Reports Pretax Profit for Third

Quarter Closed Financing Transactions with

New Issuances of $150 Million

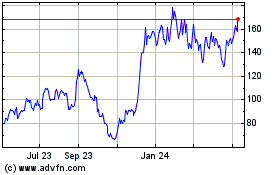

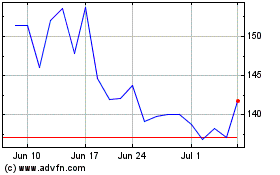

Hovnanian Enterprises, Inc. (NYSE:HOV), a leading national

homebuilder, reported results for its fiscal third quarter and nine

months ended July 31, 2016.

RESULTS FOR THE THREE MONTH AND NINE

MONTH PERIODS ENDED JULY 31, 2016:

- Total revenues were $716.9 million in the third quarter of

fiscal 2016, an increase of 32.6% compared with $540.6 million in

the third quarter of fiscal 2015. For the nine months ended July

31, 2016, total revenues increased 33.8% to $1.95 billion compared

with $1.46 billion in the first nine months of the prior

year.

- Total SG&A was $66.6 million, or 9.3% of total revenues, a

330 basis point improvement during the third quarter of fiscal 2016

compared with $67.9 million, or 12.6% of total revenues, in last

year’s third quarter. Total SG&A was $199.4 million, or 10.2%

of total revenues, a 360 basis point improvement for the first nine

months of fiscal 2016 compared with $201.5 million, or 13.8% of

total revenues, in the first nine months of the prior

year.

- Total interest expense as a percentage of total revenues was

7.2% during both the third quarter of fiscal 2016 and the third

quarter of fiscal 2015. For the nine months ended July 31, 2016,

total interest expense as a percentage of total revenues declined

70 basis points to 6.9% compared with 7.6% during the same period a

year ago.

- Homebuilding gross margin percentage, before interest expense

and land charges included in cost of sales, was 16.9% for the third

quarter ended July 31, 2016 compared with 17.8% for the third

quarter of fiscal 2015 and 16.1% for the second quarter of fiscal

2016. During the first nine months of fiscal 2016, homebuilding

gross margin percentage, before interest expense and land charges

included in cost of sales, was 16.5% compared with 17.4% in the

same period of the previous year.

- Income before income taxes in the third quarter of fiscal 2016

was $1.1 million compared with a loss before income taxes of $10.0

million in the prior year’s third quarter. For the first nine

months of fiscal 2016, the loss before income taxes was $29.7

million compared with a loss before income taxes of $59.2 million

during the first nine months of fiscal 2015.

- Income before income taxes, excluding land-related charges, in

the third quarter of fiscal 2016 was $2.7 million compared with a

loss before income taxes, excluding land-related charges, of $8.9

million in the prior year’s third quarter. For the first nine

months of fiscal 2016, the loss before income taxes, excluding

land-related charges, was $6.8 million compared with a loss before

income taxes, excluding land-related charges, of $51.5 million

during the first nine months of fiscal 2015.

- The net loss was $0.5 million, or $0.00 per common share, for

the third quarter of fiscal 2016, compared with a net loss of $7.7

million, or $0.05 per common share, in the third quarter of the

previous year. For the nine months ended July 31, 2016, the net

loss was $25.1 million, or $0.17 per common share, compared with a

net loss of $41.6 million, or $0.28 per common share, in the first

nine months of fiscal 2015.

- For the third quarter of fiscal 2016, Adjusted EBITDA was $56.3

million compared with $32.2 million during the third quarter of

2015, a 74.8% increase. For the first nine months of fiscal 2016,

Adjusted EBITDA increased 105.1% to $134.8 million compared with

$65.7 million during the first nine months of fiscal

2015.

- Adjusted EBITDA to interest incurred was 1.40x for third

quarter of fiscal 2016 compared with 0.77x for the same quarter

last year. For the nine-month period ended July 31, 2016, Adjusted

EBITDA to interest incurred was 1.07x compared with 0.53x for the

same period one year ago.

- Consolidated active selling communities decreased 15.5% from

206 communities at the end of the prior year’s third quarter to 174

communities as of July 31, 2016, which was impacted by the sale of

ten communities in Minneapolis and Raleigh and the conversion of

four consolidated communities into unconsolidated joint venture

communities. As of the end of the third quarter of fiscal 2016,

active selling communities, including unconsolidated joint

ventures, decreased 9.8% to 193 communities compared with 214

communities at July 31, 2015.

- Consolidated net contracts per active selling community

increased 13.5% to 8.4 net contracts per active selling community

for the third quarter of fiscal 2016 compared with 7.4 net

contracts per active selling community in the third quarter of

fiscal 2015. Net contracts per active selling community, including

unconsolidated joint ventures, increased 3.9% to 8.0 net contracts

per active selling community for the quarter ended July 31, 2016

compared with 7.7 net contracts, including unconsolidated joint

ventures, per active selling community in the third quarter of

fiscal 2015.

- The dollar value of consolidated net contracts decreased 4.3%

to $593.0 million for the three months ended July 31, 2016 compared

with $619.4 million during the same quarter a year ago. The dollar

value of net contracts, including unconsolidated joint ventures,

during the third quarter of fiscal 2016 decreased 8.8% to $633.3

million compared with $694.6 million in last year’s third

quarter.

- The dollar value of consolidated net contracts increased 8.5%

to $1.98 billion for the first nine months of fiscal 2016 compared

with $1.82 billion in the first nine months of the previous year.

The dollar value of net contracts, including unconsolidated joint

ventures, for the nine months ended July 31, 2016 increased 6.3% to

$2.09 billion compared with $1.97 billion in the first nine months

of fiscal 2015.

- The number of consolidated net contracts, during the third

quarter of fiscal 2016, decreased 4.3% to 1,467 homes compared with

1,533 homes in the prior year’s third quarter. In the third quarter

of fiscal 2016, the number of net contracts, including

unconsolidated joint ventures, decreased 7.3% to 1,537 homes from

1,658 homes during the third quarter of fiscal 2015.

- The number of consolidated net contracts, during the nine-month

period ended July 31, 2016, increased 3.5% to 4,810 homes compared

with 4,648 homes in the same period of the previous year. During

the first nine months of fiscal 2016, the number of net contracts,

including unconsolidated joint ventures, was 4,991 homes, an

increase of 1.5% from 4,918 homes during the first nine months of

fiscal 2015.

- As of July 31, 2016, the dollar value of contract backlog,

including unconsolidated joint ventures, was $1.48 billion, an

increase of 7.7% compared with $1.37 billion as of July 31, 2015.

The dollar value of consolidated contract backlog, as of July 31,

2016, increased 3.8% to $1.31 billion compared with $1.26 billion

as of July 31, 2015.

- As of July 31, 2016, the number of homes in contract backlog,

including unconsolidated joint ventures, decreased 1.3% to 3,232

homes compared with 3,275 homes as of July 31, 2015. The number of

homes in consolidated contract backlog, as of July 31, 2016,

decreased 4.1% to 2,969 homes compared with 3,097 homes as of the

end of the third quarter of fiscal 2015.

- Consolidated deliveries were 1,574 homes in the third quarter

of fiscal 2016, an 11.8% increase compared with 1,408 homes in the

third quarter of fiscal 2015. For the three months ended July 31,

2016, deliveries, including unconsolidated joint ventures,

increased 10.3% to 1,627 homes compared with 1,475 homes in the

third quarter of the prior year.

- Consolidated deliveries were 4,594 homes in the first nine

months of fiscal 2016, a 21.5% increase compared with 3,780 homes

in the same period in fiscal 2015. For the nine months ended July

31, 2016, deliveries, including unconsolidated joint ventures,

increased 19.0% to 4,740 homes compared with 3,984 homes in the

first nine months of the prior year.

- The contract cancellation rate, including unconsolidated joint

ventures, for the third quarter of fiscal 2016 was 22%, compared

with 20% in the third quarter of fiscal 2015.

- The valuation allowance was $635.4 million as of July 31, 2016.

The valuation allowance is a non-cash reserve against the tax

assets for GAAP purposes. For tax purposes, the tax deductions

associated with the tax assets may be carried forward for 20 years

from the date the deductions were incurred.

LIQUIDITY AND INVENTORY AS OF

JULY 31, 2016:

- After paying off $320.0 million of debt that matured in October

2015, January 2016 and May 2016, total liquidity at the end of the

third quarter of fiscal 2016 was $187.7 million.

- During the third quarter of fiscal 2016, land and land

development spending was $132.3 million compared with $130.0

million in last year’s third quarter.

- As of July 31, 2016, the land position, including

unconsolidated joint ventures, was 32,125 lots, consisting of

14,256 lots under option and 17,869 owned lots, compared with a

total of 37,442 lots as of July 31, 2015.

- During the third quarter of fiscal 2016, approximately 900

lots, including unconsolidated joint ventures, were put under

option or acquired in 20 communities.

- Subsequent to third quarter end, closed financing transactions

with certain investment funds managed by affiliates of H/2 Capital

Partners LLC by borrowing $75.0 million under a senior secured

first lien priority term loan facility, issuing $75.0 million of

10.0% Senior Secured Second Lien Notes due 2018 and issuing $75.0

million of 9.5% Senior Secured First Lien Notes due 2020 in

exchange for $75.0 million of 9.125% Senior Secured Second Lien

Notes due 2020 held by such investor. Used a portion of the

proceeds to call for redemption all $121.0 million of our 8.625%

Senior Notes due 2017.

FINANCIAL

GUIDANCE:

- Assuming no changes in current market conditions and after the

impact from exiting two markets, our guidance for all of fiscal

2016 for total revenues is expected to be between $2.7 billion and

$2.9 billion. Adjusted EBITDA is expected to be between $200

million and $225 million and income before income taxes, excluding

land related charges, gains or losses on extinguishment of debt and

other non-recurring items such as legal settlements, is expected to

be between $25 million and $35 million for all of fiscal 2016.

COMMENTS FROM

MANAGEMENT:

“During our third quarter we made progress

towards our goal of improving our profitability by increasing our

revenues 33%, growing Adjusted EBITDA by 75%, improving our

Adjusted EBITDA coverage to 1.40x from 0.77x, and achieving a

pretax profit,” stated Ara K. Hovnanian, Chairman of the Board,

President and Chief Executive Officer. “However, we are fully aware

that there is even more work to do in order to return the company

to higher levels of sustainable profits. We are anticipating a

solid fourth quarter with income before income taxes, excluding

land related charges, gains or losses on extinguishment of debt and

other non-recurring items such as legal settlements, expected to be

between $32 million and $42 million.”

“After paying off $320 million of debt since

October 15, 2015, we ended the third quarter with $187.7 million of

liquidity. Subsequent to the end of the third quarter, we issued

$150 million of new debt to refinance debt maturing in 2017.

Completing this debt transaction increases our liquidity and allows

us to continue land investments that will help return us to higher

levels of profitability in the future,” concluded Mr.

Hovnanian.

WEBCAST INFORMATION:

Hovnanian Enterprises will webcast its fiscal

2016 third quarter financial results conference call at 11:00 a.m.

E.T. on Friday, September 9, 2016. The webcast can be accessed live

through the “Investor Relations” section of Hovnanian Enterprises’

website at http://www.khov.com. For those who are not available to

listen to the live webcast, an archive of the broadcast will be

available under the “Past Events” section of the Investor Relations

page on the Hovnanian website at http://www.khov.com. The archive

will be available for 12 months.

ABOUT HOVNANIAN ENTERPRISES®,

INC.:

Hovnanian Enterprises, Inc., founded in 1959 by

Kevork S. Hovnanian, is headquartered in Red Bank, New Jersey. The

Company is one of the nation’s largest homebuilders with operations

in Arizona, California, Delaware, Florida, Georgia, Illinois,

Maryland, New Jersey, Ohio, Pennsylvania, South Carolina, Texas,

Virginia, Washington, D.C. and West Virginia. The Company’s homes

are marketed and sold under the trade names K.

Hovnanian® Homes, Brighton

Homes® and Parkwood Builders. As the

developer of K. Hovnanian’s® Four Seasons

communities, the Company is also one of the nation’s largest

builders of active lifestyle communities.

Additional information on Hovnanian Enterprises,

Inc., including a summary investment profile and the Company’s 2015

annual report, can be accessed through the “Investor Relations”

section of the Hovnanian Enterprises’ website at

http://www.khov.com. To be added to Hovnanian's investor e-mail

list, please send an e-mail to IR@khov.com or sign up at

http://www.khov.com.

NON-GAAP FINANCIAL

MEASURES:

Consolidated earnings before interest

expense and income taxes (“EBIT”) and before depreciation and

amortization (“EBITDA”) and before inventory impairment loss and

land option write-offs (“Adjusted EBITDA”) are not U.S. generally

accepted accounting principles (GAAP) financial measures. The most

directly comparable GAAP financial measure is net loss. The

reconciliation for historical periods of EBIT, EBITDA and Adjusted

EBITDA to net loss is presented in a table attached to this

earnings release.

Income (Loss) Before Income Taxes

Excluding Land-Related Charges is a non-GAAP financial measure. The

most directly comparable GAAP financial measure is Income (Loss)

Before Income Taxes. The reconciliation for historical periods of

Income (Loss) Before Income Taxes Excluding Land-Related Charges to

Income (Loss) Before Income Taxes is presented in

a table attached to this earnings release.

With respect to our expectations under

“Financial Guidance” and “Comments from Management” above, for

Adjusted EBITDA and income before income taxes excluding

land-related charges, gains or losses on extinguishment of debt and

other non-recurring items such as legal settlements, a

reconciliation to the closest corresponding GAAP financial measures

is not available without unreasonable efforts on a forward-looking

basis due to the high variability, complexity and low visibility

with respect to land-related charges excluded from these non-GAAP

financial measures. We expect the variability of these charges to

have a potentially unpredictable, and potentially significant,

impact on our future GAAP financial results.

Total liquidity is comprised of $181.5

million of cash and cash equivalents, $1.7 million of restricted

cash required to collateralize letters of credit and $4.5 million

of availability under the unsecured revolving credit facility as of

July 31, 2016.

FORWARD-LOOKING STATEMENTS

All statements in this press release

that are not historical facts should be considered as

“Forward-Looking Statements” within the meaning of the “Safe

Harbor” provisions of the Private Securities Litigation Reform Act

of 1995. Such statements involve known and unknown risks,

uncertainties and other factors that may cause actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements. Such

forward-looking statements include but are not limited to

statements related to the Company’s goals and expectations with

respect to its financial results for the current or future

financial periods, including total revenues, Adjusted EBITDA and

adjusted income before income taxes. Although we believe that our

plans, intentions and expectations reflected in, or suggested by,

such forward-looking statements are reasonable, we can give no

assurance that such plans, intentions or expectations will be

achieved. By their nature, forward-looking statements: (i) speak

only as of the date they are made, (ii) are not guarantees of

future performance or results and (iii) are subject to risks,

uncertainties and assumptions that are difficult to predict or

quantify. Therefore, actual results could differ materially and

adversely from those forward-looking statements as a result of a

variety of factors. Such risks, uncertainties and other factors

include, but are not limited to, (1) changes in general and local

economic, industry and business conditions and impacts of the

sustained homebuilding downturn; (2) adverse weather and other

environmental conditions and natural disasters; (3) levels of

indebtedness and restrictions on the Company’s operations and

activities imposed by the agreements governing the Company’s

outstanding indebtedness; (4) the Company's sources of liquidity;

(5) changes in credit ratings; (6) changes in market conditions and

seasonality of the Company’s business; (7) the availability and

cost of suitable land and improved lots; (8) shortages in, and

price fluctuations of, raw materials and labor; (9) regional and

local economic factors, including dependency on certain sectors of

the economy, and employment levels affecting home prices and sales

activity in the markets where the Company builds homes; (10)

fluctuations in interest rates and the availability of mortgage

financing; (11) changes in tax laws affecting the after-tax costs

of owning a home; (12) operations through joint ventures with third

parties; (13) government regulation, including regulations

concerning development of land, the home building, sales and

customer financing processes, tax laws and the environment; (14)

product liability litigation, warranty claims and claims made by

mortgage investors; (15) levels of competition; (16) availability

and terms of financing to the Company; (17) successful

identification and integration of acquisitions; (18) significant

influence of the Company’s controlling stockholders; (19)

availability of net operating loss carryforwards; (20) utility

shortages and outages or rate fluctuations; (21) geopolitical

risks, terrorist acts and other acts of war; (22) increases in

cancellations of agreements of sale; (23) loss of key management

personnel or failure to attract qualified personnel; (24)

information technology failures and data security breaches; (25)

legal claims brought against us and not resolved in our favor; and

(26) certain risks, uncertainties and other factors described in

detail in the Company’s Annual Report on Form 10-K for the fiscal

year ended October 31, 2015 and subsequent filings with the

Securities and Exchange Commission. Except as otherwise required by

applicable securities laws, we undertake no obligation to publicly

update or revise any forward-looking statements, whether as a

result of new information, future events, changed circumstances or

any other reason.

(Financial Tables Follow)

|

Hovnanian Enterprises, Inc. |

|

|

|

|

|

|

|

|

July 31, 2016 |

|

|

|

|

|

|

|

| Statements

of Consolidated Operations |

|

|

|

|

|

|

|

| (Dollars in

Thousands, Except Per Share Data) |

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

|

July 31, |

|

July 31, |

|

|

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

|

|

|

(Unaudited) |

|

(Unaudited) |

| Total

Revenues |

$ |

716,850 |

|

|

$ |

540,613 |

|

|

$ |

1,947,178 |

|

|

$ |

1,455,276 |

|

| Costs and

Expenses (a) |

|

713,356 |

|

|

|

550,166 |

|

|

|

1,971,656 |

|

|

|

1,516,908 |

|

| (Loss)

Income from Unconsolidated Joint Ventures |

|

(2,401 |

) |

|

|

(448 |

) |

|

|

(5,227 |

) |

|

|

2,470 |

|

| Income

(loss) Before Income Taxes |

|

1,093 |

|

|

|

(10,001 |

) |

|

|

(29,705 |

) |

|

|

(59,162 |

) |

| Income Tax

Provision (Benefit) |

|

1,567 |

|

|

|

(2,317 |

) |

|

|

(4,597 |

) |

|

|

(17,543 |

) |

| Net

Loss |

$ |

(474 |

) |

|

$ |

(7,684 |

) |

|

$ |

(25,108 |

) |

|

$ |

(41,619 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Per Share

Data: |

|

|

|

|

|

|

|

| Basic: |

|

|

|

|

|

|

|

|

|

|

Loss Per

Common Share |

$ |

(0.00 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.17 |

) |

|

$ |

(0.28 |

) |

|

|

Weighted

Average Number of |

|

|

|

|

|

|

|

|

|

|

Common

Shares Outstanding (b) |

|

147,412 |

|

|

|

147,010 |

|

|

|

147,383 |

|

|

|

146,846 |

|

| Assuming

Dilution: |

|

|

|

|

|

|

|

|

|

Loss Per

Common Share |

$ |

(0.00 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.17 |

) |

|

$ |

(0.28 |

) |

|

|

Weighted

Average Number of |

|

|

|

|

|

|

|

|

|

|

Common

Shares Outstanding (b) |

|

147,412 |

|

|

|

147,010 |

|

|

|

147,383 |

|

|

|

146,846 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a)

Includes inventory impairment loss and land option write-offs. |

|

|

|

|

|

|

|

| (b)

For periods with a net loss, basic shares are used in accordance

with GAAP rules. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hovnanian Enterprises, Inc. |

|

|

|

|

|

|

|

|

July 31, 2016 |

|

|

|

|

|

|

|

|

Reconciliation of Income (Loss) Before Income Taxes Excluding

Land-Related Charges to Income (Loss) Before Income Taxes |

|

|

|

|

|

|

|

|

|

|

|

|

| (Dollars in

Thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

|

July 31, |

|

July 31, |

|

|

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

|

|

|

(Unaudited) |

|

(Unaudited) |

| Income

(Loss) Before Income Taxes |

$ |

1,093 |

|

|

$ |

(10,001 |

) |

|

$ |

(29,705 |

) |

|

$ |

(59,162 |

) |

| Inventory

Impairment Loss and Land Option Write-Offs |

|

1,565 |

|

|

|

1,077 |

|

|

|

22,915 |

|

|

|

7,618 |

|

| Income

(Loss) Before Income Taxes Excluding Land-Related Charges(a) |

$ |

2,658 |

|

|

$ |

(8,924 |

) |

|

$ |

(6,790 |

) |

|

$ |

(51,544 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| (a) Income

(Loss) Before Income Taxes Excluding Land-Related Charges is a

non-GAAP Financial measure. The most directly comparable GAAP

financial measure is Income (Loss) Before Income Taxes. |

| Hovnanian

Enterprises, Inc. |

|

|

|

|

|

|

|

|

| July 31,

2016 |

|

|

|

|

|

|

|

|

| Gross Margin |

|

|

|

|

|

|

|

|

| (Dollars in

Thousands) |

|

|

|

|

|

|

|

|

|

Homebuilding Gross Margin |

Homebuilding Gross Margin |

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

July 31, |

|

July 31, |

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

|

(Unaudited) |

|

(Unaudited) |

| Sale of Homes |

|

$ |

640,386 |

|

|

$ |

526,156 |

|

|

$ |

1,823,318 |

|

|

$ |

1,414,799 |

|

| Cost of Sales,

Excluding Interest and Land Charges (a) |

|

|

532,116 |

|

|

|

432,625 |

|

|

|

1,521,704 |

|

|

|

1,168,874 |

|

|

Homebuilding Gross Margin, Excluding Interest and Land Charges |

|

108,270 |

|

|

|

93,531 |

|

|

|

301,614 |

|

|

|

245,925 |

|

| Homebuilding Cost of

Sales Interest |

|

|

23,108 |

|

|

|

16,323 |

|

|

|

61,291 |

|

|

|

39,615 |

|

|

Homebuilding Gross Margin, Including Interest and |

|

|

|

|

|

|

|

| Excluding Land

Charges |

$ |

85,162 |

|

|

$ |

77,208 |

|

|

$ |

240,323 |

|

|

$ |

206,310 |

|

|

|

|

|

|

|

|

|

|

|

| Gross

Margin Percentage, Excluding Interest and Land Charges |

|

16.9 |

% |

|

|

17.8 |

% |

|

|

16.5 |

% |

|

|

17.4 |

% |

| Gross Margin Percentage,

Including Interest and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Excluding Land

Charges |

|

13.3 |

% |

|

|

14.7 |

% |

|

|

13.2 |

% |

|

|

14.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Land Sales Gross Margin |

Land Sales Gross Margin |

|

|

|

Three Months Ended |

Nine Months Ended |

|

|

|

July 31, |

|

July 31, |

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

|

(Unaudited) |

|

(Unaudited) |

| Land and Lot Sales |

|

$ |

58,897 |

|

|

$ |

- |

|

|

$ |

70,051 |

|

|

$ |

850 |

|

| Cost of Sales,

Excluding Interest and Land Charges (a) |

|

|

51,667 |

|

|

|

- |

|

|

|

62,275 |

|

|

|

702 |

|

| Land and

Lot Sales Gross Margin, Excluding Interest and Land Charges |

|

7,230 |

|

|

|

- |

|

|

|

7,776 |

|

|

|

148 |

|

| Land and Lot Sales

Interest |

|

|

5,298 |

|

|

|

- |

|

|

|

5,402 |

|

|

|

39 |

|

| Land and

Lot Sales Gross Margin, Including Interest and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Excluding Land

Charges |

$ |

1,932 |

|

|

$ |

- |

|

|

$ |

2,374 |

|

|

$ |

109 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) Does

not include cost associated with walking away from land options or

inventory impairment losses which are recorded as Inventory

impairment loss and land option write-offs in the Condensed

Consolidated Statements of Operations. |

| Hovnanian

Enterprises, Inc. |

|

|

|

|

|

|

|

| July 31,

2016 |

|

|

|

|

|

|

|

| Reconciliation of

Adjusted EBITDA to Net Loss |

|

|

|

|

|

|

|

| (Dollars in

Thousands) |

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

July 31, |

|

July 31, |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

(Unaudited) |

|

(Unaudited) |

| Net Loss |

$ |

(474 |

) |

|

$ |

(7,684 |

) |

|

$ |

(25,108 |

) |

|

$ |

(41,619 |

) |

| Income Tax Provision

(Benefit) |

|

1,567 |

|

|

|

(2,317 |

) |

|

|

(4,597 |

) |

|

|

(17,543 |

) |

| Interest Expense |

|

51,565 |

|

|

|

38,816 |

|

|

|

135,161 |

|

|

|

110,248 |

|

| EBIT (a) |

|

52,658 |

|

|

|

28,815 |

|

|

|

105,456 |

|

|

|

51,086 |

|

| Depreciation |

|

879 |

|

|

|

835 |

|

|

|

2,608 |

|

|

|

2,553 |

|

| Amortization of Debt

Costs |

|

1,205 |

|

|

|

1,491 |

|

|

|

3,815 |

|

|

|

4,451 |

|

| EBITDA (b) |

|

54,742 |

|

|

|

31,141 |

|

|

|

111,879 |

|

|

|

58,090 |

|

| Inventory Impairment

Loss and Land Option Write-offs |

|

1,565 |

|

|

|

1,077 |

|

|

|

22,915 |

|

|

|

7,618 |

|

| Adjusted EBITDA

(c) |

$ |

56,307 |

|

|

$ |

32,218 |

|

|

$ |

134,794 |

|

|

$ |

65,708 |

|

|

|

|

|

|

|

|

|

|

| Interest Incurred |

$ |

40,300 |

|

|

$ |

41,856 |

|

|

$ |

126,483 |

|

|

$ |

124,031 |

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA to

Interest Incurred |

|

1.40 |

|

|

|

0.77 |

|

|

|

1.07 |

|

|

|

0.53 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) EBIT

is a non-GAAP financial measure. The most directly comparable GAAP

financial measure is net loss. EBIT represents earnings before

interest expense and income taxes. |

| (b) EBITDA

is a non-GAAP financial measure. The most directly comparable GAAP

financial measure is net loss. EBITDA represents earnings before

interest expense, income taxes, depreciation and amortization. |

| (c)

Adjusted EBITDA is a non-GAAP financial measure. The most directly

comparable GAAP financial measure is net loss. Adjusted EBITDA

represents earnings before interest expense, income taxes,

depreciation, amortization and inventory impairment loss and land

option write-offs. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Hovnanian

Enterprises, Inc. |

|

|

|

|

|

|

|

| July 31,

2016 |

|

|

|

|

|

|

|

| Interest Incurred,

Expensed and Capitalized |

|

|

|

|

|

|

|

| (Dollars in

Thousands) |

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

July 31, |

|

July 31, |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

(Unaudited) |

|

(Unaudited) |

| Interest Capitalized at

Beginning of Period |

$ |

115,809 |

|

|

$ |

119,901 |

|

|

$ |

123,898 |

|

|

$ |

109,158 |

|

| Plus Interest

Incurred |

|

40,300 |

|

|

|

41,856 |

|

|

|

126,483 |

|

|

|

124,031 |

|

| Less Interest Expensed

(a) |

|

51,565 |

|

|

|

38,816 |

|

|

|

135,161 |

|

|

|

110,248 |

|

| Less Interest

Contributed to Unconsolidated Joint Venture (a) |

|

- |

|

|

|

- |

|

|

|

10,676 |

|

|

|

- |

|

| Interest Capitalized at

End of Period (b) |

$ |

104,544 |

|

|

$ |

122,941 |

|

|

$ |

104,544 |

|

|

$ |

122,941 |

|

|

|

|

|

|

|

|

|

|

| (a)

Represents capitalized interest which was included as part of the

assets contributed to the joint venture the Company entered into in

November 2015. There was no impact to the Condensed Consolidated

Statement of Operations as a result of this transaction. |

| (b)

Capitalized interest amounts are shown gross before allocating any

portion of impairments to capitalized interest. |

HOVNANIAN ENTERPRISES, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE SHEETS(In Thousands)

| |

|

July 31,2016 |

|

|

October 31,2015 |

|

| |

|

(Unaudited) |

|

|

(1 |

) |

|

|

| ASSETS |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Homebuilding: |

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

$ |

181,526 |

|

|

|

$ |

245,398 |

|

|

| Restricted cash and cash

equivalents |

|

|

|

4,107 |

|

|

|

|

7,299 |

|

|

| Inventories: |

|

|

|

|

|

|

|

| Sold and unsold homes and lots

under development |

|

|

|

989,416 |

|

|

|

|

1,307,850 |

|

|

| Land and land options held for

future development or sale |

|

|

|

196,610 |

|

|

|

|

214,503 |

|

|

| Consolidated inventory not

owned |

|

|

|

280,728 |

|

|

|

|

122,225 |

|

|

| Total inventories |

|

|

|

1,466,754 |

|

|

|

|

1,644,578 |

|

|

| Investments in and advances to

unconsolidated joint ventures |

|

|

|

87,991 |

|

|

|

|

61,209 |

|

|

| Receivables, deposits and notes,

net |

|

|

|

66,184 |

|

|

|

|

70,349 |

|

|

| Property, plant and equipment,

net |

|

|

|

48,351 |

|

|

|

|

45,534 |

|

|

| Prepaid expenses and other

assets |

|

|

|

74,685 |

|

|

|

|

77,671 |

|

|

| Total homebuilding |

|

|

|

1,929,598 |

|

|

|

|

2,152,038 |

|

|

| |

|

|

|

|

|

|

|

| Financial

services: |

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

|

8,516 |

|

|

|

|

8,347 |

|

|

| Restricted cash and cash

equivalents |

|

|

|

17,055 |

|

|

|

|

19,223 |

|

|

| Mortgage loans held for sale at

fair value |

|

|

|

137,784 |

|

|

|

|

130,320 |

|

|

| Other assets |

|

|

|

2,530 |

|

|

|

|

2,091 |

|

|

| Total financial services |

|

|

|

165,885 |

|

|

|

|

159,981 |

|

|

| Income taxes receivable

– including net deferred tax benefits |

|

|

|

293,358 |

|

|

|

|

290,279 |

|

|

| Total assets |

|

|

$ |

2,388,841 |

|

|

|

$ |

2,602,298 |

|

|

(1) Derived from the audited balance sheet as of

October 31, 2015.

HOVNANIAN ENTERPRISES, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE SHEETS(In Thousands

Except Share and Per Share Amounts)

| |

|

July 31, 2016 |

|

October 31, 2015 |

|

| |

|

(Unaudited) |

|

|

|

|

|

|

|

|

(1 |

) |

|

| LIABILITIES AND

EQUITY |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Homebuilding: |

|

|

|

|

|

|

|

| Nonrecourse mortgages secured by

inventory |

|

|

$ |

91,319 |

|

|

$ |

143,863 |

|

| Accounts payable and other

liabilities |

|

|

|

380,786 |

|

|

|

348,516 |

|

| Customers’ deposits |

|

|

|

45,530 |

|

|

|

44,218 |

|

| Nonrecourse mortgages secured by

operating properties |

|

|

|

14,621 |

|

|

|

15,511 |

|

| Liabilities from inventory not

owned |

|

|

|

195,755 |

|

|

|

105,856 |

|

| Total homebuilding |

|

|

|

728,011 |

|

|

|

657,964 |

|

| |

|

|

|

|

|

|

|

| Financial

services: |

|

|

|

|

|

|

|

| Accounts payable and other

liabilities |

|

|

|

26,383 |

|

|

|

27,908 |

|

| Mortgage warehouse lines of

credit |

|

|

|

115,656 |

|

|

|

108,875 |

|

| Total financial services |

|

|

|

142,039 |

|

|

|

136,783 |

|

| |

|

|

|

|

|

|

|

| Notes payable: |

|

|

|

|

|

|

|

| Revolving credit agreement |

|

|

|

52,000 |

|

|

|

47,000 |

|

| Senior secured notes, net of

discount |

|

|

|

982,468 |

|

|

|

981,346 |

|

| Senior notes, net of discount |

|

|

|

521,043 |

|

|

|

780,319 |

|

| Senior amortizing notes |

|

|

|

8,094 |

|

|

|

12,811 |

|

| Senior exchangeable notes |

|

|

|

76,650 |

|

|

|

73,771 |

|

| Accrued interest |

|

|

|

30,479 |

|

|

|

40,388 |

|

| Total notes payable |

|

|

|

1,670,734 |

|

|

|

1,935,635 |

|

| Total liabilities |

|

|

|

2,540,784 |

|

|

|

2,730,382 |

|

| |

|

|

|

|

|

|

|

| Stockholders’ equity

deficit: |

|

|

|

|

|

|

|

| Preferred stock, $0.01 par value -

authorized 100,000 shares; issued and outstanding 5,600 shares with

a liquidation preference of $140,000 at July 31, 2016 and at

October 31, 2015 |

|

|

|

135,299 |

|

|

|

135,299 |

|

| Common stock, Class A, $0.01 par

value – authorized 400,000,000 shares; issued 143,739,513 shares at

July 31, 2016 and 143,292,881 shares at October 31, 2015 (including

11,760,763 shares at July 31, 2016 and October 31, 2015 held in

treasury) |

|

|

|

1,437 |

|

|

|

1,433 |

|

| Common stock, Class B, $0.01 par

value (convertible to Class A at time of sale) – authorized

60,000,000 shares; issued 16,010,071 shares at July 31, 2016 and

15,676,829 shares at October 31, 2015 (including 691,748 shares at

July 31, 2016 and October 31, 2015 held in treasury) |

|

|

|

160 |

|

|

|

157 |

|

| Paid in capital – common stock |

|

|

|

704,993 |

|

|

|

703,751 |

|

| Accumulated deficit |

|

|

|

(878,472 |

) |

|

|

(853,364 |

) |

| Treasury stock – at cost |

|

|

|

(115,360 |

) |

|

|

(115,360 |

) |

| Total stockholders’ equity

deficit |

|

|

|

(151,943 |

) |

|

|

(128,084 |

) |

| Total liabilities and

equity |

|

|

$ |

2,388,841 |

|

|

$ |

2,602,298 |

|

(1) Derived from the audited balance sheet as of

October 31, 2015.

HOVNANIAN ENTERPRISES, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS(In

Thousands Except Per Share Data)(Unaudited)

| |

|

Three Months Ended July 31, |

|

|

Nine Months Ended July 31, |

|

| |

|

2016 |

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Homebuilding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sale of homes |

|

|

$ |

640,386 |

|

|

|

$ |

526,156 |

|

|

|

$ |

1,823,318 |

|

|

|

$ |

1,414,799 |

|

| Land sales and other revenues |

|

|

|

59,979 |

|

|

|

|

97 |

|

|

|

|

72,146 |

|

|

|

|

2,538 |

|

| Total homebuilding |

|

|

|

700,365 |

|

|

|

|

526,253 |

|

|

|

|

1,895,464 |

|

|

|

|

1,417,337 |

|

| Financial services |

|

|

|

16,485 |

|

|

|

|

14,360 |

|

|

|

|

51,714 |

|

|

|

|

37,939 |

|

| Total revenues |

|

|

|

716,850 |

|

|

|

|

540,613 |

|

|

|

|

1,947,178 |

|

|

|

|

1,455,276 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Homebuilding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales, excluding

interest |

|

|

|

583,783 |

|

|

|

|

432,625 |

|

|

|

|

1,583,979 |

|

|

|

|

1,169,576 |

|

| Cost of sales interest |

|

|

|

28,406 |

|

|

|

|

16,323 |

|

|

|

|

66,693 |

|

|

|

|

39,654 |

|

| Inventory impairment loss and land

option write-offs |

|

|

|

1,565 |

|

|

|

|

1,077 |

|

|

|

|

22,915 |

|

|

|

|

7,618 |

|

| Total cost of sales |

|

|

|

613,754 |

|

|

|

|

450,025 |

|

|

|

|

1,673,587 |

|

|

|

|

1,216,848 |

|

| Selling, general and

administrative |

|

|

|

51,685 |

|

|

|

|

51,998 |

|

|

|

|

155,560 |

|

|

|

|

152,258 |

|

| Total homebuilding expenses |

|

|

|

665,439 |

|

|

|

|

502,023 |

|

|

|

|

1,829,147 |

|

|

|

|

1,369,106 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial services |

|

|

|

8,916 |

|

|

|

|

8,244 |

|

|

|

|

26,749 |

|

|

|

|

23,069 |

|

| Corporate general and

administrative |

|

|

|

14,885 |

|

|

|

|

15,874 |

|

|

|

|

43,804 |

|

|

|

|

49,275 |

|

| Other interest |

|

|

|

23,159 |

|

|

|

|

22,493 |

|

|

|

|

68,468 |

|

|

|

|

70,594 |

|

| Other operations |

|

|

|

957 |

|

|

|

|

1,532 |

|

|

|

|

3,488 |

|

|

|

|

4,864 |

|

| Total expenses |

|

|

|

713,356 |

|

|

|

|

550,166 |

|

|

|

|

1,971,656 |

|

|

|

|

1,516,908 |

|

| (Loss) income from

unconsolidated joint ventures |

|

|

|

(2,401 |

) |

|

|

|

(448 |

) |

|

|

|

(5,227 |

) |

|

|

|

2,470 |

|

| Income (loss) before

income taxes |

|

|

|

1,093 |

|

|

|

|

(10,001 |

) |

|

|

|

(29,705 |

) |

|

|

|

(59,162 |

) |

| State and federal

income tax provision (benefit): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| State |

|

|

|

1,434 |

|

|

|

|

999 |

|

|

|

|

4,995 |

|

|

|

|

3,717 |

|

| Federal |

|

|

|

133 |

|

|

|

|

(3,316 |

) |

|

|

|

(9,592 |

) |

|

|

|

(21,260 |

) |

| Total income taxes |

|

|

|

1,567 |

|

|

|

|

(2,317 |

) |

|

|

|

(4,597 |

) |

|

|

|

(17,543 |

) |

| Net loss |

|

|

$ |

(474 |

) |

|

|

$ |

(7,684 |

) |

|

|

$ |

(25,108 |

) |

|

|

$ |

(41,619 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per share data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per common share |

|

|

$ |

(0.00 |

) |

|

|

$ |

(0.05 |

) |

|

|

$ |

(0.17 |

) |

|

|

$ |

(0.28 |

) |

| Weighted-average number of common

shares outstanding |

|

|

|

147,412 |

|

|

|

|

147,010 |

|

|

|

|

147,383 |

|

|

|

|

146,846 |

|

| Assuming dilution: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per common share |

|

|

$ |

(0.00 |

) |

|

|

$ |

(0.05 |

) |

|

|

$ |

(0.17 |

) |

|

|

$ |

(0.28 |

) |

| Weighted-average number of common

shares outstanding |

|

|

|

147,412 |

|

|

|

|

147,010 |

|

|

|

|

147,383 |

|

|

|

|

146,846 |

|

| HOVNANIAN

ENTERPRISES, INC. |

|

|

|

|

|

|

|

|

|

|

|

(DOLLARS IN THOUSANDS EXCEPT AVG. PRICE) |

|

|

|

|

|

|

|

|

|

(SEGMENT DATA EXCLUDES UNCONSOLIDATED JOINT

VENTURES) |

|

|

|

|

|

|

|

|

(UNAUDITED) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Communities Under

DevelopmentThree Months - July 31,

2016 |

|

|

|

|

|

|

Net Contracts (1) |

Deliveries |

Contract |

|

|

|

Three Months Ended |

Three Months Ended |

Backlog |

|

|

|

Jul 31, |

Jul 31, |

Jul 31, |

|

|

|

|

2016 |

|

|

2015 |

|

% Change |

|

2016 |

|

|

2015 |

|

% Change |

|

2016 |

|

|

2015 |

|

% Change |

|

Northeast |

|

|

|

|

|

|

|

|

|

|

|

(NJ, PA) |

Home |

|

128 |

|

|

137 |

|

|

(6.6 |

)% |

|

136 |

|

|

78 |

|

|

74.4 |

% |

|

260 |

|

|

286 |

|

|

(9.1 |

)% |

|

|

Dollars |

$ |

61,945 |

|

$ |

69,410 |

|

|

(10.8 |

)% |

$ |

66,308 |

|

$ |

36,109 |

|

|

83.6 |

% |

$ |

130,800 |

|

$ |

143,333 |

|

|

(8.7 |

)% |

|

|

Avg.

Price |

$ |

483,942 |

|

$ |

506,642 |

|

|

(4.5 |

)% |

$ |

487,558 |

|

$ |

462,932 |

|

|

5.3 |

% |

$ |

503,079 |

|

$ |

501,164 |

|

|

0.4 |

% |

|

Mid-Atlantic |

|

|

|

|

|

|

|

|

|

|

|

(DE, MD, VA, WV) |

Home |

|

208 |

|

|

242 |

|

|

(14.0 |

)% |

|

228 |

|

|

243 |

|

|

(6.2 |

)% |

|

566 |

|

|

473 |

|

|

19.7 |

% |

|

|

Dollars |

$ |

97,338 |

|

$ |

115,164 |

|

|

(15.5 |

)% |

$ |

111,579 |

|

$ |

113,886 |

|

|

(2.0 |

)% |

$ |

312,698 |

|

$ |

252,139 |

|

|

24.0 |

% |

|

|

Avg.

Price |

$ |

467,969 |

|

$ |

475,883 |

|

|

(1.7 |

)% |

$ |

489,382 |

|

$ |

468,670 |

|

|

4.4 |

% |

$ |

552,469 |

|

$ |

533,063 |

|

|

3.6 |

% |

|

Midwest (2) |

|

|

|

|

|

|

|

|

|

|

|

(IL, MN, OH) |

Home |

|

176 |

|

|

186 |

|

|

(5.4 |

)% |

|

193 |

|

|

253 |

|

|

(23.7 |

)% |

|

464 |

|

|

696 |

|

|

(33.3 |

)% |

|

|

Dollars |

$ |

49,260 |

|

$ |

70,578 |

|

|

(30.2 |

)% |

$ |

56,643 |

|

$ |

82,618 |

|

|

(31.4 |

)% |

$ |

128,381 |

|

$ |

211,718 |

|

|

(39.4 |

)% |

|

|

Avg.

Price |

$ |

279,885 |

|

$ |

379,450 |

|

|

(26.2 |

)% |

$ |

293,487 |

|

$ |

326,554 |

|

|

(10.1 |

)% |

$ |

276,683 |

|

$ |

304,193 |

|

|

(9.0 |

)% |

|

Southeast (3) |

|

|

|

|

|

|

|

|

|

|

|

(FL, GA, NC, SC) |

Home |

|

142 |

|

|

176 |

|

|

(19.3 |

)% |

|

145 |

|

|

176 |

|

|

(17.6 |

)% |

|

355 |

|

|

331 |

|

|

7.3 |

% |

|

|

Dollars |

$ |

59,242 |

|

$ |

54,776 |

|

|

8.2 |

% |

$ |

56,471 |

|

$ |

57,294 |

|

|

(1.4 |

)% |

$ |

159,489 |

|

$ |

110,628 |

|

|

44.2 |

% |

|

|

Avg.

Price |

$ |

417,197 |

|

$ |

311,228 |

|

|

34.0 |

% |

$ |

389,458 |

|

$ |

325,534 |

|

|

19.6 |

% |

$ |

449,265 |

|

$ |

334,225 |

|

|

34.4 |

% |

|

Southwest |

|

|

|

|

|

|

|

|

|

|

|

(AZ, TX) |

Home |

|

638 |

|

|

656 |

|

|

(2.7 |

)% |

|

671 |

|

|

568 |

|

|

18.1 |

% |

|

1,008 |

|

|

1,148 |

|

|

(12.2 |

)% |

|

|

Dollars |

$ |

225,929 |

|

$ |

248,907 |

|

|

(9.2 |

)% |

$ |

248,228 |

|

$ |

203,075 |

|

|

22.2 |

% |

$ |

393,906 |

|

$ |

469,054 |

|

|

(16.0 |

)% |

|

|

Avg.

Price |

$ |

354,121 |

|

$ |

379,432 |

|

|

(6.7 |

)% |

$ |

369,937 |

|

$ |

357,526 |

|

|

3.5 |

% |

$ |

390,780 |

|

$ |

408,583 |

|

|

(4.4 |

)% |

|

West |

|

|

|

|

|

|

|

|

|

|

|

(CA) |

Home |

|

175 |

|

|

136 |

|

|

28.7 |

% |

|

201 |

|

|

90 |

|

|

123.3 |

% |

|

316 |

|

|

163 |

|

|

93.9 |

% |

|

|

Dollars |

$ |

99,284 |

|

$ |

60,573 |

|

|

63.9 |

% |

$ |

101,157 |

|

$ |

33,174 |

|

|

204.9 |

% |

$ |

186,986 |

|

$ |

77,480 |

|

|

141.3 |

% |

|

|

Avg.

Price |

$ |

567,339 |

|

$ |

445,387 |

|

|

27.4 |

% |

$ |

503,269 |

|

$ |

368,598 |

|

|

36.5 |

% |

$ |

591,727 |

|

$ |

475,339 |

|

|

24.5 |

% |

|

Consolidated Total |

|

|

|

|

|

|

|

|

|

|

|

|

Home |

|

1,467 |

|

|

1,533 |

|

|

(4.3 |

)% |

|

1,574 |

|

|

1,408 |

|

|

11.8 |

% |

|

2,969 |

|

|

3,097 |

|

|

(4.1 |

)% |

|

|

Dollars |

$ |

592,998 |

|

$ |

619,408 |

|

|

(4.3 |

)% |

$ |

640,386 |

|

$ |

526,156 |

|

|

21.7 |

% |

$ |

1,312,260 |

|

$ |

1,264,352 |

|

|

3.8 |

% |

|

|

Avg.

Price |

$ |

404,225 |

|

$ |

404,049 |

|

|

0.0 |

% |

$ |

406,853 |

|

$ |

373,691 |

|

|

8.9 |

% |

$ |

441,987 |

|

$ |

408,251 |

|

|

8.3 |

% |

|

Unconsolidated Joint Ventures |

|

|

|

|

|

|

|

|

|

|

|

|

Home |

|

70 |

|

|

125 |

|

|

(44.0 |

)% |

|

53 |

|

|

67 |

|

|

(20.9 |

)% |

|

263 |

|

|

178 |

|

|

47.8 |

% |

|

|

Dollars |

$ |

40,275 |

|

$ |

75,225 |

|

|

(46.5 |

)% |

$ |

30,714 |

|

$ |

27,286 |

|

|

12.6 |

% |

$ |

168,135 |

|

$ |

110,372 |

|

|

52.3 |

% |

|

|

Avg.

Price |

$ |

575,361 |

|

$ |

601,800 |

|

|

(4.4 |

)% |

$ |

579,511 |

|

$ |

407,250 |

|

|

42.3 |

% |

$ |

639,297 |

|

$ |

620,066 |

|

|

3.1 |

% |

|

Grand Total |

|

|

|

|

|

|

|

|

|

|

|

|

Home |

|

1,537 |

|

|

1,658 |

|

|

(7.3 |

)% |

|

1,627 |

|

|

1,475 |

|

|

10.3 |

% |

|

3,232 |

|

|

3,275 |

|

|

(1.3 |

)% |

|

|

Dollars |

$ |

633,273 |

|

$ |

694,633 |

|

|

(8.8 |

)% |

$ |

671,100 |

|

$ |

553,442 |

|

|

21.3 |

% |

$ |

1,480,395 |

|

$ |

1,374,724 |

|

|

7.7 |

% |

|

|

Avg.

Price |

$ |

412,019 |

|

$ |

418,958 |

|

|

(1.7 |

)% |

$ |

412,477 |

|

$ |

375,215 |

|

|

9.9 |

% |

$ |

458,043 |

|

$ |

419,763 |

|

|

9.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

DELIVERIES INCLUDE EXTRAS |

|

|

|

|

|

|

|

|

|

|

| Notes: |

|

|

|

|

|

|

|

|

|

|

| (1) Net

contracts are defined as new contracts signed during the period for

the purchase of homes, less cancellations of prior contracts.(2)

The Midwest net contracts include 4 homes and $1.9 million and 53

homes and $21.8 million in 2016 and 2015, respectively, from

Minneapolis, MN. Contract backlog as of July 31, 2016 reflects the

reduction of 64 homes and $24.1 million, related to the sale of our

land portfolio in Minneapolis, MN.(3) The Southeast net contracts

include 25 homes and $7.8 million in 2015 from Raleigh, NC.

Contract backlog as of July 31, 2016 reflects the reduction of 67

homes and $33.7 million, related to the sale of our land portfolio

in Raleigh, NC. |

| HOVNANIAN

ENTERPRISES, INC. |

|

|

|

|

|

|

|

|

|

|

|

(DOLLARS IN THOUSANDS EXCEPT AVG. PRICE) |

|

|

|

|

|

|

|

|

|

|

(SEGMENT DATA INCLUDES UNCONSOLIDATED JOINT

VENTURES) |

|

|

|

|

|

|

|

|

(UNAUDITED) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Communities Under

DevelopmentThree Months - July 31,

2016 |

|

|

|

|

|

|

Net Contracts (1) |

Deliveries |

Contract |

|

|

|

Three Months Ended |

Three Months Ended |

Backlog |

|

|

|

Jul 31, |

Jul 31, |

Jul 31, |

|

|

|

|

2016 |

|

|

2015 |

|

% Change |

|

2016 |

|

|

2015 |

|

% Change |

|

2016 |

|

|

2015 |

|

% Change |

|

Northeast |

|

|

|

|

|

|

|

|

|

|

|

(includes unconsolidated joint ventures) |

Home |

|

130 |

|

|

163 |

|

|

(20.2 |

)% |

|

140 |

|

|

80 |

|

|

75.0 |

% |

|

284 |

|

|

326 |

|

|

(12.9 |

)% |

|

(NJ, PA) |

Dollars |

$ |

62,339 |

|

$ |

86,118 |

|

|

(27.6 |

)% |

$ |

67,715 |

|

$ |

36,567 |

|

|

85.2 |

% |

$ |

139,392 |

|

$ |

164,404 |

|

|

(15.2 |

)% |

|

|

Avg.

Price |

$ |

479,533 |

|

$ |

528,331 |

|

|

(9.2 |

)% |

$ |

483,676 |

|

$ |

457,092 |

|

|

5.8 |

% |

$ |

490,817 |

|

$ |

504,306 |

|

|

(2.7 |

)% |

|

Mid-Atlantic |

|

|

|

|

|

|

|

|

|

|

|

(includes unconsolidated joint ventures) |

Home |

|

226 |

|

|

259 |

|

|

(12.7 |

)% |

|

240 |

|

|

260 |

|

|

(7.7 |

)% |

|

610 |

|

|

511 |

|

|

19.4 |

% |

|

(DE, MD, VA, WV) |

Dollars |

$ |

111,496 |

|

$ |

123,947 |

|

|

(10.0 |

)% |

$ |

116,743 |

|

$ |

123,749 |

|

|

(5.7 |

)% |

$ |

342,197 |

|

$ |

273,140 |

|

|

25.3 |

% |

|

|

Avg.

Price |

$ |

493,345 |

|

$ |

478,559 |

|

|

3.1 |

% |

$ |

486,429 |

|

$ |

475,961 |

|

|

2.2 |

% |

$ |

560,979 |

|

$ |

534,522 |

|

|

4.9 |

% |

|

Midwest (2) |

|

|

|

|

|

|

|

|

|

|

|

(includes unconsolidated joint ventures) |

Home |

|

181 |

|

|

189 |

|

|

(4.2 |

)% |

|

193 |

|

|

256 |

|

|

(24.6 |

)% |

|

478 |

|

|

696 |

|

|

(31.3 |

)% |

|

(IL, MN, OH) |

Dollars |

$ |

58,709 |

|

$ |

71,492 |

|

|

(17.9 |

)% |

$ |

56,643 |

|

$ |

83,533 |

|

|

(32.2 |

)% |

$ |

139,608 |

|

$ |

211,718 |

|

|

(34.1 |

)% |

|

|

Avg.

Price |

$ |

324,361 |

|

$ |

378,265 |

|

|

(14.3 |

)% |

$ |

293,487 |

|

$ |

326,299 |

|

|

(10.1 |

)% |

$ |

292,067 |

|

$ |

304,193 |

|

|

(4.0 |

)% |

|

Southeast (3) |

|

|

|

|

|

|

|

|

|

|

|

(includes unconsolidated joint ventures) |

Home |

|

169 |

|

|

186 |

|

|

(9.1 |

)% |

|

145 |

|

|

201 |

|

|

(27.9 |

)% |

|

413 |

|

|

338 |

|

|

22.2 |

% |

|

(FL, GA, NC, SC) |

Dollars |

$ |

70,116 |

|

$ |

58,719 |

|

|

19.4 |

% |

$ |

56,471 |

|

$ |

67,796 |

|

|

(16.7 |

)% |

$ |

189,486 |

|

$ |

113,368 |

|

|

67.1 |

% |

|

|

Avg.

Price |

$ |

414,885 |

|

$ |

315,696 |

|

|

31.4 |

% |

$ |

389,458 |

|

$ |

337,291 |

|

|

15.5 |

% |

$ |

458,803 |

|

$ |

335,408 |

|

|

36.8 |

% |

|

Southwest |

|

|

|

|

|

|

|

|

|

|

|

(includes unconsolidated joint ventures) |

Home |

|

638 |

|

|

656 |

|

|

(2.7 |

)% |

|

671 |

|

|

568 |

|

|

18.1 |

% |

|

1,008 |

|

|

1,148 |

|

|

(12.2 |

)% |

|

(AZ, TX) |

Dollars |

$ |

225,929 |

|

$ |

248,908 |

|

|

(9.2 |

)% |

$ |

248,227 |

|

$ |

203,075 |

|

|

22.2 |

% |

$ |

393,906 |

|

$ |

469,054 |

|

|

(16.0 |

)% |

|

|

Avg.

Price |

$ |

354,121 |

|

$ |

379,432 |

|

|

(6.7 |

)% |

$ |

369,937 |

|

$ |

357,526 |

|

|

3.5 |

% |

$ |

390,780 |

|

$ |

408,583 |

|

|

(4.4 |

)% |

|

West |

|

|

|

|

|

|

|

|

|

|

|

(includes unconsolidated joint ventures) |

Home |

|

193 |

|

|

205 |

|

|

(5.9 |

)% |

|

238 |

|

|

110 |

|

|

116.4 |

% |

|

439 |

|

|

256 |

|

|

71.5 |

% |

|

(CA) |

Dollars |

$ |

104,684 |

|

$ |

105,449 |

|

|

(0.7 |

)% |

$ |

125,301 |

|

$ |

38,722 |

|

|

223.6 |

% |

$ |

275,806 |

|

$ |

143,040 |

|

|

92.8 |

% |

|

|

Avg.

Price |

$ |

542,405 |

|

$ |

514,384 |

|

|

5.4 |

% |

$ |

526,473 |

|

$ |

352,016 |

|

|

49.6 |

% |

$ |

628,260 |

|

$ |

558,748 |

|

|

12.4 |

% |

|

Grand Total |

|

|

|

|

|

|

|

|

|

|

|

|

Home |

|

1,537 |

|

|

1,658 |

|

|

(7.3 |

)% |

|

1,627 |

|

|

1,475 |

|

|

10.3 |

% |

|

3,232 |

|

|

3,275 |

|

|

(1.3 |

)% |

|

|

Dollars |

$ |

633,273 |

|

$ |

694,633 |

|

|

(8.8 |

)% |

$ |

671,100 |

|

$ |

553,442 |

|

|

21.3 |

% |

$ |

1,480,395 |

|

$ |

1,374,724 |

|

|

7.7 |

% |

|

|

Avg.

Price |

$ |

412,019 |

|

$ |

418,958 |

|

|

(1.7 |

)% |

$ |

412,477 |

|

$ |

375,215 |

|

|

9.9 |

% |

$ |

458,043 |

|

$ |

419,763 |

|

|

9.1 |

% |

|