UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 16, 2016

GUESS?, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

|

| |

1-11893 | 95-3679695 |

(Commission File Number) | (IRS Employer Identification No.) |

1444 S. Alameda Street, Los Angeles, California 90021

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (213) 765-3100

Not applicable

(Former name or former address, if changed since last report)

|

| |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

Guess?, Inc. (the “Company”) issued a press release on March 16, 2016 announcing its financial results for the quarter and year ended January 30, 2016. A copy of the press release is being furnished as Exhibit 99.1 attached hereto.

The information in this Item 2.02 of Form 8-K is being furnished hereby and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

| |

99.1 | Press Release of Guess?, Inc. dated March 16, 2016 (financial results for the quarter and year ended January 30, 2016) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Guess?, Inc. has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

Dated: March 16, 2016 | GUESS?, INC. |

| |

| By: | /s/ Sandeep Reddy |

| | Sandeep Reddy Chief Financial Officer |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

| | |

99.1 | | Press Release of Guess?, Inc. dated March 16, 2016 (financial results for the quarter and year ended January 30, 2016) |

GUESS?, INC. REPORTS FOURTH QUARTER RESULTS

Q4 Fiscal 2016 EPS of $0.57, Compared to EPS of $0.63 in Q4 Fiscal 2015

Q4 Fiscal 2016 Revenues Decreased 6% to $658 Million; Increased 1% in Constant Currency

Fiscal Year 2016 EPS of $0.96, Compared to EPS of $1.11 in Fiscal Year 2015

Provides Guidance for Q1 Fiscal 2017 in the Range of $0.20 to $0.17 Net Loss Per Share

Provides Fiscal Year 2017 EPS Guidance in the Range of $0.65 to $0.85

Provides Target in Three Years of $3.0B in Revenues and 7.5% in Operating Margin

LOS ANGELES, March 16, 2016 - Guess?, Inc. (NYSE: GES) today reported unaudited financial results for its fourth quarter and fiscal year ended January 30, 2016.

Fourth Quarter Fiscal 2016 Highlights

| |

• | Americas Retail revenues decreased 3% in U.S. dollars and increased 1% in constant currency; retail comp sales including e-commerce decreased 1% in U.S. dollars and increased 2% in constant currency |

| |

• | Europe revenues decreased 5% in U.S. dollars and increased 6% in constant currency |

| |

• | Asia revenues decreased 18% in U.S. dollars and 14% in constant currency |

| |

• | Americas Wholesale revenues decreased 9% in U.S. dollars and 1% in constant currency |

| |

• | Operating earnings decreased 4% |

| |

• | Earnings per share decreased 10%, including the negative impact of currency of 30% |

| |

• | Announces quarterly cash dividend of $0.225 |

Fiscal Year 2016 Highlights

| |

• | Global revenues decreased 9% at $2.2 billion in U.S. dollars; decreased 1% in constant currency |

| |

• | Operating earnings decreased 4% |

| |

• | Earnings per share decreased 14%, including the negative impact of currency of 39% |

Fourth Quarter Fiscal 2016 Results

Victor Herrero, Chief Executive Officer, commented, “I am pleased to report that fourth quarter earnings per share were within the range of our guidance. In Europe, our retail business performed extremely well and delivered positive comp store sales in the high-single digits. In the Americas, our retail business in the U.S. and Canada also achieved positive comps in constant currency. There is still more work to be done, but I am convinced that the initiatives we have started to implement in the last few months have contributed to these encouraging results.”

Mr. Herrero continued, “Turning to the outlook for the next three years, based on the Strategic Initiatives that I have mentioned in the last two earnings calls, we are planning for our annual revenues to reach $3.0 billion in three years at prevailing currency rates. This $800 million increase is expected to be driven by growth in E-commerce, retail expansion and positive comp store sales. In terms of regional growth, we expect $300 million of this increase to be driven by the Americas, $300 million by Europe and $200 million by Asia. Again, assuming currencies remain at prevailing levels, we are planning for operating margin to reach 7.5% in three years, mainly driven by leverage, and for earnings per share to increase at a compound annual growth rate of 20%. Overall, more than ever, I truly believe in the potential of the Guess Brand and these three-year plans are a reflection of that.”

For the fourth quarter of fiscal 2016, the Company recorded net earnings of $47.8 million, an 11.4% decrease from $53.9 million for the fourth quarter of fiscal 2015. Diluted earnings per share decreased 9.5% to $0.57 for the fourth quarter of fiscal 2016, from $0.63 for the prior-year quarter. The negative impact of currency on earnings per share in the fourth quarter of fiscal 2016 was approximately $0.19 per share.

Total net revenue for the fourth quarter of fiscal 2016 decreased 5.5% to $658.3 million, from $696.7 million in the prior-year quarter. In constant currency, total net revenue increased 0.6%. Refer to the accompanying tables for a summary of net revenue by segment as well as information regarding the impact of foreign currency exchange rate fluctuations on the Company’s net revenue.

Operating earnings for the fourth quarter of fiscal 2016 decreased 4.4% to $70.0 million (including a $4.5 million unfavorable currency translation impact), from $73.2 million in the prior-year period. Operating margin in the fourth quarter was relatively flat at 10.6%, compared to 10.5% in the prior-year quarter. The favorable impact from lower store impairment charges was mostly offset by the negative impact from currency exchange rate fluctuations on the operating margin. The negative impact of currency on operating margin for the quarter was roughly 180 basis points.

| |

• | Operating margin for the Company’s Americas Retail segment increased 350 basis points to 6.6% in the fourth quarter of fiscal 2016, compared to 3.1% in the prior-year period, due to a lower SG&A rate, partially offset by lower gross margins. The lower SG&A rate was driven by lower store impairment charges. The lower gross margins were due primarily to more markdowns and the unfavorable impact from currency exchange rate fluctuations on product costs. |

| |

• | Operating margin for the Company’s Europe segment decreased 180 basis points to 15.1% in the fourth quarter of fiscal 2016, from 16.9% in the prior-year period, due to lower gross margins, partially offset by a lower SG&A rate. The lower gross margins were driven primarily by the unfavorable impact from currency exchange rate fluctuations on product costs. The lower SG&A rate was due primarily to the favorable impact on the fixed cost structure resulting from positive comparable store sales. |

| |

• | Operating margin for the Company’s Asia segment increased 310 basis points to 3.5% in the fourth quarter of fiscal 2016, compared to 0.4% in the prior-year period, due to higher gross margins, partially offset by a higher SG&A rate. The higher gross margins were driven by our South Korea business as we completed the phase out of our G by GUESS product line in the region. The higher SG&A rate was mainly due to overall deleveraging of expenses. |

| |

• | Operating margin for the Company’s Americas Wholesale segment decreased 100 basis points to 19.0% in the fourth quarter of fiscal 2016, from 20.0% in the prior-year period, due to lower product margins, partially offset by a lower SG&A rate. The lower product margins were driven primarily by higher product costs including the unfavorable impact from currency exchange rate fluctuations. The lower SG&A rate was due primarily to lower performance-based compensation and lower distribution costs. |

| |

• | Operating margin for the Company’s Licensing segment decreased 740 basis points to 87.9% in the fourth quarter of fiscal 2016, from 95.3% in the prior-year period. |

Other net income, which primarily includes realized gains on the sale of other assets and net realized and unrealized mark-to-market revaluation gains on foreign exchange currency contracts, partially offset by net unrealized losses on non-operating assets and net unrealized mark-to-market revaluation losses on foreign currency balances, was $0.3 million for the fourth quarter of fiscal 2016, compared to $6.9 million in the prior-year quarter.

Fiscal Year 2016 Results

Net earnings for the fiscal year ended January 30, 2016 were $81.9 million, a decrease of 13.4% from $94.6 million for the fiscal year ended January 31, 2015. Diluted earnings per share decreased 13.5% to $0.96 in fiscal year 2016, from $1.11 in the prior year. The negative impact of currency on earnings per share for the fiscal year ended January 30, 2016 was approximately $0.43 per share.

Total net revenue for fiscal year 2016 decreased 8.8% to $2.20 billion, from $2.42 billion in the prior year. In constant currency, total net revenue decreased 0.9%. Refer to the accompanying tables for a summary of net revenue by segment as well as information regarding the impact of foreign currency exchange rate fluctuations on the Company’s net revenue.

Operating earnings for fiscal year 2016 decreased 3.6% to $121.4 million (including a $10.3 million unfavorable currency translation impact), from $125.9 million in the prior year. Operating margin for fiscal 2016 increased 30 basis points to 5.5% compared to 5.2% in the prior year. The increase in operating margin was driven by lower store impairment charges and higher initial mark-ups, partially offset by the unfavorable impact from currency exchange rate fluctuations. The negative impact of currency on operating margin for fiscal 2016 was roughly 140 basis points.

| |

• | Operating margin for the Company’s Americas Retail segment increased 300 basis points to 1.7% in fiscal 2016, compared to negative 1.3% in the prior year, due to a lower SG&A rate and higher gross margins. The lower SG&A rate was driven by lower store impairment charges. The higher gross margins were due primarily to higher initial mark-ups, partially offset by the unfavorable impact from currency exchange rate fluctuations on product costs and the negative impact on the fixed cost structure resulting from negative comparable store sales. |

| |

• | Operating margin for the Company’s Europe segment decreased 40 basis points to 7.6% in fiscal 2016, from 8.0% in the prior year, due to lower gross margins, partially offset by a lower SG&A rate. The lower gross margins were driven primarily by the unfavorable impact from currency exchange rate fluctuations on product costs, partially offset by higher initial mark-ups. The lower SG&A rate was due primarily to the favorable impact on the fixed cost structure resulting from positive comparable store sales. |

| |

• | Operating margin for the Company’s Asia segment increased 140 basis points to 4.3% in fiscal 2016, compared to 2.9% in the prior year, driven by higher gross margins in our South Korea business as we completed the phase out of our G by GUESS product line in the region. |

| |

• | Operating margin for the Company’s Americas Wholesale segment decreased 200 basis points to 18.4% in fiscal 2016, from 20.4% in the prior year, driven by lower product margins due primarily to lower initial mark-ups. |

| |

• | Operating margin for the Company’s Licensing segment decreased 240 basis points to 88.7% in fiscal 2016, from 91.1% in the prior year. |

Other net income, which primarily includes net realized and unrealized mark-to-market revaluation gains on foreign exchange currency contracts and realized gains on the sale of other assets, partially offset by net unrealized mark-to-market revaluation losses on foreign currency balances, was $6.8 million for fiscal year 2016 compared to $18.0 million for the prior year.

Dividends

The Company’s Board of Directors has approved a quarterly cash dividend of $0.225 per share on the Company’s common stock. The dividend will be payable on April 15, 2016 to shareholders of record at the close of business on March 30, 2016.

Outlook

The following guidance assumes that foreign currency exchange rates remain at prevailing rates:

The Company’s expectations for the first quarter of fiscal 2017 ending April 30, 2016, are as follows:

| |

• | Consolidated net revenues are expected to decline between 1.5% and 0.5% in constant currency. Currency headwinds are expected to negatively impact consolidated revenue growth by approximately 2.0%, for a net decline between 3.5% and 2.5%. |

| |

• | Operating margin is expected to be between minus 5.0% and minus 4.0% and includes 130 basis points of currency headwind. |

| |

• | Diluted net loss per share is expected to be in the range of $0.20 to $0.17. The estimated impact on earnings per share of the currency headwinds is approximately $0.04. |

For the fiscal year ending January 28, 2017, the Company’s expectations are as follows:

| |

• | Consolidated net revenues are expected to increase between 7.0% and 9.0% in constant currency. Currency headwinds are expected to negatively impact consolidated revenue growth by approximately 1.0%, for a net increase between 6.0% and 8.0%. |

| |

• | Operating margin is expected to be between 4.0% and 5.0% and includes 50 basis points of currency headwind. |

| |

• | Diluted earnings per share are expected to be in the range of $0.65 to $0.85. The estimated impact on earnings per share of the currency headwinds is approximately $0.11. |

During the first quarter of fiscal 2017, the Company approved a global cost reduction plan to streamline its operational structure and reduce expenses. The expectations for the first quarter and fiscal year 2017 exclude the impact of any restructuring charges associated with these activities.

On a segment basis, the Company expects the following ranges for percentage changes for comparable store sales (“comps”) and net revenue in constant currency and U.S. dollars compared to the same prior-year period:

|

| | | | | | | | | | |

Outlook by Segment1 |

| | | | | | | | | |

| | | First Quarter of Fiscal 2017 | | Fiscal Year 2017 |

| | | | | | | | | |

| | | Constant Currency2 | | U.S. Dollars | | Constant Currency2 | | U.S. Dollars |

| | | | | | | | | |

Americas Retail: | | | | | | | | |

| Comps | | down LSD to up LSD | | down LSD to flat | | up LSD | | flat to up LSD |

| Net Revenue | | down LSD to flat | | down LSD | | up LSD to MSD | | up LSD to MSD |

| | | | | | | | | |

Europe: | | | | | | | | |

| Comps | | up mid-teens | | __ | | up MSD to HSD | | __ |

| Net Revenue | | flat | | flat | | up LDD | | up LDD |

| | | | | | | | | |

Asia: | | | | | | | | |

| Net Revenue | | down LSD to up LSD | | down MSD to LSD | | up high-teens to low twenties | | up mid-teens to high-teens |

| | | | | | | | | |

Americas Wholesale: | | | | | | | | |

| Net Revenue | | down LSD | | down HSD | | up MSD | | up LSD |

| | | | | | | | | |

Licensing: | | | | | | | | |

| Net Revenue | | __ | | down HSD | | __ | | down MSD |

| | | | | | | | | |

Notes | | | | | | | | |

1 |

| As used in the table above, “LSD” is used to refer to the range of Low-Single-Digits, “MSD” is used to refer to the range of Mid-Single-Digits, “HSD” is used to refer to the range of High-Single-Digits, and “LDD” is used to refer to the range of Low-Double-Digits. |

2 |

| Eliminates the impact of expected foreign currency translation to give investors a better understanding of the underlying trends within the business. |

Presentation of Non-GAAP Information

The financial information presented in this release includes non-GAAP financial measures such as constant currency financial information and free cash flow measures. The non-GAAP measures are provided in addition to, and not as alternatives for, the Company’s reported GAAP results.

This release includes certain constant currency financial information. Foreign currency exchange rate fluctuations affect the amount reported from translating the Company’s foreign revenue, expenses and balance sheet amounts into U.S. dollars. These rate fluctuations can have a significant effect on reported operating results under GAAP. The Company provides constant currency information to enhance the visibility of underlying business trends, excluding the effects of changes in foreign currency translation rates. To calculate net revenue, comparable store sales and earnings (loss) from operations on a constant currency basis, actual or forecasted results for the current-year period are translated into U.S. dollars at the average exchange rates in effect during the comparable period of the prior year. The constant currency calculations do not adjust for the impact of revaluing specific transactions denominated in a currency that is different to the functional currency of that entity when exchange rates fluctuate. However, in calculating the estimated impact of currency on our earnings per share for our actual and forecasted results, the Company estimates gross margin (including the impact of merchandise-related hedges) and expenses using the appropriate prior-year rates, translates the estimated foreign earnings at the comparable prior-year rates, and excludes the year-over-year earnings impact of gains or losses arising from balance sheet remeasurement and foreign currency contracts not designated as merchandise hedges. The constant currency information presented may not be comparable to similarly titled measures reported by other companies.

The Company also includes information regarding its free cash flows in this release. The Company calculates free cash flows as cash flows from operating activities less purchases of property and equipment. The Company also presents adjusted free cash flows excluding the impact of any significant purchases not in the ordinary course of business in order to enhance the visibility of underlying business trends. Free cash flow measures are not intended to be alternatives to cash flows from operating activities as a measure of liquidity, but rather to provide additional visibility to investors regarding how much cash is generated for discretionary and non-discretionary items after deducting purchases of property and equipment. Free cash flow information presented may not be comparable to similarly titled measures reported by other companies. A reconciliation of reported GAAP cash flows from operating activities to comparable non-GAAP free cash flow measures is provided in the accompanying tables.

Investor Conference Call

The Company will hold a conference call at 4:45 pm (ET) on March 16, 2016 to discuss the news announced in this press release. A live webcast of the conference call will be accessible at www.guess.com via the “Investor Relations” link. The webcast will be archived on the website for 30 days.

About Guess?

Guess?, Inc. designs, markets, distributes and licenses a lifestyle collection of contemporary apparel, denim, handbags, watches, footwear and other related consumer products. Guess? products are distributed through branded Guess? stores as well as better department and specialty stores around the world. As of January 30, 2016, the Company directly operated 835 retail stores in the Americas, Europe and Asia. The Company’s licensees and distributors operated 804 additional retail stores worldwide. As of January 30, 2016, the Company and its licensees and distributors operated in more than 95 countries worldwide. For more information about the Company, please visit www.guess.com.

Forward-Looking Statements

Except for historical information contained herein, certain matters discussed in this press release or the related conference call and webcast, including statements concerning the Company’s expectations, future prospects and strategic initiatives (including those identified by our Chief Executive Officer, Victor Herrero), guidance for the first quarter and full year of fiscal 2017, as well as our three-year plans (including revenues, operating margin and earnings per share growth), are forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements, which are frequently indicated by terms such as “expect,” “will,” “goal,” “strategy,” “believe,” “continue,” “outlook,” “plan” and similar terms, are only expectations, and involve known and unknown risks and uncertainties, which may cause actual results in future periods to differ materially from what is currently anticipated. Factors which may cause actual results in future periods to differ materially from current expectations include, among others: our ability to maintain our brand image and reputation; domestic and international economic conditions, including economic and other events that could negatively impact consumer confidence and discretionary consumer spending; changes in the competitive marketplace and in our commercial relationships; our ability to anticipate and respond to consumer preferences and trends; our ability to manage our inventory commensurate with customer demand; risks related to the timing and costs of delivering merchandise to our stores and our wholesale customers; our ability to effectively operate our various retail concepts, including securing, renewing, modifying or terminating leases for store locations; our ability to successfully implement our growth strategies and other strategic initiatives, including expansion in emerging markets and joint ventures; our ability to successfully or timely implement plans for cost and workforce reductions; changes to our short or long-term strategic initiatives; unexpected obligations arising from new or existing litigation, tax and other regulatory proceedings; adjustments to our unaudited financial statements identified during the completion of our annual independent audit of financial statements and financial controls or from subsequent events arising after issuance of this release; risks associated with our foreign operations, such as violations of laws prohibiting improper payments and the burdens of complying with a variety of foreign laws and regulations; risks associated with the acts or omissions of our third party vendors, including a failure to comply with our vendor code of conduct or other policies; risks associated with cyber attacks and other cyber security risks; and changes in economic, political, social and other conditions affecting our foreign operations and sourcing, including the impact of currency fluctuations, global tax rates and economic and market conditions in Eastern Europe, Southern Europe and Asia (particularly China and Korea). In addition to these factors, the economic, technological, managerial, and other risks identified in the Company’s most recent annual report on Form 10-K and other filings with the Securities and Exchange Commission, including but not limited to the risk factors discussed therein, could cause actual results to differ materially from current expectations. Additional information with respect to known and unknown risks will also be set forth in the Company’s annual report on Form 10-K for the year ended January 30, 2016, which will be filed with the Securities and Exchange Commission in the first quarter of fiscal 2017. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

|

| | |

| Contact: | Guess?, Inc. |

| | Fabrice Benarouche |

| | VP, Finance and Investor Relations |

| | (213) 765-5578 |

| | |

| Source: | Guess?, Inc. |

| | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Guess?, Inc. and Subsidiaries |

Condensed Consolidated Statements of Income |

(amounts in thousands, except per share data) |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | Three Months Ended | | Twelve Months Ended |

| | | | | January 30, 2016 | | January 31, 2015 | | January 30, 2016 | | January 31, 2015 |

| | | | | $ | % | | $ | % | | $ | % | | $ | % |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Product sales | | $ | 633,344 |

| 96.2 | % | | $ | 669,965 |

| 96.2 | % | | $ | 2,100,454 |

| 95.3 | % | | $ | 2,306,534 |

| 95.4 | % |

Net royalties | | 24,915 |

| 3.8 | % | | 26,762 |

| 3.8 | % | | 103,857 |

| 4.7 | % | | 111,139 |

| 4.6 | % |

Net revenue | | 658,259 |

| 100.0 | % | | 696,727 |

| 100.0 | % | | 2,204,311 |

| 100.0 | % | | 2,417,673 |

| 100.0 | % |

| | | | | | | | | | | | | | | |

Cost of product sales | | 418,095 |

| 63.5 | % | | 435,808 |

| 62.6 | % | | 1,416,881 |

| 64.3 | % | | 1,549,788 |

| 64.1 | % |

| | | | | | | | | | | | | | | |

Gross profit | | 240,164 |

| 36.5 | % | | 260,919 |

| 37.4 | % | | 787,430 |

| 35.7 | % | | 867,885 |

| 35.9 | % |

| | | | | | | | | | | | | | | |

Selling, general and administrative expenses | | 170,206 |

| 25.9 | % | | 187,753 |

| 26.9 | % | | 666,080 |

| 30.2 | % | | 741,973 |

| 30.7 | % |

| | | | | | | | | | | | | | | |

Earnings from operations | | 69,958 |

| 10.6 | % | | 73,166 |

| 10.5 | % | | 121,350 |

| 5.5 | % | | 125,912 |

| 5.2 | % |

| | | | | | | | | | | | | | | |

Other income (expense): | | | | | | | | | | | | |

| Interest expense | | (497 | ) | (0.0 | %) | | (477 | ) | (0.1 | %) | | (1,953 | ) | (0.0 | %) | | (2,370 | ) | (0.1 | %) |

| Interest income | | 261 |

| 0.0 | % | | 362 |

| 0.1 | % | | 1,045 |

| 0.0 | % | | 1,438 |

| 0.1 | % |

| Other, net | | 256 |

| 0.0 | % | | 6,897 |

| 1.0 | % | | 6,837 |

| 0.3 | % | | 18,028 |

| 0.7 | % |

| | | | | | | | | | | | | | | |

Earnings before income tax expense | | 69,978 |

| 10.6 | % | | 79,948 |

| 11.5 | % | | 127,279 |

| 5.8 | % | | 143,008 |

| 5.9 | % |

| | | | | | | | | | | | | | | |

Income tax expense | | 20,690 |

| 3.1 | % | | 24,359 |

| 3.5 | % | | 42,464 |

| 2.0 | % | | 45,824 |

| 1.9 | % |

| | | | | | | | | | | | | | | |

Net earnings | | 49,288 |

| 7.5 | % | | 55,589 |

| 8.0 | % | | 84,815 |

| 3.8 | % | | 97,184 |

| 4.0 | % |

| | | | | | | | | | | | | | | |

Net earnings attributable to noncontrolling interests | | 1,511 |

| 0.2 | % | | 1,660 |

| 0.3 | % | | 2,964 |

| 0.1 | % | | 2,614 |

| 0.1 | % |

| | | | | | | | | | | | | | | |

Net earnings attributable to Guess?, Inc. | | $ | 47,777 |

| 7.3 | % | | $ | 53,929 |

| 7.7 | % | | $ | 81,851 |

| 3.7 | % | | $ | 94,570 |

| 3.9 | % |

| | | | | | | | | | | | | | | |

Net earnings per common share attributable to common stockholders: |

| | | | | | | | | | | | | | | |

| Basic | | $ | 0.57 |

| | | $ | 0.63 |

| | | $ | 0.97 |

| | | $ | 1.11 |

| |

| Diluted | | $ | 0.57 |

| | | $ | 0.63 |

| | | $ | 0.96 |

| | | $ | 1.11 |

| |

| | | | | | | | | | | | | | | |

Weighted average common shares outstanding attributable to common stockholders: |

| | | | | | | | | | | | | | | |

| Basic | | 83,101 |

| | | 84,722 |

| | | 84,264 |

| | | 84,604 |

| |

| Diluted | | 83,551 |

| | | 84,924 |

| | | 84,525 |

| | | 84,837 |

| |

| | | | | | | | | | | | | | | |

Effective tax rate | | 29.6 | % | | | 30.5 | % | | | 33.4 | % | | | 32.0 | % | |

| | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

Guess?, Inc. and Subsidiaries |

Consolidated Segment Data |

(dollars in thousands) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | Three Months Ended | | Twelve Months Ended |

| | | | | | January 30, | | January 31, | | % | | January 30, | | January 31, | | % |

| | | | | | 2016 | | 2015 | | change | | 2016 | | 2015 | | change |

| | | | | | | | | | | | | | | | |

Net revenue: | | | | | | | | | | | |

| Americas Retail1 | $ | 308,638 |

| | $ | 317,019 |

| | (3%) | | $ | 981,942 |

| | $ | 1,032,601 |

| | (5%) |

| Europe | 229,676 |

| | 240,866 |

| | (5%) | | 727,144 |

| | 825,136 |

| | (12%) |

| Asia | 61,691 |

| | 75,434 |

| | (18%) | | 241,571 |

| | 281,090 |

| | (14%) |

| Americas Wholesale1 | 33,339 |

| | 36,646 |

| | (9%) | | 149,797 |

| | 167,707 |

| | (11%) |

| Licensing | 24,915 |

| | 26,762 |

| | (7%) | | 103,857 |

| | 111,139 |

| | (7%) |

| | | | | | $ | 658,259 |

| | $ | 696,727 |

| | (6%) | | $ | 2,204,311 |

| | $ | 2,417,673 |

| | (9%) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Earnings (loss) from operations: | | | | | | | | | | | |

| Americas Retail1 | $ | 20,240 |

| | $ | 9,844 |

| | 106% | | $ | 16,222 |

| | $ | (13,734 | ) | | 218% |

| Europe | 34,770 |

| | 40,690 |

| | (15%) | | 55,438 |

| | 66,231 |

| | (16%) |

| Asia | 2,154 |

| | 270 |

| | 698% | | 10,448 |

| | 8,013 |

| | 30% |

| Americas Wholesale1 | 6,323 |

| | 7,313 |

| | (14%) | | 27,525 |

| | 34,173 |

| | (19%) |

| Licensing | 21,890 |

| | 25,501 |

| | (14%) | | 92,172 |

| | 101,288 |

| | (9%) |

| Corporate Overhead | (15,419 | ) | | (10,452 | ) | | 48% | | (80,455 | ) | | (70,059 | ) | | 15% |

| | | | | | $ | 69,958 |

| | $ | 73,166 |

| | (4%) | | $ | 121,350 |

| | $ | 125,912 |

| | (4%) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Operating margins: | | | | | | | | | | | |

| Americas Retail1 | 6.6 | % | | 3.1 | % | | | | 1.7 | % | | (1.3 | %) | | |

| Europe | 15.1 | % | | 16.9 | % | | | | 7.6 | % | | 8.0 | % | | |

| Asia | 3.5 | % | | 0.4 | % | | | | 4.3 | % | | 2.9 | % | | |

| Americas Wholesale1 | 19.0 | % | | 20.0 | % | | | | 18.4 | % | | 20.4 | % | | |

| Licensing | 87.9 | % | | 95.3 | % | | | | 88.7 | % | | 91.1 | % | | |

| | | | | | | | | | | | | | | | |

| Total Company | 10.6 | % | | 10.5 | % | | | | 5.5 | % | | 5.2 | % | | |

| | | | | | | | | | | | | | | | |

Notes | | | | | | | | | | | | | | | |

1 |

| In the second quarter of fiscal 2016, the Company changed the names of its “North American Retail” and “North American Wholesale” segments to “Americas Retail” and “Americas Wholesale” to better reflect that these segments are inclusive of its operations in North America as well as Central and South America. There have been no changes to the underlying reporting in either segment. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

Guess?, Inc. and Subsidiaries |

Constant Currency Financial Measures |

(dollars in thousands) |

| | | | | | | | | | | | | | | | |

| | | | | | Three Months Ended | | | | |

| | | | | | January 30, 2016 | | January 31, 2015 | | % change |

| As Reported | | Foreign Currency Impact | | Constant Currency | | As Reported | | As Reported | | Constant Currency |

Net revenue: | | | | | | | | | | | |

| Americas Retail1 | $ | 308,638 |

| | $ | 11,339 |

| | $ | 319,977 |

| | $ | 317,019 |

| | (3%) | | 1% |

| Europe | 229,676 |

| | 25,171 |

| | 254,847 |

| | 240,866 |

| | (5%) | | 6% |

| Asia | 61,691 |

| | 3,460 |

| | 65,151 |

| | 75,434 |

| | (18%) | | (14%) |

| Americas Wholesale1 | 33,339 |

| | 2,781 |

| | 36,120 |

| | 36,646 |

| | (9%) | | (1%) |

| Licensing | 24,915 |

| | — |

| | 24,915 |

| | 26,762 |

| | (7%) | | (7%) |

| | | | | | $ | 658,259 |

| | $ | 42,751 |

| | $ | 701,010 |

| | $ | 696,727 |

| | (6%) | | 1% |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | Twelve Months Ended | | | | |

| | | | | | January 30, 2016 | | January 31, 2015 | | % change |

| As Reported | | Foreign Currency Impact | | Constant Currency | | As Reported | | As Reported | | Constant Currency |

Net revenue: | | | | | | | | | | | |

| Americas Retail1 | $ | 981,942 |

| | $ | 34,078 |

| | $ | 1,016,020 |

| | $ | 1,032,601 |

| | (5%) | | (2%) |

| Europe | 727,144 |

| | 129,436 |

| | 856,580 |

| | 825,136 |

| | (12%) | | 4% |

| Asia | 241,571 |

| | 14,454 |

| | 256,025 |

| | 281,090 |

| | (14%) | | (9%) |

| Americas Wholesale1 | 149,797 |

| | 12,667 |

| | 162,464 |

| | 167,707 |

| | (11%) | | (3%) |

| Licensing | 103,857 |

| | — |

| | 103,857 |

| | 111,139 |

| | (7%) | | (7%) |

| | | | | | $ | 2,204,311 |

| | $ | 190,635 |

| | $ | 2,394,946 |

| | $ | 2,417,673 |

| | (9%) | | (1%) |

| | | | | | | | | | | | | | | | |

Notes | | | | | | | | | | | | | | | |

1 |

| In the second quarter of fiscal 2016, the Company changed the names of its “North American Retail” and “North American Wholesale” segments to “Americas Retail” and “Americas Wholesale” to better reflect that these segments are inclusive of its operations in North America as well as Central and South America. There have been no changes to the underlying reporting in either segment. |

|

| | | | | | | | | | | | | | | | |

Guess?, Inc. and Subsidiaries |

Selected Condensed Consolidated Balance Sheet Data |

(in thousands) |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | January 30, | | January 31, |

| | | | | | | | | 2016 | | 2015 |

| | | | | | | | | | | |

ASSETS |

| | | | | | | | | | | |

Cash and cash equivalents | $ | 445,480 |

| | $ | 483,483 |

|

| | | | | | | | | | | |

Receivables, net | 222,359 |

| | 216,205 |

|

| | | | | | | | | | | |

Inventories | 311,704 |

| | 319,078 |

|

| | | | | | | | | | | |

Other current assets1 | 56,709 |

| | 73,533 |

|

| | | | | | | | | | | |

Property and equipment, net | 255,344 |

| | 259,524 |

|

| | | | | | | | | | | |

Other assets1 | 247,152 |

| | 249,582 |

|

| | | | | | | | | | | |

| | Total Assets | $ | 1,538,748 |

| | $ | 1,601,405 |

|

| | | | | | | | | | | |

| | | | | | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY |

| | | | | | | | | | | |

Current portion of capital lease obligations | $ | 4,024 |

| | $ | 1,548 |

|

| | | | | | | | | | | |

Other current liabilities | 323,035 |

| | 300,418 |

|

| | | | | | | | | | | |

Long term debt and capital lease obligations | 2,318 |

| | 6,165 |

|

| | | | | | | | | | | |

Other long-term liabilities | 172,826 |

| | 199,391 |

|

| | | | | | | | | | | |

Redeemable and nonredeemable noncontrolling interests | 18,070 |

| | 20,027 |

|

| | | | | | | | | | | |

Guess?, Inc. stockholders’ equity | 1,018,475 |

| | 1,073,856 |

|

| | | | | | | | | | | |

| | Total Liabilities and Stockholders’ Equity | $ | 1,538,748 |

| | $ | 1,601,405 |

|

| | | | | | | | | | | |

Notes | | | | | | | | | |

1 |

| As a result of the adoption of new authoritative guidance during fiscal 2016 which requires that all deferred tax liabilities and assets be classified as long-term on the balance sheet, other current assets and other assets at January 31, 2015 were adjusted to reflect the reclassification of deferred tax assets for $19.1 million from current to long-term.

|

|

| | | | | | | | | | | | | | |

Guess?, Inc. and Subsidiaries |

Condensed Consolidated Cash Flow Data |

(in thousands) |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | Twelve Months Ended |

| | | | | | | | January 30, | | January 31, |

| | | | | | | | 2016 | | 2015 |

| | | | | | | | | | |

Net cash provided by operating activities | | | $ | 179,429 |

| | $ | 153,826 |

|

| | | | | | | | | | |

Net cash used in investing activities | | | (73,745 | ) | | (57,831 | ) |

| | | | | | | | | | |

Net cash used in financing activities | | | (127,740 | ) | | (79,687 | ) |

| | | | | | | | | | |

Effect of exchange rates on cash and cash equivalents | | | (15,947 | ) | | (35,770 | ) |

| | | | | | | | | | |

Net change in cash and cash equivalents | | | (38,003 | ) | | (19,462 | ) |

| | | | | | | | | | |

Cash and cash equivalents at the beginning of the year | | | 483,483 |

| | 502,945 |

|

| | | | | | | | | | |

Cash and cash equivalents at the end of the year | | | $ | 445,480 |

| | $ | 483,483 |

|

| | | | | | | | | | |

| | | | | | | | | | |

Supplemental information: | | | | | |

| | | | | | | | | | |

Depreciation and amortization | | | $ | 70,684 |

| | $ | 85,060 |

|

| | | | | | | | | | |

Rent | | | $ | 259,070 |

| | $ | 284,045 |

|

|

| | | | | | | | | | | | | | |

Guess?, Inc. and Subsidiaries |

Reconciliation of Net Cash Provided by Operating Activities to Adjusted Free Cash Flow |

(in thousands) |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | Twelve Months Ended |

| | | | | | | | January 30, | | January 31, |

| | | | | | | | 2016 | | 2015 |

| | | | | | | | | | |

Net cash provided by operating activities | | | $ | 179,429 |

| | $ | 153,826 |

|

| | | | | | | | | | |

Less: Purchases of property and equipment | | | (83,844 | ) | | (71,498 | ) |

| | | | | | | | | | |

Free cash flow | | | 95,585 |

| | 82,328 |

|

| | | | | | | | | | |

Add: Purchase of U.S. distribution facility | 28,773 |

| | — |

|

| | | | | | | | | | |

Adjusted free cash flow | | | $ | 124,358 |

| | $ | 82,328 |

|

| | | | | | | | | | |

|

| | | | | | | | | | |

Guess?, Inc. and Subsidiaries |

Retail Store Data |

International Store Count |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | As of January 30, 2016 | | As of January 31, 2015 |

| | | | Total | | Directly Operated | | Total | | Directly Operated |

Region | | | | Stores | | Stores | | Stores | | Stores |

| | | | | | | | | | |

United States and Canada | 456 | | 455 | | 481 | | 481 |

| | | | | | | | | | |

Europe and the Middle East | 594 | | 280 | | 596 | | 265 |

| | | | | | | | | | |

Asia | 490 | | 54 | | 496 | | 49 |

| | | | | | | | | | |

Central and South America | 99 | | 46 | | 95 | | 42 |

| | | | | | | | | | |

| | | | 1,639 | | 835 | | 1,668 | | 837 |

| | | | | | | | | | |

|

| | | | | | | | | | |

Guess?, Inc. and Subsidiaries |

Directly Operated Retail Store Data |

U.S. and Canada |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | Twelve Months Ended |

| | | | | | | January 30, | | January 31, |

| | | | | | | | 2016 | | 2015 |

| | | | | | | | | | |

Number of stores at the beginning of the year | | | 481 | | 494 |

| | | | | | | | | | |

Store openings | | | 12 | | 15 |

| | | | | | | | | | |

Store closures | | | (38) | | (28) |

| | | | | | | | | | |

Number of stores at the end of the year | | | 455 | | 481 |

| | | | | | | | | | |

| | | | | | | | | | |

Total store square footage at the end of the year | | | 2,211,000 | | 2,301,000 |

|

| | | | | | | | | | | | | | | | | | | | | |

Guess?, Inc. and Subsidiaries |

Americas Retail Net Revenue |

(dollars in thousands) |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| January 30, | | January 31, | | % | | January 30, | | January 31, | | % |

| 2016 | | 2015 | | change | | 2016 | | 2015 | | change |

Net revenue: | | | | | | | | | | | |

| | | | | | | | | | | |

Retail stores | $ | 275,687 |

| | $ | 286,809 |

| | (3.9 | %) | | $ | 892,414 |

| | $ | 954,198 |

| | (6.5 | %) |

| | | | | | | | | | | |

E-commerce sites | 32,951 |

| | 30,210 |

| | 9.1 | % | | 89,528 |

| | 78,403 |

| | 14.2 | % |

| | | | | | | | | | | |

Total | $ | 308,638 |

| | $ | 317,019 |

| | (2.6 | %) | | $ | 981,942 |

| | $ | 1,032,601 |

| | (4.9 | %) |

| | | | | | | | | | | |

|

| | | | | | | |

Guess?, Inc. and Subsidiaries |

Retail Store Change in Comparable Store Sales |

U.S. and Canada |

| | | | | | | |

| | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| January 30, 2016 | | January 30, 2016 |

| U.S. Dollars | | Constant Currency | | U.S. Dollars | | Constant Currency |

| | | | | | | |

Excluding e-commerce sales | (2.2%) | | 1.2% | | (5.2%) | | (2.2%) |

| | | | | | | |

Impact of e-commerce sales | 1.0% | | 1.0% | | 1.6% | | 1.6% |

| | | | | | | |

Including e-commerce sales | (1.2%) | | 2.2% | | (3.6%) | | (0.6%) |

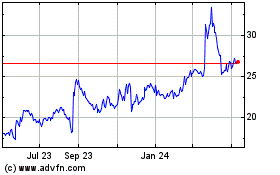

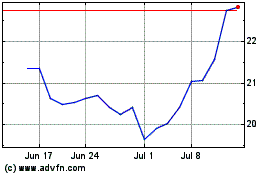

Guess (NYSE:GES)

Historical Stock Chart

From Mar 2024 to Apr 2024

Guess (NYSE:GES)

Historical Stock Chart

From Apr 2023 to Apr 2024