said third-quarter profit rose on strong

performance in the bank's corporate-focused businesses.

Revenue topped Wall Street expectations and Key shares, now down

about 13% over the past three months, rose about 4.5% in afternoon

trading.

"People thought we were going to be an underperformer this

quarter," Key Chief Executive Beth Mooney said in an interview.

Instead, she said the earnings report surprised by showing that the

company can grow across the board without the help of higher

interest rates.

The Cleveland-based bank reported a profit of $219 million, or

26 cents a share, up from $186 million, or 21 cents, a year

earlier. Revenue increased 7% to $1.07 billion. Analysts projected

27 cents in per-share profit on $1.05 billion in revenue, according

to Thomson Reuters. Key said a pension settlement charge reduced

earnings per share by one cent.

The bank's performance was aided by strong revenue from its

business banking segments. Noninterest income jumped 13% to $470

million in the latest quarter, aided by Pacific Crest Securities, a

technology-focused investment bank Key acquired last year. The bank

posted double-digit growth in investment banking, debt placement

and corporate-services income from the year prior.

Commercial lending rose 15% from a year earlier, offsetting

declines in other segments and pushing average loans up 6.2%

overall. Key executives say their firm has made a significant

investment in commercial bankers.

Deposits also increased and were up about 3% from the year-ago

period.

Like many other lenders hamstrung by low interest rates that

have made lending less profitable, Key has moved to cut costs and

has closed some branches. Despite those initiatives, the lender saw

noninterest expenses rise 2.5% from the year-ago quarter as it

spent more on banker salaries and due to costs associated with the

acquisition of Pacific Crest.

Still, KeyCorp managed to push its efficiency ratio, a measure

of costs as a percentage of revenue where lower is better, down to

66.9% from 69.7% a year earlier. On the earnings call, Chief

Financial Officer Don Kimble said Key still thinks it can get its

efficiency ratio to the low-60s range, despite the uncertainty over

when interest rates will rise.

KeyCorp's net interest margin, an important gauge of lending

profitability that measures how much a bank earns from the

difference between what it pays on deposits and what it takes in on

loans and investments, declined slightly. The metric edged down to

2.87% from 2.88% in the second quarter and fell from 2.96% a year

earlier.

Ms. Mooney said in an interview that she thinks it is time for

the Fed to raise interest rates, echoing recent comments from other

bank chief executives.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com and Rachel

Louise Ensign at rachel.ensign@wsj.com

(END) Dow Jones Newswires

October 15, 2015 16:10 ET (20:10 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

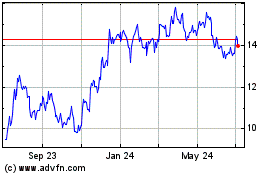

KeyCorp (NYSE:KEY)

Historical Stock Chart

From Aug 2024 to Sep 2024

KeyCorp (NYSE:KEY)

Historical Stock Chart

From Sep 2023 to Sep 2024