DuPont Boosts Its Outlook For 2016 -- WSJ

April 26 2016 - 3:03AM

Dow Jones News

By Jacob Bunge

DuPont Co. boosted its 2016 profit target as the agriculture and

chemical giant reported first-quarter earnings that topped

analysts' expectations.

"Solid execution, local price and product mix gains, and higher

corn area led to a strong start to the year for our [agriculture]

business," said Ed Breen, DuPont's chief executive. "Our other

businesses generally performed well, slightly above our

expectations."

DuPont's upbeat results in its agriculture and nutrition

divisions come as contraction in the U.S. farm sector and currency

pressures have pressured DuPont and its competitors.

The Wilmington, Del., company said it now expects to earn $3.05

to $3.20 a share in 2016, an increase of 10 cents from its prior

outlook as DuPont slashes spending ahead of its planned merger with

rival Dow Chemical Co., which the companies aim to complete this

year pending regulators' approvals.

The anticipated boost to DuPont's earnings came after the U.S.

dollar weakened against "most currencies" over the past three

months, the company said. The U.S. dollar's strength over the past

year diminished DuPont's profits abroad and made its products more

expensive in overseas markets.

The strong start for DuPont's agriculture business likely will

taper off in the second quarter, the company said, as insecticide

and soybean volumes have weakened. Profits from performance

materials declined in the first quarter because of slowing ethylene

demand, while earnings from nutrition and health products increased

because of growth in probiotic and ingredient sales volumes.

Mr. Breen said DuPont is on track with plans to eliminate $730

million in annual costs this year, with corporate expenses in the

first quarter down 44% versus prior-year levels, and overall

operating costs falling 7%. DuPont announced in December a

cost-saving plan that included cutting 5,000 employees, most of

whom have by now left the company or are in the process of

exiting.

For the first quarter, DuPont reported earnings of $1.2 billion,

or $1.39 a share, up from $1 billion, or $1.13 a share, a year ago.

DuPont estimated that foreign-exchange shifts lowered its per-share

earnings by 10 cents in the quarter.

Excluding certain items, the company's operating earnings fell

4% to $1.11 billion but were flat on a per-share basis at $1.26

because the company had fewer shares outstanding in the latest

quarter. Analysts surveyed by Thomson Reuters had forecast

operating income of $1.04 a share for the quarter ended March

31.

DuPont's sales in the quarter fell 6% to $7.4 billion, though

remained ahead of the $7.19 billion projected by analysts.

DuPont released the results ahead of the planned release time

scheduled for 6 a.m. ET Tuesday, after inadvertently sending a

partial earnings release to some reporters while formatting it

Monday evening.

Write to Jacob Bunge at jacob.bunge@wsj.com

(END) Dow Jones Newswires

April 26, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

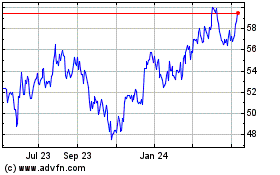

Dow (NYSE:DOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

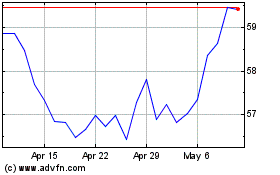

Dow (NYSE:DOW)

Historical Stock Chart

From Apr 2023 to Apr 2024