Honeywell Reveals Surprise Shortfall -- WSJ

October 08 2016 - 3:02AM

Dow Jones News

By Ted Mann

Honeywell International Inc. said an unexpectedly weak September

prompted its forecast for lower annual sales, which spooked

investors in the aerospace-and-building systems conglomerate.

Chief Executive Dave Cote told investors Friday morning that

sales in areas such as aftermarket services for business-jet

engines and hand-held scanners for shippers and logistics companies

"failed to materialize" in the third quarter, requiring the company

to cut its targets for earnings and annual sales.

"We expected short-cycle orders that normally materialize," Mr.

Cote said. "They usually do, but in this case, they didn't."

Honeywell shares fell 7.5% Friday, pressuring shares of other

industrial players, including General Electric Co. and United

Technologies Corp.

The announcement, issued late Thursday, was "uncomfortable," Mr.

Cote said on a conference call. But the company remains confident

in its direction for the long term, he said, and executives say

they have weathered some of the headwinds, including weakness in

its business linked to oil refining and chemicals.

"This is the bottom" for Honeywell businesses exposed to the oil

and gas industries, Mr. Cote said, even as he cautioned troubles in

the business-jet industry "will get worse" next year.

Sales related to business jets were hurt by a variety of

factors, executives said, including slowing growth in emerging

regions including the Middle East, Russia and China. Chief

Financial Officer Tom Szlosek said an anticorruption campaign in

China has blunted the market for luxury goods such as private

aircraft.

Honeywell's announcement came amid other changes it reported

ahead of its third-quarter earnings release, scheduled for Oct. 21,

including a reorganization of a business unit and the integration

of an acquisition that sells automation systems to warehouse

operators.

Morgan Stanley analyst Nigel Coe, who derisively compared

Honeywell's announcement to a "paella bowl" dropped in front of

investors, said "credibility is becoming a growing issue." In a

research report, he asked: "Can we be sure that the wound has been

cauterized?"

The Morris Plains, N.J.-based conglomerate now says its

so-called core sales, which exclude acquisitions or divestitures,

will likely fall 3% in the third quarter and between 1% and 2% for

the year. The company lowered the upper end of its 2016 adjusted

earnings target by six cents to $6.64 a share.

In addition to the business-jet weakness weighing on

third-quarter results, ales, Honeywell is taking a $140 million

charge for sales incentives that will get the company's aerospace

systems included on new aircraft.

Those incentives to lock in business are "painful to do," Mr.

Cote said. "You take a short-term hit for it, but I really think it

sets you up for a long time to come."

Honeywell has been a Wall Street darling over the last

half-decade, seeming to perfect a strategy of small- to midsize

acquisitions. The company prides itself on integration and has

earned the right -- in the view of many bullish analysts -- to

function as a throwback conglomerate, with product offerings that

range from jet engines to chemical catalysts for oil refining to

thermostats and rubber boots.

The steadiness of that model, along with a strong record for

meeting and beating Wall Street expectations, is key to the legacy

of Mr. Cote, who is scheduled to retire as CEO in March. Mr. Cote

will be succeeded by Darius Adamczyk, who joined the company in

2008. Mr. Cote is to stay on as executive chairman through

2018.

Mr. Adamczyk didn't appear on Friday's conference call. In

response to an analyst's question, Mr. Cote said Mr. Adamczyk had

been "fully involved" and the corporate strategy in place when he

takes over would be "consistent with what we're saying today."

Mr. Cote's final months have included some moves that struck

observers as out of character, especially an unsuccessful $90

billion takeover bid for United Technologies, one of its chief

aerospace industry rivals. United Technologies rebuffed the bid,

saying neither customers nor regulators would allow it, and

Honeywell in March said it was walking away from the bid.

Honeywell's 7.5% decline Friday to $106.94 was the stock's

biggest one-day drop since Aug. 10, 2011, when it fell 7.6%.

Still, some analysts expressed confidence in the company's

long-term trajectory. The lowered forecast announced Thursday seems

bad compared with Honeywell's recent performance but is "not

catastrophic," JP Morgan analyst Stephen Tusa wrote in a note to

investors. Honeywell's profits are off about 5% since the beginning

of the year, which is roughly in line with its industrial peers, he

said.

Write to Ted Mann at ted.mann@wsj.com

(END) Dow Jones Newswires

October 08, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

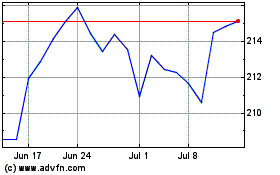

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Aug 2024 to Sep 2024

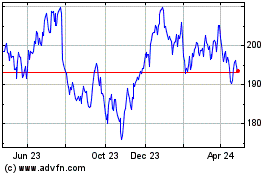

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Sep 2023 to Sep 2024