Edison International Earnings Fall Due to SCE Rate Case

October 27 2015 - 6:18PM

Dow Jones News

By Josh Beckerman

Edison International said its core earnings fell 23% in the

third quarter, partly due to an estimated revenue refund based on

the rate case for its Southern California Edison utility.

The California Public Utilities Commission issued a proposed

decision for the rate case on Sept. 18. When a final decision is

reached, the revenue requirement will be retroactive to Jan. 1,

2015.

Edison International said "while the case is generally

constructive overall, SCE has identified several important items

that the CPUC should correct."

The company said it expects core earnings of $3.77 to $3.87 for

the year, while analysts polled by Thomson Reuters project

$3.75.

Edison International shares were flat in after-hours trading at

$64.38.

Southern California Edison, with about 4.9 million customer

accounts, has been active in alternative energy. Last year, it

unveiled a Tehachapi, Calif., facility that uses electric-car

batteries to store energy. The utility has signed many contracts

for solar and other clean energy to replace some of the power lost

after the San Onofre nuclear plant closed.

For the quarter ended Sept. 30, Edison International earned $421

million, or $1.29 a share, compared with $480 million, or $1.47 a

share, a year earlier.

Core earnings fell to $389 million, or $1.19 a share, from $503

million, or $1.54 a share. On an adjusted basis, core earnings were

$1.16 a share, the company said.

Operating revenue fell to $3.76 billion from $4.36 billion.

Analysts polled by Thomson Reuters had expected earnings of

$1.17 a share on revenue of $4.2 billion.

Write to Josh Beckerman at josh.beckerman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 27, 2015 18:03 ET (22:03 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

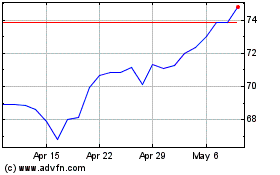

Edison (NYSE:EIX)

Historical Stock Chart

From Aug 2024 to Sep 2024

Edison (NYSE:EIX)

Historical Stock Chart

From Sep 2023 to Sep 2024