Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

May 23 2016 - 5:21PM

Edgar (US Regulatory)

Filed by E. I. du Pont de Nemours and Company

Pursuant to Rule 425 under the Securities Act of 1933,

as amended, and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: The Dow Chemical Company; E. I. du

Pont de Nemours and Company; DowDuPont Inc.

Commission File No.: 001- 00815

DuPont Colleagues,

Today we announced key members of the future senior leadership team for DowDuPont, marking

another major milestone in the process to merge and subsequently move ahead with our intention to create three highly focused, independent companies. A

copy of the press release

[press release filed with SEC pursuant to Rule 425 on May 23, 2016] is attached.

As I outlined during our recent Town Halls, after the merger is completed, DowDuPont will operate as a holding company on top of the current DuPont and Dow organizations. Through this merger of equals, we are able to pull from the exceptional talent of both organizations to assemble a world-class group of executives that will be responsible for efficiently integrating DuPont and Dow and standing up the Agriculture, Material Science and Specialty Products divisions. Our goal is to equip the three divisions so they may operate as strong, independent businesses as soon as possible after the merger closes. The DowDuPont corporate structure will be lean and efficient, as we push most of the responsibility and accountability into the three divisions.

As you know, I will become chief executive officer of DowDuPont, and Andrew Liveris will serve as executive chairman of DowDuPont. We will both report to the DowDuPont Board of Directors. Today, we announced the following senior leadership appointments:

·

Stacy Fox

, DuPont’s senior vice president and general counsel, will become general counsel for DowDuPont

;

and

·

Howard Ungerleider,

currently Dow’s vice chairman and chief financial officer, will become the DowDuPont chief financial officer. The role of

Nick Fanandakis

, DuPont’s executive vice president and chief financial officer, will be announced prior to the closing of the merger.

·

Charles J. Kalil,

executive vice president and general counsel of Dow, will become special counsellor to the executive chairman of DowDuPont and general counsel of the Material Science business.

We also named the

chief operating officers

for each of the three business divisions of DowDuPont, including:

·

Jim Collins

, executive vice president for DuPont and leader of DuPont’s Agriculture business segment, will become chief operating officer for DowDuPont’s Agriculture business.

·

Marc Doyle,

executive vice president and leader of DuPont’s Electronics & Communications, Industrial Biosciences, Nutrition & Health, Performance Materials and Safety & Protection businesses, will become chief operating officer for DowDuPont’s Specialty Products business.

·

Jim Fitterling,

president and chief operating officer for Dow, will become chief operating officer for DowDuPont’s Material Science business.

Other leadership roles will be announced prior to the closing of the merger. All leadership appointments will become effective upon closing of the merger, which is still expected to occur in the second half of 2016, subject to customary closing conditions, including receipt of Dow and DuPont stockholder approvals and regulatory approvals. There are no changes to our current management team, and DuPont and Dow will continue to operate as two separate companies until the merger closes.

It is important to note that today’s appointments are for DowDuPont only, not for the intended spin-offs. The DowDuPont Board will establish advisory committees for each, following the completion of the merger. The advisory committees will select the leaders for the intended

independent companies — a process we expect to occur no more than six months prior to their separations.

In the meantime, the business units will be working hard to assure a seamless transition for customers, and delivering the value-added solutions and exceptional service they expect from us. We all have a role to play in that important work, and customer focus is more important than ever. I am very impressed by the incredible level of energy, focus and commitment I’ve seen every day, throughout the company, especially with so much change occurring. Thank you for your dedication to DuPont’s high standards.

As we continue our transformation, I hope

the enormous potential inherent in our “Journey to Three” — and the exciting opportunities generated by the three independent companies we intend to create — becomes increasingly apparent to each of you. Thank you for your continued commitment and attention to our Core Values as we progress to a stronger, sustainable future for DuPont.

Ed Breen

Chair and CEO

Important Information About the Transaction and Where to Find It

In connection with the proposed transaction, DowDuPont Inc. (f/k/a Diamond-Orion HoldCo, Inc.) (“DowDuPont”) has filed with the Securities and Exchange Commission (“SEC”) a preliminary registration statement on Form S-4 (File No. 333-209869) (as may be amended from time to time, the “Preliminary Registration Statement”) that includes a joint proxy statement of The Dow Chemical Company (“Dow”) and E. I. du Pont de Nemours and Company (“DuPont”) and that also will constitute a prospectus of DowDuPont. These materials are not final and may be amended. Dow, DuPont and DowDuPont may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus or definitive registration statement or any other document which Dow, DuPont or DowDuPont may file with the SEC. INVESTORS AND SECURITY HOLDERS OF DOW AND DUPONT ARE URGED TO READ THE PRELIMINARY REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND THE DEFINITIVE VERSIONS THEREOF AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the Preliminary Registration Statement and the definitive versions of these materials and other documents filed with the SEC (when available) by Dow, DuPont and DowDuPont through the web site maintained by the SEC at www.sec.gov or by contacting the investor relations department of Dow or DuPont at the following:

|

Dow

|

DuPont

|

|

2030 Dow Center

|

974 Centre Road

|

|

Midland, MI 48674

|

Wilmington, DE 19805

|

|

Attention: Investor Relations

|

Attention: Investor Relations:

|

|

1-989-636-1463

|

1-302-774-4994

|

Participants in the Solicitation

Dow, DuPont, DowDuPont and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Dow’s directors and executive officers, including a description of their direct interests, by security holdings or otherwise, is contained in Dow’s Form 10-K for the year ended December 31, 2015, its proxy statement filed on April 1, 2016 and the joint proxy statement/prospectus of Dow contained in the Preliminary Registration Statement, which are filed with the SEC. Information regarding DuPont’s directors and executive officers, including a description of their direct interests, by security holdings or otherwise, is contained in DuPont’s Form 10-K for the year ended December 31, 2015, its proxy statement filed on March 18, 2016 and the joint proxy statement/prospectus of DuPont contained in the Preliminary Registration Statement, which are filed with the SEC. A more complete description will be available in the definitive registration statement on Form S-4 and the joint proxy statement/prospectus.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Cautionary Notes on Forward Looking Statements

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. These and other forward-looking statements, including the failure to consummate the proposed transaction or to make or take any filing or other action required to consummate such transaction on a timely matter or at all, are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statements. Important risk factors that may cause such a difference include, but are not limited

to, (i) the completion of the proposed transaction on anticipated terms and timing, including obtaining shareholder and regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the new combined company’s operations and other conditions to the completion of the merger, (ii) the ability of Dow and DuPont to integrate the business successfully and to achieve anticipated synergies, risks and costs and pursuit and/or implementation of the potential separations, including anticipated timing, any changes to the configuration of businesses included in the potential separation if implemented, (iii) the intended separation of the agriculture, material science and specialty products businesses of the combined company post-mergers in one or more tax efficient transactions on anticipated terms and timing, including a number of conditions which could delay, prevent or otherwise adversely affect the proposed transactions, including possible issues or delays in obtaining required regulatory approvals or clearances, disruptions in the financial markets or other potential barriers, (iv) potential litigation relating to the proposed transaction that could be instituted against Dow, DuPont or their respective directors, (v) the risk that disruptions from the proposed transaction will harm Dow’s or DuPont’s business, including current plans and operations, (vi) the ability of Dow or DuPont to retain and hire key personnel, (vii) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the merger, (viii) uncertainty as to the long-term value of DowDuPont common stock, (ix) continued availability of capital and financing and rating agency actions, (x) legislative, regulatory and economic developments, (xi) potential business uncertainty, including changes to existing business relationships, during the pendency of the merger that could affect Dow’s and/or DuPont’s financial performance, (xii) certain restrictions during the pendency of the merger that may impact Dow’s or DuPont’s ability to pursue certain business opportunities or strategic transactions and (xiii) unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as management’s response to any of the aforementioned factors. These risks, as well as other risks associated with the proposed merger, are more fully discussed in the joint proxy statement/prospectus included in the Preliminary Registration Statement filed with the SEC in connection with the proposed merger. While the list of factors presented here is, and the list of factors presented in the Preliminary Registration Statement are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Dow’s or DuPont’s consolidated financial condition, results of operations, credit rating or liquidity. Neither Dow nor DuPont assumes any obligation to publicly provide revisions or updates to any forward looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws.

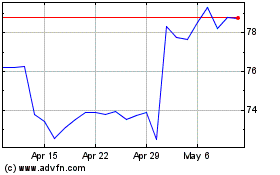

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Mar 2024 to Apr 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024