The Wall Street Journal to Combine Sections to Cope With Ad Decline

November 02 2016 - 12:00PM

Dow Jones News

The Wall Street Journal will debut a newly formatted version of

its print edition starting Nov. 14, which will combine several

sections and reduce the size of some coverage areas as the paper

copes with an accelerating industrywide decline in print

advertising.

Editor in chief Gerard Baker announced the changes to staff in a

memo Wednesday. As a result, the paper will feature fewer pages

with less space dedicated to coverage of arts, culture and local

news, but will continue to dedicate about the same amount of space

for business and finance coverage.

"All newspapers face structural challenges and we must move to

create a print edition that can stand on a sound financial footing

for the foreseeable future while our digital horizons continue to

expand," Mr. Baker wrote in the memo.

The restructuring of the print paper will result in the

elimination of some positions. The paper has already offered

buyouts to all staffers and warned of possible layoffs.

The new version of the Journal will feature two bigger sections

on Tuesdays, Wednesdays and Thursdays, with a third section on

Mondays and Fridays. The weekend edition of the paper will remain

unchanged.

The paper will combine the Business & Tech and Money &

Investing sections into one section in an effort to save on

production costs. Mr. Baker said the new section "will contain

about the same amount of news space as we have now for business,

technology, financial and markets coverage."

Additionally, the Personal Journal and Arena sections, which

focus on lifestyle, art, sports and culture coverage, will be

combined into a new section called Life & Arts, which will

become part of the A section of the paper.

The Greater New York section will be reduced in size into "a

more concise, focused daily report on life and business in the New

York area," and will also be moved into the A section of the

paper.

The paper will continue to publish Journal Reports and Mansion

as separate sections on Monday and Friday, respectively.

The move comes amid a sharp decline in print advertising that is

hitting publishers across the industry. Ad buying firm GroupM has

projected that global print ad spending will drop 8.7% this year,

the biggest decline since 2009 during the recession.

On Wednesday, New York Times Co. reported a 19% decline in print

ad revenue in the third quarter. USA Today owner Gannett Co. last

week reported a 15% drop in print ad revenue, and Tronc Inc., owner

of the Los Angeles Times and Chicago Tribune, reported a 13%

decline.

The Journal's parent company, News Corp is scheduled to report

its fiscal first-quarter earnings next week. For the fourth

quarter, News Corp said domestic advertising revenue at the Journal

fell 12% from the same quarter a year earlier.

"I want to stress that these changes and their ramifications for

the newsroom are necessary not just because we must adjust to

changing conditions in the print advertising business, but because

we know from audience research that readers want a more digestible

newspaper," Mr. Baker wrote.

Write to Lukas I. Alpert at lukas.alpert@wsj.com

(END) Dow Jones Newswires

November 02, 2016 11:45 ET (15:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

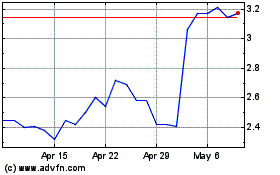

New Gannett (NYSE:GCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

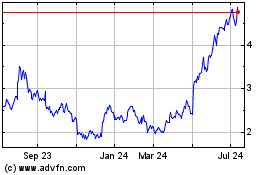

New Gannett (NYSE:GCI)

Historical Stock Chart

From Apr 2023 to Apr 2024