Hartford Profit Rises on Strong Commercial-Lines Results

October 27 2016 - 6:00PM

Dow Jones News

Hartford Financial Services Group Inc. said third-quarter core

earnings rose 13%, partly because of favorable pricing and

retention trends in the insurer's commercial lines business.

The company also announced a $1.3 billion stock-buyback program

and boosted its quarterly dividend to 23 cents from 21 cents.

Connecticut-based Hartford sells commercial and personal

insurance as well as financial products, including property and

casualty insurance, group benefits and mutual funds.

The company said it had strong margins and investment returns

during the quarter.

Within personal lines, auto-insurance results "remain

challenged," but the business is undergoing improvements including

"aggressive" pricing moves.

Shares fell 14 cents to $43.29 in after-hours trading.

Hartford's net investment income rose 6% to $772 million, partly

because of improved hedge-fund results.

Over all, Hartford earned $438 million, or $1.12 a share,

compared with $381 million, or 90 cents a share, a year earlier.

Revenue rose 2.9% to $4.7 billion.

Core earnings were $413 million, or $1.06 a share, compared with

$364 million, or 86 cents a share, a year earlier.

Analysts polled by Thomson Reuters had expected earnings

excluding items of 95 cents a share on revenue of $4.68

billion.

In July, Hartford bought Maxum Specialty Insurance Group for

$168 million. In May, its Hartford Funds unit agreed to acquire

exchange-traded funds operator Lattice Strategies.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

October 27, 2016 17:45 ET (21:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

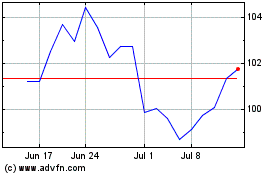

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Aug 2024 to Sep 2024

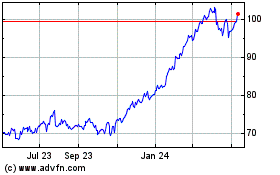

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Sep 2023 to Sep 2024