UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 5, 2015

FREEPORT-McMoRan INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 001-11307-01 | | 74-2480931 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

|

| |

333 North Central Avenue | |

Phoenix, AZ | 85004-2189 |

(Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (602) 366-8100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01. Other Events.

Freeport-McMoRan Inc. (FCX) issued a press release dated August 5, 2015, announcing significant reduction in oil and gas capital budget and continuing review of mining operations. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated in this Item 8.01 by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The Exhibit included as part of this Current Report is listed in the attached Exhibit Index.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

FREEPORT-McMoRan INC.

By: /s/ C. Donald Whitmire, Jr.

----------------------------------------

C. Donald Whitmire, Jr.

Vice President and Controller -

Financial Reporting

(authorized signatory and

Principal Accounting Officer)

Date: August 5, 2015

Freeport-McMoRan Inc.

Exhibit Index

Exhibit

Number |

| | |

| | Press release dated August 5, 2015, titled “Freeport-McMoRan Announces Significant Reduction in Oil & Gas Capital Budget & Continuing Review of Mining Operations.” |

| | |

| | |

|

| | | | | |

333 North Central Avenue Phoenix, AZ 85004 | Financial Contacts: | | | | Media Contact: |

| Kathleen L. Quirk (602) 366-8016 | | David P. Joint (504) 582-4203 | | Eric E. Kinneberg (602) 366-7994 |

Freeport-McMoRan Announces

Significant Reduction in Oil & Gas Capital Budget &

Continuing Review of Mining Operations

PHOENIX, AZ, August 5, 2015 - Freeport-McMoRan Inc. (NYSE: FCX) today provided an update on its progress in reducing costs and capital spending.

In response to current oil and gas market conditions, Freeport-McMoRan Oil and Gas (FM O&G) is deferring investments in several long-term projects. In addition, FM O&G has revised its estimate of the start-up of initial production from its recent drilling success in the Horn Mountain area to 2016 from the previously estimated start-up in 2017. This revised operating plan will allow FM O&G to continue to grow production and enhance cash flow in a weak oil and gas price environment.

The company announced the following revisions to its oil and gas capital expenditure and production outlook:

|

| | | |

| 2015e | 2016e | 2017e |

| | | |

July 23, 2015 Forecast | | | |

Capital Expenditures ($ in billions) | $2.8 | $2.9 | $2.9 |

Production (MBOE per day) | 143 | 151 | 173 |

| | | |

Revised Plan | | | |

Capital Expenditures ($ in billions) | $2.8 | $2.0 | $2.0 |

Production (MBOE per day) | 145 | 163 | 170 |

| | | |

Change | | | |

Capital Expenditures ($ in billions) | $— | $(0.9) | $(0.9) |

Production (MBOE per day) | 2 | 12 | (3) |

The revised plans, together with the previously announced potential initial public offering of a minority interest in FM O&G and potential other actions, will be pursued as required to fund oil and gas capital spending within cash flow for 2016 and subsequent years.

FCX is also completing a review of operating plans at each of its global copper and molybdenum operations and will revise operating and capital plans to strengthen its financial position in a weak copper price environment. The revised plans will target lower operating and capital costs to achieve maximum cash flow under the current market conditions. Production at certain operations challenged by low commodity prices will be curtailed. The company expects to complete this review promptly and will report its revised plans during the third quarter of 2015.

In addition, FCX will continue to assess opportunities to partner with strategic investors potentially interested in investing capital with FCX in the development of its oil and gas and its mining properties. FCX has a broad set of assets with valuable infrastructure and associated resources with attractive long-term production and development potential.

James R. Moffett, FCX’s Chairman, Richard C. Adkerson, Vice Chairman and Chief Executive Officer and James C. Flores, Vice Chairman and FM O&G Chief Executive Officer, said, “The steps we are taking are necessary under current market conditions to strengthen our financial position and preserve our large resource base for improved future market conditions. Our high quality portfolio of long-lived assets, flexible operating structure and experience management team position FCX for success. Our "leaner, longer" plan at FM O&G will enhance near-term cash flow while preserving long-term growth opportunities.”

FCX is a premier U.S.-based natural resources company with an industry-leading global portfolio of mineral assets, significant oil and gas resources and a growing production profile. FCX is the world's largest publicly traded copper producer.

FCX's portfolio of assets includes the Grasberg minerals district in Indonesia, one of the world's largest copper and gold deposits; significant mining operations in the Americas, including the large-scale Morenci minerals district in North America and the Cerro Verde operation in South America; the Tenke Fungurume minerals district in the DRC; and significant U.S. oil and natural gas assets in the Deepwater GOM, onshore and offshore California and in the Haynesville natural gas shale, and a position in the Inboard Lower Tertiary/Cretaceous natural gas trend onshore in South Louisiana. Additional information about FCX is available on FCX's website at "fcx.com."

Cautionary Statement and Regulation G Disclosure: This press release contains forward-looking statements, which are all statements other than historical facts, such as statements regarding targeted reductions in capital spending and operating and administrative costs and potential adjustments to mine plans and production volumes. FCX cautions readers that forward-looking statements are not guarantees of future performance and actual results may differ materially from those anticipated, projected or assumed in the forward-looking statements. Important factors that can cause FCX's actual results to differ materially from those anticipated in the forward-looking statements include supply of and demand for, and prices of copper, gold, molybdenum, cobalt, crude oil and natural gas, mine sequencing, production rates, industry risks, regulatory changes, political risks, drilling results, potential additional oil and gas property impairment charges, potential additional LCM inventory adjustments, potential impairment of long-lived mining assets, weather- and climate-related risks, labor relations, environmental risks, litigation results and other factors described in more detail under the heading “Risk Factors” in FCX's Annual Report on Form 10-K for the year ended December 31, 2014, filed with the U.S. Securities and Exchange Commission (SEC) as updated by FCX’s subsequent filings with the SEC.

Investors are cautioned that many of the assumptions on which FCX's forward-looking statements are based are likely to change after its forward-looking statements are made, including for example commodity prices, which FCX cannot control, and production volumes and costs, some aspects of which FCX may or may not be able to control. Further, FCX may make changes to its business plans that could or will affect its results. FCX cautions investors that, except for its expectation that it will report revised operating plans during third-quarter 2015, it does not intend to update forward-looking statements more frequently than quarterly notwithstanding any changes in FCX's assumptions, changes in business plans, actual experience or other changes, and FCX undertakes no obligation to update any forward-looking statements.

# # #

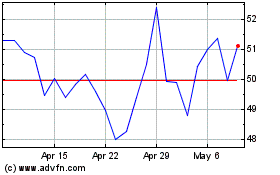

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

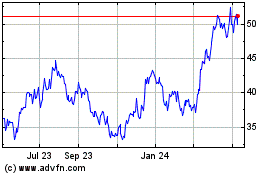

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024